- Home

- »

- Medical Devices

- »

-

North America Hospital Gowns Market, Industry Report 2030GVR Report cover

![North America Hospital Gowns Market Size, Share & Trends Report]()

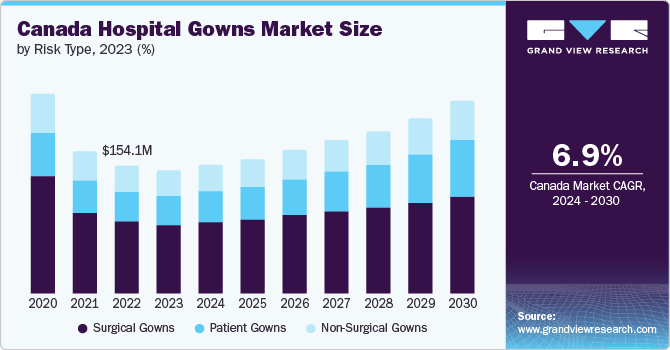

North America Hospital Gowns Market Size, Share & Trends Analysis Report By Type (Surgical Gowns, Non-surgical Gowns, Patient Gowns), By Usability (Disposable, Reusable), By Risk Type (Minimal, Low, Moderate, High), By Region, And Region Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-427-0

- Number of Report Pages: 104

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

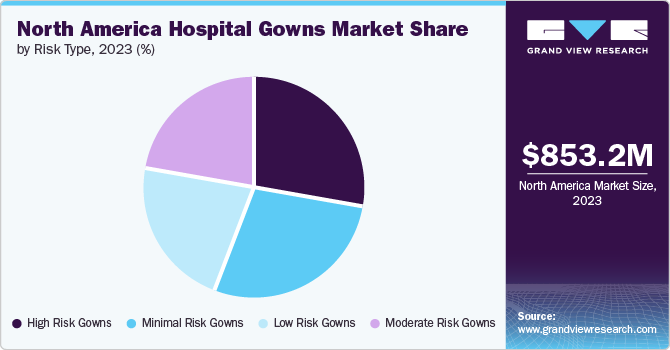

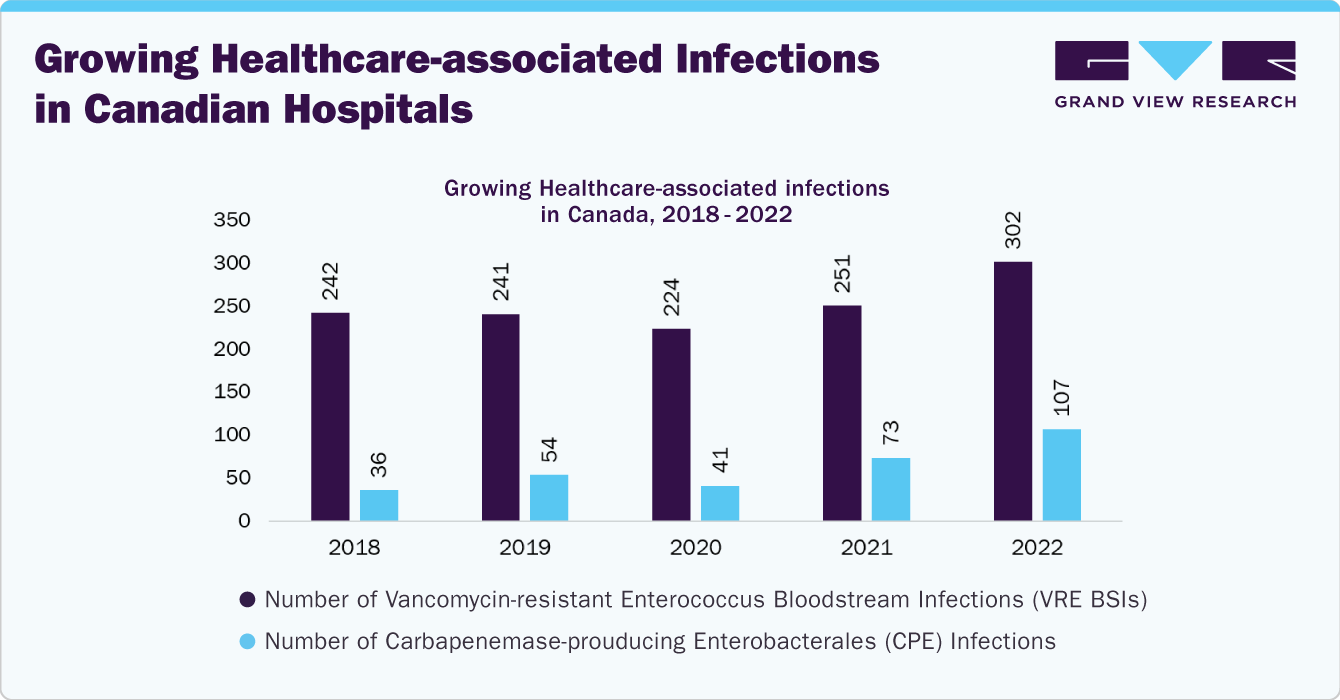

The North America hospital gowns market size was estimated at USD 853.16 million in 2023 and is projected to grow at a CAGR of 7.72% from 2024 to 2030. The growth can be attributed to the increasing number of surgical procedures and the rising prevalence of chronic conditions, which can lead to higher hospital admission rates. Furthermore, the growing incidence of Hospital-Acquired Infections (HAIs) is anticipated to increase the demand for hospital gowns. According to data published by IQAir in May 2024, approximately 1.7 million Americans (one in ten patients) are affected by hospital-acquired infections in U.S. hospitals yearly. In Canada, 220,000 HAIs occur annually, accounting for one in eight patients.

The increasing number of surgical procedures is expected to drive market growth. Hospital gowns play a crucial role in protecting patients and healthcare workers during surgeries by shielding them from microorganisms and bodily fluids. A study published by the National Library of Medicine in May 2023 reported that over two million surgical procedures are performed in Canada each year.

Furthermore, the increasing popularity of cosmetic surgeries is projected to boost market growth. Certain cosmetic procedures, like breast augmentation, involve the use of hospital gowns. According to statistics released by the Toronto Cosmetic Surgery Institute in January 2024, over 400,000 women in Canada undergo breast augmentation surgery each year. Therefore, the substantial number of surgical procedures may drive the demand for hospital gowns in the future.

Moreover, the rising prevalence of chronic diseases such as cancer and heart diseases, which often require surgeries, is also anticipated to contribute to North America hospital gowns market growth over the forecast period. For instance, a study published by the National Library of Medicine in January 2024 projected around 2,001,140 new cancer patients and 611,720 cancer deaths in the U.S. in 2024.

