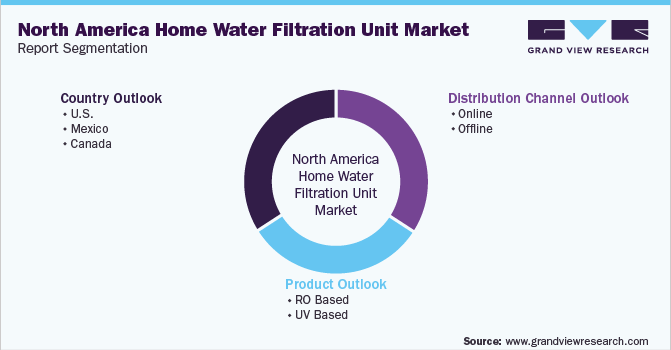

North America Home Water Filtration Unit Market Size, Share & Trends Analysis Report By Product (RO Based, UV Based), By Distribution Channel (Online, Offline), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-035-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2021

- Forecast Period: 2023 - 2030

- Industry: Consumer Goods

Report Overview

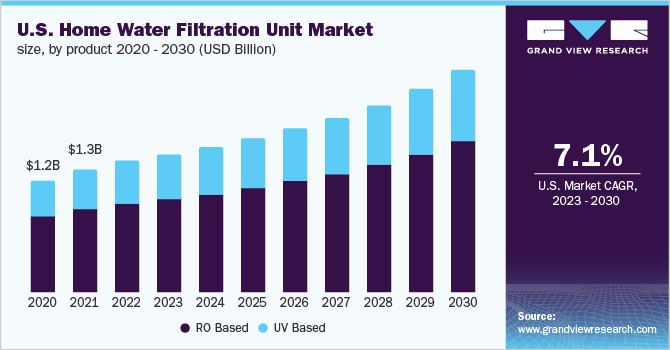

The North America home water filtration unit market size was estimated at USD 2.09 billion in 2022 and is expected to exhibit a CAGR of 7.4% during the forecast period till 2030. In recent years, the overall home water filtration market has gained immense traction as a result of changing lifestyles, especially in urban areas. In addition, the availability of filtered water all the time encourages the adoption of home water filtration units. The scarcity of drinking water has obligated the domestic authorities to provide the population with adequate supply of the same. The outbreak of COVID-19 across the globe impacted all aspects of human life. Consumers are still adjusting to the socioeconomic effects of the pandemic. During the past three years, countries have implemented varying degrees of lockdown, social isolation orders, and shelter-at-home policies. Customers are also put at ease by initiatives such as no-contact delivery. Amazon and other large e-commerce companies focus on strategies to continue operations despite the pandemic with proper safety precautions.

The pandemic altered consumer purchasing habits and e-commerce has emerged as one of the most promising and trending distribution channels for the household appliances such as water filtration. According to the Annual Retail Trade Survey of the U.S. Census Bureau, as compared to 2019 e-commerce sales increased by 43.0% in 2020, this trend is expected to continue in the coming years, benefiting online sales.

The penetration of water purification solutions in developed countries such as the U.S. and Canada is relatively high. Home water filtration is seen as a necessity, especially in metros and urban cities, due to the alarmingly high microbial and chemical contamination of the surface water sources. Growing awareness among consumers about the ill effects of consuming contaminated water, along with the declining levels of potable water, has resulted in a significant shift in consumer preferences from conventional water purification methods such as boiling, addition of chlorines or iodine to technology-based systems.

Filters commonly used in the residential sector include water filter pitchers, end-of-tap or faucet-mounted filters, faucet-integrated (built-in) filters, on-counter filters, and under-sink filters. Due to the availability of a wide range of products, determining the type of unit that best suits consumers’ requirements is of utmost importance.

Various companies are introducing innovative products to cater to consumers’ demands and further contribute to regional market growth. For instance, in January 2020, Cott Corporation introduced PureFlo an IoT-enabled water filtration system that provides everyone drinking from the device with in-depth, real-time data on water usage and water quality as well as continuous analysis of water quality and filter life.

Product Insights

The RO-based segment held the largest share of above 65.2% in 2022. RO water purification systems are widely used owing to their performance effectiveness, low electricity consumption, and advanced technological features. Increasing penetration of low-budget residential water purifiers is likely to stimulate global demand during the coming years. Manufacturers have been introducing variants of RO-based filters with advanced technology measures in order to better adapt to evolving home settings. For instance, APEC Water Systems introduced the APEC ROES-PH75 with a 6-stage water filtration system and food-grade calcium cartridge used for pH enhancement.

