- Home

- »

- Communications Infrastructure

- »

-

North America Fiber Optics Market, Industry Report, 2030GVR Report cover

![North America Fiber Optics Market Size, Share & Trends Report]()

North America Fiber Optics Market Size, Share & Trends Analysis Report By Mode (Single-mode, Multi-mode, Plastic Optical Fiber), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-288-9

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2017 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

North America Fiber Optics Market Trends

The North America fiber optics market size was estimated at USD 2.58 billion in 2023 and is projected to grow at a CAGR of 4.9% from 2024 to 2030. Information technology (IT), telecommunications, medical, and other sectors in North America are driving market growth in optical fiber, further boosting market expansion. As bandwidth demands increase and the necessity for dependable high-capacity networks grows, optical fiber cables have become essential in North America.

Fiber optic cables can transmit sound, data, and images from a few meters to several kilometers. The two industries with the most significant applications are information and telecommunication technology. The telecommunication industry is undergoing many advancements, resulting in various technological improvements and upgrades. Innovations within the telecom sector are driving the development of bandwidth-intensive communication solutions. The increasing demand for fiber optic cables is directly linked to the growing bandwidth requirements in enterprise and carrier networks. Broadband network topologies are being rapidly deployed as telecom technology progresses.

Fiber optics is used in many applications, such as in the military, aerospace, medical, oil, and gas industries. With the help of fiber optics, broadband services are provided in houses, buildings, and workplaces. Specialized programs like media, gaming, and video require fast internet connections that demand more data usage. Growing interest in communication and entertainment causes consumers to be drawn toward gadgets that have high-speed internet access. As a result, the global fiber optics market is growing rapidly over the forecasted period. According to the Fiber Broadband Association Survey, the number of homes in the U.S. that have access to and are being offered Fiber to the Home (FTTH) services increased by 13% in 2023, reaching 78 million homes. Fiber broadband coverage extends to nearly 69 million homes across the country. Fiber providers in the U.S. are witnessing an average take rate of 45.4% among the homes they've passed in 2023.

During the COVID-19 pandemic, the fiber optics industry experienced a downturn as numerous businesses and operations were forced to close. However, with a significant portion of the North American population staying at home, there was a rise in the demand for high-speed internet applications such as video conferencing, social media, and online education. This surge drove many internet service providers to initiate Fiber-To-The-Home (FTTH) deployments to meet the increased need for reliable connectivity. The shift towards remote work setups and limited outdoor activities contributed to a growing dependence on streaming services for entertainment, which increased demand for internet and broadband services during this period.

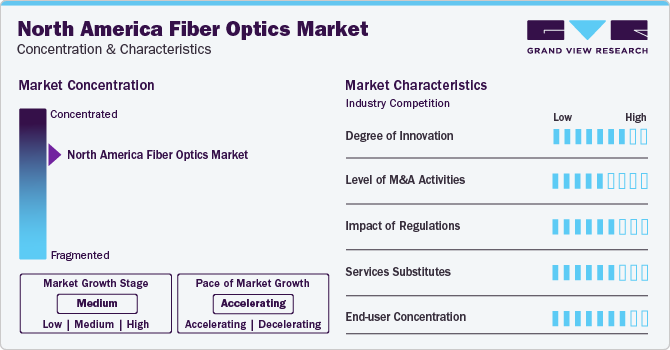

Market Concentration & Characteristics

The industry is concentrated in nature, and the pace of growth is accelerating. Companies are dedicated to creating faster, more efficient, cost-effective solutions to address the increasing need for high-speed internet and data transmission. This commitment to innovation ensures that the industry remains at the forefront of technological advancements, meeting the evolving demands of consumers and businesses alike.

The North America fiber optics industry faces competition from alternative technologies such as coaxial cables, wireless broadband, satellite internet, and others. Fiber optics offer superior speed, reliability, and bandwidth compared to other technologies. The widespread adoption depends on factors such as geographical coverage, cost-effectiveness, and infrastructure investment.

