North America And Europe Preclinical Medical Device Testing Services Market Size, Share & Trends Analysis Report By Service (Biocompatibility Tests, Chemistry Test, Microbiology & Sterility Testing, Package Validation), By Region, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-817-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

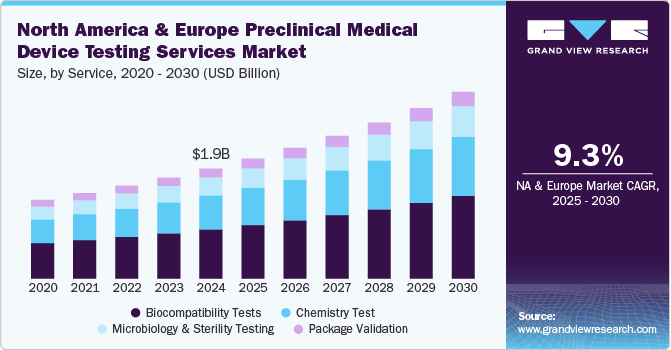

The North America and Europe preclinical medical device testing services market size was estimated at USD 1.85 billion in 2024 and is projected to grow at a CAGR of 9.3% from 2025 to 2030. The market is driven by emerging players operating in this industry over the past decade. Medical device companies today are operating at a rapid pace across the globe. In developed countries, such as the U.S., there is pricing pressure; hence, operators are exploring every possible way to reduce costs throughout the value chain. On the other hand, developing countries holds the actual potential. However, developing regions are likely to be price sensitive. Hence, market players today are striving hard to reduce the overall cost of devices. Outsourcing testing operations helps companies focus on product development and enhance marketing efforts.

Moreover, in such an intensely competitive environment, companies must reduce the time to market from the developmental phase. Considering that the approval processes for medical devices are not simple, companies need to have a sound knowledge of updated regulatory norms and protocols. As a result, medical device companies prefer to outsource it to a specialized firm.

The European Commission mentioned that it has adopted revised harmonized standards to expedite the production of sterilization devices & disinfectants, gloves, medical face masks, and containers for intravenous injections, as well as to alter the specific requirements for emergency & transport ventilators. In collaboration with the European Committee for Electro Technical Standardization (CENELEC) and the European Committee for Standardization (CEN), the European Commission has agreed to make several harmonized standards freely available.

Most medical devices are classified by the FDA as Class II or Class III. These classes require higher control and monitoring. Class II devices need pre-market notification, whereas Class III devices need pre-market approval (PMA) from the regulatory bodies. Apart from this special compliance, the basic ones include labeling requirements, manufacturing plant-established registration, medical device listing, quality systems regulation, and Medical Device Reporting (MDR). The FDA’s Center for Devices and Radiological Health (CDRH) mandates the framework and standards regarding the manufacturing, labeling, packaging, and storage of imported devices sold in the U.S.

Service Insights

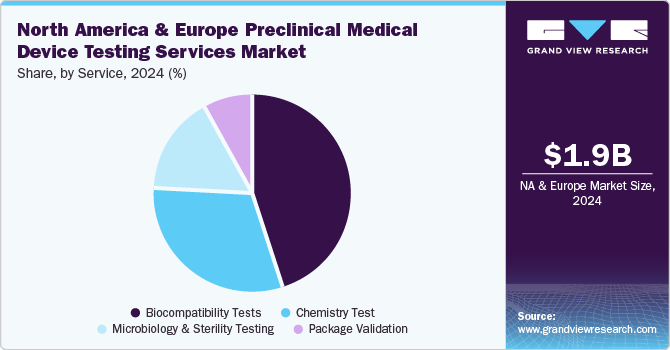

In 2024, the biocompatibility tests segment dominated the market, accounting for a revenue share of 44.7%. Manufacturing safe and effective goods is a top priority for medical device manufacturers, and quality assurance is crucial in accomplishing this aim. The test is a critical step for medical device development where an assessment of biocompatibility helps medical device manufacturers ensure the device’s safety for patients & provides data that can be used to support regulatory compliance. Such factors are anticipated to drive the market.

