- Home

- »

- Healthcare IT

- »

-

North America Electronic Health Records Market, Report 2030GVR Report cover

![North America Electronic Health Records Market Size, Share & Trends Report]()

North America Electronic Health Records Market Size, Share & Trends Analysis Report By Product (Web/ cloud-based EHR, and On-premise EHR), By Type, By Business Models, By Application, By End-use, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-314-3

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

Market Size & Trends

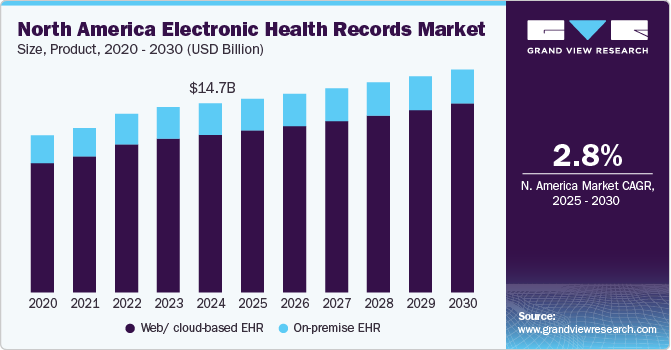

The North America electronic health records market size was estimated at USD 14.72 billion in 2024 and is expected to grow at a CAGR of 2.84% from 2025 to 2030. The market is expected to grow significantly, driven by a rise in demand for centralized and streamlined healthcare administration and an increase in proactive government initiatives to enhance HCIT usage. The growing trend of preventive healthcare and rising funding for digital health solutions startups are other factors boosting the market. Recent advancements in electronic health records (EHR) technology, including interoperability, mobile, cloud, and Big Data, are propelling the demand for advanced EHRs in the market.

The need for centralizing medical records for efficient care delivery and the shift toward value-based care are among factors driving the EHR market. For instance, in March 2022, Google Health collaborated with MEDITECH to use its search and summarization capabilities within MEDITECH's Expanse EHR platform to help clinicians provide the best care through easy and quick access to information from multiple sources.

In Canada, the adoption of Electronic Medical Records (EMRs) has also seen substantial progress. As per a study published by the National Library of Medicine (NCBI) in 2021, over 86% of primary care physicians utilize EMRs, indicating a robust integration of digital health technologies in the country's healthcare system. In addition, the Canada Health Infoway launched ACCESS 2022, an initiative to provide citizens with access to their personal health information and digitally delivered health services. This initiative is expected to significantly expand virtual healthcare options, accelerating the digital transformation of healthcare in Canada. These government initiatives underscore a strong commitment to enhancing healthcare through digital solutions, significantly driving the growth of the EHR market in North America.

Furthermore, the market is expected to grow significantly, driven by adopting cloud-based EHR systems. Cloud-based EHRs offer many advantages over traditional web-based systems, making them highly attractive to healthcare providers. These benefits include easy implementation, cost savings, reduced IT resource requirements, enhanced accessibility and collaboration, and simplified scalability. In addition, cloud-based EHRs enhance data security and address interoperability and data exchange challenges, further boosting their adoption.

Case Study: Adoption of HCIT and EHRs in the U.S.

The adoption of HCIT solutions, particularly EHR, has significantly transformed the U.S. healthcare landscape. The shift from paper-based records to digital systems aims to enhance patient care, streamline operations, and improve data accuracy. However, the adoption rate of these technologies varies among states and healthcare providers due to multiple influencing factors. This case study examines the adoption patterns in Oregon, the impact of the HITECH Act, and overall trends in EHR adoption across the U.S.

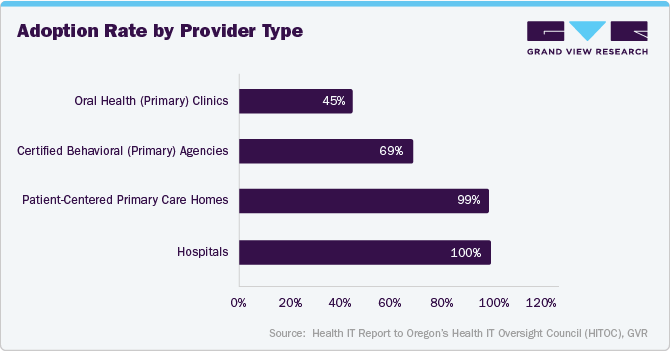

EHR Adoption in Oregon

Oregon stands out as a leading state in the adoption of EHR systems. According to the 2022 Report on Oregon's HCIT Landscape by the Oregon Health Authority-Office of Health Information Technology, the state exhibits high EHR adoption rates among healthcare providers. This widespread acceptance can be attributed to several factors:

Oregon implemented various programs and initiatives to encourage the adoption of HCIT solutions. This includes financial incentives, training programs, and technical support to facilitate the transition to digital records.

