- Home

- »

- Animal Health

- »

-

North America And Europe Pet Birds Health Market, Report 2030GVR Report cover

![North America And Europe Pet Birds Health Market Size, Share & Trends Report]()

North America And Europe Pet Birds Health Market Size, Share & Trends Analysis Report By Product (Pharmaceutical, Diagnostics), By Application, By Distribution Channel (E-Commerce, Retail), By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-459-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

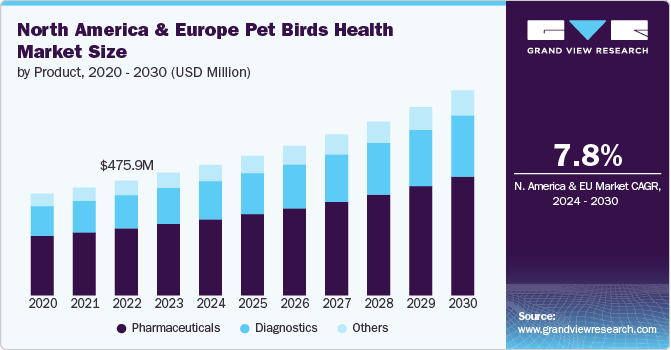

The North America and Europe pet birds health market size was estimated at USD 509.0 million in 2023 and is projected to grow at a CAGR of 7.80% from 2024 to 2030. The increasing pet bird’s ownership, rising awareness of birds’ health, and advancement in avian veterinary care is driving the market growth. Pet owners are becoming more knowledgeable about bird health, leading to higher demand for proper nutrition, vaccines, and healthcare services. New diagnostic tools, treatments, and specialized care have led to better health outcomes for pet birds, encouraging more people to seek professional care. Moreover, the rise in the number of households keeping birds as pets boosts demand for health products and services for birds.

The COVID-19 pandemic had notable effects on the global market. During the pandemic, lockdowns and social isolation led to an increase in pet bird adoption as people sought companionship. This contributed to greater demand for bird healthcare products, including supplements, treatments, and veterinary services. The global supply chain faced significant disruptions during COVID-19, impacting the availability of healthcare products and bird food. This led to shortages in some areas, particularly in specialized veterinary care and exotic pet services. Moreover, veterinary clinics increasingly embraced telemedicine as a way to provide consultations for bird owners. This innovation helped bird owner’s access care and advice without visiting clinics in person, expanding the reach of avian veterinarians.

Rising bird ownership is influencing the market growth by increasing demand for specialized health products and veterinary care. As more people adopt birds as pets, they seek proper healthcare, including nutrition, supplements, and veterinary services, leading to growth in bird-specific medical products, diagnostic services, and preventive care. The 2021 - 2022 National Pet Owners Survey conducted by the American Pet Products Association (APPA) states, pet birds are owned by 8% of households in the United States (5.7 million). This trend is further supported by growing awareness of avian diseases and the importance of immunizations and wellness examinations. The rising demand is also reflected in the increasing availability of pet bird health products, including vitamins, medications, and grooming supplies.

Market Concentration & Concentration

The market has a moderate concentration. The market is currently in a medium growth stage. One major factor propelling the market growth is the technological advancements. Innovations like portable imaging devices, genetic testing, and remote monitoring systems allow veterinarians to diagnose illnesses in birds more accurately and quickly. This leads to early detection and better outcomes for bird health. Moreover, with the growth of telemedicine, bird owners can consult veterinarians remotely, which is especially useful for exotic birds or rare species. Wearable devices and health trackers for birds monitor their vital signs and alert owners to any potential issues.

The market demonstrates a moderate degree of innovation, characterized by the rise of veterinary telemedicine that made it easier for bird owners to access expert care remotely. This includes consultations, monitoring chronic conditions, and even providing emergency care advice, reducing stress for birds who may not travel well. For instance, In May 2021, WhiskerDocs-which offers health advice to dog and cat owners by phone, text, email, and video-expanded into the field of avian telemedicine

Within the market, there exists a moderate level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic acquisition and partnerships among industry players. For instance, in September 2022, Zoetis acquired Newmetrica, expanding its companion animal portfolio with health-related quality-of-life instruments

The market experiences a moderate to high impact of regulations. Veterinarians who wish to specialize in exotic animal medicine typically need additional training and certification. The clinics and facilities that treat exotic animals may require specific licenses to handle, treat, and house these animals. Moreover, regulatory bodies oversee the development, approval, and sale of veterinary medicines for birds. These regulations ensure that treatments, and health supplements meet safety and efficacy standards. Compliance with these standards increases consumer trust and encourages the growth of veterinary health products targeted at birds

The market experiences a moderate level of product substitutes. The presence of alternatives frequently boosts competition, which lowers costs. Veterinary clinics and pet owners may prefer less expensive options that provide equivalent efficacy and safety. If veterinarians and pet owners believe that alternatives are more effective, safer, or easier to administer, they may switch to them

