- Home

- »

- Animal Health

- »

-

North America And Europe Exotic Companion Animal Market, Report, 2030GVR Report cover

![North America And Europe Exotic Companion Animal Market Size, Share & Trends Report]()

North America And Europe Exotic Companion Animal Market Size, Share & Trends Analysis Report By Animal Type (Birds, Reptiles), By Route of Administration, By Product, By Indication, By Distribution Channel, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-390-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

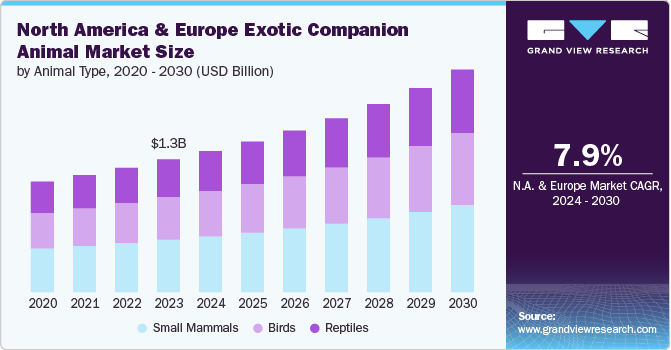

The North America and Europe exotic companion animal market size was estimated at USD 1.30 billion in 2023 and is projected to grow at a CAGR of 7.9% from 2024 to 2030. The increasing pet humanization, rising medicalization rate, supportive R&D initiatives and the growing adoption of pet insurance coupled with combination of demographic trends and advancements in veterinary care is driving the market growth. According to the report published by PangoVet in May 2024, Approximately 17.6 million exotic pets are currently owned across 9 million American households. Among these, 26% are birds, and 51% are reptiles highlighting a substantial exotic pet population in the U.S.

As urbanization and apartment living become more prevalent, traditional pets like dogs and cats, which often require more space and care, are being supplemented by smaller, exotic species that are more suited to confined living spaces. Animals such as reptiles, birds, and small mammals like ferrets and hedgehogs are becoming popular choices, offering pet owners a sense of novelty and distinction. The rising awareness and acceptance of the therapeutic benefits of owning exotic pets also drives the market growth. Many studies have highlighted the psychological and emotional advantages of pet ownership, such as reduced stress and increased happiness.

According to the study published by National Institute of Health, animal interaction can reduce stress, lower blood pressure, and boost mood, while also reducing loneliness, increasing social support, and enhancing mood. This has led to a growing trend of acquiring exotic pets for companionship and mental health support. For instance, birds and reptiles are often praised for their calming presence and relatively low maintenance compared to more traditional pets. In addition, the increasing visibility of exotic pets in media and popular culture has normalized and even glamorized their ownership, further driving market demand.

Regulatory influences significantly impact the care and welfare of exotic animals, driving improvements in their treatment and increasing demand for veterinary services. In many regions, stringent regulations ensure pet owners provide proper nutrition, housing, and medical care. In the U.S., the USDA's Animal and Plant Health Inspection Service (APHIS) and the Office of Laboratory Animal Welfare (OLAW) are crucial in enforcing the Animal Welfare Act (AWA) and the Public Health Service (PHS) Policy.

These regulations set standards for humane treatment in various settings. Similarly, in the European Union, the Directorate-General for Health and Food Safety (DG SANTE) implements regulations like Directive 2010/63/EU, which governs the welfare of animals used in scientific research. The European Convention for the Protection of Pet Animals, a Council of Europe treaty, ensures pet welfare by setting standards for their breeding, care, keeping, and trade. These regulatory frameworks in both regions aim to uphold high standards of animal welfare through strict enforcement and oversight.

