- Home

- »

- Green Building Materials

- »

-

North America Geosynthetics Market Size, Research Report 2019-2025GVR Report cover

![North America Geosynthetics Market Size, Share & Trends Report]()

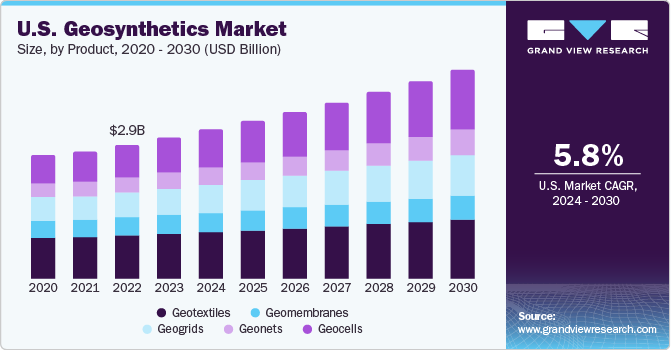

North America Geosynthetics Market Size, Share & Trends Analysis Report By Product (Geotextiles, Geomembranes, Geogrids, Geonets, Geocells), By Country (U.S., Canada, Mexico), And Segment Forecasts, 2019 - 2025

- Report ID: GVR-4-68038-091-0

- Number of Report Pages: 179

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2017

- Forecast Period: 2019 - 2025

- Industry: Advanced Materials

Industry Insights

The North America geosynthetics market size was valued at USD 3.4 billion in 2018 and is expected to register a CAGR of 5.5% over the forecast period. The rising demand for hotels and high-rise luxury buildings for the development of the tourism sector is expected to augment the demand for geosynthetics in the construction sector in North America.

Mexico is expected to be an attractive construction market in the region. This can be attributed to ongoing development of the industrial service segment, a fewer number of days to obtain construction permits, a thriving manufacturing base, a growing labor pool, and easy access to reserves. Rising penetration of geosynthetic products in the construction sector is likely to impact its demand positively.

Easy availability of raw materials such as polypropylene on account of the high prevalence of petrochemical complexes of companies, including Chevron Phillips, ExxonMobil, Shell, and BP, encourages market players for increased production. This, in turn, is anticipated to drive the demand for geosynthetic products in the U.S. over the forecast period.

A majority of the shale gas in North America is produced in countries such as U.S. and Canada owing to huge reserves. The shale gas boom in the U.S. has changed the overall energy scenario of the nation and has led to the subsequent rise in demand for geosynthetic products for lining applications. Therefore, increasing drilling activities for shale gas and tight oil in the country is projected to drive the North America geosynthetics market over the forecast period.

Geosynthetic products, particularly geomembrane, are used to effectively line disposal and storage ponds for freshwater required during hydraulic fracturing in the exploration and production (E&P) of unconventional sources such as tight oil and shale gas. These products also provide a lining to flow backwater, a by-product comprising a high level of salt and chemicals used in the hydraulic fracturing process.

Geosynthetics are susceptible to rupture if the overlying layer above is displaced or too shallow. This rupture may result in permanently damaging the sheet. These problems of blocking, clogging, and rupture would require the frequent changing of geotextile sheets, thus posing a challenge for the geosynthetic manufacturers.

Product Insights

Geosynthetic products such as geotextiles are manufactured using natural fibers in the form of wool mulch, wood shavings, jute nets, and paper strips. The demand for natural geotextiles in North America is estimated to reach USD 133.9 million by 2025 on account of the increasing environmental awareness in the region.

Rising expenditure on landfills in the mining industry, on account of the implementation of various environmental protection programs in this industry, is expected to promote the incorporation of geosynthetic products, mainly geomembranes, over the forecast period. In addition, geosynthetics are used as a containment solution in crude oil production sites, exploration fields, stormwater management ponds, and recreational ponds, thereby driving the market growth.

The primary function of geogrids is reinforcement; however, the product is also used for waterproofing, asphalt overlay, and stabilization and separation. In addition, the product is used as sheet anchors or gabions, inserted between geomembranes and geotextiles, and as a foundation mattress for supporting embankment over soft soils.

Geonets are estimated to witness register a CAGR of 6.6% from 2019 to 2025 in terms of revenue on account of the product’s use for creating an overlay system on distressed pavements. This helps in reducing the concentration of stress in small areas and slowing down the development of reflective cracks on paved roads.

