- Home

- »

- Next Generation Technologies

- »

-

North America Household Refrigerators And Freezers Market, Report 2030GVR Report cover

![North America Household Refrigerators and Freezers Market Size, Share & Trends Report]()

North America Household Refrigerators and Freezers Market Size, Share & Trends Analysis Report By Equipment, By Structure, By Capacity, By Price Range, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-486-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

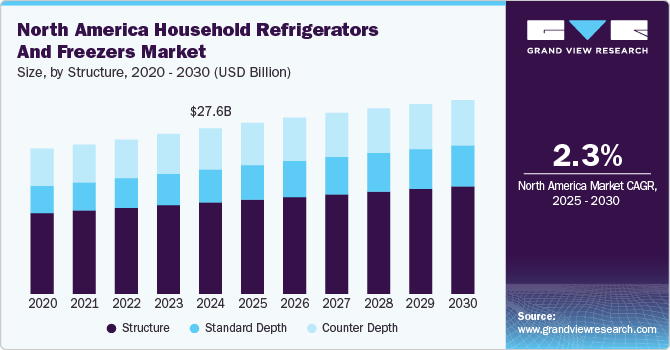

The North America household refrigerators and freezers market size was estimated at USD 27.58 billion in 2024 and is projected to grow at a CAGR of 2.3% from 2025 to 2030. The integration of smart technology into refrigerators is gaining massive momentum in the industry. Smart refrigerators are increasingly equipped with features such as Wi-Fi connectivity, touchscreens, and virtual assistants that tend to take consumer experience to the next level.

Moreover, homeowners can receive real-time updates on food inventory, control temperature settings, and access recipes directly from the refrigerator. The emerging trend of smart homes offering convenience and connectivity in the kitchen is positively influencing the overall market.

The concept of Crisper drawers in refrigerators has been a basic feature in refrigerators as they allow users to organize fruits, vegetables, and other food items separately. However, with technological improvements, manufacturers have developed advanced crisper drawers that come with configurable controls. These drawers set the temperature separately from the main compartment so that users can adjust it to accommodate their food items. Also known as Climate Zone Drawers, these refrigerator sections are set to the exact temperature and settings for whatever is preserved inside. The refrigerator's digital control or a mobile app allows users to set temperatures or choose from a list of presets, like beverages, produce, meat, cheese, etc. This allows them to increase the shelf life of some of their frequently used foods.

The modern refrigerators are integrating advanced cooling technologies to ensure optimal freshness and longer shelf life for food items. Features such as dual cooling, air purification, and precision temperature control are becoming standard features. This trend is meeting the rising demand for refrigerators that go beyond traditional cooling methods. For instance, in January 2024, Panasonic Corporation introduced the PRIME+ Edition Premium Refrigerators that are equipped with PRIME Fresh, PRIME Freeze, and nanoe X Technology, bringing together advanced cooling and hygiene technologies to preserve high-grade ingredients. These refrigerators ensure ingredients stay fresh, tasty, and nutritious with PRIME Fresh for extending the shelf life of fresh produce, PRIME Freeze ensures precise temperature control, and nanoe X Technology maintains a hygienic environment.

The ongoing innovation in refrigerator systems, such as manufacturing technologies involving defrosting systems, compressors, and low-energy consuming modes, helps in reducing energy consumption. According to the vice president of Liebherr North America, several manufacturers are integrating variable-speed compressors that conserve energy by running at very slow revolutions-per-minute rate. Prominent brands, including Liebherr, SunFrost, and Sub-Zero, offer dual refrigeration system technologies, which provide the refrigerator and the freezer with their compressor. Each compressor only runs enough to keep its specific compartment cool, cutting down on energy consumption and keeping the temperature more constant.

The trend toward larger, more customizable refrigerators is also prominent, as households seek models with adjustable storage options, multi-door designs, and advanced preservation technologies. These appliances are tailored to changing consumer preferences for flexible storage and longer-lasting freshness, which are particularly relevant for larger families and health-conscious consumers. Lastly, minimalistic and modern designs are gaining traction as homeowners look to match kitchen appliances with contemporary aesthetics. This shift is prompting manufacturers to offer products with sleek finishes, such as matte or fingerprint-resistant stainless steel, that blend style with functionality. Together, these trends highlight the market's adaptation to consumer priorities around sustainability, technology, and design.