Market Concentration & Characteristics

The North America & Europe Exotic Companion Animal market has a moderate market concentration. The market is currently in a medium growth stage. One major factor propelling the market growth is the technological advancements. Technological advancements in veterinary medicine have significantly impacted the Exotic Companion Animal (ECA) market by improving care options and accessibility for non-traditional pets. These innovations include specialized treatments, advanced capabilities in nutritional science, disease prevention, and specialized surgeries. Diagnostic tools, treatment modalities, and medical procedures have raised the standard of care for animals, with techniques such as endoscopy and advanced imaging revolutionizing diagnosis. These advancements have expanded treatment options and increased pet owners' confidence in seeking veterinary care for their companions, driving the growth of the exotic companion animal market.

The market demonstrates a moderate degree of innovation, characterized by product launches, ongoing partnership and collaboration between market players, and supportive initiatives. For instance, in September 2022, MSD Animal Health entered into a definitive agreement with Vence to broaden the company's portfolio with complementary products and technologies to advance animal health and well-being as well as customer satisfaction.

Within the market, there exists a moderate to high level of mergers and acquisitions activity, indicative of ongoing consolidation and strategic acquisition and partnerships among industry players. For instance, in January 2023, Merck announced the acquisition of Imago BioSciences, Inc. After the completion of this merger Imago will transform into a fully owned subsidiary of Merck.

The market experiences a moderate to high impact of regulations. Veterinarians who wish to specialize in exotic animal medicine typically need additional training and certification. In the U.S., the American Board of Veterinary Practitioners (ABVP) offers certification in exotic companion mammal practice. Moreover, clinics and facilities that treat animals may require specific licenses to handle, treat, and house these animals.

The market experiences a moderate level of product substitutes. The presence of alternatives frequently boosts competition, which lowers costs. Veterinary clinics and pet owners may prefer less expensive options that provide equivalent efficacy and safety. If veterinarians and pet owners believe that alternatives are more effective, safer, or easier to administer, they may switch to them.

High levels of regional growth operations in the market are caused by initiatives by major competitors in the market. For example, in January 2023,Merck & Co., Inc. established an innovative production facility in Boxmeer, Netherlands, for the sterile filling and freeze-drying of companion animal vaccinations.

Animal Type Insights

Based on the animal type, small mammals held the largest market share of 39.6% in 2023. With urbanization on the rise, more people are living in apartments or smaller homes where traditional pets such as dogs and cats may not be practical. Small mammals such as rabbits, guinea pigs, hamsters, and ferrets offer an ideal solution due to their compact size and manageable care requirements. These pets are particularly popular among young professionals, families with children, and older adults seeking companionship without the demands associated with larger animals. Consumer preferences have also shifted towards small mammals due to their unique appeal and the joy of owning an uncommon pet. The novelty and distinctive characteristics of small mammals make them attractive to pet owners looking for an alternative to traditional pets. For instance, rabbits are known for their gentle nature, making them suitable for families with children, while ferrets are prized for their playful and curious personalities. These attributes contribute to the increasing popularity of small mammals as pets.

Reptiles is expected to grow at the fastest CAGR of 8.0% during the forecast period driven by a combination of evolving consumer preferences, technological advancements in veterinary care, increased accessibility and affordability, demographic shifts, and growing awareness of reptile health needs. One of the primary drivers of this growth is the increasing popularity of reptiles as pets. Reptiles such as snakes, lizards, and turtles appeal to a broad range of pet owners due to their unique characteristics and relatively low maintenance requirements compared to traditional pets like dogs and cats. According to the report by American Veterinary Medical Association in May 2022, approximately 5.7 million households in the U.S. own at least one reptile. Younger generations, particularly Generation Z, show increasing ownership rates among pet owners, reflecting a growing trend towards reptiles as favored pets among younger demographics.

