North America Hotel Furniture, Fixtures, And Equipment Market Size, Share & Trends Analysis Report By Product (Furniture, Fixtures), By Hotel Type (Independent, Chain), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-476-0

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

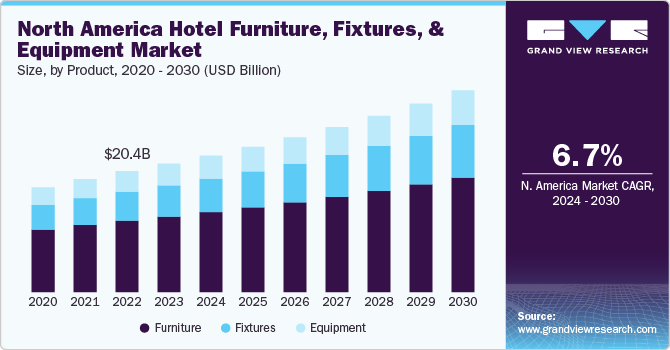

The North America hotel furniture, fixtures, and equipment market size was estimated at USD 21.65 billion in 2023 and is expected to grow at a CAGR of 6.7% from 2024 to 2030. Functionality and versatility are paramount considerations in hotel furniture selection. Hotels require furniture that serves multiple purposes and adapts to various guests' needs. For instance, guest room furniture should offer ample and efficient storage space, allowing guests to organize their belongings comfortably. Similarly, modular furniture designs enable flexible arrangements for events and gatherings in common areas such as lobbies and lounges.

Moreover, ergonomic considerations are crucial, especially for furniture pieces like chairs and sofas, ensuring guest comfort during extended periods of use. By addressing these needs and requirements, hotels can enhance guest satisfaction, optimize operational efficiency, and differentiate themselves in the competitive hospitality market.

Hotels in North America are also incorporating smart technology into their room designs to enhance guest experience. For instance, the YOTEL chain uses smart beds that can be adjusted for different activities, from lounging to sleeping. Its fully adjustable SmartBed reclines from an upright sofa to a queen-sized bed at the touch of a button. However, this feature is unavailable in all its hotels because it is committed to limiting energy consumption and recycling more.

Buyers increasingly prioritize sustainability, durability, and technological integration in furniture, fixtures, and equipment. Hoteliers focus on eco-friendly materials and energy-efficient solutions as part of their commitment to sustainability and reducing operational costs. This trend is evident in the growing demand for furniture made from recycled materials, energy-efficient lighting systems, and fixtures that support water conservation.

According to Lodging Econometrics (LE), the U.S. hotel industry is witnessing robust growth in construction and renovation activities. As of Q3 2023, 1,100 projects encompassing 146,757 rooms underwent refurbishments or transformations. This momentum thrives, with the active renovation and conversion pipeline expanding to 1,912 projects and 258,568 rooms.

The surge in renovations and conversions within the hospitality industry, as evidenced by the unprecedented number of projects and rooms undergoing refurbishments and transformations, directly correlates to the increased demand for FF&E in retrofit hotels across North America.

This sustained demand presents significant opportunities for FF&E suppliers and procurement specialists to support hoteliers in sourcing quality products, managing logistics, and executing successful renovation projects to elevate guest satisfaction and drive revenue growth.

Product Insights

Furniture dominated the market and accounted for a share of about 58% in 2023. The increased demand for furniture in North American hotels is attributed to the robust growth in the travel and tourism sector. According to the World Travel & Tourism Council, North America has steadily increased domestic and international tourism over the past decade. For instance, according to the American Hotel and Lodging Association, the average hotel occupancy rate in the U.S. is expected to reach 63.8% in 2023, which is slightly below the 65.9% rate seen in 2019 but represents a substantial recovery from the historic low of 43.9% recorded in 2020. This influx of travelers necessitates the expansion of existing hotel capacities and constructing new properties, both of which require substantial investments in furniture.

The demand for fixtures is expected to grow at a CAGR of 7.8% from 2024 to 2030. The integration of technology into hotel fixtures has revolutionized the guest experience. Smart fixtures, including automated lighting systems, smart thermostats, and touchless faucets, are becoming increasingly popular. These technologies enhance guest comfort and improve energy efficiency and operational control for hotel management. The adoption of smart fixtures reflects a broader trend toward digital transformation in the hospitality industry, focusing on providing a tech-savvy and personalized guest experience. This technological shift significantly drives the increased demand for modern hotel fixtures.

Hotel Type Insights

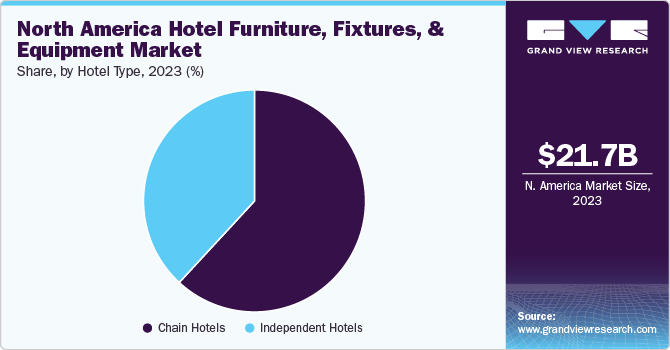

The demand for FF&E among chain hotels held the largest market share of about 61% in 2023. As hotel chains expand, they need to furnish these new establishments to meet their brand's specific standards and expectations, further driving demand for new furniture, fixtures, and equipment. Chain hotels employ strategic expansion strategies to increase their market presence and capture new customer segments. This includes opening new properties in high-demand locations, acquiring existing hotels, and converting independent hotels into branded properties. By expanding their footprint, chain hotels can cater to a broader audience and capitalize on emerging travel trends. For example, major hotel chains like Marriott, Hilton, and Hyatt continuously expand their portfolios by opening new hotels and diversifying their offerings.

