- Home

- »

- Plastics, Polymers & Resins

- »

-

North America & Europe Adhesives And Sealants Market Report 2030GVR Report cover

![North America & Europe Adhesives And Sealants Market Size, Share & Trends Report]()

North America & Europe Adhesives And Sealants Market Size, Share & Trends Analysis Report By Product, By Technology, By Application , By Region, And Segment Forecasts, 2023 - 2030

- Report ID: GVR-4-68040-142-7

- Number of Report Pages: 130

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2021

- Forecast Period: 2023 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

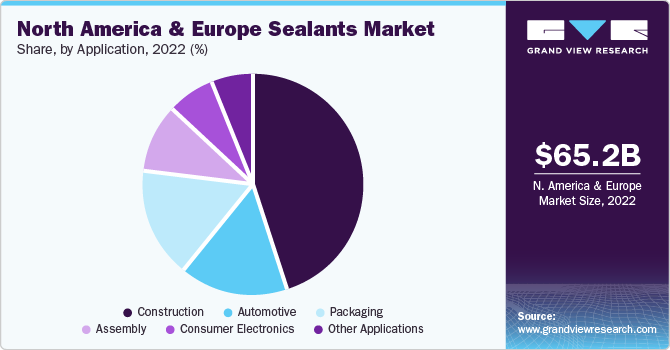

The North America & Europe adhesives and sealants market was estimated at USD 65.2 billion in 2022 and is anticipated to grow at a compound annual growth rate (CAGR) of 7.7% from 2023 to 2030. The growth of the market is attributed to the growing usage of high-performance sealants for producing lightweight vehicles to reduce the overuse of conventional materials such as metals and plastics. In the construction sector, sealants find widespread application in tasks such as sealing structural joints within buildings, filling gaps around windows and doors, and securing expansion joints.

Manufacturers of adhesives and sealants are actively creating eco-friendly products that exhibit reduced emissions of volatile organic compounds (VOCs). This mirrors the global drive to curtail pollution and mitigate the environmental repercussions associated with manufacturing. Furthermore, the utilization of adhesives and sealants has the potential to elevate energy efficiency by delivering improved insulation and sealing attributes. This aspect carries particular significance in the construction sector, where there is a strong emphasis on constructing energy-efficient buildings.

During the manufacturing phase, adhesives and sealants are mass-produced. This process entails the blending and mixing of raw materials, typically carried out in controlled settings to guarantee uniform product quality. Subsequently, these adhesives and sealants are placed into a variety of containers such as bottles, tubes, drums, or cartridges. Packaging may also encompass labeling and branding to distinguish between different product offerings.

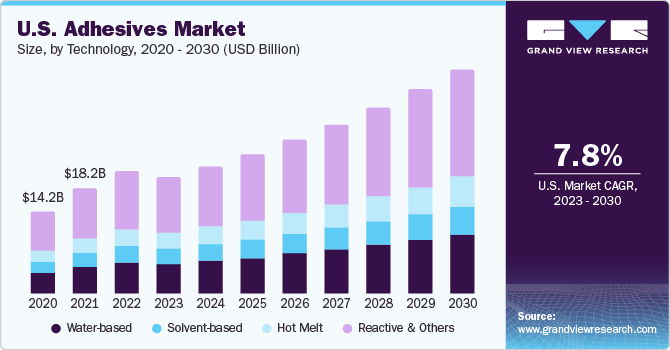

Adhesives Technology Insights

Based on the technology, water-based adhesives dominated the market with a revenue share of 24.0% in 2022. This is attributed to their non-flammable nature which makes them safer to handle and store. These adhesives offer several advantages over their solvent-based counterparts, making them a preferred choice for manufacturers concerned about sustainability and safety. The solvent-based segment was the second-largest segment and is predicted to grow at a CAGR of 7.2% during the forecast period. This is attributed to their extensive applications in various industries due to their unique characteristics and performance advantages. Organic solvents, such as acetone, toluene, or ethyl acetate, serve as the primary carrier for the adhesive. They dissolve the adhesive components and facilitate their application.

