North America Food Packaging Market Size, Share & Trends Analysis Report By Type (Rigid, Flexible), By Material (Paper & Paper-based, Plastic, Metal, Glass), By Application, By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68038-343-0

- Number of Report Pages: 100

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

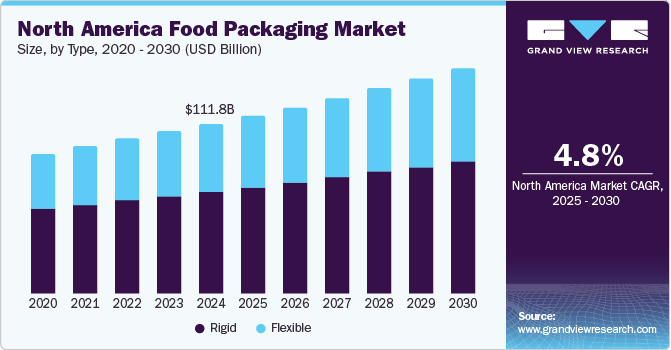

The North America food packaging market size was estimated at USD 111.8 billion in 2024 and is projected to grow at a CAGR of 4.8% from 2025 to 2030. As of 2023, approximately 331 million people reside in North America, with an increasing number living in urban areas characterized by fast-paced lifestyles. This demographic shift has led to a surge in the consumption of packaged foods, particularly ready-to-eat meals. According to recent trends, nearly 60% of consumers opt for convenient food options due to their busy schedules. This growing reliance on packaged products is further exacerbated by the rise of foodservice suppliers and digital platforms that facilitate food ordering, ultimately enhancing the accessibility of these meals.

E-commerce has emerged as another major driver of the food packaging market, reshaping packaging designs to meet safety requirements during transit. With online grocery shopping growing annually post-pandemic, the need for effective and durable packaging solutions has intensified. Consumers are increasingly purchasing groceries online, necessitating innovations in packaging that protect products while ensuring they arrive fresh. Consequently, manufacturers are compelled to invest in packaging technologies that can sustain the integrity and quality of food during distribution, ultimately driving market expansion.

Sustainability initiatives are significantly transforming the food packaging landscape, driven by heightened consumer awareness of environmental issues. Currently, approximately 70% of North American consumers prefer eco-friendly packaging solutions. This shift is further reinforced by regulatory pressures to reduce plastic waste, resulting in greater adoption of biodegradable and recyclable materials, ultimately fostering brand loyalty and driving projected market growth.

Technological advancements in packaging are gaining traction, with innovations such as smart packaging solutions enhancing product freshness and safety. Approximately 30% of consumers report that they are willing to pay a premium for packaging that extends shelf life and maintains product quality. This trend towards health consciousness is reshaping packaging choices, urging manufacturers to invest in solutions that preserve nutritional value while appealing to a growing segment of health-focused consumers.

Type Insights

Rigid packaging dominated the market and accounted for a share of 59.8% in 2024 due to its superior protection for food products, ensuring safety and maintaining quality. Its robust nature is particularly suited for ready-to-eat meals and beverages, aligning with consumer preferences for convenience. The growth of e-commerce necessitates durable packaging capable of withstanding transportation, reinforcing the inclination toward rigid solutions across various food applications.

Flexible packaging is expected to grow at the fastest CAGR of 5.2% over the forecast period. The increasing demand for convenience foods and on-the-go meals has driven the popularity of flexible options that provide resealability and portion control. Moreover, technological advancements have enhanced barrier properties, ensuring product freshness and shelf life, appealing particularly to health-conscious consumers.

Material Insights

Paper & paper-based packaging led the market with a revenue share of 42.6% in 2024, driven by a growing consumer preference for sustainable and recyclable packaging solutions. Rising environmental concerns are prompting manufacturers to adopt paper products recognized for their biodegradability and reduced plastic reliance. Furthermore, paper packaging allows for effective branding while maintaining product integrity, making it a favored choice among environmentally conscious consumers.

Plastic packaging is expected to register the fastest growth of 5.4% over the forecast period. The convenience of plastic containers aligns with consumer lifestyles seeking quick meal solutions. Moreover, innovations in plastic materials, featuring enhanced barrier properties and increased recyclability, are facilitating adoption as manufacturers address sustainability trends while meeting consumer expectations for quality and safety.

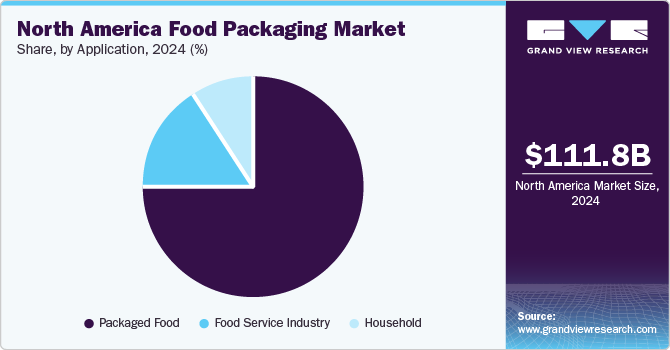

Application Insights

Packaged food held the largest market share of 75.0% in 2024, fueled by evolving consumer lifestyles that favor convenience and ready-to-eat options. More consumers are opting for quick meal solutions due to their busy schedules, making packaged foods an accessible means to enjoy nutritious meals without extensive preparation. Innovations in packaging further enhance product appeal and freshness maintenance.

