North America Functional Mushroom Supplements Market Size, Share & Trends Analysis Report By Form (Powder, Liquid Extracts), By Type (Reishi, Chaga,Shiitake), By Function, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-349-5

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America functional mushroom supplements market size was valued at USD 541.77 million in 2023 and is expected to grow at a CAGR of 15.0% from 2024 to 2030. A notable driver is the growing preference for natural health solutions, as consumers increasingly gravitate toward alternative medicine for their wellness requirements. Functional mushrooms, known for their medicinal properties in traditional medicine systems like Traditional Chinese Medicine (TCM) and Ayurveda, have captured the attention of individuals seeking natural remedies. In addition, increased awareness of the health benefits associated with mushrooms, such as immune support, cognitive enhancement, and stress management, has fueled consumer interest.

The wellness industry's expansion has driven the demand for mushroom supplements, with companies innovating to meet consumer demand. The availability of various mushroom-based products in different forms has made it easier for consumers to incorporate them into their daily routines.

For instance, in March 2023, North American Reishi Ltd. introduced two new mushroom ingredients: ErgoGold and mushroom-derived vitamin D. ErgoGold is a powder extract of golden oyster mushrooms that contains ergothioneine and other therapeutic compounds. It is suitable for individuals with yeast sensitivities and those seeking non-synthetic ingredients. The mushroom-derived vitamin D is produced using pulsed UV light technology to convert ergosterol into high levels of vitamin D2, offering a vegan source of vitamin D that can meet daily requirements with a small dose.

Vitamin supplement sales in the U.S. witnessed a 16% y-o-y increase in 2020, as per the data published by SPINS. In addition, nutritional supplement sales gained USD 435 million in the six weeks ending April 5, 2020. In response to the pandemic, consumers increasingly sought dietary supplements, including functional mushroom supplements, to enhance their immune systems and support their overall health.

Across various demographics, there is a growing preference for supplements tailored to specific wellness needs. Baby boomers, for instance, prioritize supplements supporting bone health, memory, and cognitive function. In contrast, millennials are drawn to products addressing concerns such as anxiety, stress, and energy levels.

This holistic approach resonates with the market, which cannot make explicit disease claims but can focus on holistic and lifestyle benefits. Millennials take pride in their health management, attributing their purchasing decisions, such as choosing plant-based or locally sourced foods, to responsible self-care. This mindset aligns well with the principles of the functional mushroom supplements industry, driving its growth among millennial consumers.

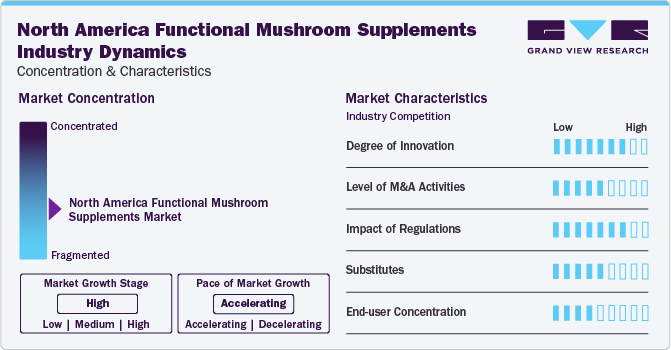

Market Concentration & Characteristics

The degree of innovation in North America's functional mushroom supplements industry is high, driven by advancements in extraction techniques, product formulations, and delivery methods. Companies are continually developing new blends and incorporating cutting-edge technologies to enhance bioavailability and efficacy, catering to diverse consumer needs and preferences.

Regulations in North America ensure product safety and efficacy, fostering consumer trust and industry credibility. However, stringent regulatory requirements can increase costs and slow down product launches, posing challenges for smaller companies.

The availability of substitutes like traditional vitamins, herbal supplements, and synthetic health products can limit the growth of the North American functional mushroom supplements market by providing consumers with alternative health solutions. This competition pressures mushroom supplement producers to innovate and differentiate their products to maintain market share.