Country Insights

Rising awareness regarding investments in public infrastructure on account of the increasing volatility of oil prices is anticipated to drive the demand for geosynthetic materials such as geocells and geotextiles for earth reinforcement in infrastructure projects. Furthermore, the presence of stable regulations in Saskatchewan supporting companies for expanding existing operations as well as new investments is likely to drive North America geosynthetics market growth.

Upcoming construction projects near the Mexico-U.S. border implement a combination of traditional techniques from Mexico and advanced technologies from U.S. These projects are expected to drive the demand for geosynthetics in several construction projects. Mexico is expected to register a CAGR of 6.1% from 2019 to 2025, in terms of revenue.

Rising investments by the British Columbian government in community infrastructure projects such as drinking water, solid waste management, and wastewater management are anticipated to boost the demand for geomembranes in water and waste management. In addition, other community infrastructure projects related to roads, highways, bridges, and airport improvements are expected to drive the demand for geotextiles for providing stabilization to the structures.

Nevada is anticipated to reach USD 219.2 million by 2025. The infrastructure sector of Nevada has witnessed steady improvement over the past several decades and this trend is expected to continue over the forecast period. This would lead to an increased demand for geosynthetic products such as geogrids, geocells, and geonets for various infrastructure projects, including railways, roadways, and dam constructions.

North America Geosynthetics Market Share Insights

The major players in the North America market include AGRU America, Inc.; Propex Operating Company, LLC; and Koninklijke Ten Cate bv. Manufacturers are focusing on several efficient and effective distribution channels. As a result, the companies are likely to establish partnerships with e-commerce portals to ensure that buyers have easy access to geosynthetic products.

Changing standards and regulations regarding environment protection, coupled with the governmental policies concerning infrastructural growth, is anticipated to drive the product demand in the region. This, in turn, is expected to encourage geosynthetic manufacturers to expand their presence in the region.

Report Scope

Attribute

Details

Base year for estimation

2018

Actual estimates/Historical data

2014 - 2017

Forecast period

2019 - 2025

Market representation

Volume in Million Square Meters, Revenue in USD Million, and CAGR from 2019 to 2025

Regional scope

North America

Country scope

U.S., Canada, Mexico

Report coverage

Volume forecast, revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analysts working days)

If you need specific information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts volume and revenue growth at regional, country, and province levels and provides an analysis of the latest industry trends in each of the sub-segments from 2014 to 2025. For the purpose of this study, Grand View Research has segmented the North America geosynthetics market report on the basis of product and country:

-

Product Outlook (Volume, Million Square Meters; Revenue, USD Million, 2014 - 2025)

-

Geotextiles

-

By Material

-

Natural

-

Jute

-

Others

-

-

Synthetic

-

Polypropylene

-

Polyester

-

Polyethylene

-

-

-

By Product

-

Woven

-

Non-woven

-

Knitted

-

-

By Application

-

Erosion control

-

Reinforcement

-

Drainage systems

-

Lining systems

-

Asphalt overlays

-

Separation & stabilization

-

Silt Fences

-

-

-

Geomembranes

-

By Material

-

HDPE

-

LDPE

-

Ethylene Propylene Diene Monomer (EPDM)

-

Polyvinyl chloride (PVC)

-

Others

-

-

By Application

-

Waste management

-

Water management

-

Mining

-

Lining Systems

-

Others

-

-

By Technology

-

Extrusion

-

Calendering

-

Others

-

-

-

Geogrids

-

By Material

-

HDPE

-

Polypropylene

-

Polyester

-

-

By Application

-

Road construction

-

Railroad

-

Soil reinforcement

-

Others

-

-

By Product

-

Uniaxial

-

Biaxial

-

Multi-axial

-

-

-

Geonets

-

By Material

-

HDPE

-

MDPE

-

Others

-

-

By Application

-

Road construction

-

Drainage

-

Railroad

-

Others

-

-

-

Geocells

-

By Material

-

HDPE

-

Polypropylene (PP)

-

Others

-

-

By Application

-

Earth reinforcement

-

Load support

-

Tree root protection

-

Slope protection

-

Others

-

-

-

-

Regional Outlook (Volume, Million Square Meters; Revenue, USD Million, 2014 - 2025)

-

North America

-

The U.S.

-

Nevada

-

Arizona

-

Colorado

-

Utah

-

-

Canada

-

British Columbia

-

Alberta

-

Saskatchewan

-

Ontario

-

-

Mexico

-

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."