According to data published by Baystate Health in February 2024, nearly 400,000 coronary artery bypass graft surgical procedures are performed in the U.S. Patients with heart disease and cancer often need to visit hospitals and may require hospitalization for several days during their treatment and surgeries. As a result, the growing prevalence of chronic conditions and related hospitalizations is anticipated to contribute to North America market growth in the forecast period.

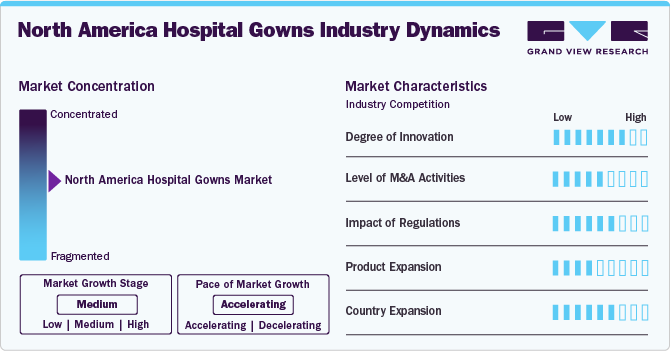

Market Concentration & Characteristics

The market growth stage is moderate, and the pace of growth is accelerating. The North America hospital gowns market is characterized by a high degree of growth owing to rising hospitalization rate and the growing focus of manufacturers on expanding the manufacturing of hospital gowns in the region.

Firms in the industry are focusing on technological advancements to innovate their product offerings and regularly introduce new and improved products. Manufacturers are creating products with additional instrument pockets to aid healthcare professionals in surgical procedures. For example, in November 2023, Cardinal Health, a provider of hospital gowns, introduced the Breathable Surgical Gown, SmartGown EDGE. This gown includes ASSIST Instrument Pockets, which can keep commonly used surgical instruments within easy reach while surgeons and clinicians work in complex sterile environments. These developments of novel products are expected to drive innovation in the market.

In North America, regulatory bodies such as the U.S. Food and Drug Administration (FDA) and Health Canada set safety and quality standards for regulating medical devices, including hospital gowns. These authorities classify gowns into different categories, such as surgical gowns, non-surgical gowns, and surgical isolation gowns, to provide regulatory guidance and recommendations for these medical devices. In addition, during the COVID-19 pandemic, the FDA has relaxed the regulatory requirements for hospital gowns to meet the rising demand due to significantly increased patient populations and associated hospitalizations. Such regulations positively impact the hospital gown market in North America.

In addition, regulatory authorities oversee the marketing authorizations of hospital gowns. For instance, in November 2022, Medtecs International Corporation Limited received FDA clearance for its two disposable gowns: CoverU Disposable Gown with Tape - Chemo Gown and with Tape AAMI Level 4 Isolation Gown. Approvals from regulatory bodies like the FDA increase the availability of products in the North American market, which can support market growth in the coming years.

