North America Electrical Steel Market Size, Share & Trend Analysis Report By Product (GOES, Non-Grain Oriented Electrical Steel (NGOES)), By Application (Transformers, Motors, Inductors), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-077-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

North America Electrical Steel Market Trends

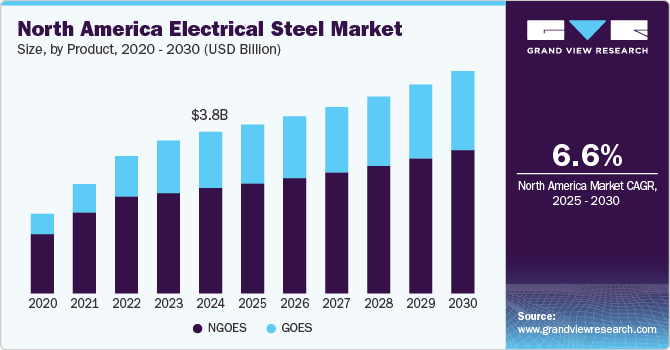

The North America electrical steel market size was estimated at USD 3.76 billion in 2024 and is projected to grow at a CAGR of 6.6% from 2025 to 2030. This growth is driven by several factors, including the increasing global electricity generation, rising awareness of green energy, and the growing demand for electric vehicles (EVs). Moreover, transformers and inductors, essential components in electricity generation and distribution, heavily rely on this material. The expansion of electricity production and the development of distribution infrastructure are propelling demand for it, which in turn is supporting market growth.

In addition, for electricity generation, electrical steel is critical in the production of motors, which are used in EVs. The ongoing shift toward vehicle electrification is significantly driving the demand for the product. This trend further boosts its consumption, contributing to the overall market expansion.

Electrical steel is also used in a variety of other applications, including generators, relays, solenoids, and other electromagnetic devices crucial for power distribution systems. According to Enerdata, global power generation rose by 2.6% in 2023, aligning with the historical growth trend of 2.5% annually from 2010 to 2019, indicating a steady demand for these materials. Overall, the continued growth in global power generation and the increasing adoption of EVs is anticipated to ensure a strong and sustained demand for electrical steel across the forecast period.

Drivers, Opportunities & Restraints

The growth of the EV industry is a key driver for the North America electrical steel market. As the shift toward electric mobility accelerates, the demand for electrical steel in EV motors is increasing. This material enhances motor performance by improving efficiency, with non-grain oriented electrical steel (NGOES) reducing energy losses in the motor core. As governments set sustainability targets and consumer demand for EVs rises, the need for electrical steel, essential for transferring power from the battery to the motor, is expected to grow, supported by investments in clean energy and EV infrastructure.

The rising global concern over climate change is driving a shift toward renewable energy, with governments and organizations investing in cleaner solutions to reduce emissions. In North America, government programs and incentives, such as feed-in tariffs and tax credits, are encouraging investments in clean energy. This transition is stimulating demand for renewable energy infrastructure, including wind and solar power plants, and creating a strong need for materials like electrical steel, which enhance the efficiency of energy generation and distribution systems. The growth of renewable energy generation and grid modernization presents substantial opportunities for the electrical steel market in North America.

Steel manufacturers in North America rely on raw materials like coal, iron ore, and ferroalloys for electrical steel production, and fluctuations in their prices can significantly impact production costs. Factors such as new market entrants, demand shifts, and logistics costs contribute to price volatility, which was especially evident during the COVID-19 pandemic, when supply chain disruptions led to increased raw material prices. Examples of this volatility include reduced ferrosilicon trading in 2020 and supply shortages from Brazil. These ongoing disruptions and price fluctuations create uncertainty around production costs and material availability, which could limit investments in new production capacity, restraining market growth.

Raw Material Price Trend

Fluctuations in iron ore prices significantly impact the production of electrical steel, as iron ore is a key raw material in steelmaking. When iron ore prices rise, production costs for these materials increase, potentially driving up their overall price. For example, the surge in iron ore prices in 2021, driven by high demand from China, likely contributed to higher costs for manufacturers. Conversely, as iron ore prices are expected to decline in 2024 due to weaker demand, production costs may decrease, benefiting manufacturers. However, ongoing volatility in raw material prices, along with uncertain demand from key sectors like electric vehicles and renewable energy, continues to affect market stability and growth.

Product Insights

NGOES is an iron-silicon alloy with nearly uniform magnetic properties in all directions, used in applications like household appliances, office equipment, and stabilizers. It features medium to high alloy content, depending on core loss requirements, and offers superior coatings, excellent thickness accuracy, and strong magnetic properties. NGOES undergoes cold-temperature annealing to ensure smooth surfaces, high flatness, and a high stacking factor, while its surface coating reduces magnetic losses from eddy currents. This material is widely used in rotating machines, high-efficiency motors, transformers, generators, and various other electromagnetic applications.

Grain-oriented electrical steel (GOES) segment is anticipated to register a growth rate of 7.0% in terms of revenue across the forecast period. It is produced from cold-rolled strips, providing an insulated coating with a thickness of less than 2 mm. It also helps to mitigate the eddy current losses. These strips are cut in lamination shapes, which are stacked on each other to form laminated cores of transformers, rotors, and stators of electric motors. GOES is an essential material in the production of energy-efficient transformers and generators.

Application Insights

Cold rolled grain oriented (CRGO) core, also known as laminations, is used in transformers as core material to provide high permeability and mitigate eddy current losses. Increasing investment in expanding the grid increases the rate of deployment of transformers, which is anticipated to drive the market in the projected timeline.