National Trends And The Impact Of The Hitech Act

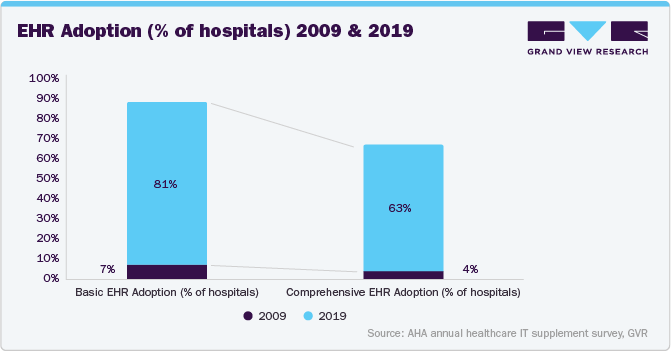

The Health Information Technology for Economic and Clinical Health (HITECH) Act of 2009 has significantly influenced the nationwide adoption of EHR systems. This act was part of broader healthcare reform efforts and aimed to accelerate the adoption of EHRs through financial incentives.

HITECH Act incentives: The federal government allocated USD 27 billion to create incentive programs to encourage hospitals and healthcare providers to adopt & implement EHR systems. This funding was pivotal in reducing the financial barriers associated with the initial setup and ongoing maintenance of EHR systems.

Adoption rates over time: According to a study published in Health Affairs Scholar in November 2023, EHR adoption among U.S. hospitals saw significant growth between 2009 and 2019. Basic EHR adoption surged from 6.6% to 81.2%, while comprehensive system adoption increased from 3.6% to 63.2%. This indicates a broad acceptance of EHRs across the healthcare sector.

List of Hospitals Utilizing EHR Systems by Vendor in the U.S.

EHR Vendor

Hospitals Utilizing the EHR

Epic Systems Corporation

AdventHealth Carrollwood

AdventHealth Sebring

Delray Medical Center

Adventist Health Hanford

Adventist Health Lodi Memorial

MEDHOST

Andalusia Health

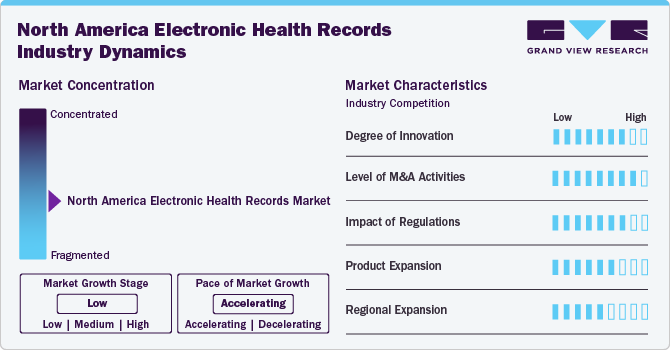

Market Concentration & Characteristics

The chart below illustrates the relationship between market concentration, market characteristics, and market participants. The x-axis represents the level of market concentration, ranging from low to high. The y-axis represents various market characteristics, including the degree of innovation, industry competition, product & services expansion, the impact of regulations, level of merger & acquisition activities, and regional expansion. For instance, the North America EHR market is fragmented, with many small players entering the market and launching new innovative products & services. The degree of innovation is high, the level of merger & acquisition activities is also high, and product expansion is moderate. The impact of regulations on the market is moderate, and the regional expansion of the market is also moderate.

Degree of innovation is high in the market with several industry players launching new products to improve their industry penetration. For instance, in April 2024, Oracleannounced an Autonomous Shield Plan to assist customers in transitioning to a comprehensive EHR and Cloud Infrastructure solution, minimizing risk and enhancing system performance.

