- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Expanded Polypropylene Foam Market, Report, 2030GVR Report cover

![North America Expanded Polypropylene Foam Market Size, Share & Trends Report]()

North America Expanded Polypropylene Foam Market Size, Share & Trends Analysis Report By Product (Low Density, Medium Density, High Density), By Application, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68038-454-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

The North America expanded polypropylene foam market size was estimated at USD 311.46 million in 2023 and is expected to grow at a CAGR of 12.4% from 2024 to 2030. The market has witnessed significant growth due to the increasing demand for EPP products in various end-use industries, such as automotive, consumer goods, electrical & electronics, and packaging.

Over the past few years, there has been considerable demand for polymers for their use as a replacement for metals and alloy materials across various industries, such as automotive, industrial machinery, and consumer goods. The criticality of the industry lies in technology, as the ever-increasing requirement of end users, in terms of product specification and versatility, gradually tends to overshadow the consumption dynamics. Other factors, such as feedstock availability, production process, and socio-political events, also have a significant impact on industry trends.

The growth of the market in the region can be attributed to the growing number of end-use industries in the U.S. and Canada. The presence of high-income economies propels the market demand for technologically advanced and superior-quality consumer goods, such as electronics, appliances, cosmetics, and automobiles. These factors, coupled with high investments in the manufacturing sector, are expected to propel the demand for EPP foam over the forecast period.

Government initiatives promoting the use of alternative materials that are sustainable and safe have further propelled the growth of the EPP foam market in North America. Policies encouraging innovation and adoption of advanced materials have created a conducive environment for the expansion of EPP foam applications. Several states, such as California, Vermont, New Jersey, and Washington D.C., have implemented laws to restrict or ban single-use plastic items, such as bags, straws, and expanded polystyrene (EPS) containers, motivating companies and consumers to opt for alternatives such as EPP foams.

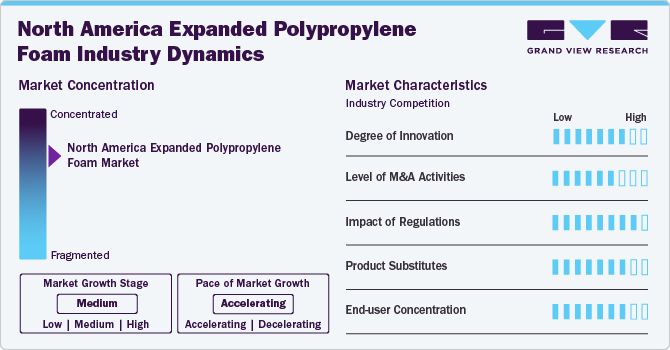

Industry Dynamics

The market is highly consolidated, with key participants involved in R&D and technological innovations. Notable companies include Trelleborg AB, SynFoam, Diab International AB, Acoustic Polymers Limited, Advanced Insulation, Deepwater Buoyancy, among others. Several players are engaged in framework development to improve their market share.

The EPP foam market is characterized by a high degree of innovation. Global population growth is resulting in a rise in plastic consumption across the world. Continued R&D efforts to create EPP foam with improved properties like impact resistance, thermal insulation, and chemical resistance are expected to drive market growth. Moreover, the presence of sustainable feedstocks and production procedures for producing environmentally friendly EPP foam manufactured from recycled PP or bio-based sources is likely to benefit the market growth.

The North America Expanded Polypropylene Foam Market is subject to numerous regulations, guidelines, and restrictions concerning polymer production and its applications, owing to the toxic nature of raw materials, such as isocyanates, coupled with certain health hazards of improperly disposed of products and over-exposure to chemicals contained in these foams.

Product Insights

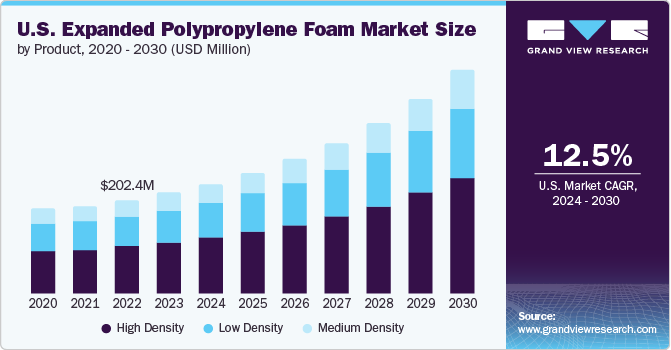

Based on product, the market is segmented into low-density Expanded Polypropylene Foam, medium-density Expanded Polypropylene Foam and high-density Expanded Polypropylene Foam. The high-density EPP held the largest market share of 51.0% in 2023. The rising need for energy management in the automobile sector is driving the segment. High-density EPP foam is widely used in the automotive industry for various components, such as automotive cushioning components in bumpers, door panels, pillars, headrests, and tool kits. The high strength-to-weight ratio and energy absorption capabilities of high-density EPP foam make it an ideal choice for automotive applications.

The medium-density EPP foam segment is growing at a rapid CAGR and is expected to maintain the growth rate over the projected period. The growth of the medium-density EPP foam segment can be attributed to the increasing demand for protective and chemically stable materials for the production of household goods, such as furniture, appliances, baby seats, toys, and mattresses.

Application Insights

The automotive segment dominated the North America Expanded Polypropylene Foam Market in terms of revenue in 2023. The North American automotive market is a significant player in the global automotive industry, characterized by its size, innovation, and market dynamics. The U.S., Canada, and Mexico collectively form a robust automotive market encompassing a wide range of vehicle types, including passenger cars, commercial vehicles, and two-wheelers. The presence of leading automotive manufacturers, such as Honda Motor Company, Volkswagen Group, and Fiat Chrysler Automobiles, as well as component manufacturers, is boosting the market value in the region. With the increasing adoption of electric vehicles, the need for better energy management solutions is growing, boosting the demand for EPP foams.