The demand for furniture, fixtures, and equipment in independent hotels is expected to grow at a CAGR of 7.4% from 2024 to 2030. Travelers increasingly seek personalized and authentic experiences, which independent hotels are well-positioned to provide. Independent hotels offer unique aesthetics, tailored services, and a sense of place that resonates with guests looking for more than just a place to sleep. This shift is particularly pronounced among millennials and Generation Z travelers, who value individuality and cultural immersion over uniformity. Moreover, the rise of boutique hotels is another significant factor contributing to the increased demand for furniture, fixtures, & equipment in independent hotels.

Country Insights

U.S. Hotel Furniture, Fixtures, And Equipment Market Trends

The hotel furniture, fixtures, and equipment market in the U.S. accounted for a market share of around 76% in 2023 in the North American market. The market here is dominant due to the country's vast hospitality sector, which is driven by high tourism, business travel, and convention traffic. Major hotel chains continuously invest in renovations and upgrades to stay competitive, fueling demand for FF&E. In addition, the U.S. is home to numerous FF&E manufacturers and suppliers, making sourcing more accessible. Strict quality standards and trends towards eco-friendly and tech-integrated designs further solidify its leadership in the market.

Canada Hotel Furniture, Fixtures, And Equipment Market Trends

The hotel furniture, fixtures, and equipment market in Canada accounted for a market share of around 18% in 2023 in the North American market. Canada attracts millions of tourists and business travelers yearly, driving demand for new hotels and renovations. Hotel operators prioritize upgrading furniture, fixtures, and technology to meet evolving guest expectations, particularly around comfort, design, and sustainability. In addition, with major cities like Toronto, Vancouver, and Montreal hosting global events, the industry benefits from frequent refurbishments to stay competitive.

Mexico Hotel Furniture, Fixtures, And Equipment Market Trends

The hotel furniture, fixtures, and equipment market in Mexico is anticipated to rise at a CAGR of about 7.8% from 2024 to 2030. The market here is set to rise due to the growing tourism sector, driven by the country's popularity as a travel destination and post-pandemic recovery. Increased foreign investments in luxury resorts and boutique hotels drive demand for high-quality furnishings and décor. Mexico's strong manufacturing base and proximity to the U.S. make it an ideal location for cost-effective sourcing and customization of FF&E products.

Key North America Hotel Furniture, Fixtures, And Equipment Company Insights

The market is fragmented. Many brands have identified untapped opportunities within their product lines and are taking steps to address these market gaps. This often involves developing new product designs or marketing campaigns that better meet consumer needs and preferences. Some of the key players operating in the North American hotel furniture, fixtures, and equipment market include:

Key North America Hotel Furniture, Fixtures, And Equipment Companies:

- Vogue Decor Furniture

- Hospitality Furniture Group

- Kimball International

- Consolidated Hospitality Supplies (CHS)

- Milliken & Company

- Hotel Spec International, Inc.

- Benjamin West

- Carroll Adams

- Innvision Hospitality, Inc.

- Beyer Brown

Recent Developments

-

In December 2023, luxury hotel group Aman debuted its first furniture line, Aman Interiors, at Design Miami. The launch featured the "Foundations Collection" alongside limited edition pieces, including a dining set by Japanese architect Kengo Kuma. Aman Interiors offers high-end furniture to the public, while its interior design service is reserved for Aman residence owners.

-

In October 2020, Furniture Fusion unveiled its Hotel Collection, featuring 50 new design-led pieces, including bar stools, tables, sofas, and chairs. The collection introduced contemporary designs like the Grace side chair with a wraparound beech frame and brass detailing and the statement-making Gill range with contrasting upholstery.

North America Hotel Furniture, Fixtures, And Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 23.02 billion |

|

Revenue forecast in 2030 |

USD 34.02 billion |

|

Growth rate |

CAGR of 6.7% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, hotel type, country |

|

Country scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

Vogue Decor Furniture; Hospitality Furniture Group; Kimball International; Consolidated Hospitality Supplies (CHS); Milliken & Company; Hotel Spec International, Inc.; Benjamin West; Carroll Adams; Innvision Hospitality, Inc.; Beyer Brown |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Hotel Furniture, Fixtures, And Equipment Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America hotel furniture, fixtures, and equipment market report based on product, hotel type, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Furniture

-

Fixtures

-

Equipment

-

-

Hotel Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Independent Hotels

-

Chain Hotels

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America hotel furniture, fixtures, and equipment (FF&E) market was estimated at USD 21.65 billion in 2023 and is expected to reach USD 23.02 billion in 2024.

b. The North America hotel furniture, fixtures, and equipment (FF&E) market is expected to grow at a compound annual growth rate of 6.7% from 2024 to 2030 to reach USD 34.02 billion by 2030.

b. U.S. dominated the North America hotel furniture, fixtures, and equipment (FF&E) market with a share of around 76% in 2023. The market here is dominant due to the country's vast hospitality sector, driven by high tourism, business travel, and convention traffic.

b. Key players in the North America hotel furniture, fixtures, and equipment (FF&E) market are Vogue Decor Furniture; Hospitality Furniture Group; Kimball International; Consolidated Hospitality Supplies (CHS); Milliken & Company; Hotel Spec International, Inc.; Benjamin West; Carroll Adams; Innvision Hospitality, Inc.; Beyer Brown

b. Key factors that are driving the North America hotel furniture, fixtures, and equipment (FF&E) market include increasing tourism, the growth of boutique and luxury hotels, and rising consumer preferences for aesthetically pleasing and functional hotel interiors.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."