North America Food Service Equipment Market Size, Share & Trends Analysis Report By Product (Kitchen Purpose Equipment), By End-use, By Sales Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-330-2

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

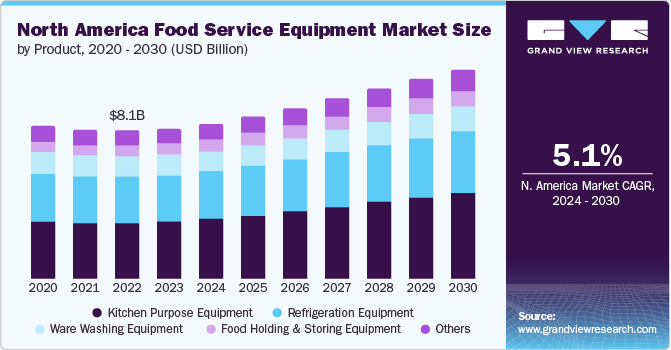

The North America food service equipment market was valued at USD 8,217.0 million in 2023 and is projected to grow at a CAGR of 5.1% from 2024 to 2030. The growth of the food service industry in the U.S. is likely to drive the demand for the food service equipment market in North America. The demand for high-quality food service equipment becomes vital as the food service industry expands, encompassing a diverse range of establishments, from fine dining restaurants to fast-food chains. This increasing demand is expected to drive market growth over the forecast period.

Moreover, the surge in consumer sales propels the growth of delivery and takeout services, which require specialized equipment to maintain food quality during transport. Investments in high-quality packaging equipment, warming units, and advanced delivery logistics systems become essential. Restaurants need to ensure that food reaches customers in optimal condition, which drives the demand for equipment that can maintain temperature and preserve freshness. This trend supports the growth of the market, particularly in segments that cater to delivery and takeout operations.

The companies are significantly investing in research & development activities to develop innovative, smart appliances with user-friendly, intelligent operations. This includes integrating smart technology into equipment, such as IoT-enabled devices that allow for remote monitoring and management. Manufacturers utilize extensive in-house resources to produce many problem-solving designs. Their capabilities range from designing, testing, and tuning the products. Combined with flexible manufacturing systems, these companies elevate production capacity utilization to offer shorter lead times and meet fast-track delivery requirements.

Drivers, Opportunities & Restraints

In the post-pandemic landscape, fast food consumption has surged to unprecedented levels, prompting significant growth in North America's quick-service restaurant (QSR) industry. This expansion is expected to drive substantially the growth of food service equipment. The rising working-age population and the global expansion of prominent restaurant chains through franchise establishments are key factors contributing to this growth.

Further, emerging markets and new segments within the food service industry, such as food trucks, pop-up restaurants, and ghost kitchens, are expected to present opportunities for manufacturers to innovate and develop compact, portable, and space-saving refrigeration solutions. These establishments often operate in non-traditional settings with limited space and infrastructure, requiring efficient, durable, and adaptable equipment for different environments. By addressing the specific needs of these emerging markets, manufacturers can expand their customer base and drive revenue growth.

However, installing kitchen equipment in commercial hotels and food chains requires a high capital investment. The growing popularity of self-service equipment is increasing the cost of these products. The investment cost, which includes purchase, installation, and accessories, is higher than that of conventional appliances, which may restrict consumers with a low budget from buying them. In addition, new appliances require more frequent maintenance and replacement of worn-out accessories. These factors are expected to restrain market demand, particularly in emerging economies, over the forecast period.

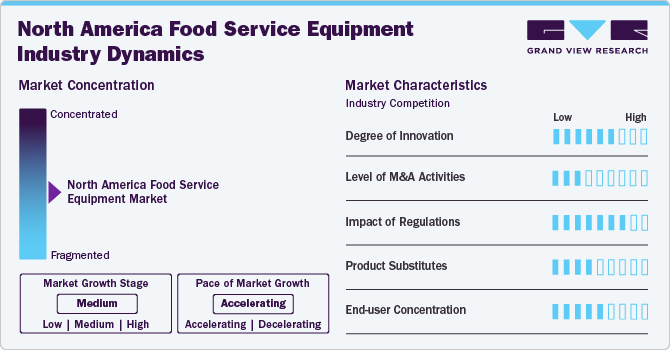

Market Concentration & Characteristics

The industry growth stage is medium, with an accelerating pace. The market is characterized by a high degree of innovation, which is attributable to the rapid technological advancements. Moreover, market players are adopting organic and inorganic growth strategies, such as product launches, geographical expansions, mergers & acquisitions, and collaborations, to strengthen their position in the global market.

