- Home

- »

- Clothing, Footwear & Accessories

- »

-

North America Golf Apparel Market, Industry Report, 2030GVR Report cover

![North America Golf Apparel Market Size, Share & Trends Report]()

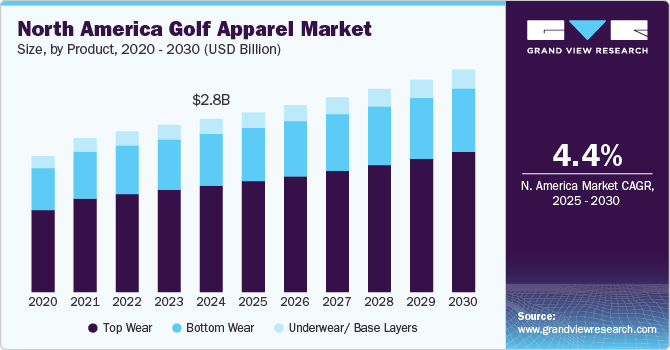

North America Golf Apparel Market Size, Share & Trends Analysis Report By Product (Top Wear, Bottom Wear), By Distribution Channel (Online, Exclusive Brand Outlets), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-489-6

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America golf apparel market size was estimated at USD 2.76 billion in 2024 and is expected to expand at a CAGR of 4.4% from 2025 to 2030. The industry has been experiencing steady growth fueled by increased participation in golf, the rise of golf tourism, and the sport's growing appeal as a leisure activity. This market includes a broad range of products, such as clothing, footwear, and accessories specifically designed for golfers. As the sport gains popularity, particularly among younger generations, the demand for golf apparel continues to rise.

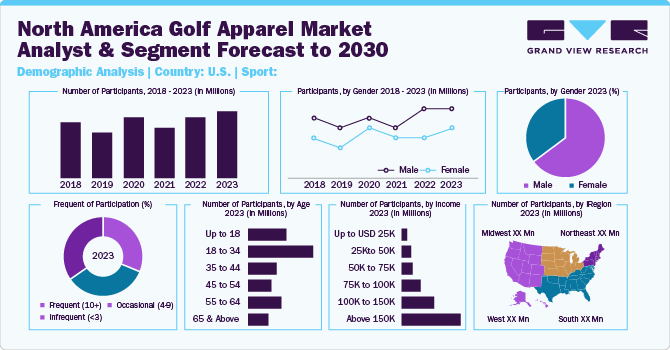

Golf participation in the U.S. has surged, with more Americans playing both traditional on-course golf and taking advantage of more accessible off-course options like Topgolf. In 2022, about one in seven Americans played golf, contributing to a significant USD 101.7 billion in direct economic impact. This marked a 20% increase from the USD 84.1 billion recorded in 2016, as a new study by the American Golf Industry Coalition reported. This growth underscores golf's expanding popularity and economic importance in the U.S.

Sport has seen a resurgence post-pandemic, as people seek outdoor activities that offer both recreation and social interaction. This increased participation has directly influenced the demand for golf apparel, with consumers looking for clothing that combines performance and style. The rise of off-course venues like Topgolf has also broadened the market, attracting new players who are interested in the sport but might not engage in traditional golfing environments.

Several key trends are shaping the golf apparel industry in North America. One significant trend is the shift toward more versatile and fashionable designs. Consumers are looking for golf apparel that is functional on the course and stylish enough to wear casually. Brands like Lululemon and Nike have capitalized on this by offering athleisure-inspired golf collections that appeal to a broader audience. There is also a growing emphasis on sustainability, with brands like Adidas introducing eco-friendly lines made from recycled materials, catering to the increasing demand for environmentally conscious products.