The household sector is projected to grow at the fastest rate of 5.5% over the forecast period as consumers increasingly prioritize efficiency and convenience in daily routines. With a shift toward home meal preparation, households are turning to packaged food solutions that simplify cooking processes while ensuring quality. Furthermore, rising disposable incomes are enabling consumers to invest in premium packaged products that enrich their culinary experiences at home.

Country Insights

U.S. Food Packaging Market Trends

The U.S. food packaging market dominated North America with a revenue share of 78.0% in 2024. The diverse food industry, particularly in dairy and beverages, drives demand for innovative packaging that ensures product safety and freshness. Growth in e-commerce and meal delivery services enhances the need for efficient packaging solutions.

Mexico Food Packaging Market Trends

The food packaging market in Mexico is projected to grow at the fastest rate of 6.6% over the forecast period. Rising disposable incomes are prompting consumers to prefer convenient, high-quality packaged foods. The rise of modern retail and e-commerce platforms, coupled with government initiatives promoting sustainable packaging practices, positions Mexico as a significant player in North America market.

Key North America Food Packaging Company Insights

Some key companies operating in the market include Amcor plc; Sealed Air; Sonoco; Berry Global Inc.; WestRock Company; Mondi; Genpak LLC; Pactiv Evergreen Inc.; among others. Organizations are undertaking strategic initiatives in product innovation, sustainability, and technology advancements to enhance packaging solutions, driven by consumer demand for convenient and eco-friendly options. For instance, in May 2024, Genpak celebrated a USD 22.8 million renovation of its Montgomery facility, enhancing production efficiency, retaining 145 jobs, and creating 155 new positions to support regional economic growth.

-

Sealed Air, renowned for its CRYOVAC brand, provides innovative food packaging solutions aimed at enhancing food safety, extending shelf life, and minimizing waste through sustainable, recyclable, and compostable packaging options tailored for diverse applications.

-

Berry Global Inc. specializes in flexible and rigid packaging solutions for food products, prioritizing sustainability through innovative designs that reduce material usage and enhance recyclability, while ensuring freshness and safety to meet consumer demand for eco-friendly options.

Key North America Food Packaging Companies:

- Amcor plc

- Sealed Air

- Sonoco

- Berry Global Inc.

- WestRock Company

- Mondi

- Genpak LLC

- Pactiv Evergreen Inc.

- Chantler Packages

- WINPAK LTD.

- Alpha Packaging

- BE Packaging And Logistic Sdn Bhd

- Cheer Pack North America

- Evanesce Inc.

- PacMoore Products Inc.

- Innovative Fiber

- Emmerson Packaging

- PakTech

- Tradepak

- ProAmpac

View a comprehensive list of companies in the North America Food Packaging Market

Recent Developments

-

In December 2024, Berry Global and VOID Technologies successfully collaborated to launch a high-performance, recyclable polyethylene film for pet food packaging, enhancing sustainability while improving strength and puncture resistance.

-

In August 2024, Pactiv Evergreen Inc. launched Recycleware Reduced-Density Polypropylene meat trays, offering a sustainable alternative to foam polystyrene, recognized by the Association of Plastic Recyclers for recyclability and environmental impact.

-

In July 2024, Mondi launched FlexiBag Reinforced, a recyclable, mono-PE-based packaging solution with enhanced mechanical properties, enabling cost-effective customization for pet food while incorporating post-consumer recycled content to promote sustainability.

-

In January 2024, Genpak launched a revamped Harvest® Fiber line of sustainable, molded fiber packaging, offering containers and tableware free from intentionally added PFAS to meet eco-friendly restaurant demands.

North America Food Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 117.1 billion |

|

Revenue forecast in 2030 |

USD 148.2 billion |

|

Growth rate |

CAGR of 4.8% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative units |

Volume in kilotons, revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Volume and revenue forecast, company ranking, competitive landscape, growth factors, trends |

|

Segments covered |

Type, material, application, region |

|

Regional scope |

North America |

|

Country scope |

U.S., Canada, Mexico |

|

Key companies profiled |

Amcor plc; Sealed Air; Sonoco; Berry Global Inc.; WestRock Company; Mondi; Genpak LLC; Pactiv Evergreen Inc.; Chantler Packages; WINPAK LTD.; Alpha Packaging; BE Packaging And Logistic Sdn Bhd; Cheer Pack North America; Evanesce Inc.; PacMoore Products Inc.; Innovative Fiber; Emmerson Packaging; PakTech; Tradepak; ProAmpac |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Food Packaging Market Report Segmentation

This report forecasts volume and revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America food packaging market report based on type, material, application, and region:

-

Type Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Rigid

-

Bottles & Jars

-

Cans

-

Trays & Containers

-

Caps & Closures

-

Dispensing Caps

-

Screw Closures

-

Crown Closures

-

Aerosol Closures

-

Others

-

-

Others

-

-

Flexible

-

Wraps & Films

-

Bags

-

Pouches

-

Others

-

-

-

Material Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper & Paper-based

-

Plastic

-

PE

-

PP

-

PET

-

Others

-

-

Metal

-

Glass

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Packaged Food

-

Food Service Industry

-

Household

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."