By Distribution Channel Insights

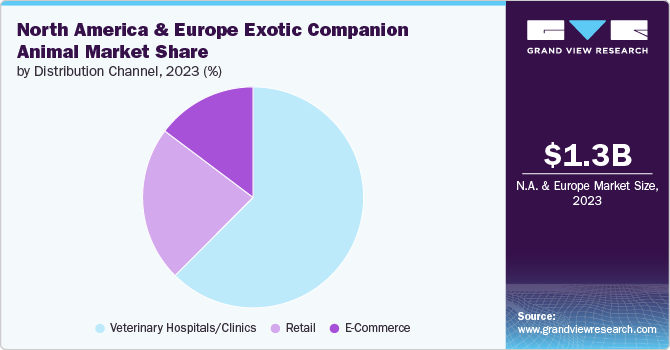

The veterinary hospitals/ clinics segment held the largest share of over 62.4% of North America & Europe exotic companion animal market in 2023. The increasing ownership of exotic pets across North America and Europe has led to a growing demand for specialized veterinary services. There is a growing emphasis on preventive care practices among pet owners and veterinary professionals. Veterinary hospitals and clinics are equipped with experienced exotic animal specialists and specialized facilities essential for providing comprehensive medical care, diagnostics, and treatments tailored to the specific requirements of these species. Regular wellness check-ups, vaccinations, and nutritional counseling tailored for exotic animals are becoming standard offerings in veterinary hospitals and clinics.

E-commerce is expected to grow at the fastest CAGR of 8.6% during the forecast period. E-commerce platforms provide a convenient channel for purchasing a wide range of products specifically designed for pets such as reptiles, birds, and small mammals. From specialized diets and nutritional supplements to pharmaceuticals, bedding, cages, and accessories, pet owners can easily browse and purchase these items from the comfort of their homes. This convenience is particularly appealing to busy pet owners who may have limited access to physical pet stores or veterinary clinics offering niche products.

By Route of Administration Insights

The oral segment held the largest share of 45.6% of the North America & Europe exotic companion animal market in 2023. Oral medications offer convenience and ease of administration, particularly for exotic pets that may be more challenging to handle for other routes, such as injections. Owners find oral medications more manageable for administering routine treatments, such as antibiotics, antiparasitic, and supplements, which are essential for maintaining the health of exotic animals like reptiles, birds, and small mammals. Moreover, the unique physiological characteristics of exotic animals often make the oral route of administration preferable.

Many species have delicate skin or tissues that are sensitive to injections, making oral medications a safer and less invasive alternative. In addition, the gastrointestinal tract of these animals is well-suited for absorbing orally administered medications, ensuring efficient delivery of therapeutic agents to target tissues and organs. For instance, in June 2024, the FDA approved fenbendazole as the first drug for treating and controlling gastrointestinal worms in wild quail. It previously authorized for use in cattle, swine, and turkeys against intestinal parasites, now extends its benefits to wild quail populations.

Topical is expected to grow at the fastest CAGR of 8.1% during the forecast period. The preference for topical treatments among pet owners stems from their ease of application and effectiveness in managing various health conditions in exotic animals. Topical medications, such as creams, ointments, sprays, and spot-on treatments, offer convenience and reduced stress for both animals and owners during administration. Advancements in veterinary pharmaceuticals have played a crucial role in expanding the range and efficacy of topical treatments for exotic animals. Pharmaceutical companies have developed specialized formulations that are safe, effective, and specifically designed to address dermatological issues, parasitic infestations, and wound care in exotic pets. For example, spot-on treatments for reptiles can effectively control mites and ticks, while topical antifungal creams are used to treat skin infections in small mammals.

By Product Insights

The pharmaceuticals segment held the largest share of 58.3% of North America & Europe exotic companion animal market in 2023. As more individuals choose non-traditional pets like reptiles or birds, the demand for specialized pharmaceuticals tailored to their unique health needs has surged. Pharmaceuticals play a crucial role in managing common ailments in exotic animals, including respiratory infections, parasitic infestations, metabolic disorders, and dermatological conditions. This growing pet ownership trend directly contributes to the expansion of the pharmaceuticals market within the ECA health sector. The affordability and accessibility of pharmaceutical products also play a role, making them a practical choice for addressing a wide range of health issues in animals.

