- Home

- »

- Sensors & Controls

- »

-

North America Fire Protection System Market, Industry Report, 2030GVR Report cover

![North America Fire Protection System Market Size, Share & Trends Report]()

North America Fire Protection System Market Size, Share & Trends Analysis Report By Product (Detection, Suppression, Response), By Service (Managed Service, Maintenance Service), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-254-7

- Number of Report Pages: 105

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Semiconductors & Electronics

Market Size & Trends

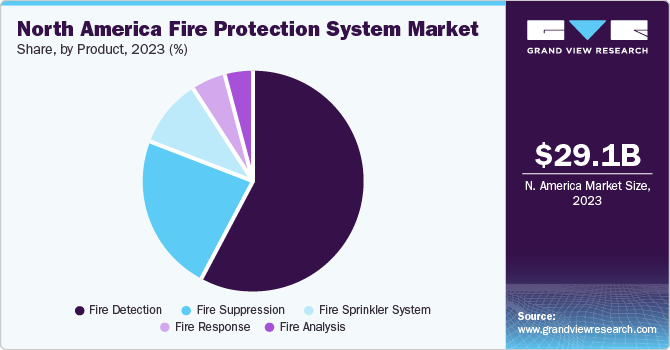

The North America fire protection system market size was valued at USD 29.09 billion in 2023 and is anticipated to grow at a CAGR of 3.6% from 2024 to 2030. The increasing number of fire-related injuries and deaths across the U.S. and Canada has become a primary enabler for the adoption of fire protection systems. With a rise in the number of larger premises such as supermarkets, stadiums, and building complexes, there has been a notable preference for the installation of Public Address and Voice Alarm (PAVA) systems, which help in a faster and more efficient evacuation process in case of a fire. With various regulations increasingly mandating the installation of these systems in new commercial and residential buildings, the market for voice alarm systems is likely to expand notably over the next few years.

North America accounted for a revenue share of 34.94% in the global fire protection system market in 2023. Any occurrence of fire breakout in a commercial or residential building, if left unchecked, can lead to significant loss of life and property, which highlights the importance of a proper fire detection and suppression system. According to the NFPA (National Fire Protection Association), in 2022, there were approximately 1.5 million reported fires in the United States, causing almost 3,800 deaths and over 13,000 injuries. Furthermore, property damages due to these fires stood at around USD 18 billion. Consequently, governments are constantly striving to increase awareness regarding fire safety standards among homeowners and building owners to lessen the occurrence of such incidents. This has acted as a major driver for growth of the regional fire protection system industry.

Regulatory bodies in the U.S. have been prompt in implementing standards that have aided the growth of the fire alarm and detection sector. The Fire Code is a model code adopted by local and state authorities and enforced by fire prevention officers from municipal fire departments. It comprises several regulations outlining the minimum requirements for preventing explosions and fire hazards that can occur while handling, storing, or using dangerous materials. Fire safety regulations under the United States Department of Transportation (DOT) Federal Motor Carrier Safety Administration include Part 173.309: Fire Extinguishers and Part 393.95: Emergency equipment on all power units. These regulations state that any vehicle transporting hazardous materials must have an operational fire extinguisher with a DOT labeling. Violation of the DOT fire extinguisher regulation results in significant fines and penalties. As a result, demand for fire safety equipment has risen steadily in the region.

The growing popularity of smart homes and building automation systems (BAS) has further increased awareness about the importance of integrating fire detection sensors, sprinkler systems, and smoke control systems into modern infrastructure. Notable benefits of such integration include reduced installation costs, minimized use of additional equipment, and better monitoring of emergency incidents through a central location. Furthermore, BAS can respond to a fire emergency in real time through shutdown of HVAC systems, gaining control of elevators, and activation of sprinklers. The increasing positive attitude toward smart homes in North America is also expected to strengthen market expansion. Manufacturers of smoke detectors, alarms, and fire suppression systems are enhancing the smart home compatibility of their products so that early action can be taken in case of fires, even from remote locations by homeowners.

Market Concentration & Characteristics

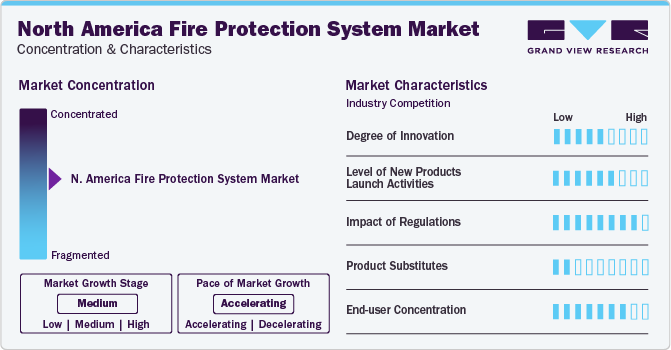

The market growth stage is moderate, and pace of market growth is accelerating. With the aim to address changing consumer requirements and modifications in fire safety standards, manufacturers are aiming to introduce innovative solutions that encompass a variety of functions related to fire detection, suppression, and analytics. Concepts such as water mist systems, sound wave fire extinguishers, and visual flame detectors are expected to become well-established technologies in the coming years.