Equipment Insights

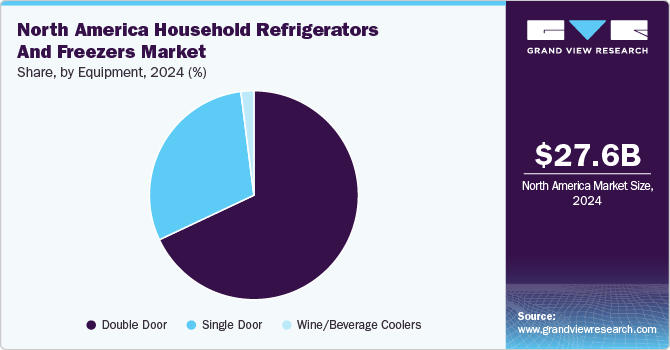

The double door segment led the market in 2024, accounting for over 67% of the revenue. The segment is estimated to expand at a CAGR of 2.9% from 2024 to 2030. Double door refrigerators offer several advantages, such as enhanced storage capacity, better organization, and improved energy efficiency compared to their single-door counterparts. In addition, the rising trend of larger households and increased food storage needs is boosting the demand for spacious refrigeration solutions, making double door models particularly appealing. Moreover, the availability of diverse features such as water dispensers, ice makers, and smart technology integration further adds to their attractiveness among consumers seeking convenience and functionality. Furthermore, the aesthetic appeal and modern design of double door refrigerators align with the preferences of consumers looking to upgrade their kitchen appliances.

The wine/beverage coolers segment is predicted to foresee the fastest growth in the coming years. This growth is primarily driven by evolving consumer preferences, increasing interest in entertaining at home, and a growing appreciation for specialty beverages such as wine and craft beer. Consumers are seeking refrigeration solutions specifically designed to store and showcase their collection of beverages, leading to a surge in demand for wine and beverage cooler door types. These coolers often feature specialized temperature controls, UV-resistant glass doors, and adjustable shelving to accommodate various bottle sizes and types.

Structure Insights

The counter depth segment accounted for the largest market revenue share in 2024. Counter-depth refrigerators and freezers are designed to align flush with kitchen cabinetry, offering a sleek and integrated look that appeals to consumers seeking modern aesthetics and space optimization. This growth is further fueled by the rising popularity of open-concept kitchen layouts, where seamless integration of appliances into cabinetry is desired. In addition, as urbanization continues and living spaces become more compact, counter-depth refrigerators and freezers provide an attractive solution for maximizing available space without compromising functionality. Manufacturers are responding to this demand by introducing innovative features and designs such as flexible storage options, advanced temperature control, and smart connectivity. As a result, the counter-depth structure segment is expected to continue its upward trajectory, catering to consumers' desire for both style and practicality in their kitchen appliances.

The standard depth segment is predicted to foresee the highest growth in the coming years. As urbanization continues, there is a trend toward smaller living spaces, prompting consumers to seek appliances that maximize functionality within limited areas. Standard depth refrigerators and freezers fit seamlessly into most kitchen layouts, making them a preferred choice for modern households. Moreover, technological advancements such as improved insulation, energy efficiency, and smart features are enhancing the appeal of standard depth appliances. Consumers are increasingly interested in appliances that offer convenience and connectivity, driving demand for smart refrigerators and freezers within this segment. In addition, as awareness of environmental issues grows, there is a heightened demand for energy-efficient appliances that reduce carbon footprints. Standard depth structures, often designed with such considerations in mind, are well-positioned to capitalize on this trend.

Capacity Insights

The 18 - 24.5 cu/ft segment accounted for the largest market revenue share in 2024. As family sizes and living spaces continue to expand, there is a growing demand for larger refrigeration units that offer ample storage space to accommodate groceries and perishables for extended periods. Moreover, with an increasing emphasis on bulk buying and meal preparation, consumers are seeking refrigerators and freezers with larger capacities to store a variety of food items efficiently. In addition, advancements in technology, such as energy-efficient features and smart connectivity options, are enhancing the appeal of larger appliances in this segment.