Food & supplements is expected to grow at the fastest CAGR of 8.2% during the forecast period. The increasing awareness and emphasis on proper nutrition for exotic pets plays a pivotal role in food & supplements. Pet owners are becoming more knowledgeable about the specific dietary requirements of their exotic companions, which differ significantly from those of traditional pets like dogs and cats. For instance, reptiles often require diets rich in calcium and vitamins to prevent metabolic bone disease, while birds may need specialized pellets to maintain optimal health. This heightened awareness has led to a growing demand for high-quality, species-specific diets and nutritional supplements that cater to the unique nutritional needs of animals.

By Indication Insights

The bacterial infection segment held the largest share of over 41.0% of North America & Europe exotic companion animal market in 2023 . Reptiles, birds, and small mammals are susceptible to a variety of bacterial infections, which can arise from improper husbandry practices, environmental factors, or contact with other infected animals. Common bacterial infections in exotic pets include respiratory infections, gastrointestinal diseases, skin infections, and systemic bacterial diseases. These infections can have serious health consequences if not promptly diagnosed and treated, necessitating a robust market for pharmaceuticals and treatments targeted at bacterial pathogens. Advancements in veterinary diagnostics and increased awareness among pet owners have also contributed to the growth of this segment. Veterinarians now have access to improved diagnostic tools such as bacterial cultures, PCR assays, and sensitivity testing, which enable accurate identification of bacterial pathogens and appropriate selection of antibiotics. Early detection and targeted treatment are crucial in managing bacterial infections effectively, minimizing the spread of disease and optimizing outcomes for exotic pets.

Parasitic infection is expected to grow at the fastest CAGR of 8.2% during the forecast period. The increasing globalization and movement of exotic animals across borders have contributed to the spread of parasitic infections. Exotic pets such as reptiles, birds, and small mammals may harbor parasites that are endemic to their native habitats but can become pathogenic in new environments. For example, reptiles imported for the pet trade may carry mites, ticks, or intestinal parasites that can spread to other animals or pose risks to human health. This heightened risk underscores the need for effective parasitic control measures and drives demand for pharmaceuticals and treatments tailored to exotic species.

Regional Insights

North America exotic companion animal market dominated the global market with a revenue share of over 61.0% in 2023. The region has a robust culture of pet ownership that extends beyond traditional cats and dogs to encompass a diverse array of exotic animals such as reptiles, birds, and small mammals. This cultural affinity for exotic pets drives demand for specialized veterinary care, pharmaceuticals, nutritional supplements, and other products tailored to meet the unique health needs of these non-traditional companions.

U.S. Exotic Companion Animal Market Trends

The U.S. exotic companion animal market is experiencing significant growth, driven by a diverse population of exotic companion animals, including reptiles, birds, and small mammals. This demographic diversity reflects a strong cultural affinity for exotic pets among American households. As a result, the demand for specialized veterinary care, pharmaceuticals, nutritional supplements, and other health products tailored to the unique needs of these animals is robust. Veterinarians across the country are increasingly specializing in animal medicine, offering advanced diagnostic and treatment options that cater specifically to non-traditional pets.

Europe Exotic Companion Animal Market Trends

Europe exotic companion animal market is expected to grow at the fastest CAGR of 8.0% during the forecast period. European culture embraces a wide range of pets beyond the traditional cats and dogs, including reptiles, birds, amphibians, and small mammals. This cultural openness and increasing interest in unique pets drive the demand for specialized veterinary services, nutritional supplements, habitat equipment, and other tailored health products. Moreover, the stringent regulatory standards further bolster the market by ensuring the safety, efficacy, and quality of veterinary pharmaceuticals and healthcare products. Regulatory bodies such as European Medicines Agency (EMA) rigorously evaluate veterinary drugs before approving them for distribution. This regulatory oversight instills confidence among both pet owners and veterinarians, guaranteeing that pets receive treatments that meet the high standards set by the European Union (EU).

