- Home

- »

- Clothing, Footwear & Accessories

- »

-

North America Glamping Market Size & Share, Report, 2030GVR Report cover

![North America Glamping Market Size, Share & Trends Report]()

North America Glamping Market Size, Share & Trends Analysis Report By Accommodation (Cabins & Pods, Tents, Yurts, Treehouses), By Age Group (18 - 32 Years, 33 - 50 Years, 51 - 65 Years, Above 65 Years), By Booking Mode, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-061-0

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

North America Glamping Market Trends

The North America glamping market size was estimated at USD 885.3 million in 2024 and is expected to grow at a CAGR of 12.6% from 2025 to 2030. This growth is attributed to the increasing influence of social media, which is raising awareness of glamping and its appeal. Additionally, the market is benefiting from attractive discounts and vacation packages offered by tourism platforms. Festivals and large-scale events in U.S. cities have also boosted the trend, making glamping a popular choice for travelers.

Key trends in the North American glamping market include the rise of luxury camping experiences that offer more comfort and amenities compared to traditional camping. This growing trend is driven by the desire for unique, off-the-grid vacations combined with modern comforts, such as proper beds, private bathrooms, and gourmet meals. Structures like cabins, safari tents, and tipis are popular choices, catering to travelers seeking immersive, nature-based experiences with the added convenience of luxury amenities.

Additionally, sustainability is becoming a core focus, with glamping sites increasingly incorporating eco-friendly practices. Glamping businesses are embracing green technologies like compostable toilets and greywater systems, and many are seeking certification from environmental organizations to attract conscious consumers. The emphasis on sustainability aligns with the growing demand for eco-friendly travel options in the market.

Glamping, often described as camping with luxury, is increasingly appealing to younger generations seeking an outdoor escape without compromising comfort. The allure of plush furnishings and cozy beds makes glamping more attractive than traditional camping. Initiatives by platforms like Airbnb, along with local government efforts to promote the benefits of glamping, are expected to drive market growth during the forecast period.

Additional factors contributing to the expansion of the North American glamping market include the growing preference for glamping over camping, increased leisure time, and a willingness among consumers to pay for premium travel experiences. UK-based Sykes, a vacation rental company with over 30 years of experience, reported a 45% rise in glamping bookings in 2021 compared to 2019, highlighting this trend.

Staycations have also contributed to market growth, offering travelers a variety of destinations without the need to venture far from home. This is particularly appealing to consumers seeking luxurious nature-based vacations with diverse recreational activities offered by glamping resorts. While relaxation and stress relief remain key drivers of the market, the rise of eco-tourism and a growing focus on healthy lifestyles are expected to further boost demand.

Accommodation Insights

Cabins & pods accounted for a revenue share of over 38% in 2024.This growth is driven by the rising demand for immersive camping experiences that don’t compromise on comfort. Eco-pods, which use sustainable materials like local, natural, and recycled resources, are gaining popularity among eco-conscious campers, offering protection from the elements while maintaining a cozy, home-like feel.

The demand for tent accommodation is projected to grow at a CAGR of 13.6% from 2025 to 2030.Major outdoor tourism companies are enhancing tent accommodations with luxury amenities like air conditioning, Wi-Fi, and premium beds, combining rugged camping with modern comfort. These tents often feature indoor bathrooms or portable toilets, making them appealing to a wider range of consumers. National parks and wildlife-rich areas further boost the appeal of tents, and the rise of booking platforms and travel agents has made selecting the appropriate tent easier for consumers.

Age Group Insights

Glamping among 18 to 32 age group accounted for a revenue share of over 44% in 2024. The idea of wedding glamping is appealing to younger generations, who are interested in destination weddings, so business organizers are including this category in their product offerings. For weddings, private gatherings, and concerts, Buffalo, a New York-based startup, provides luxury rentals. As a result, these developments are encouraging younger generations to embrace the glamping lifestyle.

The demand for glamping among 33 to 50 age group is projected to grow at a CAGR of 13.3% from 2025 to 2030, driven by driven by an increasing preference for experiential travel that balances adventure and comfort. This demographic seeks unique outdoor experiences that offer luxurious amenities, making glamping an attractive option. Additionally, the desire for stress relief and a break from daily routines, coupled with the appeal of immersive nature experiences, further fuels this growth. As this age group prioritizes quality time with family and friends, glamping provides an ideal solution that combines leisure, relaxation, and the enjoyment of nature.

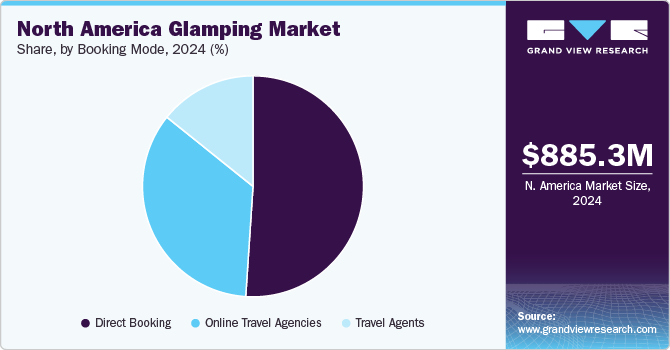

Booking Mode Insights

Direct bookings accounted for a revenue share of over 51% in 2024, owing to the increasing consumer preference for convenience and personalized experiences. Many travelers now prefer to book directly with glamping providers to access exclusive offers, tailored packages, and detailed information about accommodations. Additionally, the rise of user-friendly booking platforms and the growing trust in online transactions have made it easier for consumers to secure their stays directly, bypassing third-party intermediaries. This trend not only enhances customer satisfaction but also allows glamping operators to foster direct relationships with their guests, leading to increased loyalty and repeat bookings.

