- Home

- »

- Sensors & Controls

- »

-

North America Fire Protection Systems Market Report, 2030GVR Report cover

![North America Fire Protection Systems Market Size, Share & Trends Report]()

North America Fire Protection Systems Market Size, Share & Trends Analysis Report By Application (Residential, Industrial), By Service (Managed, Installation & Design), By Product (Detection, Analysis), And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-078-4

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

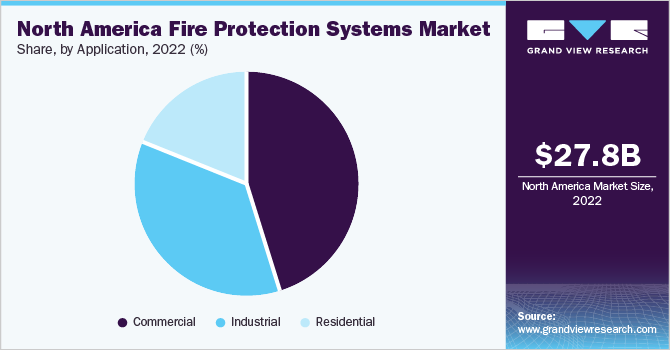

The North America fire protection systems market size was valued at USD 27.87 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 3.6% from 2023 to 2030. In the past few years, the significance of fire safety in the North America region has escalated due to notable incidents of fire. According to the National Fire Protection Association (NFPA), in 2020, an estimated 1,291,500 fire cases were reported in the U.S., which caused 3,420 civilian deaths, 16,720 civilian injuries, and USD 14.8 billion in property damage. Also, the region has been witnessing significant growth in construction activities, which has led to the installation of fire protection systems in buildings. The growing demand for fire protection systems in new construction projects has been a key driver of the market.

It is driven by stringent government regulations pertaining to building structure and fire safety. The U.S. and Canadian governments are implementing strict fire safety rules to reduce the dangers and losses caused by fires at multistory/high-rise structures. For instance, the NFPA has established approximately 300 codes and standards for installing and maintaining fire safety equipment, which local governments and insurance companies use to enforce fire protection regulations.In addition, major players are focused on product development; their approach towards integration of smart response systems to enhance product quality & reliability is expected to impact the growth of the fire protection system market in the region positively.

Smart fire detection products aid in the early detection of smoke and smoldering, thereby preventing heavy damage to property and health injury or death. However, the market can be challenged by the factors, such as the high cost associated with installing and increasing adoption of alternative solutions, such as water mist and gaseous suppression systems. Moreover, in the coming years, there will be a substantial increase in the adoption of fire protection system products, particularly sprinklers from the industrial sector, owing to stringent government regulations pertaining to employee safety. Also, the introduction of low-cost advanced products from manufacturers is anticipated to drive the market over the forecast period.

COVID-19 significantly impacted the market growth. During the pandemic, with more people working from home, the demand for fire protection systems in office buildings has decreased. However, the demand from the healthcare sector for fire safety equipment increased significantly. Hospitals and other healthcare facilities require specialized fire safety equipment to ensure the safety of patients and healthcare workers. The healthcare industry’s strict fire safety regulations have increased demand for specialized equipment like smoke evacuation systems and fire-rated doors. This is due to the higher likelihood of fires in healthcare settings and the necessity of safeguarding vulnerable patients and healthcare staff.

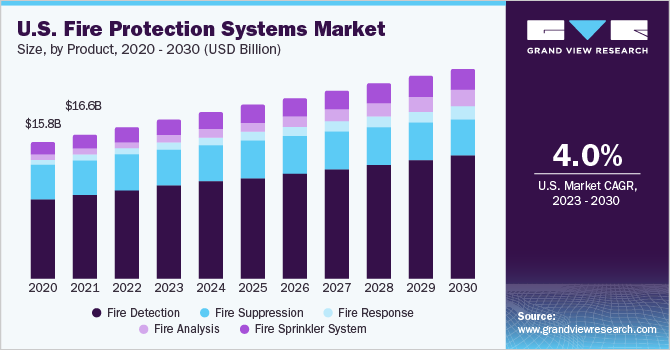

Product Insights

On the basis of products, the market has been further segmented into fire detection, fire suppression, fire response, fire analysis, and fire sprinkler system. The fire detection segment accounted for the largest share of over 57.0% in 2022. A fire detection system comprises several devices that work together to detect carbon monoxide leaks and fires and notify people of crises through video and audio systems.