In April 2024, Aimé Leon Dore, a New York City-based label renowned for its elevated streetwear, expanded into the golf industry, as hinted by a teaser video. The video showcased a man cleaning Titleist golf clubs and placing them in a vintage caddie bag, with an NYC weather report playing in the background. The collection, which seems to emphasize technical fabrics suited for various weather conditions, features items like a bucket hat, relaxed-fit trousers, and a wind shirt with a half-zip. The logo, depicting a green flagstick with the word "AIMÉ," suggests a golf-inspired design direction. This move aligns with the growing trend of consumers seeking apparel that combines performance with style, both on and off the golf course. As golf gains popularity in both underground and mainstream fashion, brands like Aimé Leon Dore are capitalizing on this demand by offering stylish yet functional clothing.

Recent developments in the industry reflect these evolving consumer preferences. Customization is becoming a major selling point, with brands offering personalized apparel options such as monogramming and tailored fits. This trend is particularly strong in the premium segment, where exclusivity and individuality are highly valued. Moreover, the women’s golf apparel segment is expanding rapidly, with more brands introducing lines specifically designed for female golfers. This includes a focus on better-fitting, more stylish options that reflect the growing participation of women in the sport.

Consumer Insights

A blend of functionality, style, and sustainability shapes consumer trends and preferences in the North America golf apparel industry. Golfers are increasingly seeking performance-oriented apparel that offers advanced features such as moisture-wicking, UV protection, and stretchable fabrics to enhance comfort and mobility during play. These technical attributes have become essential, particularly for younger golfers who prioritize comfort without compromising style.

A notable trend is the rise of athleisure-inspired golf apparel, blending traditional golf aesthetics with modern, casual designs. This shift reflects a broader cultural trend toward versatile clothing that transitions seamlessly from the golf course to everyday settings. Brands are responding with hybrid collections that cater to this dual-purpose demand.

Product Insights

Top wear accounted for a share of revenue of 61.43% in 2024. One primary reason is the emphasis on comfort and performance. Modern golf top wear is crafted from advanced fabrics that are moisture-wicking and breathable. These materials help golfers stay cool and dry during their game, enhancing their overall performance. Moreover, the flexibility of these garments allows for a full range of motion, which is essential for executing a golf swing effectively. Fashion and style also play a significant role in the growing popularity of golf top wear. The market has seen an influx of trendy designs catering to functionality and aesthetics. Golfers are increasingly looking for apparel that performs well and aligns with their style. This trend is further fueled by endorsements and partnerships with professional golfers, which elevate the desirability of certain brands and styles.

The Golf underwear/ base layers market is expected to grow at a CAGR of 4.0% from 2025 to 2030 in the region. Golfers increasingly seek base layers that provide a supportive foundation and enhance their performance on the course. These garments are essential for moisture management, temperature regulation, and overall comfort, which is critical during long golf rounds or varying weather conditions. As golfers become more aware of the benefits of wearing high-quality base layers, there is a growing demand for products that offer superior fit, breathability, and technological advancements to improve the overall golfing experience. Leading brands offering golf underwear and base layers include Nike, Under Armour, and Adidas, which are renowned for their performance-oriented designs and use of advanced materials. Nike’s Pro line and Under Armour’s ColdGear and HeatGear series are particularly popular for their moisture-wicking and temperature-regulating properties. Adidas also provides a range of base layers focusing on breathability and comfort.

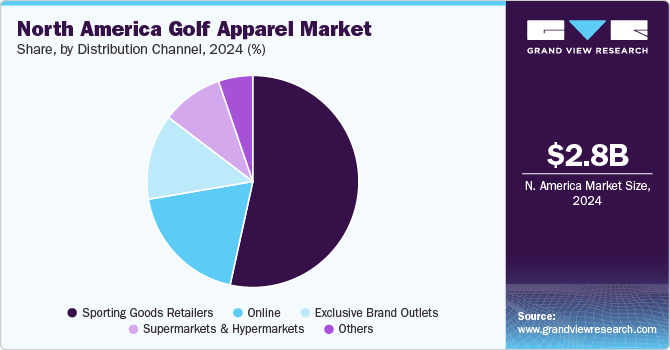

Distribution Channel Insights

The sales of golf apparel through sporting goods retailers accounted for a revenue share of over 53.45% in 2024 in the North America golf apparel industry. These retailers offer a broad range of high-quality golf apparel brands under one roof, making it convenient for consumers to compare products and find the best fit for their needs. The variety of products available-ranging from specialized golf brands to broader sportswear labels-allows consumers to explore multiple options, including the latest technological innovations in moisture-wicking, UV-protective, and stretchable fabrics. This range is particularly appealing in a sport where apparel directly impacts comfort and performance on the course.