Regulations play a significant role in shaping the market dynamics. Besides safety, these regulations encourage innovation and sustainability in the food service equipment market. Manufacturers must comply with energy-efficiency standards and environmental impact requirements, which drive the development of more sustainable and eco-friendly equipment. This not only helps businesses reduce operating costs but also aligns with global efforts to minimize the environmental footprint of the food service industry.

Operators of quick-service restaurants, fine dining establishments, and institutional kitchens are seeking equipment that improves their operational efficiency, such as multifunctional appliances that save space and time. In addition, end users prefer technology-integrated solutions, including smart appliances with IoT capabilities that allow remote monitoring, automated controls, and data analytics to optimize performance.

Manufacturers sell their products to the end users through distributors, independent dealers, retailers, independent manufacturer’s representatives, or the company’s sales personnel. Products are also sold directly to restaurants that have established the procurement of the products either through direct partnerships or as a franchise system. The sales engineers work closely with end-use customers to design and develop products specific to their requirements. For example, the distributors of AB Electrolux in Asia include Mayet Enterprises Ltd and Galaxy Refrig. Pvt. Ltd, and Westwing Appliances Ltd.

Product Insights

“The demand for kitchen purpose equipment is expected to grow at a significant CAGR of 6.3% from 2024 to 2030 in terms of revenue.”

The kitchen-purpose equipment segment held the largest share in 2023. Kitchen purpose equipment refers to the tools, appliances, and items specifically used for cooking and food preparation in kitchens. This includes a wide range of items, such as grills, fryers, ovens, toasters, cooking utensils, pots, pans, cutlery, blenders, and food processors. These tools are designed to make the process of cooking, baking, and food preparation efficient, safer, and more enjoyable.

The demand for food storing and holding equipment segment is expected to grow at the second fastest CAGR from 2024 to 2030 in terms of revenue. Food holding and storage equipment include devices and containers, which are used to preserve the quality and safety of food before it is served. It comprises food warmers and storage containers, which are crucial in preventing food spoilage, maintaining nutritional value, and adhering to health and safety standards. These pieces of equipment are essential in commercial kitchens, restaurants, and any setting where food needs to be kept at specific temperatures for extended periods.

End-use Insights

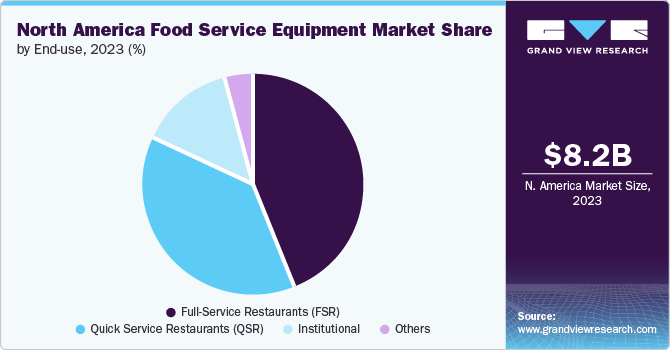

“The demand for food service equipment in the full quick restaurant segment is expected to grow at a significant CAGR of 6.1% from 2024 to 2030 in terms of revenue.”

The demand for food service equipment in the full-service restaurant (FSR) segment held the largest share in 2023. Full-service restaurant establishments offer a wide range of food items, beverages, and table services and require a diverse and extensive set of kitchen and dining equipment to operate effectively. They rely on high-quality, durable, and efficient food service equipment to prepare, cook, and serve various dishes. This equipment includes, but is not limited to, cooking appliances like stoves and ovens, refrigeration units, dishwashing machines, and food preparation tools.