End-user concentration in North America's functional mushroom supplements industry primarily includes health-conscious consumers, athletes, and wellness enthusiasts. This diverse group is driven by an interest in boosting immunity, enhancing cognitive function, and improving overall well-being.

Form Insights

In 2023, capsules & tablets accounted for a revenue share of 46.97% in 2023.These represent an older form of supplements, enduringly popular due to their convenience, ease of consumption, and precise dosage control. With a long history of use, these traditional forms of supplements have established themselves as reliable options for delivering nutrients and medicinal compounds.In August 2023, Four Sigmatic, renowned for its popular mushroom coffee and protein products, introduced its latest offering, the Organic Mushroom Complex Capsules. These capsules are free of fillers, grains, or mycelium, ensuring purity and potency.

The demand for liposomal functional mushroom supplements is projected to grow at a CAGR of 17.6% from 2024 to 2030. These are favored for several reasons, with enhanced absorption and bioavailability compared to traditional forms of supplementation being one of the primary factors.In recent years, liposomal functional mushroom supplements have gained importance among people due to their potential health benefits and ease of consumption. Consumers are increasingly incorporating liposomal functional mushroom supplements into their daily routines, often adding them to food and beverages for convenience and versatility.

Type Insights

In 2023, lion’s mane supplements accounted for a market share of 25.79%. One significant factor contributing to the growing demand for lion's mane mushroom supplements is the increasing aging population worldwide. With aging comes concerns about cognitive decline and neurological disorders such as Alzheimer's disease and dementia. Consumers are increasingly turning to natural remedies like lion's mane mushrooms to support brain health and potentially mitigate the risk of cognitive decline. This demographic shift has created a substantial market opportunity for supplements targeting brain health, including those containing lion’s mane extract.

The demand for Chaga supplements is projected to grow at a CAGR of 17.6% from 2024 to 2030.According to a 2022 study published in Molecules, Chaga mushrooms contain anti-inflammatory compounds that help fight inflammation in the gut, which can cause problems like irritable bowel syndrome. Moreover, there is a rising trend toward sustainable and eco-friendly products, and chaga mushroom fits well into this narrative. As a natural resource that can be harvested without damaging the environment when done responsibly, chaga appeals to environmentally conscious consumers who are looking for ethical and sustainable options.Brands that offer chaga mushroom functional supplements include Dr. Mercola, Laird Superfood, Fungi Perfecti, and OM Mushrooms.

Function Insights

Immune support mushroom supplements held a share of 26.11% in 2023. According to an article published on Fungies, LLC, three key functional mushrooms-lion’s mane, cordyceps, and reishi-have been noted for their potential to boost the immune system in various ways.There are several brands that offer functional mushroom supplements for immune support. U.S. based Nutriflair Mushroom Complex is an affordable option for those seeking immune support, with a blend of mushrooms that have immune-boosting properties.

Demand for mushroom supplements that improve cognitive health is anticipated to rise at a CAGR of about 16.5% from 2024 to 2030.Functional mushroom supplements can significantly contribute to cognitive health by promoting neuronal health, stimulating brain cell growth, and protecting brain cells from damage caused by Alzheimer's disease.Several functional mushroom supplements have been launched for cognitive health. For instance, in March 2023, Spacegoods, a startup founded by Matthew Kelly, launched a mind-health supplement in the form of powdered supplements, including Rainbow Dust and Dream Dust. Rainbow Dust is designed to provide sharper focus and sustained energy throughout the day, while Dream Dust is designed to help relax and achieve deep sleep.