Organizations, such as National Fire Protection Association in the U.S. and the Building Code in Australia, are creating awareness among consumers and instructing them to install fire protection system products at the workplace, job sites, and smart homes. This has the product demand. The fire analysis segment is expected to register the highest CAGR over the forecast period. The need for fire analysis that aids in compelling wise judgments during fire prevention is on the rise, which can be ascribed to the growth of the segment. Installation and design services for fire mapping & analysis and fire modeling & simulation are frequently used in fire analysis.

Service Insights

The installation and design service segment accounted for the largest market share of over 41.0% in 2022. Installation and design services refer to outsourcing the fire protection system’s design, development, updates, documentation, and installation operations. With increasing awareness about the benefits of fire prevention systems to buildings of all sizes, they are now being implemented more widely.

The maintenance services segment is expected to register a significant CAGR over the forecast period. Effective fire protection systems are crucial in detecting and alerting individuals in the event of smoke or fire. However, even a minor defect in the system can lead to major accidents. To mitigate such risks, it is imperative to ensure that these systems undergo regular maintenance to decrease the likelihood of failure and prolong their lifespan.

Application Insights

The commercial application segment dominated the market and accounted for over 45.0% revenue share in 2022. The commercial application segment includes software for retail, BFSI, the government, healthcare, telecom, and IT educational institutions. The growth is attributed to insurance companies often requiring commercial buildings to install fire safety equipment to reduce the risk of fire damage. This has led to an increase in demand for fire safety equipment as businesses seek to comply with insurance requirements and minimize their risk of financial losses due to fire.

Hence, such factors drive the growth of the segment. The industrial application segment is expected to register the highest CAGR over the forecast period. The industrial application covers major sectors, such as oil & gas, energy & power, mining, and manufacturing. The high emphasis of product manufacturers on installing advanced fire protection systems in areas, such as electrical distribution, lighting equipment, and chemical storage, that are major fire mishap locations is anticipated to augment the demand for fire protection systems over the forecast period.

Key Companies & Market Share Insights

Companies are focused on strategic activities, such as partnerships, mergers & acquisitions, and geographical expansion, to stay afloat in the competitive market scenario. For instance, in August 2022,Honeywell International, Inc.launched the Morley MAx fire detection and alarm system. This launch contributes to enhancing occupant and building safety. Morley Max is a versatile solution that can be effectively utilized in a range of industries, including but not limited to education, commercial, residential, healthcare, and hospitality. Some of the prominent players in the North America fire protection systems market include:

-

Eaton

-

Gentex Corp.

-

Halma plc

-

Hitachi Ltd.

-

Honeywell International, Inc.

-

Iteris, Inc.

-

Johnson Controls

-

Raytheon Technologies Corp.

-

Robert Bosch GmbH

-

Siemens

North America Fire Protection Systems Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 29.09 billion

Revenue forecast in 2030

USD 37.36 billion

Growth rate

CAGR of 3.6% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2023 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, application, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Johnson Controls; Honeywell International, Inc.; Raytheon Technologies Corp.; Gentex Corp.; Siemens; Robert Bosch GmbH; Halma plc; Eaton

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Fire Protection Systems Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America fire protection systems market based on product, service, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Detection

-

Fire Suppression

-

Fire Response

-

Fire Analysis

-

Fire Sprinkler System

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Managed Service

-

Installation & Design Service

-

Maintenance Service

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America fire protection system market size was estimated at USD 29.09 billion in 2023 and is expected to reach USD 30.30 billion in 2024.

b. The North America fire protection system market is expected to grow at a compound annual growth rate of 3.6% from 2024 to 2030 to reach USD 37.36 billion by 2030.

b. The commercial sector dominated the market with a share of nearly 46.0% in 2023. The growth is attributed to insurance companies often requiring commercial buildings to install fire safety equipment to reduce the risk of fire damage.

b. Some key players operating in the North America fire protection system market include Johnson Controls; Honeywell International, Inc.; Raytheon Technologies Corporation; GENTEX CORPORATION; Siemens; Robert Bosch GmbH; Halma plc; Eaton

b. The North America fire protection system is driven by stringent government regulations pertaining to building structure and fire safety. The U.S. and Canadian governments are implementing strict fire safety rules to reduce the dangers and losses caused by fire at multistory/high-rise structures.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."