- Home

- »

- Renewable Chemicals

- »

-

North America Essential Oils Market Size, Share Report 2030GVR Report cover

![North America Essential Oils Market Size, Share & Trends Report]()

North America Essential Oils Market Size, Share & Trends Analysis Report By Product (Orange, Cornmint, Eucalyptus), By Application (Medical, Food & Beverages), By Sales Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-162-3

- Number of Report Pages: 116

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

Market Size & Trends

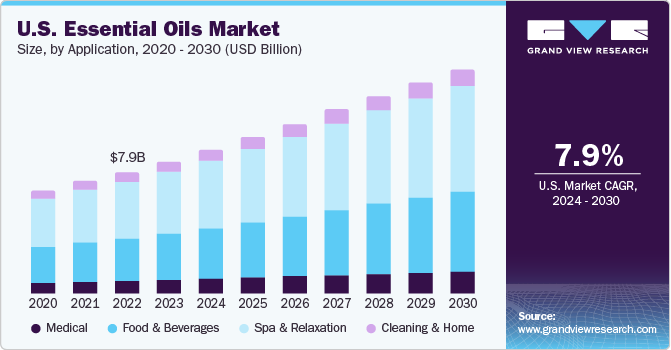

The North America essential oils market size was estimated at USD 9.26 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to 2030. This is attributable to the rising consumer awareness regarding organic and natural personal care products and food & beverages that has led manufacturers to shift their focus from synthetic to natural products. Essential oils have gained widespread usage across various industries such as medical, spa & relaxation, cleaning agents, food & beverage, and others, serving as substitutes for traditional products. These oils are primarily derived from organic matter, flowers, fruits, and plants through distillation and extrusion processes. In the food & beverage sector, they are extensively employed as flavorings and fragrances, as well as in aromatherapy.

Essential oils primarily consist of terpenes and their oxygenated derivatives, such as monoterpenes and sesquiterpenes. These oils are found in specialized cells or glands in various plants, with the location of these glands varying based on the plant's morphology and physiology. The extraction process involves rupturing these glands through pressing or the application of heat, resulting in the release of aroma. They are composed of volatile and hydrophobic aromatic compounds.

The numerous health benefits associated with essential oils are expected to drive demand in pharmaceutical and medical applications. Unlike conventional medicines, essential oils are known to have minimal side effects, making them a favorable choice. The cosmetics industry is also projected to witness significant growth in essential oil usage, particularly as film formers and emollients in hair care products like setting lotions, shampoos, and hairsprays. In addition, the demand for deodorizing products is increasing due to rising disposable income and changing consumer lifestyles.

In the U.S., essential oils industry is governed by regulatory agencies such as the U.S. Food & Drug Administration (FDA). The regulations and directives issued by these agencies vary with the intended use of the product and the type of marketing used. Industry participants must make their products and packaging compliant with regulations such as the Federal Food, Drug, And Cosmetic Act (FD&C Act).

Demand from the U.S. occupies a significant share in the North America market. Growing inclination toward preventive healthcare in the country is a major contributing factor to this scenario. Many consumers are buying health & wellness products to maintain a healthy lifestyle. Essential oils are also used in complementary and alternative medicine (CAM) in the country, driving their usage.

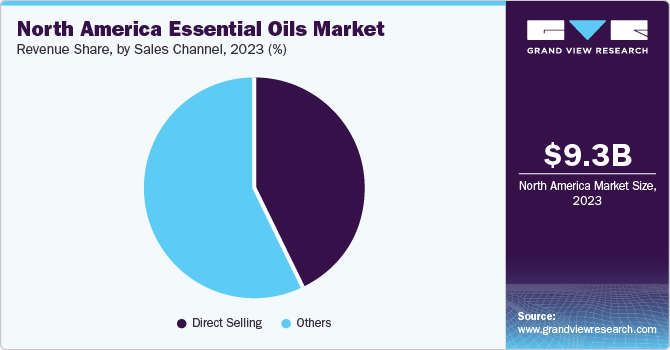

Sales Channel Insights

Direct selling channels dominated the market with the largest revenue share of 43.56% in 2023. This is attributed to the most straightforward form of sales, with the manufacturers selling their products directly to their end customers. Two major methods employed by the firms for direct sales purposes are online retail stores and offline retail stores. Traditional method of direct sales includes retail outlets in shopping malls or high-traffic locations, allowing customers to buy products in person. Increasingly with the digitalization of commercial activities, many essential oil companies have opened their own websites and e-commerce platforms allowing for a convenient and efficient shopping experience.