The demand for the quick service restaurant (QSR) segment is expected to grow at a significant CAGR from 2023 to 2030 in terms of revenue. Quick Service Restaurants (QSRs) belong to a category of restaurants that specialize in fast food service. They are designed to provide meals conveniently and quickly. These restaurants often have limited menus, and customers typically order at a counter or through a drive-thru. Major examples of QSR include burger chains, pizza stores, and sandwich shops. The primary appeal of QSRs lies in their efficiency and affordability.

Sales Channel Insights

“The online sales channel segment is expected to grow at a significant CAGR of 5.4% from 2024 to 2030 in terms of revenue.”

The offline sales channel segment held the largest share in 2023. The offline sales channel often involves a more traditional, direct method of selling products to businesses and end users. Unlike online sales, offline channels primarily focus on face-to-face interactions and the physical presence of the product. Detailed exploration of this sales channel reveals a variety of components and strategies at play.

The online sales channel segment is expected to grow at a significant CAGR from 2024 to 2030 in terms of revenue. The online sales channel within the market refers to selling equipment used in food service applications, such as cookware, appliances, and tools, through e-commerce websites, company-specific online stores, and other digital marketplaces. This mode allows customers, ranging from restaurant owners to catering services, to browse, compare, and purchase the necessary equipment conveniently from the comfort of their locations.

Country Insights

“In North America, the U.S. dominated the market in 2023 with an 84.0% market share.”

U.S. Food Service Equipment Market Trends

The food service equipment market in the U.S. dominated the North America region in 2023 with a revenue share of 84.0%. The rising demand for QSRs and the growth of fast-food chains in the U.S. are significantly driving the market growth. QSRs require advanced, efficient kitchen tools to meet the fast-paced, high-volume demands of their operations while adapting to technological advancements and the changing dietary preferences of consumers. In addition, QSRs are growing in the U.S. due to their ability to offer fast, convenient, and affordable meal options that cater to the busy and diverse lifestyles of Americans.

Moreover, the incorporation of digital, prompt service delivery measures by the QSRs is helping them further develop and expand their presence in the U.S. For example, in December 2023, McDonald's declared an acceleration in the number of restaurant openings to fully leverage the rising demand, attributed to its marketing efforts and digital presence. The fast food chain intends to enhance its unparalleled expansion rate by establishing an additional 1,000 restaurants in the U.S. by the end of 2027. This initiative is set to represent the most rapid expansion phase in the company’s history. Such heavy expansion strategies adopted by the QSRs in the U.S. are likely to generate the demand for food service equipment.

Key North America Food Service Equipment Company Insights

Some of the key players operating in the market include AB Electrolux, The Middleby Corporation, Illinois Tool Works, Inc., Dover Corporation, and Ali Group Worldwide.

-

AB Electrolux has been manufacturing appliances for more than 100 years. The company’s offerings include microwave ovens, tumble dryers, refrigerators, hoods, ovens, cookers, freezers, hobs, washing machines, dishwashers, vacuum cleaners, air conditioners, small domestic appliances, and air purifiers. The company has a geographical presence across North America, Latin America, Europe, Asia Pacific, the Middle East, and Africa.

-

Ali Group Worldwide is a global food service equipment manufacturer and has been in the market for over 50 years. The company has a sales presence in more than 150 countries and has manufacturing sites in 17 countries. The company has numerous product lines, which include cooking equipment, refrigeration equipment, washing & waste management equipment, ice & beverage dispenser equipment, bakery equipment, coffee machines, and prepping equipment.

Fujimak Corporation, Haier Group, Rancilio Group, Truelsen, and Smeg S.p.A. are some of the emerging market participants in the North America food service equipment market.

-

Fujimak Corporation manufactures teppanyaki griddles, combi ovens, gas stoves, induction-heating stoves, fryers, tilting pans, noodle boilers, salamanders, blast chillers, blast freezers, prefabricated refrigerators, dough conditioners, proofers, molders, rice cookers, and other products. It operates manufacturing facilities in China, Japan, and Vietnam and has an extensive operational presence across Asia.