On the other hand, the UV-based segment is expected to register a significant CAGR during the forecast period. A large number of players in the home water filtration unit market have been launching UV-based water filters. For instance, to effectively separate and recover photocatalysts from the water for reuse, Panasonic developed a technique that binds the photocatalyst (titanium dioxide) to a commercial adsorbent and a catalyst called zeolite.

These purifiers are generally manufactured in conjunction with other forms of filtration such as reverse osmosis (RO) or activated carbon and are largely effective for purifying biologically contaminated water. These filters are considered extremely effective in reducing the risk of waterborne diseases caused by viruses, bacteria, or other pathogens that display resistance to chlorine. Thus, consumers are increasingly opting for this cost-effective method of water filtration, expanding the scope of this segment in the market.

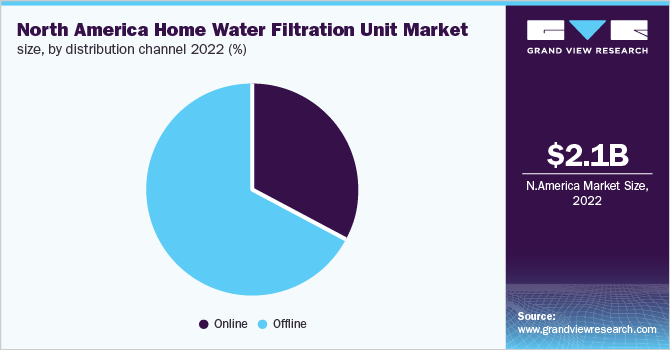

Distribution Channel Insights

The offline segment dominated the market and held a revenue share of more than 67.1% in 2022. Consumers are more likely to purchase water purifiers from offline stores in the US. Numerous purifying technologies and designs are displayed in conferences, exhibitions, and events conducted by the water organization and water treatment trade shows.

For instance, in April 2022, Water drop attended the 2022 Water Quality Association (WQA) Convention & Exposition in Florida to display its cutting-edge technologies and advanced solutions to be used in the water industry. The WQA Convention and Exposition 2022 welcomed more than 13,000 exhibitors and 400 companies, making it one of the highest-rated events in the water purification industry.

The online segment is expected to exhibit the fastest growth rate of 9.3% during the forecast period. The increasing use of online retail channels is one of the key aspects that are anticipated to boost the market growth for water purifiers. The world's growing urbanization and widespread use of the internet have accelerated the growth of online platforms. Due to the increasing popularity of online markets, consumers can compare different products in terms of quality, features, and price.

Country Insights

The U.S. accounted for the largest revenue share of above 65.2% in 2022. In North America, the primary markets for home water filtration are U.S., Canada, and Mexico. Hard water results in scaling due to the presence of minerals. This piles up on the inner surfaces of the pipeline, thereby clogging the plumbing and pipes in the appliance. Consumers are therefore increasingly investing in water filtration units to reduce electrical costs associated with hard water storage and filtration. High prices of bottled water are also compelling consumers in the region to switch to home water purification systems.

On the other hand, Mexico is expected to register the fastest growth rate of 8.4% during the forecast period. Growing public awareness of the detrimental effects of contaminated surface water and a decrease in the supply of potable water in the nation both had a substantial impact on consumer choices for domestic water filtration systems across the country. According to the article published on explorando Mexico, despite having the infrastructure to receive drinkable water, 90.0 million Mexicans require to filter their water at home, which further increases demand for the home water filtration systems in the country.

Key Companies & Market Share Insights

The market is fragmented owing to the presence of a large number of domestic as well as international players. However, key players capture the majority of the market share. The leading and well-established companies have a large customer base, including regional and international consumers, owing to the presence of strong & vast distribution networks.

The impact of major players on the market is quite high as most of them have a global presence. They are also engaged in strategic alliances to expand their respective portfolios and gain a strong footing in the market. For instance, in May 2022, Quench USA Inc., a Culligan company, acquired Pure Water Solutions of America. Pure Water Solutions is a leading Wellsys dealer and operates in five U.S. states: Nevada, Utah, Arizona, Washington, and Idaho.