An indirect sales channel involves using third-party entities to distribute essential oil products. Different forms of indirect sales channel include retailers, distributors & wholesalers, online marketplaces as well as spa and wellness centers. Small retailers including beauty supply shops, health food stores, and major supermarket chains act as distributors of indirect sales channel. Major producers have a working agreement with distributors and wholesalers which allows the companies to expand the presence of their products in far-flung areas.

Product Insights

The orange segment dominated the market in 2023 with the highest revenue share of 9.30%. The product is projected to witness a strong growth in demand owing to the growing key end-use industries such as spa & relaxation and medical products. Orange essential oil is widely utilized in medical applications owing to its anticancer and antioxidant properties.

Eucalyptus oil is widely utilized in spa & relaxation, personal care, aromatherapy, and medical applications. The oil has three types, namely eucalyptus radiata, eucalyptus horistes, and eucalyptus citriodora. It contains eucalyptol, a chemical component that is commonly used to formulate detergents and makeup items as well as home cleaning, hair care, bath, and skincare products. The oil is also used for manufacturing cough suppressants and insect repellants.

Cornmint oil, also known as field mint or Japanese mint, is distilled from Mentha arvensis plant and is used as an immediate substitute for peppermint. The oil finds application in personal care, household cleaning, and food & beverage industries. Spa & relaxation is the largest application for this product, followed by food & beverages. The demand for the oil in the industries can be attributed to its beneficial properties, less menthol content, and low prices as compared to peppermint oil.

Cedarwood oil is of four types, namely Texas cedarwood (juniperus mexicana), Himalayan cedarwood (cedrus deodora), Virginian cedarwood (juniperus virginia) and Atlas cedarwood (cedrus atlantica). Most widely used types are Himalayan and Atlas cedarwood oils. These oils are widely utilized by the personal care industry for formulating hair care and skin care products.

Application Insights

The spa and relaxation segment dominated the market in 2023 with the largest revenue share of 45.89%. This is attributable to the fact that essential oils are basically plant-extracted concentrates. Different oils have distinct properties and benefits. Eucalyptus, Bergamot, Peppermint, Sandalwood, Tea Tree, and Chamomile oils are the most widely used oils for relaxation and spa applications. Neroli oil, Juniper Berry oil, ylang-ylang oil, chamomile oil, rose oil, and lavender oil prove to be very effective in relieving stress. To obtain a spa-like stance, essential oils can be melted into a bathtub, sprayed in linens, or diffused in the room.

The medical segment emerged as one of the most prominent application of the North America market in 2023. The segment is expected to experience growth over the coming years due to the rising usage scope of floral extracts & essential oils in the medical sector. The growth of the nutraceutical sector and the increasing popularity of integrative medicine emerged as other major factors driving the market growth. Essential oils contain volatile and complex chemical compounds, known for their anti-inflammatory, antibacterial, antifungal, and antiviral properties. The excellent medicinal properties of the product make it an ideal product for use in the medical sector.

Clove, Lemon, cinnamon, orange, lime peppermint, bergamot, cilantro, lavender, and Melaleuca are some of the most prominently used essential oils in cleaning and home applications. These oils help in breaking down toxins, cleaning and purifying the air, relieving seasonal discomfort, and supporting healthy respiratory function. Eucalyptus and tea tree essential oils are widely utilized for bathroom washing applications owing to their antibacterial and antifungal properties, which are key in controlling the spread of influenza, staph germs, and pneumonia. Thyme oil is used in kitchen cleaners for appliances due to its antibacterial and antiseptic properties, which enable it to control Salmonella bacteria.

Regional Insights

The U.S. dominated the market with the largest revenue share of 93.34% in 2023. This is attributed to the large concentration of personal care companies in the country along with the rising popularity of aromatherapy among its citizens, which is expected to further accelerate the market growth. Minimal taxes and relaxed regulations of import of goods have emerged as key reasons positively influencing demand for floral extracts & essential oils in the country.

In Canada, there has been a rise in the demand for some oil-based self-care practices in the recent past, boosting the growth prospects of the market. Companies in the country are adopting novel strategies to increase their market share. Introduction of new product lines, identification of new application prospects, emphasis on manufacturing process optimization, and distinctive packaging and labeling are some of the strategies being adopted by Canadian companies.