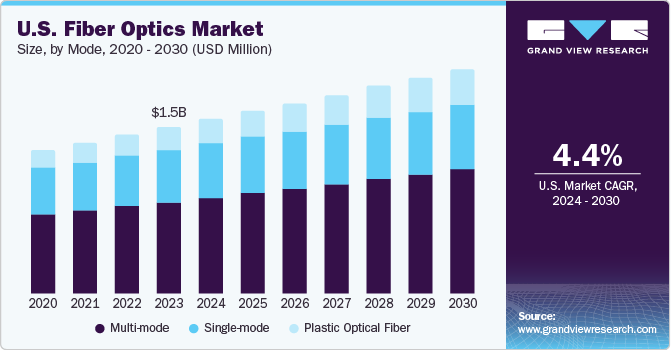

Mode Insight

Based on mode, the multi-mode segment led the market with the largest revenue share of 54.8% in 2023. Lower cost and ease of installation are the key factors driving the demand for multi-mode fiber optics among campuses or buildings, as these cables are suitable for short-distance communication applications. Multi-mode fiber optics applications include Local Area Networks (LANs), data centers, and audio and video transmission.

The plastic segment is anticipated to register at the fastest CAGR during the forecast period, due to its greater flexibility and large core diameters, plastic optical fiber is used in applications where it is bent and routed around tight corners. Moreover, it is used in automotive communication, networking, sensor systems, and decorative lights due to its high durability and bandwidth. These factors, coupled together, are driving the segment's growth.

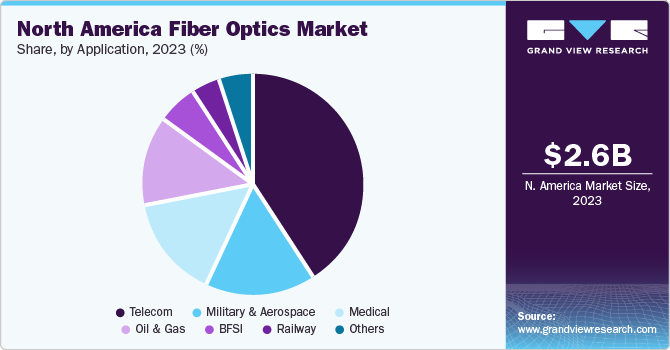

Application Insights

Based on application, the telecom segment led the market with the largest revenue share of 40.7% in 2023. The rising need for signal quality and support for advanced smartphone technology such as 5G in the telecom sector is increasing the demand for the fiber optics market. The radical shift of the population towards internet services, online services, and digital platforms is fueling the market growth of the telecom segment. For instance, AT&T offers FTTH services to over 3.1 million customer locations in California, reflecting the company's commitment to expanding high-speed internet access in the state.

The medical segment is expected to grow at the fastest CAGR over the forecasted period. Fiber optics play a crucial role in biomedical sensing, imaging, and minimally invasive surgery. It is utilized in various medical procedures such as endoscopy, magnetic resonance imaging (MRI), computed tomography (CT), and X-rays. Fiber optics' inert, flexible, sterile, and non-toxic nature makes them user-friendly for surgeons and doctors during operations.

Country Insights

U.S. Fiber Optics Market Trends

The U.S. dominated the North America fiber optics market with the largest revenue share of 56.8% in 2023. In the U.S., there is a growing demand for various emerging technologies, platforms, and trends, such as Netflix, Amazon Prime Video, online gaming tournaments, cloud computing, trading platforms, social media platforms, and others that require fast internet speed, these factor fueling the market growth of fiber optics. Ongoing advancements in fiber networks by companies such as AT&T Fiber and Verizon Fios are improving the capabilities of fiber optics. These enhancements are making fiber optics more attractive for applications like ultra-fast file uploads and 4K video delivery, meeting the growing demand for high-speed and reliable connectivity solutions.

Mexico Fiber Optics Market Trends

The fiber optics market in Mexico is expected to witness at the fastest CAGR over the forecast period. The demand for fiber optics in Mexico is rising due to the increased adoption of advanced communication technologies, improvements in healthcare infrastructure, and a growing interest in entertainment and communication services. These factors are driving the expansion of fiber optic networks to meet the evolving needs of various sectors in the country. Many internet service providers and Telecommunication companies in Mexico are investing in fiber optics infrastructure to meet the growing demand for high-speed internet and advanced connectivity.

Key North America Fiber Optics Company Insights

Some of the key companies in North American market include OFS Fitel LLC, COMMSCOPE, M2Optics, Inc., Corning Incorporated, Honeywell International Inc. and others.