Moderate levels of regional growth operations in the market are caused by initiatives by major competitors in the market. For example, in January 2023, Merck & Co., Inc. established an innovative production facility in Boxmeer, Netherlands, for the sterile filling and freeze-drying of companion animal vaccinations

Product Insights

The pharmaceuticals segment led the market with the largest revenue share of 58.33% in 2023. Pharmaceutical companies are focusing on creating bird-specific medications, including antiparasitic drugs, and nutritional supplements. This meets the increasing demand for advanced bird healthcare. For instance, Beaphar offers products against fleas and ticks, grooming and hygiene products, and food supplements for birds. Moreover, advancements in drug delivery, like oral medications, topical treatments, and more targeted therapies, are making it easier to treat bird-specific ailments, improving overall health outcomes. The increasing number of avian veterinarians is driving the demand for prescription-based products in the bird health market, pushing pharmaceutical companies to offer a wider range of therapeutic solutions.

The diagnostics segment is expected to grow at the fastest CAGR of 8.20% during the forecast period. Diagnostic tools, such as imaging technologies, blood tests, and molecular diagnostics, help veterinarians identify illnesses in birds before they become critical. With the rise of bird ownership, there's an increasing demand for more accurate and accessible diagnostic tools. These advancements improve disease management, reduce mortality rates, and increase overall bird health, fueling growth in the pet bird health market. Furthermore, technological innovations in diagnostic methods also enable faster and more efficient detection of pathogens and genetic disorders in pet birds, boosting market expansion. For instance, Thermo Fisher Scientific Inc. offers VetMAX AIV Reagents allow to conduct one-step, real-time RT-PCR amplification of the Xeno RNA Internal Positive Control and the Avian Influenza Virus matrix gene RNA in birds.

Application Insights

Based on application, the bacterial infections segment led the market with the largest revenue share of 48.57% in 2023. A bird that has poor hygiene or is under a lot of psychological or environmental stress is more likely to get a bacterial infection. Among bacterial infections in birds, staphylococci and streptococci are the two most prevalent forms. Moreover, according to Merck & Co., Inc., domestic birds often suffer from bacterial infections.

Young birds and newborns are particularly vulnerable. The most frequent illnesses that might cause systemic illness are GI and respiratory infections. Companion birds typically have nonhemolytic Streptococcus, Corynebacterium, Lactobacillus, Micrococcus species, and Staphylococcus epidermidis in their bacterial flora. Therefore, the veterinary health market is growing rapidly due to the increasing prevalence of bacterial diseases in birds, particularly in the areas of diagnostics, medicines, and treatment services. Moreover, veterinarians and bird owners seek early detection tools, immunizations and medications to address these diseases, which fuels developments and innovations in this sector.

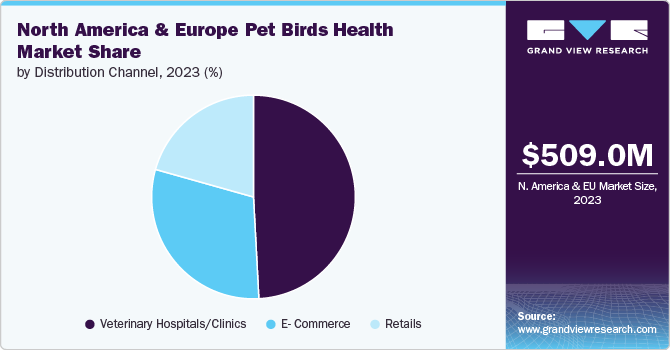

Distribution Channel Insights

Based on distribution channel, the veterinary hospital/clinics segment led the market with the largest revenue share of 49.48% in 2023. Veterinary hospitals and clinics often offer advanced diagnostic services for birds, including blood tests, imaging, and specialized avian medicine. This can lead to increased demand for diagnostic tools and treatments. Moreover, these facilities frequently provide specialized treatments and medications for birds, such as antibiotics, antifungals, and anti-parasitic. The availability of these treatments can boost market growth. The presence of facilities in the region offering medical services for birds often drives the market growth. For example, The Center for Bird and Exotic Animal Medicine (CBEAM) is a unique bird and exotic animal veterinarian establishment with the expertise to provide compassionate, competent treatment for all species of non-traditional pets. The hospital provides emergency care in addition to general wellness, diagnostics, surgeries, special health care, and hospitality services.

The e-commerce segment is expected to grow at the fastest CAGR of over 11% during the forecast period. E-commerce platforms provide a convenient channel for purchasing a wide range of products specifically designed for exotic pets such as companion birds. Pet owners may conveniently explore and buy a wide range of products from the comfort of their homes, including medications, bedding, cages, accessories, and specialty meals and nutritional supplements. This convenience is particularly appealing to busy pet owners who may have limited access to physical pet stores or veterinary clinics offering niche products.