Sporting goods retailers also benefit from knowledgeable sales staff trained to assist consumers with specific golf-related queries, including sizing, functionality, and product performance in varying weather conditions. This personalized shopping experience, combined with the opportunity to physically try on apparel, resonates well with consumers who prioritize the feel and fit of their gear.

The sales of golf apparel through online channels are expected to grow with a CAGR of 5.6% from 2025 to 2030 in North America. Online channels offer convenience, allowing customers to browse, compare, and purchase golf apparel from the comfort of their homes. Furthermore, online platforms facilitate transparent pricing and easy comparison shopping, enabling consumers to quickly compare prices, features, and customer reviews across different brands and retailers.

Moreover, changing consumer preferences, particularly among younger demographics in the region, favor online shopping due to its convenience, flexibility, and seamless user experience. As digital natives become a larger share of the consumer market in the region, the preference for online channels is expected to drive high sales growth through this channel in the North America golf apparel industry during the forecast period.

Country Insights

The U.S. golf apparel market accounted for a revenue share of 85.43% in 2024. Growing golf participation significantly boosts golf apparel sales in the U.S. market. The demand for golf-specific apparel increases as more individuals engage in the sport, whether through traditional on-course play or off-course activities. According to the National Golf Foundation’s 2024 Participation Report, golf remains a significant sport in the U.S. Approximately 45 million Americans are engaged in various aspects of the game, including playing, reading about, or watching it. This figure represents about 40% of the national population, highlighting the sport's broad appeal.

The increasing emphasis on both performance and style is also driving the U.S. market for golf apparel. Golfers now seek apparel that enhances their on-course performance and aligns with contemporary fashion trends. This shift has led to a greater demand for clothing that offers technical features like moisture-wicking, breathability, and stretchability, combined with stylish designs that can transition seamlessly from the golf course to everyday activities.

The Canada golf apparel market is expected to grow at a CAGR of 5.0% from 2025 to 2030. Growing participation in the sport, especially among younger demographics and women, fuels the demand for golf apparel. The rise in casual players who do not hold formal memberships but still invest in golf apparel also contributes to industry growth. According to the R&A Global Golf Participation Report 2023, around 5.6 million Canadians participated in golf in 2022, encompassing registered and non-registered players. This figure represents approximately 19.4% of the Canadian population, marking a modest increase from 18.4% in 1990. Despite this high level of engagement, only 6% of golfers are officially registered with national federations, highlighting a significant number of casual players who do not hold formal memberships. However, a notable 12% increase in registered players has occurred since 2020, indicating a positive trend toward formal participation and membership in the sport.

Key North America Golf Apparel Company Insights

The North America regional market is characterized by the presence of numerous well-established players and is fragmented owing to the presence of a large number of golf apparel manufacturers with strong customer networks. Manufacturers are actively innovating and diversifying their offerings to meet evolving consumer demands and maintain competitiveness. They are leveraging advanced fabric technologies to create performance-oriented products that enhance comfort and mobility on the course. These include moisture-wicking materials, UV protection, temperature regulation, and stretchable fabrics, which are increasingly becoming standard in golf apparel.

Furthermore, in response to the growing popularity of online shopping, manufacturers are enhancing their digital presence through e-commerce platforms, augmented reality (AR) tools, and virtual try-on solutions. Some collaborate with influencers and professional golfers for targeted marketing campaigns, leveraging their endorsements to build brand credibility.

Key North America Golf Apparel Companies:

- Topgolf Callaway Brands Corp.

- TaylorMade Golf Co.

- Footjoy Golf Wear (Acushnet Company)

- Eastside Golf

- Peter Miller

- Oakley, Inc.