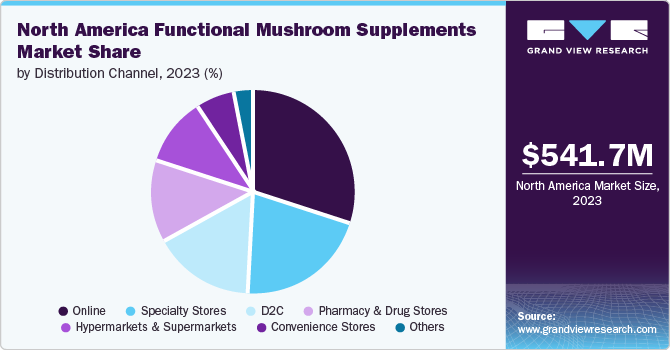

Distribution Channel Insights

The sales of functional mushroom supplements through online channels accounted for a market share of 30.30% share in 2023.Functional mushroom supplements are predominantly sold through online channels due to their accessibility, offering consumers a broad array of products without the constraints of physical store visits.In February 2022, Optima Health Corp., a Canadian company, launched an e-commerce platform offering functional mushroom supplements to Canadian consumers. The company focuses on providing high-quality, fruiting body mushroom formulations for health and wellness.

Sales of functional mushroom supplements through specialty stores in North America is expected to grow at a CAGR of 15.5% from 2024 to 2030. These establishments typically employ knowledgeable staff with expertise in health and wellness products, including supplements like functional mushrooms. This expertise allows them to provide customers with detailed information about the benefits and uses of mushroom supplements, facilitating informed decision-making.

Regional Insights

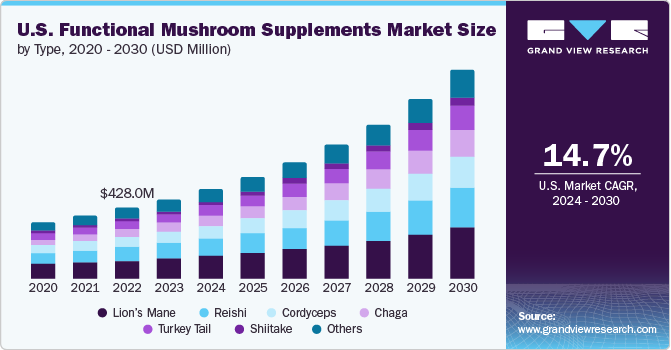

U.S. Functional Mushroom Supplements Market Trends

The functional mushroom supplements market in the U.S. accounted for a market share of around 88% in 2023 in the North American market. In the U.S., consumers are increasingly drawn to natural and plant-based products as they seek alternatives to conventional pharmaceuticals.In October 2023, Auri Nutrition, a health supplement brand, launched the world's first super mushroom daily gummies. These gummies contain a blend of sustainably sourced mushrooms that offer mental and physical benefits. The brand emphasizes quality and potency in selecting ingredients and capturing bioactive compounds through advanced extraction techniques.

Canada Functional Mushroom Supplements Market Trends

The functional mushroom supplements market in Canada is expected to grow at a CAGR of about 17.1% from 2024 to 2030. Market players in Canada are pushing mushroom functional supplements through targeted national marketing campaigns that emphasize the historical healing role of medicinal mushrooms and highlight their commitment to quality and research-based products. In February 2022, Doseology Sciences Inc., a Canadian life sciences company specializing in mushroom-related health solutions, announced the launch of its medicinal mushroom product line, approved by the Health Canada NPN, and its plans for a nationwide multichannel marketing campaign.

Key North America functional mushroom supplements Company Insights

The North America functional mushroom supplements industry is fragmented. Key players in the functional mushroom supplements market in North America are actively pursuing strategic initiatives such as expansions, marketing campaigns, surveys, and product launches. These efforts aim to strengthen market presence, expand consumer reach, and enhance product offerings. For example, Four Sigmatic's expansion into Albertsons, an American supermarket chain, in September 2023 underscores its goal of offering consumers high-quality products made from extracted, certified organic, rigorously tested mushrooms, free of filler grains or mycelium to enhance mental performance effectively.