Regional Insights

The pet birds health market in North America is anticipated to grow at a significant CAGR over the forecast period, due to high pet expenditures and advanced veterinary care. North America is home to advance veterinary facilities and technologies, which support the health and well-being of pet birds. Moreover, Pet owners in North America often spend more on their pets, including birds, which boosts the market for health-related products and services. As pet owners spend more on their pets, they are more likely to invest in preventative health measures, including regular check-ups, vaccinations, and health screenings for their pet birds.

U.S. Pet Birds Health Market Trends

The pet birds health market in the U.S. is experiencing significant growth, driven by a diverse population of pet birds. This demographic diversity reflects a strong cultural affinity for exotic pets among American households. As a result, the demand for specialized veterinary care, pharmaceuticals, nutritional supplements, and other health products tailored to the unique needs of these animals is robust. Veterinarians across the country are increasingly specializing in exotic animal medicine, offering advanced diagnostic and treatment options that cater specifically to non-traditional pets.

Europe Pet Birds Health Market Trends

Europe dominated the pet birds health market with the largest revenue share of 54% in 2023. The factors driving the Europe pet birds health market is presence of veterinary hospitals offering specialized services for pet birds. Veterinary hospitals that offer avian care provide pet owners with better access to specialized health services for their birds. This increases awareness of the health needs of pet birds and encourages owners to seek regular check-ups and treatments. Moreover, access to specialized veterinary care can lead to increased spending on bird health.

Italy pet birds health market is anticipated to grow at the fastest CAGR during the forecast period. With a larger population of pet birds, there is an increased demand for veterinary care, including health checks, treatments, and preventive measures. This boosts market growth for various segments, such as pharmaceuticals, diagnostics, and specialized avian care products. In addition, a higher bird population often leads to greater awareness of bird health, further driving demand for products and services tailored to avian well-being.

Key North America And Europe Pet Birds Health Company Insights

The market is fairly competitive due to the existence of small and large market participants. The companies are increasingly adopting various strategies, such as mergers & acquisitions, geographic expansion, and launch of products to grow in the market. For instance, in August 2022, Zoetis introduced the Poulvac Procerta HVT-IBD vaccine to the line of poultry products to protect birds against Infectious Bursal Disease (IBD). This expanded the range of recombinant vector vaccines offered by the company.

Key North America And Europe Pet Birds Health Companies:

- Vetafarm

- Vetnil

- AdvaCare Pharma

- Thermo Fisher Scientific Inc.

- INDICAL BIOSCIENCE GmbH

- VioVet Ltd

- Zoetis

- HomeoPet LLC.

- Merck & Co., Inc

- Johnsons

Recent Developments

-

In September 2022, Zoetis acquired Jurox. This acquisition helped Zoetis in the development of a variety of key products for larger global expansion, including Alfaxan, a leading anesthesia product for pets.

North America And Europe Pet Birds Health Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 541.5 million

Revenue forecast in 2030

USD 849.8 million

Growth rate

CAGR of 7.80% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Product, application, distribution channel, region

Regional scope

North America; Europe

Country Scope

U.S.; Canada; Mexico; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway

Key companies profiled

Vetafarm.; Vetnil; AdvaCare Pharma; Thermo Fisher Scientific Inc.; INDICAL BIOSCIENCE GmbH; VioVet Ltd; Zoetis; HomeoPet LLC; Merck & Co., Inc; Johnsons

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America And Europe Pet Birds Health Market Report Segmentation

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America and Europe pet birds health market report based on the product, application, distribution channel and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceuticals

-

Anti Parasitic

-

Antibiotics

-

Antifungal

-

Nutritional Supplements

-

-

Diagnostics

-

Consumables, reagents and kits

-

Instruments and devices

-

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Parasitic Infestations

-

Bacterial Infections

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail

-

E-Commerce

-

Veterinary Hospital/ Clinics

-

-

Regional Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

Rest of Europe

-

-

Frequently Asked Questions About This Report

b. The North America and Europe pet birds health market size was estimated at USD 509.0 million in 2023 and is expected to reach USD 541.5 million in 2024

b. The North America and Europe pet birds health market is expected to grow at a compound annual growth rate of 7.80% from 2024 to 2030 to reach USD 849.8 million by 2030

b. Europe dominated the North America and Europe pet birds health market with a share of 54.72% in 2023. This is attributable to presence of large numbers of veterinary hospitals offering specialized services for pet birds and increasing awareness of the health needs of pet birds and encourages owners to seek regular check-ups and treatments.

b. Some key players operating in the North America and Europe pet birds health Health market include Vetafarm., Vetnil, AdvaCare Pharma, Thermo Fisher Scientific Inc., INDICAL BIOSCIENCE GmbH, VioVet Ltd, Zoetis, HomeoPet LLC, Merck & Co., Inc, Johnsons

b. Key factors that are driving the market growth include increasing pet bird’s ownership, rising awareness of birds’ health, and advancement in avian veterinary care

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."