The chemistry test segment is expected to rise with the fastest CAGR of 9.6% in the forecast period. Chemistry tests support the medical device industry across the value chain. These tests ensure that medical devices do not cause adverse reactions when in contact with the human body. In addition, the test is used for regulatory submissions while being flexible to deliver against rapid problem-solving, manufacturing quality control & internal medical device component R&D requirements. These tests support the review of the safety parameters of medical devices. Therefore, the FDA is facilitating data analysis of polymer & colorant examinations to provide a holistic view of the safety of these tests. This is expected to positively impact the segment growth over the forecast period.

Regional Insights

North America preclinical medical device testing services marketdominated in 2024 with a larger share of 55.0%. This can be attributed to the presence of a large number of players in this region. It is also the top manufacturing hub for complex, highly reliable, and high-end medical devices. There is a rapid increase in the manufacturing of medical devices to meet the rising demand for efficient and cost-effective healthcare in this region. Besides this, the presence of the FDA is fueling the growth of the market for medical device testing services.

U.S. Preclinical Medical Device Testing Services Market Trends

The U.S. accounts for the largest share of the North America preclinical medical device testing services market. The country is home to numerous medical device companies, which outsource part of their R&D functions to service providers, contributing to the market's growth. In addition, the increasing outsourcing of medical device companies to CROs, CMOs, & CDMOs, minimizing product lifecycle costs, accelerating time-to-market, and accessing specialized expertise. In addition, medical device companies are committed to expanding their services with the innovations of new device development for patients, which has led to a rise in the requirement for preclinical medical device testing services in the country.

The preclinical medical device testing services market in Canada is driven by high demand for efficient healthcare, increased commitment to provide high-quality medical device services, and increasing need for outsourcing services that cater to medical device manufacturers' manufacturing and regulatory compliance needs. In addition, the presence of a well-established healthcare system and favorable government support are expected to improve the number of medical device services in the country. According to the International Trade Agency, the medical device market in Canada accounted for USD 6.8 billion in 2022, and this number is expected to grow at a rate of 5.4% by 2028.

Europe Preclinical Medical Device Testing Services Market Trends

In Europe, the preclinical medical device testing service is anticipated to witness a CAGR of 9.1% during the forecast period. The market is driven by rising demand for cost-effectiveness and increasing product design complexity. In addition, a number of market players are seeking entry into the Europe market, requiring extensive knowledge of complexity in product design. In addition, small & mid-sized medical device companies have rising requirements for preclinical medical device testing services for the safety and quality of medical devices in the region. In addition, stringent regulatory policies are anticipated to drive the market.

Germany preclinical medical device testing services market accounted for the largest share of the European market owing to its high-quality products, and increased emphasis on quality is expected to boost the demand for preclinical medical device testing outsourcing services. In addition, the growing number of clinical trials, rising R&D investment, and growing adoption of new technology further drive the market.

The preclinical medical device testing services market in the UK is driven by the presence of multinational medical device companies, increasing R&D spending, well-established healthcare infrastructure, technological advancements, and expanding innovation among medical devices companies and outsourcing companies have benefited the market growth.

Key North America And Europe Preclinical Medical Device Testing Services Company Insights

The market players operating across North America and Europe preclinical medical device testing services market are seeking to enhance their customer base, production capacities, and market presence with the adoption of in-organic strategic initiatives such as partnerships & agreements, service launches, expansions, mergers & acquisitions, and others to increase market presence & revenue and gain a competitive edge drives the market growth. Additionally, growing strategic initiatives are anticipated to boost the market share of prominent players operating across the market. For instance, in November 2023, Crown Bioscience & JSR Life Sciences company mentioned the launch of a service offering, OrganoidXplore. This platform provides robust, reproducible, & clinically relevant output, accelerating preclinical oncology drug discovery by reshaping the landscape of cancer treatment development.

Key North America And Europe Preclinical Medical Device Testing Services Companies:

- SGS SA

- Toxikon, Inc.