Manufacturers in the North America hospital gowns market are introducing new products or improving existing ones to meet changing patient needs and market demands. They are expanding their product range by launching new items. Some of the companies expanding their product portfolio include Cardinal Health.

The hospital gowns market in North America is fragmented among numerous small, medium, and large-sized companies. These companies compete based on price, product differentiation, and product quality. Manufacturers in the region offer various types of gowns, including surgical gowns, isolation gowns, non-surgical gowns, and patient gowns. For instance, Medline Industries, LP., a company in the regional market, provides surgical and patient gowns.

The industry players are expanding their presence in the U.S. and Canada by increasing their hospital gown manufacturing capacities and establishing new manufacturing facilities. For instance, in July 2021, ProTEC-USA introduced a new production work cell that increased and enhanced its capacity to develop and produce EZDoff medical gowns for healthcare and other vital industries. These expansions and increased investments in hospital gown manufacturing capacities are anticipated to drive market growth in the coming years.

Type Insights

The surgical gowns segment dominated the market, accounting for 55.68% of the revenue in 2023. This can be attributed to advancements in gown fabrics and design, such as improved fluid resistance, enhanced comfort, and better breathability, making surgical gowns more effective and appealing. These advancements are anticipated to drive the adoption of surgical gowns in the coming years. In addition, surgical gowns are available from various manufacturers, including Cardinal Health, Medline Industries, LP., Medicom, and Encompass Group, LLC, which is expected to support the segment's growth over the forecast period.

The patient gown segment is expected to grow at the fastest CAGR during the forecast period, due to the increasing patient population. A growing number of outpatient procedures and routine hospital visits are expected to drive the growth of this segment in the coming years. According to an article published by the Emergency Center in November 2023, approximately 136 million patients visit emergency rooms in the U.S. each year. Therefore, the increasing number of patients visiting healthcare facilities is expected to support the growth of this segment in the coming years.

Usability Insights

The disposable hospital gown segment dominated the market in 2023. The reduction in the risk of cross-contamination and ease of disposal associated with disposable gowns are anticipated to support the segment's growth in the coming years. In addition, these gowns are often designed to meet specific standards for fluid resistance and barrier protection, aligning with the stringent guidelines set by health authorities. Therefore, their compliance with regulatory requirements and standards is expected to bolster the demand for disposable gowns in the coming years.

The reusable hospital gowns segment is expected to grow fastest, with the highest CAGR of 8.51% during the forecast period. The demand for reusable hospital gowns is anticipated to be driven by several factors, including their cost effectiveness compared to disposable gowns and the growing emphasis of industry participants on reusable gowns to reduce hospital waste that can harm the environment. During the COVID-19 pandemic, many industry players responded to the shortage of hospital gowns by developing various reusable options. For instance, Inova Health System, based in Washington, D.C., produced custom, reusable isolation gowns to ensure an adequate supply during the pandemic, as reported by the Association for Professionals in Infection Control and Epidemiology, Inc. in June 2022.

Risk Type Insights

The high-risk gowns segment dominated the market and accounted for the largest revenue share, at 28.01% in 2023. These gowns help protect against infectious disorders and pathogens during fluid-intensive surgical procedures. They provide high tear resistance, tensile strength, and breathability. The high-risk hospital gown segment is growing due to the increasing demand for enhanced protection and infection control in high-risk medical settings.

The minimal-risk gowns segment is expected to grow with the highest CAGR during the forecast period. These gowns are used when there is no direct contact with hazardous materials or blood. Generally, minimal-risk gowns are more economical compared to surgical or high-risk gowns, as they are made from less expensive materials and provide a lower level of protection. Thus, the cost-effectiveness of minimal-risk gowns is anticipated to boost their adoption in the coming years.

The graph shows the number of cases of carbapenemase-producing Enterobacterales (CPE) infections and vancomycin-resistant Enterococcus (VRE) bloodstream infections (BSIs) in Canada from 2018 to 2022. The data included information from 88 Canadian sentinel acute care hospitals between January 1, 2018, and December 31, 2022. VRE BSIs and CPE infections are common pathogens in hospital-acquired infections. Therefore, the increasing number of hospital-acquired infections caused by VRE BSIs, and CPE infections is expected to drive up the demand for hospital gowns in the upcoming years.