Key North America And Europe Exotic Companion Animal Company Insights:

The North America & Europe exotic companion animal market is fairly competitive due to the existence of small to major market participants. Due to the existence of multiple small and large companies, the market is slightly fragmented. Thus, small players face intense competition to maintain their market position. Moreover, companies are increasingly adopting various strategies, such as mergers & acquisitions, geographic expansion, and launch of products to grow in the market. For instance, in September 2022, Zoetis completed the acquisition of Jurox, which provides Zoetis with a portfolio of important products with potential for broader international expansion and a valuable animal health portfolio.

Key North America And Europe Exotic Companion Animal Companies:

- AdvaCare Pharma

- Merck & Co., Inc.,

- VETARK (Candioli Srl)

- Vetafarm.

- VioVet Ltd (Pethealth)

- Mazuri

- Earth Paws Private Limited.

- Versele Laga

- CROCdoc (a sister company of The Birdcare Company)

- Zoetis

- Vetnil

Recent Developments

-

In September 2022, Zoetis acquired Jurox. This acquisition helped Zoetis in the development of a variety of key products for larger global expansion, including Alfaxan, a leading anesthesia product for pets.

North America And Europe Exotic Companion Animal Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.38 billion

Revenue forecast in 2030

USD 2.18 billion

Growth rate

CAGR of 7.9% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends, clinical trials outlook, volume analysis

Segments covered

Animal type, by route of administration, by product, by indication, by distribution channel and region

Regional scope

North America and Europe

Country Scope

U.S.; Canada; UK; Germany; Italy; France; Spain; Denmark; Sweden; Norway

Key companies profiled

AdvaCare Pharma; Merck & Co., Inc., ; VETARK (Candioli Srl); Vetafarm; VioVet Ltd (Pethealth); Mazuri; Earth Paws Private Limited. ; Versele Laga; CROCdoc ; Zoetis; Vetnil

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America And Europe Exotic Companion Animal Market

This report forecasts revenue growth and provides an analysis on the latest trends in each of the sub-segments from 2018 to 2030. For the purpose of this report, Grand View Research has segmented the North America & Europe exotic companion animal market on the basis of by animal type, by route of administration, by product, by indication, by distribution channel and region.

-

Animal Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Small Mammals

-

Birds

-

Reptiles

-

-

By Route of Administration Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oral

-

Topical

-

Injectable

-

-

By Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Pharmaceuticals

-

Parasiticides

-

Antibacterial

-

Medicated Feed Additives

-

Others (Antiviral)

-

-

Foods & Supplements

-

Others

-

-

By Indication Outlook (Revenue, USD Billion, 2018 - 2030)

-

Bacterial infection

-

Parasitic infection

-

Orthopedic diseases

-

Others

-

-

By Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Veterinary Hospitals/Clinics

-

Retail

-

E-Commerce

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

UK

-

Germany

-

France

-

Italy

-

Spain

-

Denmark

-

Sweden

-

Norway

-

-

Frequently Asked Questions About This Report

b. The North America & Europe exotic companion animal market was valued at USD 1.30 billion in 2023 and is projected to reach USD 1.38 billion in 2024

b. The North America & Europe exotic companion animal market is projected to grow at a compound annual growth rate (CAGR) of 7.9% from 2024 to 2030 to reach USD 2.18 billion by 2030.

Which segment accounted for the largest North America & Europe exotic companion animal market share?b. Small mammals dominated the North America & Europe exotic companion animal market with a share of 39.6% in 2023. With urbanization on the rise, more people are living in apartments or smaller homes where traditional pets like dogs and cats may not be practical

b. Some key players operating in the North America & Europe exotic companion animal market include AdvaCare Pharma; Merck & Co., Inc., ; VETARK (Candioli Srl); Vetafarm; VioVet Ltd (Pethealth); Mazuri; Earth Paws Private Limited. ; Versele Laga; CROCdoc ; Zoetis; and Vetnil

b. Key factors that are driving the market growth include increasing pet humanization, rising medicalization rate, supportive R&D initiatives and the growing adoption of pet insurance coupled with combination of demographic trends and advancements in veterinary care

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."