The 25-29.9 cu/ft segment is predicted to foresee the fastest CAGR in the coming years. Technological advancements have enhanced the appeal of larger refrigerators and freezers, with features such as improved energy efficiency, advanced temperature control, and smart connectivity options becoming increasingly prevalent. These features not only enhance convenience but also appeal to environmentally conscious consumers seeking energy-efficient appliances. Furthermore, as kitchen spaces in homes continue to expand, there is a trend toward premiumization, with consumers willing to invest in larger, higher-end appliances that offer both functionality and aesthetic appeal. Overall, the 25 to 29.9 cubic feet segment is poised for sustained growth as it meets the evolving needs and preferences of North American households.

Price Range Insights

The $900 - $1,999 segment accounted for the largest market revenue share in 2024. Consumers are increasingly seeking refrigerators and freezers equipped with advanced functionalities such as smart connectivity, energy efficiency, and customizable storage options. The $900 - $1,999 price range offers a balance between affordability and features, appealing to a wide range of consumers who are willing to invest in quality appliances for their homes. Moreover, heightened awareness of sustainability and environmental concerns has driven demand for energy-efficient appliances within this price segment. As a result, manufacturers are focusing on developing eco-friendly refrigeration solutions, further stimulating growth in this market segment.

The more than $3,500 segment is anticipated to exhibit the fastest CAGR over the forecast period. This surge can be attributed to several factors. First, advancements in technology have led to the production of more energy-efficient and cost-effective appliances, making them accessible to a wider consumer base. In addition, changing consumer preferences towards affordable yet quality products have bolstered demand within this segment. Furthermore, the increasing focus on home cooking and food preservation, particularly amid health concerns, has driven the need for reliable refrigeration solutions at accessible price points. Market players have responded by introducing innovative features and designs tailored to the budget-conscious consumer. Overall, these factors combined have contributed to the steady expansion of the less than $900 price range segment in the North American market.

Regional Insights

The North America household refrigerators and freezers market is witnessing several key trends. One significant trend is the growing demand for energy-efficient and eco-friendly appliances, driven by environmental awareness and government incentives encouraging reduced energy consumption. Many consumers now prioritize Energy Star-rated refrigerators that promise lower utility bills and a smaller carbon footprint. In addition, the market is experiencing a surge in smart refrigerators with connectivity features that allow remote control, monitoring, and integration with smart home systems. This technology caters to consumers looking for convenience and innovation, especially as it enables advanced features like automatic temperature adjustment and inventory tracking.

U.S. Household Refrigerators and Freezers Market Trends

The U.S. household refrigerators and freezers market is expected to grow at a CAGR from 2025 to 2030. Several factors are contributing to the market growth, such as increasing demand for frozen food prompted by busy lifestyles and requirements for efficient food storage solutions. Consumers are increasingly inclined towards advanced features such as smart technology for remote monitoring and energy efficiency to keep running costs down.

Key North America Household Refrigerators and Freezers Company Insights

Leading players in the market for household refrigerators and freezers in North America, such as KitchenAid, LG Electronics, Liebherr, Panasonic Corporation, Robert Bosch GmbH, Samsung Electronics, and Whirlpool Corporation, are actively pursuing strategic efforts to expand their customer base and strengthen their competitive edge. These companies are engaging in partnerships, acquisitions, collaborations, and innovative product development to address evolving consumer needs and demands. By enhancing their product offerings and incorporating advanced technologies, they aim to bolster their market presence and drive industry innovation. This proactive strategy helps them adapt to changing trends while maintaining a strong market position.

-

LG Electronics is a major player in the North American market, focusing on premium, energy-efficient products with smart technology integration. Their line of refrigerators includes features like InstaView technology, which lets users see inside without opening the door, and SmartThinQ connectivity, allowing remote control and monitoring. LG’s products emphasize energy efficiency, often meeting or exceeding Energy Star standards, addressing both environmental concerns and consumer demand for reduced energy costs. Through continuous innovation and consumer-focused technology, LG has positioned itself as a brand that prioritizes convenience, sustainability, and advanced functionality.