- PING

- Nike, Inc.

- Under Armour, Inc.

- Adidas America, Inc.

- Galvin Green

- Cutter & Buck

- Mizuno Corporation

- Lululemon Athletica Inc.

- PUMA SE

View a comprehensive list of companies in the North America Golf Apparel Market

Recent Developments

-

In August 2024, Adidas AG teamed up with luxury fashion label JAY3LLE to introduce a limited-edition capsule collection of footwear, apparel, and accessories designed to elevate women’s golf fashion. The collection, created by Johan Lindeberg and his daughter Blue, merges streetwear with high fashion, featuring bold silhouettes and a stylish high-top performance golf shoe. Available now on adidas.com, the Adidas app, and select retailers, the collection was showcased by Adidas golfer Linn Grant at the AIG Women’s Open at St Andrew's.

-

In July 2024, Under Armour, Inc. introduced its new fashion-forward apparel line, the Goin’ Under Golf Collection, designed for men and women to wear both on and off the golf course. It included hoodies, jackets, sweaters for warmth, and lightweight polos and tees for hot days. The line features updated classics like the UA Drive Goin’ Under Polo with a bomber collar and camo print and the UA Empower Skort for women. The collection also introduced Phantom Footwear, combining training shoe comfort with golf shoe performance, including waterproof features and strong traction.

-

In July 2024, FootJoy’s Mid-Summer apparel range introduced stylish prints and classic designs with a modern fit and performance feature. The collection, inspired by "Manmade versus Nature" in golf, offers two new color stories: Pine Cliffs, featuring rich Emerald green paired with Navy and White, and Marina Bay, inspired by nighttime golf with deep Black and Purple Dusk highlighted by Pink and White.

North America Golf Apparel Report Scope

Report Attribute

Details

Market size value in 2025

USD 2.87 billion

Revenue forecast in 2030

USD 3.55 billion

Growth rate (revenue)

CAGR of 4.4% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, distribution channel, country

Country scope

U.S.; Canada

Key companies profiled

Topgolf Callaway Brands Corp.; TaylorMade Golf Co.; Footjoy Golf Wear (Acushnet Company); Eastside Golf; Peter Miller; Oakley, Inc.; PING; Nike, Inc.; Under Armour, Inc.; adidas America, Inc.; Galvin Green; Cutter & Buck; Mizuno Corporation; lululemon athletica inc.; PUMA SE

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options North America Golf Apparel Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America golf apparel market report based on product, distribution channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Top Wear

-

T-shirts & Tops

-

Jackets

-

Sweaters

-

Others

-

-

Bottom Wear

-

Pants

-

Shorts & Skorts

-

-

Underwear/ Base Layers

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America golf apparel market size was estimated at USD 2.76 billion in 2024 and is expected to reach USD 2.87 billion in 2025.

b. The North America golf apparel market is expected to grow at a compounded growth rate of 4.4% from 2025 to 2030 to reach USD 3.55 billion by 2030.

b. Top wear dominated the North America golf apparel market with a share of 61.43% in 2024. This growth is driven by the increasing preference for performance fabrics that enhance comfort and mobility during play. Moisture-wicking, UV-protective, and stretchable materials have become integral to top-wear, making them highly sought-after among golfers.

b. Some key players operating in the North America golf apparel market include Topgolf Callaway Brands Corp.; TaylorMade Golf Co.; Footjoy Golf Wear (Acushnet Company); Eastside Golf; Peter Miller; Oakley, Inc.; PING; Nike, Inc.; Under Armour, Inc.; adidas America, Inc.; Galvin Green; Cutter & Buck; Mizuno Corporation; lululemon athletica inc.; and PUMA SE.

b. The North America golf apparel market is driven by the increasing popularity of golf as a recreational and professional sport, supported by a growing base of younger participants. The sport’s image as a lifestyle activity that promotes health, wellness, and networking appeals to a diverse demographic, fueling demand for stylish and performance-enhancing apparel.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."