The fire protection system market in the U.S. and Canada has witnessed several product launches by notable organizations such as Honeywell, Eaton, and Johnson Controls in recent years. For instance, in October 2020, Honeywell launched a new cloud platform, the Connected Life Safety Services (CLSS) suite, for fire safety systems. This platform enables technicians to minimize disruptions, follow government regulations, and reduce the time required for designing, installing, commissioning, and maintaining safety systems.

The development of various codes and standards by bodies such as the NFPA has resulted in building owners and homeowners increasingly installing advanced fire protection systems. The NFPA has around 300 standards and codes concerning the installation and maintenance of fire safety equipment, which are extensively implemented by insurance companies and local government bodies in the U.S.

The market is expected to face a low risk of substitute products, since manufacturers are constantly aiming to introduce advanced solutions that can offer better efficiency. Additionally, the increasing focus on sustainability is expected to proliferate this industry also through the introduction of more energy-efficient offerings, further reducing the threat of substitutes.

The market has a large end-user base, comprising residential consumers, commercial building owners, and industrial facilities. An increase in home development and renovation projects in North America, along with the presence of established industries and business organizations, has translated to a higher demand for advanced fire detection and suppression offerings in the region.

Service Insights

Based on service, the installation and design service segment held the largest revenue share in 2023. The growing number of construction projects in North America has led to an increased adoption of building safety and security systems by owners, in order to comply with updated regulations and fire safety standards. These services involve the outsourcing of design & development, documentation, upgradation, and installation solutions of the fire protection system. In a bid to gain higher customer share, companies are developing customized fire detection and suppression solutions that need to be installed professionally for optimum functioning, driving segment growth.

Meanwhile, the maintenance service segment is expected to witness the fastest growth rate during the forecast period. The growing installation of fire protection solutions has also necessitated frequent scheduling of maintenance activities at regular intervals, as continued operations can cause a gradual reduction in efficiency of these systems. Such maintenance tasks are of greater importance in industrial settings, as any irregularities in operation can cause significant damage during a fire breakout. Additionally, faulty or obsolete fire protection systems can create legal issues for the facility owner, which further highlights the importance of professional maintenance services. In the U.S., failure to follow the National Fire Protection Association (NFPA 72) inspection standards can incur a substantial fine, which can be avoided with regular maintenance inspections.

Application Insights

The commercial application segment held the largest revenue share in the North America fire protection system market in 2023. The extensive presence of global headquarters of various major multinational firms in the U.S. and Canada has resulted in the development of highly advanced commercial buildings. These buildings usually consist of several floors and offices that can house thousands of people, thus requiring a complex fire protection setup that can work optimally in case of emergencies. The NFPA 13 is the Standard for Installation of Sprinkler Systems in the United States. It has outlined the presence of automatic fire sprinklers in new commercial structures having a fire area of over 5,000 sq. ft., as well as in structures whose height exceeds 55 feet. Manufacturers need to comply with various state and national regulations and standards that are instrumental in shaping market demand in North America.

The industrial segment is expected to showcase the fastest CAGR from 2024 to 2030. The U.S. and Canada are home to several major manufacturing, automotive, and oil & gas facilities, which has accelerated the adoption of modern fire protection systems. As these locations generally have several combustible and inflammable materials, often in proximity to each other, there is a high risk of even a small fire incident spreading instantaneously. This puts the lives of the workforce in grave danger, necessitating the installation of advanced fire detection and suppression systems. Johnson Controls, for instance, has a varied portfolio of industrial fire suppression systems, such as gas station systems, dry chemical piped systems, twin-agent firefighting handline unit, and dry chemical firefighting handline units, among other products and services.

Product Insights

In terms of product, the fire detection segment accounted for 57.95% of the revenue share in the market in 2023. North America is the leading market for fire alarms and detection systems globally, as the region is witnessing strong investments by both the U.S. and Canadian governments to improve building infrastructure and prevent loss of life and property due to fire accidents. Automatic fire detection systems help reduce personal injuries, property damage, and minimize fatalities due to workplace fire accidents by identifying a fire in its earliest stage and promptly alerting building occupants to enable their safe evacuation. The National Fire Protection Association in the United States and the Canadian Fire Alarm Association are some leading organizations that are promoting awareness regarding the benefits of fire detection systems, driving their adoption.

The fire suppression segment is expected to remain a major contributor to the regional market, aided by the increasing incidences of fire accidents in commercial and residential buildings in the United States and Canada. In the U.S., the Fire Suppression Systems Association (FSSA) is involved in developing strategies to advance the fire suppression system sector. Commercial buildings such as hospitals and educational institutions require the presence of efficient fire suppression equipment to combat fire accidents. Guidelines implemented by authorities in these countries have helped push the adoption of such solutions. For instance, per the Occupational Safety and Health Administration Standard, portable fire extinguishers must be placed within a travel distance of 75 feet in industrial units in the U.S. Consequently, sales of related equipment have grown steadily.