Key North America Functional Mushroom Supplements Companies:

- Four Sigmatic

- Fungi Perfecti - Host Defence

- Om Mushroom Superfood

- Swanson

- Mushroom Wisdom

- Real Mushrooms

- LifeCykel

- LifeCykel

- New Chapter, Inc.

- DIRTEA

- Pure Essence Labs

- Sun Potion

Recent Developments

-

In April 2023, Four Sigmatic announced the introduction of three new Think Organic Coffee products. These new SKUs are now available across the U.S. at Whole Foods Market. Four Sigmatic is also sold at Target, Sprouts, Wegmans, King Soopers, HEB, Fred Meyer, Thrive Market, and Amazon.

-

In February 2023, Fungi Perfecti introduced four new mushroom mycelium products to its lineup. These included the well-loved formulas MyCommunity, Breathe, and CordyChi, which were previously only offered in capsules and extracts but are now available in 100-gram powder form. Moreover, due to high demand, the top-selling mushroom species, Lion's Mane, is now accessible in a 200-gram powder canister.

-

In August 2022, Swanson launched Swanson W/I/O (Wellness Inside and Out), a new line of nutraceuticals specifically curated to address the growing demand for mental health and self-care products. It offers a suite of 21 personalized products, each designed to target specific aspects of mental wellness and self-care. These products are created using high-quality ingredients and backed by scientific research, ensuring their effectiveness and safety.

North America Functional Mushroom Supplements Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 612.2 million |

|

Revenue forecast in 2030 |

USD 1.41 billion |

|

Growth rate (Revenue) |

CAGR of 15.0% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Form, type, function, distribution channel, region. |

|

Regional scope |

North America |

|

Country scope |

U.S, Canada, Mexico |

|

Key companies profiled |

Four Sigmatic; Fungi Perfecti - Host Defence; Om Mushroom Superfood; Swanson; Mushroom Wisdom; Real Mushrooms; LifeCykel; New Chapter, Inc.; DIRTEA; Pure Essence Labs; Sun Potion |

|

Customization |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Functional Mushroom Supplements Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America functional mushroom supplements market report based on form, type, function, distribution channel, and region.

-

Form Outlook (Revenue, USD Million, 2018 - 2030)

-

Powder

-

Single-Serve

-

Multi-Serve

-

-

Liquid Extracts

-

Liposomal

-

Single-Serve

-

Multi-Serve

-

-

Capsules & Tablets

-

Gummies

-

Spray

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Reishi

-

Chaga

-

Lion’s Mane

-

Cordyceps

-

Turkey Tail

-

Shiitake

-

Others

-

-

Function Outlook (Revenue, USD Million, 2018 - 2030)

-

Immune Support

-

Cognitive Health

-

Anxiety & Stress Relief

-

Elit Performance, Energy & Endurance

-

Digestive Health

-

Anti-inflammatory Support

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Pharmacy & Drug Stores

-

Convenience Stores

-

D2C

-

Online

-

Others

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America functional mushroom supplements market was estimated at USD 541.77 million in 2023 and is expectd to reach USD 612.2 million in 2024.

b. The North America functional mushroom supplements market is expected to grow at a compound annual growth rate of 15.0% from 2024 to 2030 to reach USD 1.41 billion by 2030.

b. U.S. dominated the North America functional mushroom supplements market with a share of around 88% in 2023. This is due to its advanced healthcare infrastructure, strong consumer demand for wellness products, and robust research and development capabilities.

b. Key players operating in the North America functional mushroom supplements market are Four Sigmatic; Fungi Perfecti – Host Defence; Om Mushroom Superfood; Swanson; Mushroom Wisdom; Real Mushrooms; LifeCykel; New Chapter, Inc.; DIRTEA; Pure Essence Labs; Sun Potion.

b. Key factors that are driving the North America functional mushroom supplements market growth include growing health consciousness, increasing research on mushroom benefits, and rising demand for natural and organic supplements.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."