The level of M&A activities in the market is high. Key industry players, including GE HealthCare, Veradigm LLC, TruBridge (CPSI), and NXGN Management, LLC. Inc. involved in merger and acquisition activities to grow their industry presence. For instance, in November 2023, Thoma Bravo, a software investment firm, announced the acquisition of NXGN Management, LLC. Inc., an innovative, cloud-based healthcare technology solutions provider, for USD 1.8 billion.

Regulations have a high impact on the North American EHR industry. The regulations related to EHRs are the HITECH Act, the 21st Century Cures Act, the ONC Health IT Certification Program, and the HIPAA Privacy Rule and Security Rule, which aim to promote the adoption and use of EHRs while ensuring the privacy and security of patient's health information.

Industry players leverage the strategy of product expansion to increase capabilities and promote the reach of their offerings. For instance, in September 2023, NXGN Management, LLC. launched NextGen Ambient Assist, an ambient listening solution that interprets patient-provider discussions in real-time, rapidly summarizing appointments and documenting care plans. AI-generated SOAP notes are seamlessly integrated into the EHR for provider ease.

The degree of regional expansion is moderate in the industry. The presence of numerous local companies that understand regional industry and customer preferences that pose significant competition to EHR. Some prominent companies in the industry are implementing various strategies, such as geographical expansion and launching new solutions, to consolidate their industry position across the North America region. For instance, in May 2024, Valley Health System opened a smart hospital in Paramus, NJ. The establishment will use the Meditech Expanse platform and other advanced technologies to improve workflows, including network infrastructure, clinical functions, & administrative operations.

Product Insights

The web/cloud-based EHR segment dominated the market in 2024 with a market share of 83.28% and is anticipated to grow at the fastest rate during the forecast period. The segment's growth can be attributed to its popularity among physicians and healthcare providers who operate on a smaller scale. On-premise EHRs can be installed and used without in-house servers and can offer a wide range of improvements and customizations as per the customer’s needs. In addition, major EHR vendors are launching new web-based solutions and expanding their services to cater to the growing demand, which is anticipated to boost the segment's growth during the forecast period. For instance, in March 2022, MEDITECH expanded the availability of its practice management solution and On-premise EHR system, Expanse Ambulatory, to independent and physician-owned practices without the requirement for an Expanse EHR in a hospital setting.

However, the on-premises EHR segment is expected to grow significantly during the forecast period. Healthcare organizations often prefer on-premises solutions for enhanced data security and control, addressing concerns about patient privacy and compliance with regulations such as HIPAA. In addition, these systems allow for customized configurations tailored to specific organizational needs, which can improve workflow efficiency and integration with existing infrastructure. As healthcare continues to prioritize patient data security and operational efficiency, the on-premises EHR segment is likely to remain robust within the North America market.

Type Insights

The acute segment dominated the market in 2024 with a market share of 46.03%. This is attributed to theincreasing adoption of EHR systems in hospitals to improve patient care, streamline workflows, and meet regulatory requirements, which is expected to drive the segment. For instance, according to ONC, in 2021, a 2015 Edition certified EHR was adopted by 86% of non-Federal general acute care hospitals.

The post-acute segment is expected to grow at the fastest rate during the forecast period. Moreover, market players are implementing merger and acquisition strategies to expand their offerings, improve care coordination, and enhance their market position, which is expected to support the segment growth in the coming years. For instance, in January 2024, PointClickCare Technologies acquired American HealthTech, a subsidiary of Computer Programs and Systems, Inc. (CPSI) that provides EHR solutions for the post-acute care market. This acquisition expands PointClickCare's presence in the post-acute care sector, enabling it to connect more providers and improve care collaboration & value-based care delivery.

Business Model Insights

The professional services segment dominated the market in 2024 with a market share of 32.33% and is expected to grow at the fastest rate during the forecast period. The professional services leverage healthcare organizations to design and implement EHR systems more effectively, leading to improved patient outcomes, better resource utilization, and enhanced decision-making based on health data. Moreover, the continuous development in the professional services EHR business model in North America, leads to the segment's growth. For instance, in January 2021, the U.S. Orthopedic Alliance (USOA) and Veradigm LLC entered into a strategic partnership. This partnership aims to help orthopedic practices scale more quickly & increase the use of EHRs, provide evidence-based guidelines to support evolving clinical protocols, and use value-based care analytics to link the entire community.