The motors segment is expected to register the fastest CAGR of 7.1% in terms of revenue across the forecast period. Product manufacturers are focused on developing soft magnetic materials with high flux density and minimal core losses at high frequencies such as high-speed motors for EVs, power tools, and traction motors.

Increased demand for HVAC systems for residential, commercial, and industrial purposes drives the use of motors which is estimated to propel the market growth during the projected period. For instance, in September 2024, Hitachi Energy announced over USD 155 million in investments to expand its manufacturing capacity in North America, including new factories and expansions in Mexico, Virginia, and Pennsylvania, to meet the growing global demand for energy infrastructure, such as distribution transformers, high-voltage switchgear, and breakers, and power and traction transformers.

Country Insights

U.S. Electrical Steel Market Trends

The U.S. is driven by economic growth, rising energy demand, and significant investments in power generation and infrastructure, which contributed to the high demand for electrical steel. The government’s USD 550 billion clean energy investment package, passed in 2021, is expected to further boost this demand, while the growing EV market plays a key role in increasing the need for electrical steel in motors. By October 2024, major automakers like General Motors had surpassed 300,000 EV sales, and EV sales saw an 11% year-over-year increase in Q3 2024.

Canada Electrical Steel Market Trends

Canada's electrical steel market is poised for growth, driven by clean energy investments, a growing EV industry, and infrastructure development. With Canada's economy expected to grow by 1.3% in 2024 and 2.4% in 2025, demand for electricity and construction projects will rise, boosting the use of electrical steel.

Mexico Electrical Steel Market Trends

Electrical steel market in Mexico is set for growth, fueled by economic expansion, infrastructure developments, and an increasing emphasis on EVs and clean energy. With a 3.2% GDP growth in 2023 and a projected 1.5% growth in 2024, Mexico's manufacturing and automotive sectors, particularly under the USMCA, contribute to this demand. Initiatives like General Motors' USD 1 billion EV investment and Mexico's national EV project is anticipated to drive the need for electrical steel in transformers, motors, and charging stations.

Key North America Electrical Steel Company Insights

The North America electrical steel market is highly competitive due to the presence of several major as well as small players. These companies, in order to have a competitive edge, are engaged in implementing different strategies such as development in significant research activities, technology, and presence in the regional market.

Some of the key players operating in the North America electrical steel market include POSCO, Nippon Steel Corporation, and Clevelands-Cliff Corporation.

-

POSCO one of the leading steel companies worldwide offers a wide range of products, which includes electrical steel, stainless steel, titanium, hot rolled coil, and others. The company produces more than 1 million tons of electrical steel sheets every year.

-

Nippon Steel Corporation operates across four business segments, of which electrical steel products are part of the steelmaking and steel fabrication segment. The company has an electric arc furnace facility at Setouchi Works Hirohata, Japan, with a production capacity of 60,000 MT/month.

-

Clevelands-Cliff Corporation, a leading steel company in North America, produces various products, including electrical steel. The company follows a growth strategy centered around mergers and acquisitions. Notably, it acquired AK Steel, a producer of GOES with a production capacity of 250 kilotons annually in the U.S.

Key North America Electrical Steel Companies:

- ArcelorMittal

- Cleveland-Cliffs Inc.

- JFE Shoji Corporation

- Steel Dynamics

- Nippon Steel Corporation

- POSCO

- Tata Steel

- Thyssenkrupp AG

- United States Steel Corporation

Recent Developments

-

In April 2024, ArcelorMittal announced plans to build an advanced manufacturing facility in Calvert, Alabama, which is expected to produce 150 kilotons of NGOES annually. The U.S. Department of Energy has recognized electrical steel as a critical material for energy, further reinforcing the importance of securing a stable domestic supply.

-

In October 2023, U.S. Steel Corporation introduced a new electrical steel production line in Osceola, Arkansas, with the capacity to produce a higher volume of non-grain-oriented (NGO) electrical steel annually compared to other domestic producers.

North America Electrical Steel Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 3.93 billion |

|

Revenue forecast in 2030 |

USD 5.17 billion |

|

Growth rate |

CAGR of 6.6% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 – 2023 |

|

Forecast period |

2025 - 2030 |

|

Report updated |

December 2024 |

|

Quantitative Units |

Volume in Kilotons, Revenue in USD million, and CAGR from 2025 to 2030 |

|

Report coverage |

Volume forecast, revenue forecast, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, application, country |

|

Country scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

ArcelorMittal; Cleveland-Cliffs Inc.; JFE Shoji Corporation; Steel Dynamics; Nippon Steel Corporation; POSCO; Tata Steel; Thyssenkrupp AG; United States Steel Corporation |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Electrical Steel Market Report Segmentation

This report forecasts revenue and volume growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America electrical steel market report based on product, application, and country.

-

Product Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Non-Grain Oriented Electrical Steel (NGOES)

-

Grain Oriented Electrical Steel (GOES)

-

-

Application Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

Transformers

-

Motors

-

Inductors

-

Others

-

-

Country Outlook (Volume, Kil0tons; Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America electrical steel market is expected to grow at a compound annual growth rate of 6.6% from 2025 to 2030 to reach USD 5.17 billion by 2030.

b. The transformer was the key application segment of the market with a revenue share of above 53.0% in 2024.

b. Some of the key vendors of the North America electrical steel market are ArcelorMittal, POSCO, Nippon Steel Corporation, JFE Shoji Corporation, and Cleveland-Cliffs, among others.

b. The key factor that is driving the growth of the North America electrical steel market is the rising investment by countries in green energy and EVs.

b. The North America electrical steel market size was estimated at USD 3.76 billion in 2024 and is expected to reach USD 3.93 billion in 2025.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."