-

M2Optics, Inc. specializes in developing cutting-edge fiber optic solutions for network simulation, optical time delay, and fiber monitoring. Their product line includes specialized testing, networking, and applications. Serving a wide range of clients, from local internet service providers to major global web service providers, data centers, and financial networks, M2Optics equipment supports some of the world's most advanced critical networks

-

OFS Fitel LLC specializes in manufacturing, researching, and offering a wide range of fiber optics products and solutions for various industries such as medicine, telecommunications, sensing, government, aerospace, industrial automation, and defense. Their product line includes optical connectors, specific fibers, attenuators, ribbon cables, hard-clad silica fibers, and many other innovations that have significantly advanced fiber optics technology

Key North America Fiber Optics Companies:

- Colonial TelTek

- COMMSCOPE

- Corning Incorporated

- Honeywell International Inc.

- M2Optics, Inc.

- OFS Fitel LLC

- Opticonx

- PRECISION OPTICAL TECHNOLOGIES

- TC Communications, Inc.

- Zeus Company LLC

Recent Developments

-

In October 2023, Precision Optical Technologies Inc. acquired Opticonx, a provider of fiber optic cabling, components, and systems. This strategic decision aims to boost Precision Optical Technologies standing in the optical networking market and expand its capacity to cater to a broader spectrum of applications

-

In August 2023, Lumos launched fiber optic internet services in Orange County, North Carolina, marking a significant milestone in providing reliable, high-speed internet access to previously unserved areas. This initiative, achieved through a public-private partnership between Lumos and Orange County, involves substantial investments from both parties, including utilizing American Rescue Plan Act (ARPA) funds

-

In February 2023, Honeywell launched the Spectra Medical Grade (MG) Bio fiber portfolio, featuring a blue-colored fiber designed to enhance visibility and distinguish between various suture sets during intricate surgeries. This color-contrasting fiber helps healthcare professionals work with greater precision and efficiency, ultimately improving patient safety and comfort

North America Fiber Optics Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.72 billion

Revenue forecast in 2030

USD 3.62 billion

Growth rate

CAGR of 4.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2017 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Mode, application, region

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Colonial TelTek; COMMSCOPE; Corning Incorporated; Honeywell International Inc.; M2Optics, Inc.; OFS Fitel LLC; Opticonx; PRECISION OPTICAL TECHNOLOGIES; TC Communications, Inc.; Zeus Company LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Fiber Optics Market Report Segmentation

This report forecasts revenue growth at region and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2017 to 2030. For this study, Grand View Research has segmented the North America fiber optics market report based on mode, application, and country

-

Mode Outlook (Revenue, USD Million, 2017 - 2030)

-

Single-mode

-

Multi-mode

-

Plastic Optical Fiber

-

-

Application Outlook (Revenue, USD Million, 2017 - 2030)

-

Telecom

-

Oil & Gas

-

Material Sensing

-

High Bandwidth Communication

-

Others

-

-

Military & Aerospace

-

Secure Communication

-

Weapon System

-

Surveillance System

-

Optical Computing

-

UAV

-

Military Vehicle Sensing

-

-

BFSI

-

Medical

-

Biomedical Sensing

-

Minimal Invasive Surgery

-

Imaging

-

Endoscopy

-

MRI

-

CT

-

PET

-

X-Ray

-

Others

-

-

Others

-

-

Railway

-

Railway Maintenance

-

Speed Monitoring

-

Dynamic Load Calculation

-

-

Others

-

-

Country Outlook (Revenue, USD Million, 2017 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America fiber optics market size was estimated at USD 2.58 billion in 2023 and is expected to reach USD 2.72 billion in 2024

b. The North America fiber optics market is expected to grow at a compound annual growth rate of 4.9% from 2024 to 2030 to reach USD 3.62 billion by 2030

b. U.S. dominated the North America fiber optics market with a share of 56.8% in 2023. Growing demand for various emerging technologies, platforms, and trends, such as Netflix, Amazon Prime Video, online gaming tournaments, cloud computing, trading platforms, social media platforms, and others that require fast internet speed, these factors fueling the growth of fiber optics.

b. Some key players operating in the North America fiber optics market include Colonial TelTek, COMMSCOPE, Corning Incorporated, Honeywell International Inc., M2Optics, Inc., OFS Fitel LLC, Opticonx, PRECISION OPTICAL TECHNOLOGIES, TC Communications, Inc., Zeus Company LLC

b. Factors such as increasing bandwidth requirement and growing adoption of 5G network are driving the growth of fiber optics market in North America

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."