Adhesives Product Insights

Acrylic adhesives dominated the market with a revenue share of 36.7% in 2022. This is attributed to their ability to bond with a variety of materials, including metals, plastics, glass, ceramics, wood, etc. They develop strong and durable bonds, even in demanding environments. Acrylic adhesives also have excellent resistance to extreme temperatures, moisture, chemicals, and UV radiation. As such, they are ideal for indoor as well as outdoor applications.

PVA emerged as the second-largest product segment and is predicted to grow at a CAGR of 7.5% during the forecast period. This is attributed to their cost-effectiveness as compared to the other products. They are predominantly utilized for porous surfaces such as wood and paper. They are also used in the construction industry for flooring and panel installation applications. The demand for PVA-based adhesives is driven by their use in wood and packaging applications.

Adhesives Application Insights

Based on application, the paper & packaging segment dominated the market with a revenue share of 29.0% in 2022. This is attributed to a wide range of applications of adhesives as they play a crucial role in ensuring the integrity, durability, and efficiency of products of this industry throughout the value chain. Adhesives are utilized in various stages, from raw material processing to end-product assembling, thereby resulting in the development of cost-effective and versatile paper & packaging products.

Building & construction was the second-largest application segment and is predicted to grow at a CAGR of 7.3% during the forecast period. This is attributed to their ability to secure the bonding of tiles, vinyl, wooden floors, and carpets by enabling their strong connection that can withstand heavy foot traffic and resist moisture. They also find extensive use in the assembly and installation of building facades & curtain walls, adhesives bond glass, metal panels, and composite materials. They provide structural integrity to buildings and enhance their visual appeal.

Sealants Product Insights

Based on product, silicones dominated the market with a revenue share of 31.0% in 2022. This is attributed to their high-temperature resistance. In structural glazing systems, they are the prime components for bonding glass to structural parts of buildings. In the automotive industry, these sealants are expected to experience significant demand owing to the introduction of pollution emission norms to control vehicular pollution.

Polyurethanes was the second-largest product segment and is predicted to grow at a CAGR of 5.7% during the forecast period. This is attributed to their high strength and increased shelf life offered by them making the product an indispensable part of any construction activity. Polyurethane sealants are increasingly used in construction, marine, transportation, and industrial applications. The availability of polyurethane sealants in both solid and paste form has increased their market penetration owing to the ease of application offered by them.

Sealants Application Insights

The construction segment dominated the market with a revenue share of 44.9% in 2022.This is attributed to the rise in spending on infrastructure development projects in countries like the U.S., China, and India. Sealants are used in construction applications for sealing cracks, concrete road joints, and expansion joints, as well as for filling concrete gaps.The highest growth in their demand can be witnessed in countries such as China and India owing to the surged government spending for the construction industry.

Automotive was the second-largest application segment in 2022 and is predicted to grow at a compound annual growth rate of 5.9% during the forecast period. This is attributed to their wide usage in the automotive industry for waterproofing. The increasing sales of vehicles in emerging economies such as China, India, and Brazil are expected to fuel the demand for sealants used in automobiles.

Regional Insights

Europe dominated the market with a revenue share of 52.9% in 2022. This is attributed to the surging construction activities, growing automotive production, and ongoing advancements in technologies in the region. As Europe witnesses a rise in infrastructure development projects and renovations, the requirement for reliable and durable bonding materials has become paramount in the region. Renovation of dwellings in Europe is anticipated to create numerous growth opportunities for vendors of construction adhesives.

With the increasing penetration of electric vehicles (EVs) in Germany, the demand for adhesives is increasing for developing lightweight vehicles in the country. Adhesives & sealants help in reducing and replacing heavy mechanical fasteners employed in battery designs of electric vehicles during their production, thereby helping developers in achieving designing liberty, coupled with less assembling time.