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- WUXI APPTEC

- TÜV SÜD AG

- Sterigenics International LLC

- Nelson Labs

- North American Science Associates, Inc.

- American Preclinical Services

- Charles River Laboratories International, Inc.

Recent Developments

-

In December 2023, Veranex mentioned the acquisition of T3 Labs, a preclinical laboratory. The acquisition of T3 Labs will allow Veranex to complete the entire MedTech development process, from concept to commercialization.

-

In July 2023, Versiti acquired Quantigen, a specialty lab based in Indiana. With the acquisition, Versiti will expand its clinical trial expertise and service offering; Quantigen provides a range of services supporting preclinical & clinical research and clinical diagnostics. The Quantigen specializes in biomarker validation, assay development, and diagnostic regulatory filings for a wide range of methods & disease states.

-

In May 2023, STEMart introduced medical device testing services for researchers across the globe. In accordance with ISO 10992 & ISO 18562 standards, American Society of Testing Materials standards, FDA guidance, & other guidelines, the company can assist clients, ensuring that medical device is inspected precisely.

-

In January 2023, Aethlon Medical, Inc. entered into an agreement with NAMSA to look over the company’s clinical trials investigating the Hemopurifier, Aethlon’s immunotherapeutic device for oncology indications.

North America And Europe Preclinical Medical Device Testing Services Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 2.01 billion |

|

Revenue forecast in 2030 |

USD 3.14 billion |

|

Growth rate |

CAGR of 9.3% from 2025 to 2030 |

|

Historical data |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD Million and CAGR from 2025to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Service, region |

|

Country scope |

U.S.; Canada; Mexico; UK; Germany; France; Italy; Spain; Sweden; Denmark; Norway |

|

Key companies profiled |

SGS SA; Toxikon Inc.; Eurofins Scientific; Pace Analytical Services LLC; Intertek Group Plc; WUXI APPTEC; TÜV SÜD AG; Sterigenics International LLC; Nelson Labs; North American Science Associates; Inc.; American Preclinical Services; Charles River Laboratories International, Inc. |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope. |

North America And Europe Preclinical Medical Device Testing Services Market Report Segmentation

This report forecasts revenue growth at the regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America and Europe preclinical medical device testing services market report based on service and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Biocompatibility Tests

-

Chemistry Test

-

Microbiology & Sterility Testing

-

Bioburden Determination

-

Pyrogen & Endotoxin Testing

-

Sterility Test and Validation

-

Ethylene Oxide (EO) gas sterilization

-

Gamma-irradiation

-

E-beam sterilization

-

X-ray sterilization

-

-

Antimicrobial Activity Testing

-

Others

-

-

Package Validation

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Sweden

-

Denmark

-

Norway

-

-

Frequently Asked Questions About This Report

b. The North America & Europe preclinical medical device testing services market was estimated at USD 1.85 billion in 2024 and is expected to reach USD 2.01 billion by 2025.

b. The North America & Europe preclinical medical device testing services market is expected to grow at a compound annual growth rate of 9.26% from 2025 to 2030 to reach USD 3.14 billion by 2030.

b. North America dominated the market in 2024 with the largest share of 54.99%. This can be attributed to the presence of a large number of players in this region. In addition, rapid increase in the manufacturing of medical devices to meet the rising demand for efficient and cost-effective healthcare in this region. Besides this, the presence of the FDA is fueling the growth of the market for medical device testing services.

b. Some of the players operating in the North America & Europe preclinical medical device testing services market are SGS SA, Toxikon, Inc., Eurofins Scientific, Pace Analytical Services LLC, Intertek Group Plc, WUXI APPTEC, TÜV SÜD AG, Sterigenics International LLC, Nelson Labs, North American Science Associates, Inc., American Preclinical Services, Charles River Laboratories International, Inc.

b. Some of the major factors driving the market include an increase in the number of small medical devices lacking in-house testing capabilities, complexity in product design, strict approval norms, and intense competition in the medical device industry.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."