Country Insights

U.S. Fire Protection System Market

The U.S. dominated the North American market for fire protection systems with a revenue share of 85.50% in 2023. The country has a significantly higher number of residential and commercial establishments than Canada, which has led to a much greater demand for fire protection services and offerings. Furthermore, residential property development has also grown steadily, leading to extensive demands for innovative and easy-to-use products from homeowners. An NFPA report published in November 2023 stated that residential facilities contributed to 25% of all fire incidents in the U.S. in 2022, but accounted for around 75% of civilian injuries and deaths. As a result, tightening policies and guidelines in the coming years will keep the country on a positive growth path in this market in the coming years.

Canada Fire Protection System Market

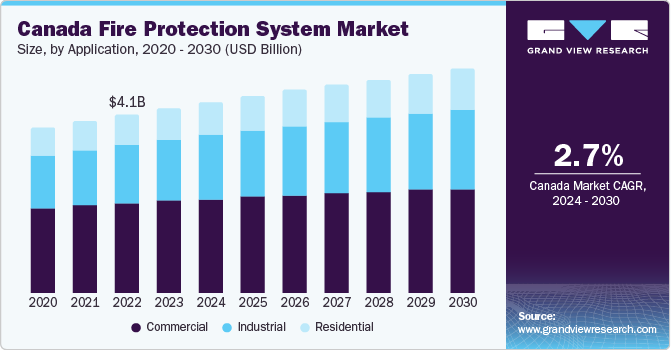

Canada is expected to witness moderate growth during the projection period. The construction industry in Canada is steadily growing due to increasing urbanization and commercialization, which has boosted the adoption of advanced fire protection solutions. As per data by Statistics Canada, there was a marginal growth in the number of residential fires in the country, rising from 10,557 in 2017 to 10,819 in 2021. Cities such as Montreal, Toronto, Calgary, and Edmonton are major commercial and industrial centers in the country with the highest population bases, and their fast-developing infrastructure has also driven the need for fire safety equipment, creating opportunities for fire suppression and detection system manufacturers to diversify their offerings. Organizations such as the National Research Council of Canada (NRC) and the Council of Canadian Fire Marshals and Fire Commissioners are involved in developing fire safety codes in the country.

Key North America Fire Protection System Company Insights

The fire protection system industry in North America includes several established players that are focusing on strategic initiatives such as new product launches to address customer requirements. Furthermore, companies are also aiming to enhance their geographical footprint by acquiring smaller regional companies serving a particular area, or undertaking distributor agreements to expand their customer base.

For instance, in November 2020, Johnson Controls expanded its ‘Johnson Controls OpenBlue’ digital solutions portfolio with the introduction of its ‘Smart Connected Fire Sprinkler Monitoring’ solution. This monitoring system offers insights regarding the health of the fire sprinkler system in real time so that preventative actions can be taken instantly. The solution gathers information such as temperature, pressure, and water presence for measuring the overall sprinkler system health, which is displayed via cloud to the customer’s dashboard. Such advanced offerings are expected to drive regional market expansion.

Key North America Fire Protection System Companies:

- Eaton

- Gentex Corp.

- Halma plc

- Hitachi Ltd.

- Honeywell International, Inc.

- Iteris, Inc.

- Johnson Controls

- Raytheon Technologies Corp.

- Robert Bosch GmbH

- Siemens

Recent Developments

-

In January 2024, Gentex Corporation showcased its latest solutions spanning the automotive, aerospace, fire protection, and wearable technologies segments, at the Consumer Electronics Show held in Las Vegas. In the commercial fire protection space, the company unveiled a smart home device range called PLACE, which comprises safety solutions offering room-specific functionality. The Any Space unit offers smart carbon monoxide and smoke detection, along with Wi-Fi connectivity for real-time, space-specific alerts

-

In July 2023, Bosch announced its imminent acquisition of Paladin Technologies, a notable life safety & security solutions and system integration service provider headquartered in Vancouver, Canada. This development has enabled Bosch Building Technologies to expand its North American system integration business substantially by increasing its operations in the United States and entering the Canadian market. Paladin offers monitoring services including fire panel monitoring, intrusion detection, alarm monitoring, and video monitoring

-

In October 2022, Johnson Controls announced the acquisition of Rescue Air Systems, a notable San Francisco-based firefighter air replenishment systems (FARS) provider. These systems allow firefighters to refill breathing air bottles in a building during an emergency response. This acquisition would enable Johnson Controls to design, sell, and install FARS in the safety sector and further expand its portfolio of advanced fire suppression offerings for the global market

North America Fire Protection Systems Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 30.30 billion

Revenue forecast in 2030

USD 37.36 billion

Growth rate

CAGR of 3.6% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, service, application, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Johnson Controls; Honeywell International, Inc.; Raytheon Technologies Corp.; Gentex Corp.; Siemens; Robert Bosch GmbH; Halma plc; Eaton; Hitachi, Ltd.; Iteris, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Fire Protection System Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America fire protection system market report based on product, service, application, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Fire Detection

-

Fire Suppression

-

Fire Response

-

Fire Analysis

-

Fire Sprinkler System

-

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Managed Service

-

Installation & Design Service

-

Maintenance Service

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Commercial

-

Industrial

-

Residential

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."