-

Haier Group manufactures appliances such as refrigerators, washing machines, TVs, air conditioners, water heaters, microwave ovens, kitchen appliances, and small appliances. It has established 71 research institutes, 35 industrial parks, 10 R&D centers, 143 manufacturing centers, and an extensive sales network across North America, Europe, and Asia Pacific. In overseas markets, the company focuses on employing high-end branding strategies and leveraging global R&D insights and local market insights.

Key North America Food Service Equipment Companies:

- AB Electrolux

- Ali Group Worldwide

- Dover Corporation

- Blue Star Limited

- Duke Manufacturing

- FUJIMAK CORPORATION

- Haier Group

- HOSHIZAKI CORPORATION

- Illinois Tool Works Inc.

- MARUZEN CO., LTD.

- SMEG S.p.A.

- The Middleby Corporation

- The Vollrath Company, LLC

- AK Service & Food Equipment

Recent Developments

-

In May 2024, HOSHIZAKI CORPORATION announced its acquisition of the shares of two food service equipment import and sales companies in the Philippines, making them subsidiaries. This move aims to enhance HOSHIZAKI CORPORATION’s sales structure in the country, where the market holds significant growth potential, and expand its sales channels.

-

In June 2024, Hillphoenix, a Dover Corporation brand, announced the launch of its new solution called ChargeSecure. This solution is designed specifically for Hillphoenix CO2 refrigeration systems and aims to help food retailers maintain the CO2 charge during power outages and service events.

North America Food Service Equipment Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8,473.1 million |

|

Revenue forecast in 2030 |

USD 11,412.1 million |

|

Growth rate |

CAGR of 5.1% from 2024 to 2030 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, end-use, sales channel, country |

|

Region scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

AB Electrolux; Ali Group Worldwide; Dover Corporation; Blue Star Limited; Duke Manufacturing; FUJIMAK CORPORATION; Haier Group; HOSHIZAKI CORPORATION; Illinois Tool Works Inc.; MARUZEN CO., LTD.; SMEG S.p.A.; The Middleby Corporation; The Vollrath Company, LLC; AK Service & Food Equipment |

|

Customization scope |

Free report customization (equivalent to up to 8 analysts' working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Food Service Equipment Market Report Segmentation

This report forecasts revenue growth at global, regional & country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America food service equipment market based on product, end-use, sales channel, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Kitchen Purpose Equipment

-

Cooking Equipment

-

Grills

-

Fryers

-

Ovens

-

Toasters

-

Others

-

-

Food & Beverage Equipment

-

Slicers & Peelers

-

Mixers & Grinders

-

Blenders

-

Juicers

-

Ice Crushers

-

Others

-

-

-

Refrigeration Equipment

-

Ware Washing Equipment

-

Food Holding & Storing Equipment

-

Others

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Full-Service Restaurants (FSR)

-

Quick Service Restaurants (QSR)

-

Institutional

-

Others

-

-

Sales Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Offline

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America food service equipment market size was estimated at USD 8,217.0 million in 2023 and is expected to reach USD 8,473.1 million in 2024.

b. The North America food service equipment market, in terms of revenue, is expected to grow at a compound annual growth rate of 5.1% from 2024 to 2030 to reach USD 11,412.1 million by 2030.

b. U.S. dominated the North America food service equipment market and accounted for a 84.0% share in revenue in 2023. The rising demand for QSRs and the growth of fast food chains in the U.S. are significantly driving the food service equipment market. QSRs require advanced, efficient kitchen tools to meet the fast-paced, high-volume demands of their operations while adapting to technological advancements and the changing dietary preferences of consumers. In addition, QSRs are growing in the U.S. due to their ability to offer fast, convenient, and affordable meal options that cater to the busy and diverse lifestyles of Americans.

b. Some of the key players operating in the North America food service equipment market include AB Electrolux, Ali Group Worldwide, Dover Corporation, Blue Star Limited, Duke Manufacturing FUJIMAK CORPORATION, Haier Group, HOSHIZAKI CORPORATION, Illinois Tool Works Inc. , MARUZEN CO.,LTD., SMEG S.p.A., The Middleby Corporation, The Vollrath Company, LLC, AK Service & Food Equipment

b. Growth of the food service industry in the U.S. and rising preference for quick service restaurants in the North America have remained as an important factors driving the market.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."