-

Whirlpool is known for its extensive range of refrigerators and freezers designed to cater to diverse consumer needs, from compact models for small spaces to large-capacity units for families. With features like adaptive defrost technology, Whirlpool’s appliances enhance energy efficiency and maintain optimal food freshness. The company has also been incorporating advanced filtering systems to extend food preservation and improve air quality within refrigerators. By focusing on durability, energy efficiency, and advanced food storage technologies, Whirlpool addresses consumer demand for high-performance, long-lasting appliances suitable for modern lifestyles.

Key North America Household Refrigerators and Freezers Companies:

- Dacor Inc.

- Dover Corporation

- Electrolux AB

- Frigidaire

- GE Appliances

- Haier Group

- KitchenAid

- LG Electronics

- Liebherr

- Panasonic Corporation

- Robert Bosch GmbH

- Samsung Electronics

- Whirlpool Corporation

View a comprehensive list of companies in the North America Household Refrigerators and Freezers Market

Recent Developments

-

In December 2023, Haier Group acquired the commercial refrigeration business of Carrier Corporation. The acquisition will help Haier Smart Home establish its commercial refrigeration platform, enabling the company to capture additional growth opportunities by expanding its presence to food retail refrigeration and cold storage.

-

In April 2023, Samsung Electronics partnered with TOILETPAPER, a creative studio. The collaboration brings TOILETPAPER’s unique and disruptive art style to limited-edition Samsung Bespoke refrigerator panels.

-

In January 2024, Liebherr launched new wine-tempering fridges. The product comes with humidity control. The humidity here can be regulated to your preferences in 5% increments between 50% and 80% relative humidity.

North America Household Refrigerators and Freezers Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 28.60 billion

Revenue forecast in 2030

USD 32.08 billion

Growth rate

CAGR of 2.3% from 2025 to 2030

Actual data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion/million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Equipment, structure, capacity, price range, region.

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Dacor Inc, .Dover Corporation, Electrolux AB, Frigidaire, GE Appliances, Haier Group, KitchenAid, LG Electronics, Liebherr, Panasonic Corporation, Robert Bosch GmbH, Samsung Electronics, Whirlpool Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Household Refrigerators and Freezers Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America household refrigerators and freezers market report based on equipment, structure, capacity, price range, and region.

-

Equipment Outlook (Revenue, USD Million, 2018 - 2030)

-

Single Door

-

Double Door

-

Top Mounted Freezer

-

Bottom Mounted Freezer

-

Side by Side

-

French Door

-

-

Wine/Beverage Coolers

-

-

Structure Outlook (Revenue, USD Million, 2018 - 2030)

-

Standard Depth

-

Counter Depth

-

-

Capacity Outlook (Volume; Thousand Units; Revenue, USD Million, 2018 - 2030)

-

0-11.9 cu/ft

-

12-17.9 cu/ft

-

18-24.9 cu/ft

-

25-29.9 cu/ft

-

30+ cu/ft

-

-

Price Range Outlook (Volume; Thousand Units; Revenue, USD Million, 2018 - 2030)

-

Up to $899

-

$900 - $1,999

-

$2,000 - $3,499

-

More than $3,500

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America household refrigerators and freezers market size was estimated at USD 27.58 billion in 2024 and is expected to reach USD 28.60 billion in 2025.

b. The North America household refrigerators and freezers market is expected to grow at a compound annual growth rate of 2.3% from 2025 to 2030 to reach USD 32.08 billion by 2030.

b. The double door segment dominated the North America household refrigerators and freezers market with a share of 67.9% in 2024. Advancements such as energy-efficient compressors, smart cooling systems, and improved temperature control features are driving the appeal of double door refrigerators. These innovations not only enhance performance but also align with increasing consumer awareness of sustainability.

b. Some key players operating in the North America household refrigerators and freezers market include Dacor Inc, Dover Corporation, Electrolux AB, Frigidaire, GE Appliances, Haier Group, KitchenAid, LG Electronics, Liebherr, Panasonic Corporation, Robert Bosch GmbH, Samsung Electronics, Whirlpool Corporation.

b. Key factors that are driving the market growth of the North America household refrigerators and freezers market include rising disposable incomes, technological advancements in energy-efficient and smart appliances, increasing urbanization, and changing consumer preferences for convenience and food preservation solutions.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."