The EHR subscription model is more affordable for small and medium-sized healthcare organizations than licensed software, as it saves on additional costs such as license fees, regular upgrades, and device maintenance. The subscription model reduces the need for in-house IT staff, as the EHR service provider handles software installation, configuration, testing, operation, and upgrades. Furthermore, the subscription model is expected to continue growing in popularity due to its cost-effectiveness and ease of use for healthcare providers. For larger healthcare facilities, the annual subscription fees for leading EHR software such as Epic EHR can be higher, up to USD 500,000.

End Use Insights

The hospital use segment dominated the market in 2024 with a market share of 52.96%. The segment's growth is driven bythe increased adoption of EHR in hospitals for improving clinical, financial, & administrative efficiency and the rising need for enhancing hospital information systems. Moreover, the shift from volume-based care to value-based care leads to increased hospital EHR demand. According to the Office of the National Coordinator for Health Information Technology (ONC), EHR adoption in U.S. hospitals increased from 9% in 2008 to 96% in 2021.

The ambulatory use segment is expected to grow at the fastest growth rate during the forecast period owing to the increase in need for seamless healthcare information exchange, technological advancements, increased adoption in developed markets, and government initiatives to improve patient health record portals. For instance, in 2021, nearly 87% of acute and ambulatory care facilities adopted enterprise-wide patient flow systems, with high adoption in critical areas, according to an article by the College of Healthcare Information Management Executives.

Application Insights

The cardiology segment dominated the market in 2024 with a market share of 9.45% and is expected to grow at the fastest rate during the forecast period. The growth of the segment is driven by the increase in the incidence of hospitalization of patients diagnosed with cardiovascular diseases such as coronary heart disease and stroke. According to the American Heart Association's Heart Disease & Stroke 2024 Statistical Update, cardiovascular diseases, such as coronary heart disease, hypertension, and stroke, were the leading causes of death in the U.S. In 2021, the age-adjusted U.S. death rate attributable to cardiovascular disease was around 224.0 deaths per 100,000 population. This rise in the prevalence of cardiovascular diseases, coupled with government initiatives and the need for efficient evaluation & monitoring of cardiovascular functioning to prevent medication errors, is expected to fuel the demand for EHR systems over the forecast period.

The neurology segment is anticipated to grow significantly during the forecast period. The increasing incidence of neurological diseases, the need for high-quality healthcare services, and the widespread adoption of EHR software contribute to the importance of neurology EHRs. Neurology-specific EHR systems often include built-in templates for common symptoms and diagnoses, streamlining documentation and reducing monotony for healthcare providers. As the healthcare industry continues to emphasize the importance of digital transformation, the demand for specialized EHR solutions tailored to the unique needs of neurology practices is expected to grow significantly in the market.

Country Insights

U.S. Electronic Health Records Market Trends

U.S. EHR market held the largest share in 2024 owing to favorable government regulations and acts for monitoring the safety of healthcare IT solutions, growing investment in R&D, and the rising need for interoperability between different EHR systems.Many companies offer EHR systems in North America, including large established companies such as Oracle, GE Healthcare, Veradigm LLC, Epic Systems Corporation, eClinicalWorks, Greenway Health, LLC, NextGen Healthcare, Inc., Medical Information Technology, Inc. (Meditech), TruBridge (CPSI), AdvancedMD, Inc., CureMD Healthcare, and McKesson Corporation compete on factors such as cost, ease of use, system functionality, and customer support.

Canada Electronic Health Records Market Trends

The EHR market in Canada is witnessing significant advancements driven by government initiatives and increasing adoption rates among healthcare providers. According to the National Center for Biotechnology Information (NCBI), as of 2021, over 86% of primary care physicians in Canada reported using electronic medical records, reflecting a robust integration of digital health technologies into the healthcare system. In addition, the Canadian government continues to promote interoperability among EHR systems to ensure seamless data sharing across various healthcare settings, which is crucial for improving patient outcomes and streamlining care processes.

Mexico Electronic Health Records Market Trends

The EHR market in Mexico is evolving with a focus on regulatory support and public-private partnerships to enhance healthcare delivery. The Mexican government has been actively promoting the adoption of digital health solutions through regulatory frameworks that encourage healthcare providers to implement EHR systems. For instance, initiatives led by the government and private health organizations to implement electronic health record systems in Mexico are ongoing. Many hospitals embrace digital strategies that offer significant advantages for the nation's healthcare, citizens, and healthcare providers. These developments highlight Mexico's commitment to advancing its healthcare infrastructure through digitalization while addressing unique regional challenges.