North America accounted for a revenue share of 47.1% and is predicted to grow at a CAGR of 7.9% over the forecast period. The automotive sector in North America is at the forefront of technological advancements, focusing on lightweight materials and enhanced vehicle performance. Adhesive sealants are widely used in automotive manufacturing, replacing traditional mechanical fasteners and welding. With superior bonding capabilities and reduced weight, adhesives & sealants contribute to improving fuel efficiency and overall vehicle performance. The growing demand for automotive and the rise in imports and exports of vehicles are expected to propel the growth of the adhesives & sealants market.

Key Companies & Market Share Insights

The key players in the market are engaged in adopting various strategic initiatives such as expansion, collaboration, and new product launches to gain a competitive edge. For instance, in March 2023, Wacker Chemical AG undertook a capacity expansion project for silicone sealants at its Nunchritz facility. This expansion, with an estimated investment of approximately USD 21 million, is set to bolster the company's capacity for manufacturing readily available silicone sealants intended for direct sales.

Key North America & Europe Adhesives And Sealants Companies:

- 3M

- Arkema

- Avery Dennison Corporation

- H.B. Fuller

- Henkel AG & Co.

- Pidilite Industries Ltd.

- Huntsman International LLC.

- Wacker Chemie AG

- Sika AG

- RPM International Inc.

North America & Europe Adhesives And Sealants Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 61.5 billion

Revenue forecast in 2030

USD 118.2 billion

Growth rate

CAGR of 7.7% from 2023 to 2030

Base year for estimation

2022

Historical data

2018 - 2021

Forecast period

2023 - 2030

Quantitative units

Volume in kilotons; revenue in USD million/billion, and CAGR from 2023 to 2030

Report coverage

Volume forecast, revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Adhesives by technology, adhesives by product, adhesives by application, sealants by product, sealants by application

Regional scope

North America; Europe

Country scope

U.S.; Canada; Mexico; Germany; UK;

France; Italy; Spain

Key companies profiled

3M; Arkema; Avery Dennison Corporation; H.B. Fuller; Henkel AG & Co.; Pidilite Industries Ltd.; Huntsman International LLC.; Wacker Chemie AG; Sika AG; RPM International Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America & Europe Adhesives And Sealants Market Report Segmentation

This report forecasts revenue and volume growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America & Europe adhesives and sealants market report based on technology, product, application, and region:

-

Adhesives Technology Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Water-based

-

Solvent-based

-

Hot Melt

-

Reactive & Others

-

-

Adhesives Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Acrylic

-

PVA

-

Polyurethanes

-

Styrenic Block

-

Epoxy

-

EVA

-

Other Products

-

-

Adhesives Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Paper & Packaging

-

Consumer & DIY

-

Building & Construction

-

Furniture & Woodworking

-

Footwear & Leather

-

Automotive & Transportation

-

Medical

-

Other Applications

-

-

Sealants Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Silicones

-

Polyurethanes

-

Acrylic

-

Polyvinyl Acetate

-

Other Products

-

-

Sealants Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Construction

-

Automotive

-

Packaging

-

Assembly

-

Consumer Electronics

-

Other Applications

-

-

Adhesives And Sealants Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Europe

-

Germany

-

UK

-

France

-

Italy

-

Spain

-

-

Frequently Asked Questions About This Report

b. The North America & Europe adhesives and sealants market size was estimated at USD 65.2 billion in 2022 and is expected to reach USD 61.5 billion in 2023.

b. The North America & Europe adhesives and sealants market is expected to grow at a compound annual growth rate of 7.7% from 2023 to 2030 to reach USD 118.2 billion by 2030.

b. Europe dominated the Adhesives market with a share of 52.9% in 2022. The growth can be attributed to surging construction activities, growing automotive production, and ongoing advancements in technologies in the region.

b. Some key players operating in the North America & Europe adhesives and sealants market include 3M, Arkema, Avery Dennison Corporation, H.B. Fuller, Henkel AG & Co., Pidilite Industries Ltd., Huntsman International LLC., Wacker Chemie AG, Sika AG, and RPM International Inc., among others.

b. Key factors that are driving the market growth include large-scale utilization of adhesives & sealants for assembling glass, metals, rubber, etc. in the automotive and construction industries.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."