Revenue from bookings via online travel agencies is projected to grow at a CAGR of 13.4% from 2025 to 2030,owing to the increasing popularity of digital platforms for travel planning and reservations. As consumers increasingly rely on OTAs for their convenience, wide selection, and competitive pricing, these platforms are becoming essential for accessing a variety of glamping options. The user-friendly interfaces and comprehensive reviews available on OTAs enhance customer confidence in their choices. Furthermore, the integration of advanced search functionalities and personalized recommendations is expected to drive higher booking rates through these channels, making it easier for travelers to find and secure their ideal glamping experiences.

Country Insights

U.S. Glamping Market Trends

The glamping market in the U.S. accounted for a share of 83.35% of the North American glamping market revenue in 2024. Glamping, a blend of luxury and nature, is rapidly gaining popularity in the U.S. as a new style of camping that offers upscale accommodations in the great outdoors. While traditional camping can be cost-effective, glamping typically commands higher prices, often exceeding those of high-end hotels. For instance, visitors to U.S. national parks spent an average of USD 351 per day on traditional lodging, while campers averaged just USD 149. However, glamping can cost significantly more, with prices like USD 650 per night at resorts such as Under Canvas Zion, which offers safari-inspired tents equipped with private bathrooms and modern amenities.

Canada Glamping Market Trends

The Canada glamping market is expected to grow at a CAGR of 11.5% from 2025 to 2030. This growth is expected to be driven by rising income levels among tourists and their increasing willingness to explore diverse vacation options. Additionally, provincial parks and provincial recreation areas (PRAs) in Canada provide a variety of front-country camping amenities, including washrooms, showers, firewood, lake access, and maintained trails. The range of campground services offered in these areas-from walk-in tent sites to full-service recreational vehicle (RV) sites, tent camping, and yurt accommodations with electricity and water-enhances the appeal of glamping. This variety of options is likely to lead to increased bookings at glamping sites throughout the country.

Key North America Glamping Company Insights

The North America glamping market is fragmented. To stay competitive, businesses in the glamping industry are focusing on expanding and enhancing their sites. Many market players are forming partnerships with established hotels, restaurants, tech providers, and entertainment services to broaden their offerings, reach new customers, and boost revenue.

Key North America Glamping Companies:

- THE LAST BEST BEEF LLC (The Resort at Paws Up)

- Conestoga Ranch

- Capitol Reef Resort

- Ventana Big Sur, an Alila Resort

- Westgate Resorts (Westgate River Ranch)

- LITTLE ARROW OUTDOOR RESORT

- Huttopia Adirondacks

- The Griffin Ranch

- Dunton Hot Springs

- Under Canvas

- VILLAGE CAMP

View a comprehensive list of companies in the North America Glamping Market

Recent Developments

-

In January 2022, Under Canvas and Rivian, an American electric vehicle automaker and automotive technology company, announced a partnership to offer Rivian’s open-network Waypoints chargers to outdoor campsite areas, including the Under Canvas Moab and Under Canvas Lake Powell-Grand Staircase, in the 2022 season.

-

In June 2020, Ventana Big Sur introduced an all-inclusive package that combines luxury, simplicity, and convenience. Ventana’s all-inclusive approach is highly customized, with a dedicated Leisure Concierge connecting each guest before booking.

North America Glamping Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 993.2 million

Revenue forecast in 2030

USD 1,799.1 million

Growth rate

CAGR of 12.6% from 2025 to 2030

Actuals

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Accommodation, age group, booking mode, region

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

THE LAST BEST BEEF LLC (The Resort at Paws Up); Conestoga Ranch; Capitol Reef Resort, Ventana Big Sur, an Alila Resort; Westgate Resorts (Westgate River Ranch); LITTLE ARROW OUTDOOR RESORT; Huttopia Adirondacks; The Griffin Ranch; Dunton Hot Springs; Under Canvas; VILLAGE CAMP

Customization

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Glamping Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America glamping market report based on accommodation, age group, booking mode, and region:

-

Accommodation Outlook (Revenue, USD Million, 2018 - 2030)

-

Cabins & Pods

-

Tents

-

Yurts

-

Treehouses

-

Others

-

-

Age Group Outlook (Revenue, USD Million, 2018 - 2030)

-

18 - 32 years

-

33 - 50 years

-

51 - 65 years

-

Above 65 years

-

-

Booking Mode Outlook (Revenue, USD Million, 2018 - 2030)

-

Direct Booking

-

Travel Agents

-

Online Travel Agencies

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North American glamping market was estimated at USD 885.3 million in 2024 and is expected to reach USD 993.2 million in 2025.

b. The North American glamping market is expected to grow at a compound annual growth rate of 12.6% from 2025 to 2030 to reach USD 1799.1 million by 2030.

b. The U.S. dominated the North American glamping market with a share of around 83.35% in 2024. This is owing to the consumers' preferences for comfortable and luxurious vacations, as well as open-air live music events and social media influencers, which have increased the popularity of glamping sites.

b. Some of the key players operating in the North American glamping market include THE LAST BEST BEEF LLC (The Resort at Paws Up), Conestoga Ranch, Capitol Reef Resort, Ventana Big Sur, an Alila Resort, Westgate Resorts (Westgate River Ranch, LITTLE ARROW OUTDOOR RESORT, Huttopia Adirondacks, The Griffin Ranch, Dunton Hot Springs, Under Canvas, VILLAGE CAMP.

b. Key factors that are driving the North American glamping market growth include increasing consumer spending on comfortable and luxury camping in an eco-friendly environment.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."