Key North America Electronic Health Records Company Insights

The demand for EHR led to increased competition among companies in the North American electronic health records market. Key players in this market include eClinicalWorks, NXGN Management, LLC.; Epic Systems Corporation; GE Healthcare; Medidata, Veradigm LLC; Greenway Health, LLC, and NXGN Management LLC, among others. Furthermore, increasing industry consolidation activities such as partnership & collaboration, acquisitions, and mergers by the top market players, as well as growing initiatives in launching new services by key players, are also anticipated to increase their share in the market.Some of the few startup players includehc1, Kareo, Inc., and EverHealth Solutions Inc.

Key North America Electronic Health Records Companies:

- AdvancedMD, Inc.

- CureMD Healthcare

- eClinicalWorks

- Epic Systems Corporation

- GE Healthcare

- Greenway Health, LLC

- McKesson Corporation

- NXGN Management, LLC.

- Oracle

- TruBridge (CPSI)

- Veradigm LLC

Recent Developments

-

In May 2024, eClinicalWorks launched Sunoh.ai, a listening EHR-focused AI technology for dental practices. Its goal is to enhance clinical documentation speed and efficiency and elevate patient care.

-

In May 2024, The Department of Veterans Affairs extended the one-year EHR contract with Oracle to modernize its legacy health record system

-

In March 2024, eClinicalWorks, the ambulatory cloud EHR provider, announced the successful completion of synthetic testing for UDS Patient Level Submission (UDS+) reporting through Fast Healthcare Interoperability Resources (FHIR).

-

In March 2024, Veradigm LLC announced the acquisition of ScienceIO, an AI platform and foundation model provider for the healthcare ecosystem. This acquisition aims to accelerate the delivery of results from unstructured data to customers across the healthcare ecosystem.

-

In September 2023, Oracle incorporated generative AI into its EHR policies. The Oracle Clinical Digital Assistant tool is designed to interact with clinicians through conversational voice prompts. The company emphasizes its goal of alleviating the burden of repetitive tasks and mitigating burnout among healthcare professionals.

North America Electronic Health Records Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 17.34 billion

Growth rate

CAGR of 2.84% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, business model, application, end use, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

AdvancedMD, Inc.; CureMD Healthcare; eClinicalWorks; Epic Systems Corporation; GE Healthcare; Greenway Health, LLC; McKesson Corporation; NXGN Management, LLC.; Oracle; TruBridge (CPSI); Veradigm LLC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Electronic Health Records Market Report Segmentation

This report forecasts revenue growth, country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America electronic health records market report based on product, type, business model, application, end use, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Web/ cloud-based EHR

-

On-premise EHR

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Acute

-

Ambulatory

-

Post-Acute

-

-

Business Model Outlook (Revenue, USD Billion, 2018 - 2030)

-

Licensed software

-

Technology resale

-

Subscriptions

-

Professional services

-

Others (Support & Maintenance, Managed Services, etc.)

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Cardiology

-

Neurology

-

Radiology

-

Oncology

-

Mental & Behavioral Health

-

Nephrology & Urology

-

Gastroenterology

-

Pediatrics

-

General Medicine

-

Physical Therapy & Rehabilitation

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospital

-

Ambulatory surgical centers

-

Other end user

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America electronic health records market size was estimated at USD 14.72 billion in 2024 and is expected to reach USD 15.07 billion in 2025.

b. The North America electronic health records market is expected to grow at a compound annual growth rate of 2.84% from 2025 to 2030 to reach USD 17.34 billion by 2030.

b. The Web/ cloud-based EHR dominated the market with a share of 83.28% in 2024. This is attributable to its popularity among physicians and healthcare providers, which operate on a smaller scale. This is because web-based EHRs can be installed & used without in-house servers and can offer a wide range of improvements & customizations, as per the customer’s need.

b. Some key players operating in the North America electronic health records market include AdvancedMD, Inc., CureMD Healthcare, eClinicalWorks, Epic Systems Corporation, GE Healthcare, Greenway Health, LLC, McKesson Corporation, Medical Information Technology, Inc. (Meditech), NXGN Management, LLC., Oracle, TruBridge (CPSI), Veradigm LLC, and others.

b. Key factors that are driving the North America electronic health records market growth include the government initiatives to encourage HCIT usage, the introduction of technologically advanced healthcare services, and rising demand for centralization and streamlining of healthcare administration.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."