The construction segment is expected to witness the fastest growth over the forecast period. The rise in construction activities in North America is expected to create demand for Expanded Polypropylene Foam (EPP) foam-based products in the region during the forecast period. The construction industry plays a crucial role in the economic development of North America. According to the Associated General Contractors (AGC) of America, about 919,000 construction projects were present in the U.S. during the first quarter of 2023.

Country Insights

U.S. Expanded Polypropylene Foam Market Trends

The U.S. Expanded Polypropylene Foam Market held the largest share of 70.10% in 2023 and is expected to maintain its position over the forecast period. The shifting focus of the U.S. automotive industry toward electricity-powered and fuel-efficient cars has resulted in numerous innovations and technological advancements, further leading to the growing consumer demand for luxury electric cars. Increasing demand for fuel-efficient cars has resulted in the widespread use of high-performance materials for auto components, which, in turn, has promoted the use of chemically stable EPP foam.

Canada Expanded Polypropylene Foam Market Trends

Expanded Polypropylene Foam Market in Canada is expected to grow significantly from 2024 to 2030. The growing demand for EPP foam within the automotive industry is one of the key market drivers in Canada. EPP foam is increasingly being used in automotive applications, such as bumpers and interior components, due to its lightweight nature, energy absorption capabilities, and resistance to impact.

Mexico Expanded Polypropylene Foam Market Trends

Mexico Expanded Polypropylene Foam Marketcontributed to a significant revenue share in 2023. The urban population in Mexico is on the rise, and this trend has created a growing demand for construction in the residential, commercial, and infrastructure sectors. New housing developments, office spaces, retail centers, and transportation infrastructure projects are being undertaken to accommodate the expanding urban population, thereby driving the construction market. As a result, the construction and infrastructure sectors in Mexico are increasingly contributing to the demand for EPP foam.

Key North America Expanded Polypropylene Foam Company Insights

Key companies are adopting several organic and inorganic growth strategies, such as new product development, mergers & acquisitions, and joint ventures, to maintain and expand their market share.

-

In October 2023, Sonoco ThermoSafe expanded its manufacturing capabilities globally to enhance product quality and service offerings for a diverse customer base in healthcare, pharmaceuticals, life sciences, food, and perishables. This expansion involves acquiring state-of-the-art machinery, such as expanded polystyrene (EPS) tools and molding machines for EPP foam to improve precision, quality control, and production speed. Automation is expected to be implemented to streamline manufacturing processes, increase productivity, and reduce operational costs.

Key North America Expanded Polypropylene Foam Companies:

- BASF SE

- Sonoco Products Company

- Magna International, Inc.

- Woodbridge

- Clark Foam Products Corporation

- PDM Foam (Signode Industrial Group LLC)

- Knauf Industries

- Bradford Company

North America Expanded Polypropylene Foam Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 339.44 million

Revenue forecast in 2030

USD 682.97 million

Growth rate

CAGR of 12.4% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative Units

Volume in tons, revenue in USD million and CAGR from 2024 to 2030

Report coverage

Volume forecast, Revenue forecast, competitive landscape, growth factors, and trends

Segments covered

Product, application, region

Country scope

U.S.; Canada; Mexico

Key companies profiled

BASF SE; Sonoco Products Company; Magna International, Inc.; Woodbridge; Clark Foam Products Corporation; PDM Foam (Signode Industrial Group LLC); Knauf Industries; Bradford Company

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Expanded Polypropylene Foam Market Report Segmentation

This report forecasts revenue growth at the global, regional, and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America Expanded Polypropylene Foam Market report based on product, application, and country:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Low Density

-

Medium Density

-

High Density

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Automotive

-

Bumper Cores

-

Seating

-

Instrument Panels

-

Interior trim components (Headliners, Door Panels, Armrests)

-

Underbody protection (Fuel Tanks, Exhaust Systems, Suspension Components)

-

-

Construction

-

Insulation (Wall and Roof)

-

Formwork

-

Underlayment

-

Structural Components

-

-

Packaging

-

Protective packaging

-

Temperature controlled packaging

-

Reusable/returnable packaging

-

-

Consumer Electronics

-

Protective Cases

-

Insulation

-

-

Aerospace

-

HVAC

-

Heat Exchanger Casings

-

Insulation (Heating and Air conditioning Systems)

-

-

Medical

-

Others

-

Horticulture

-

Furniture & Design

-

Toys

-

Military & Defense

-

-

-

Country Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. North America's expanded polypropylene foam market size was estimated at USD 311.46 million in 2023 and is expected to reach USD 339.44 million in 2024.

b. The North American expanded polypropylene foam market is expected to grow at a compound annual growth rate of 12.4% from 2024 to 2030, reaching USD 682.97 million by 2030.

b. The U.S. dominated the North American expanded polypropylene foam market, with a share of 70.10% in 2023. This is attributable to the U.S. automotive industry's shifting focus towards electricity-powered and fuel-efficient cars coupled with the growing application of EPP foam for lightweight and durable products.

b. Some key players operating in the North America expanded polypropylene foam market include JSP Corporation, BASF SE, Mascoat, Armacell, PDM Foam, Clark Foam Products, Sonoco Products Company Corporation, and DS Smith.

b. Key factors that are driving the market growth include North America expanded polypropylene foams application for automobile parts, such as headrest, battery cover, sun visor, impact systems, and its application for light-weight and fuel-efficient cars across the world.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."