Mexico is an important market for essential oils & floral extracts in North America region. The country is the second-largest lemon producer and holds a significant share in lime and orange production across the region. Southeast and Southwest regions of Mexico are the major lemon producers. Oaxaca, Guerrero, and Jalisco, among others, are several major lemon-producing states in the country.

The dominating position of processors in plantations provides them control over the lemon supply to produce essential oils, thus reducing the dependence on fresh fruit market for the extraction of essential oils. Key essential oil companies are focusing on Mexico for the lime, lemon, and orange market owing to the suitable environment for production. Growth in lime, lemon, orange fruits along with others is projected to develop the essential oil & floral extracts market over the coming years.

Key Companies & Market Share Insights

The North America market is highly fragmented with key manufacturing integrating across the value chain in the region. A few of the prominent players in the product market are Takasago International Corporation, Symrise, MANE, Firmenich SA, among others.

Players operating in this market have adopted the strategy of mergers & acquisitions to enhance the reach of their products in the market by utilizing the network of acquired players and increasing the availability of their products in diverse geographies. For instance, in February 2023, ROBERTET GROUP announced the acquisition of Aroma Essential, a Girona, Spain-based company with expertise in the extraction of natural substances like vetiver, patchouli, cedar, ylang-ylang, and other essential products crucial to the fragrance industry.

Key North America Essential Oils Companies:

- Takasago International Corporation

- Symrise

- MANE

- Firmenich SA

- Synthite Industries Ltd.

- ROBERTET GROUP

- International Flavors & Fragrances Inc.

- Givaudan

- Falcon

- Norex Flavours Private Limited

- VedaOils

- MOKSHA LIFESTYLE PRODUCTS

- Vidya Herbs Pvt. Ltd.

North America Essential Oils Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 10.07 billion

Revenue forecast in 2030

USD 15.70 billion

Growth rate

CAGR of 7.8% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, volume in tons, and CAGR from 2024 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, sales channel, region

Regional scope

U.S.; Canada; Mexico

Market Players

Takasago International Corporation; Symrise; MANE; Firmenich SA; Synthite Industries Ltd.; ROBERTET GROUP; International Flavors & Fragrances Inc.; Givaudan; Falcon; Norex Flavours Private Limited; VedaOils; MOKSHA LIFESTYLE PRODUCTS; Vidya Herbs Pvt. Ltd..

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Essential Oils Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis on the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America essential oils market report based on product, application, sales channel and region:

-

Product Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Acorus Calamus

-

Ajowan

-

Basil

-

Black pepper

-

Cardamom

-

Carrot Seed

-

Cassia

-

Cedarwood

-

Celery

-

Cinnamon

-

Citronella

-

Clove

-

Cornmint

-

Cumin Seed

-

Curry Leaf

-

Cypriol

-

Davana

-

Dill Seed

-

Eucalyptus

-

Fennel

-

Frankincense

-

Garlic

-

Ginger

-

Holy Basil

-

Juniper Berry

-

Lemon

-

Lemongrass

-

Lime

-

Mace

-

Mustard

-

Neem

-

Nutmeg

-

Orange

-

Palmarosa

-

Pepper Mint

-

DMO

-

Rosemary

-

Spearmint

-

Turmeric

-

Vetiver

-

Ciz-3 Hexanol

-

Tea Tree

-

Other Products

-

-

Application Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Medical

-

Food & Beverages

-

Spa & Relaxation

-

Cleaning & Home

-

-

Sales Channel Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

Direct Selling

-

Others

-

-

Regional Outlook (Volume, Tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North American essential oils Market size was estimated at USD 9.26 billion in 2023 and is expected to reach USD 10.07 billion in 2024.

b. The North America essential oils market is expected to grow at a compound annual growth rate (CAGR) of 7.8% from 2024 to reach USD 15.70 billion by 2030.

b. U.S. dominated the North America essential oils market with a market share of 93.34% in 2023. This was attributed to the large concentration of personal care companies in the country along with the rising popularity of aromatherapy among its citizens, which is expected to further accelerate the market growth.

b. The key players in the North America essential oils market include Takasago International Corporation, Symrise, ROBERTET GROUP, MANE, Firmenich SA, International Flavors & Fragrances Inc. (IFF), Givaudan, and Falcon, among others.

b. Essential oils have numerous medicinal and aromatic benefits owing to which it is expected to witness significant opportunities in the medical, food & beverage, and personal care industries in the country.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."