Growing Shift Towards Reusable Gowns

The healthcare industry is shifting its focus towards reusable gowns to reduce the environmental impact caused by hospital waste generated from disposable products. Reusable gowns are also cost-effective compared to disposable ones. According to the article published by the TRSA, in a January 2024, Surrey Memorial Hospital in BC conveyed that disposable gowns were nine times more expensive per use than reusable isolation gowns. Here are some key opinions about the adoption of reusable gowns:

“Converting to reusable gowns immediately introduced a predictable supply of product for the foreseeable future. The fact that it also reduced our environmental footprint was an added benefit. ”Mackenzie Health has now converted all of the isolation gowns used in the ICU to reusables.”Altaf Stationwala, CEO, Mackenzie Health in Ontario

“Early in the pandemic, UHN and Ecotex, our health care linen services partner, collaborated on the development of a high-volume reusable isolation gown program. This process was quickly scalable, enabling Ecotex to launder and return clean reusable isolation gowns up to three times a day during the peaks of the COVID-19 pandemic, when reusable isolation gown use had more than tripled to 120,000 gowns per week. Through this creative and sustainable local initiative, TeamUHN was consistently provided with high quality reusable isolation gowns to continue caring for patients safely during this very challenging time. Today, over 99% of the isolation gowns used at UHN are reusable.”Joanne Bridle, Executive Director, FM-PRO Operations, University Health Network (UHN) in Ontario

Key North America Hospital Gowns Company Insights

The industry players are focusing on expanding their manufacturing and production facilities across North America. Moreover, the rising launch of hospital gowns in North America is anticipated to boost the competitive rivalry in the North America market.

Key North America Hospital Gowns Companies:

- Cardinal Health

- 3M

- Medline Industries, LP.

- Standard Textile Co., Inc.

- AmeriPride Services Inc. (Vestis)

- Medicom

- PRIMED

- Encompass Group, LLC

- Taromed

Recent Developments

-

In March 2024, Henna & Hijabs, a Minnesota-based company, collaborated with the Kid Experts at Children's Minnesota, a pediatric health system, to introduce modest hospital gowns for kids. These gowns are mainly designed for patients who wear hijabs. This gown has a detachable hijab component and sleeves that are 3/4 length.

-

In October 2023, Starlight Children’s Foundation partnered with the MoneyGram Haas F1 Team to introduce the Starlight Hospital Gown featuring the VF-23 theme at St. David’s Children’s Hospital in Austin, Texas.

-

In April 2023, Taromed reported the completion of its 2.1 version of the fully automated production line for surgical and isolation gowns. They also disclosed their plans to open a new production site in the U.S. in 2024. This expansion will allow Taromed to produce "Made in U.S." products and serve North American customers more effectively.

North America Hospital Gowns Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 898.27 million

Revenue forecast in 2030

USD 1,403.41 million

Growth rate

CAGR of 7.72% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in units, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, trends, and volume analysis

Segments covered

Type, usability, risk type, region

Regional scope

North America

Country Scope

U.S.; Canada

Key companies profiled

Cardinal Health; 3M; Medline Industries, LP, Standard Textile Co., Inc.; AmeriPride Services Inc. (Vestis); Medicom; PRIMED; Encompass Group, LLC;

Taromed

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Hospital Gowns Market Report Segmentation

This report forecasts volume & revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America hospital gowns market report based on type, usability, risk type, and country:

-

Type Outlook (Volume Unit; Revenue, USD Million, 2018 - 2030)

-

Surgical Gowns

-

Non-Surgical Gowns

-

Patient Gowns

-

-

Usability Outlook (Revenue, USD Million, 2018 - 2030)

-

Reusable Hospital Gowns

-

Low Cost Reusable Hospital Gowns

-

Average Cost Reusable Hospital Gowns

-

Premium Cost Reusable Hospital Gowns

-

-

Disposable Hospital Gowns

-

Low Cost Disposable Hospital Gowns

-

Average Cost Disposable Hospital Gowns

-

Premium Cost Disposable Hospital Gowns

-

-

-

Risk Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Minimal Risk Gowns

-

Low Risk Gowns

-

Moderate Risk Gowns

-

High Risk Gowns

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America hospital gowns market size was estimated at USD 853.16 million in 2023 and is expected to reach USD 898.27 million in 2024.

b. The North America hospital gowns market is expected to grow at a compound annual growth rate of 7.72% from 2024 to 2030 to reach USD 1,403.41 million by 2030.

b. The surgical gowns segment held the largest revenue share of 55.68% in the market in 2023 due to advancements in gown fabrics and design, such as improved fluid resistance, enhanced comfort, and better breathability.

b. Some key market players operating in the North America hospital gowns market include Cardinal Health, 3M, Medline Industries, LP., Standard Textile Co., Inc., AmeriPride Services Inc. (Vestis), Medicom, PRIMED, Encompass Group, LLC, and Taromed.

b. The North America hospital gowns market growth can be attributed to the increasing number of surgical procedures and the rising prevalence of chronic conditions, which can lead to higher hospital admission rates.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."