Some of the major strategic initiatives undertaken by the market players are listed below:

-

In October 2022, HUL announced a new range of water purifiers-'Pure it Vital Series’-which includes RO + UV + minerals-based water purifiers with Filtra Power Technology. The new range of water purifiers is proven to remove toxic substances like pathogens, pesticides, and other chemicals to provide safe drinking water

-

In June 2022, A.O. Smith Corporation, the parent company of Aqua Sana, acquired water treatment solutions provider Atlantic Filter Corporation to provide effective water treatment solutions, making them a leader in the water treatment industry

-

In May 2022, Quench USA Inc., a Culligan company, acquired Pure Water Solutions of America. Pure Water Solutions is a leading Wellsys dealer and operates in five U.S. states: Nevada, Utah, Arizona, Washington, and Idaho

-

In May 2022, Aqua Sana Inc., a leading maker of high-performance water filters, upgraded its water filtration with the launch of 'Clean Water Machine', the first powered countertop water filter to combine a sleek, compact, and no-install design with four different methods of filtration technology

-

In March 2022, LG Electronics launched the UF + UV Water Purifier that filters water in seven stages to eliminate impurities and heavy metals from the water. The company also launched a 'Post Carbon Filter' in the water purifier, which eliminates 99.9% of the virus present in the water

-

In January 2022, Culligan International and Water logic Group Holdings signed an agreement to become a market leader in clean and sustainable drinking water products and services. The merger adds extra scale, experience, and distribution channels to support innovation in the creation of innovative water filtration, purification, and treatment technologies

-

In September 2021, For USD 595.1 million, American buyout firm Advent International acquired the majority shares of Eureka Forbes Ltd, the consumer durables division's flagship and a well-known brand in the vacuum cleaner and water purifier industries

Some prominent key companies operating in the North America home water filtration unit market include:

-

LG Electronics

-

Panasonic Holdings Corporation

-

Aqua Sana, Inc.

-

Whirlpool Corporation

-

Koninklijke Philips N.V.

-

Hindustan Unilever Limited

-

Eureka Forbes Ltd

-

General Electric

-

Trojan Technologies Group ULC

-

Culligan Water

-

Brita GmbH

-

Amway Corporation

-

LUMINOR Environmental Inc.

-

KENT RO SYSTEMS LTD

North America Home Water Filtration Unit Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2023 |

USD 2,211.6 million |

|

Revenue forecast in 2030 |

USD 3,707.4 million |

|

Growth rate |

CAGR of 7.4% from 2023 to 2030 |

|

Base year for estimation |

2022 |

|

Historical data |

2017 - 2021 |

|

Forecast period |

2023 - 2030 |

|

Quantitative units |

Revenue in USD million, thousand units, CAGR from 2023 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, distribution channel, region |

|

Regional scope |

North America |

|

Country scope |

U.S.; Mexico; Canada |

|

Key companies profiled |

LG Electronics; Panasonic Holdings Corporation; Aqua Sana, Inc.; Whirlpool Corporation; Koninklijke Philips N.V.; Hindustan Unilever Limited; Eureka Forbes Ltd; General Electric; Trojan Technologies Group ULC; Culligan Water; Brita GmbH; Amway Corporation; LUMINOR Environmental Inc.; KENT RO SYSTEMS LTD. |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Home Water Filtration Unit Market Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest trends and opportunities in each of the sub-segment from 2017 to 2030. For this study, Grand View Research has segmented the North America home water filtration unit market based on the product, distribution channel, and country.

-

Product Outlook (Revenue, USD Million; 2017 - 2030)

-

RO Based

-

UV Based

-

-

Distribution Channel Outlook (Revenue, USD Million; 2017 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million; 2017 - 2030)

-

U.S.

-

Mexico

-

Canada

-

Frequently Asked Questions About This Report

b. The global North America home water filtration unit market size was estimated at USD 2,092.5 million in 2022 and is expected to reach USD 2,211.6 million in 2023.

b. The global North America home water filtration unit market is expected to grow at a compound annual growth rate of 7.4% from 2023 to 2030 to reach USD 3,707.4 million by 2030.

b. U.S. dominated the North America home water filtration unit market with a share of 65.29% in 2022. In North America, the primary markets for home water filtration are U.S, Canada, and Mexico. Hard water results in scaling due to the presence of minerals. This piles up on the inner surfaces of the pipeline, thereby clogging the plumbing and pipes in the appliance.

b. Some key players operating in the North America home water filtration unit market include LG Electronics, Panasonic Holdings Corporation, Aquasana, Inc., Whirlpool Corporation, Koninklijke Philips N.V. Hindustan Unilever Limited, Eureka Forbes Ltd, General Electric, Trojan Technologies Group ULC, Culligan Water, Brita GmbH, Amway Corporation, LUMINOR Environmental Inc., KENT RO SYSTEMS LTD.

b. Key factors that are driving the North America home water filtration unit market growth include the availability of filtered water all the time encourages the adoption of home water filtration units. The scarcity of drinking water has obligated the domestic authorities to provide the population with adequate supply of the same.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."