- Home

- »

- Electronic & Electrical

- »

-

North America Electric Hair Clipper And Trimmer Market, Industry Report, 2030GVR Report cover

![North America Electric Hair Clipper And Trimmer Market Size, Share & Trends Report]()

North America Electric Hair Clipper And Trimmer Market Size, Share & Trends Analysis Report By Product (Blades, Hair Clipper), By Type, By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-278-8

- Number of Report Pages: 91

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America electric hair clipper & trimmer market size was estimated at USD 1.18 billion in 2023 and is expected to grow at a CAGR of 3.8% from 2024 to 2030. Increased spending on grooming products has significantly fueled the market growth in the region. As individuals place more emphasis on personal grooming and self-care, the demand for advanced and efficient grooming tools has seen a significant surge. This cultural shift toward a more appearance-conscious society has propelled the market for hair trimmers and clippers to new heights.

Consumers are increasingly seeking versatile and high-performance grooming devices that offer precision and ease of use. Hair trimmers and clippers have evolved to meet these demands, incorporating innovative technologies, ergonomic designs, and multiple functionalities. These advancements not only cater to professionals in salons and barbershops but also appeal to the growing population of individuals who prefer grooming themselves at home.

According to the 2023 Harris Williams annual health and beauty report, which surveyed 1,250 U.S. beauty enthusiasts (with 38 percent of respondents aged between 18 and 38 years), it was revealed that 58 percent plan to spend more on male grooming, and approximately 47 percent plan to spend more on facial tools. This increasing consumer expenditure on grooming and beauty products, coupled with the preference for time-efficient grooming solutions, particularly among the Generation Z and millennial demographics, is expected to drive the electric hair clipper and trimmer market in North America during the forecast period.

Increasing technological advancements have significantly impacted the hair clipper and trimmer market for both pets and humans. The integration of cutting-edge technologies has revolutionized the grooming industry, enhancing the performance, efficiency, and user experience of these grooming tools.

One key market driver is the advent of precision engineering in blade technology. Advanced materials and manufacturing processes have led to sharper and more durable blades, ensuring a smoother and more precise cutting experience. This technological improvement is particularly crucial in the grooming industry, where precision is paramount for achieving desired hairstyles or fur trims.

Moreover, the introduction of innovative features such as adjustable length settings, self-sharpening blades, and wireless connectivity has contributed to the growing popularity of high-tech grooming tools. Adjustable length settings allow users to customize their grooming preferences easily, catering to a diverse range of styles and lengths for both human hair and pet fur. Self-sharpening blades ensure longevity and consistent cutting performance, reducing the need for frequent maintenance.

Wireless connectivity features, such as Bluetooth or app integration, enable users to control and monitor their grooming devices through smartphones or other smart devices. This connectivity not only adds convenience but also provides insights into usage patterns and maintenance reminders, enhancing the overall user experience.

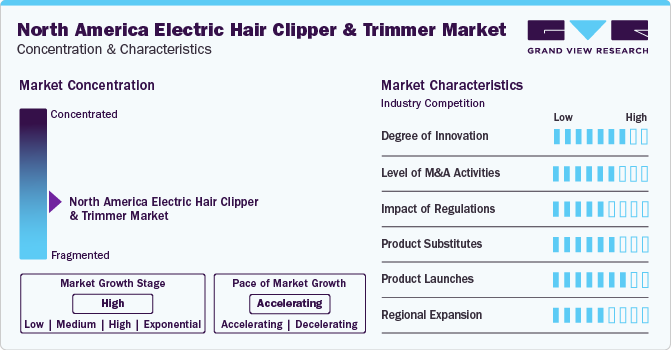

Market Concentration & Characteristics

The market has witnessed innovation in terms of technology and features. Manufacturers have been introducing cordless models with longer battery life, precision cutting blades, and ergonomic designs for user convenience. Some brands have incorporated smart features, such as Bluetooth connectivity and compatibility with mobile apps, allowing users to customize settings and track usage patterns.

The industry has seen some consolidation through mergers and acquisitions, with larger companies acquiring smaller ones to expand their product portfolios or enhance technological capabilities. Some companies may form strategic alliances or partnerships to leverage complementary strengths and gain a competitive edge in the market.

The market is subject to regulatory standards ensuring product safety and performance. Compliance with these standards is crucial for manufacturers to gain consumer trust and meet legal requirements. Increasing awareness of environmental sustainability may influence product design and manufacturing processes, with a focus on eco-friendly materials and energy-efficient technologies.

Product Insights

The electric hair clippers segment held the largest revenue share of 54.6% in 2023. Electric hair clippers offer a convenient and portable solution for individuals who enjoy styling their hair while on the go. These compact devices have become increasingly popular among travelers and those who value versatility in their hairstyling routine. The rising demand for hair clippers can be attributed to advancements in battery technology, resulting in improved battery life and enhanced usability. This enables users to enjoy extended usage without the hassle of frequent recharging.

In addition, the compact design of these clippers makes them easy to carry and store, further contributing to their appeal among consumers. As technology continues to evolve, we can expect further innovations in battery-operated hair clippers, catering to individuals seeking convenience and efficiency in their grooming routines.

The hair trimmer segment is expected to grow at a CAGR of 4.2% from 2024 to 2030. The introduction of products with advanced features such as ergonomic shapes, comfortable grip, and compact designs is anticipated to drive the adoption of electric hair trimmers. Robust motors ensure efficient and precise cutting, while ergonomic designs optimize user comfort during prolonged use. Furthermore, longer-lasting batteries enable extended grooming sessions without frequent recharging, enhancing the overall user experience. Electric trimmers have high-quality guard combs and powerful high-torque motors to ensure exceptional performance.

Several companies are offering hair trimmers with advanced features to cater to the rising demand for technologically advanced trimmers. In October 2023, U.S.-based men’s grooming company MANSCAPED launched The Lawn Mower 5.0 Ultra, an electric groin and body hair trimmer. This trimmer is designed for precision and comfort, with a dual-head system allowing a customizable trimming experience. The trimmer is equipped with SkinSafe technology to reduce the risk of nicks and cuts, a powerful motor with QuietStroke technology, and is waterproof for wet or dry use. The trimmer also offers wireless charging options, an LED spotlight, and a long battery life.

Type Insights

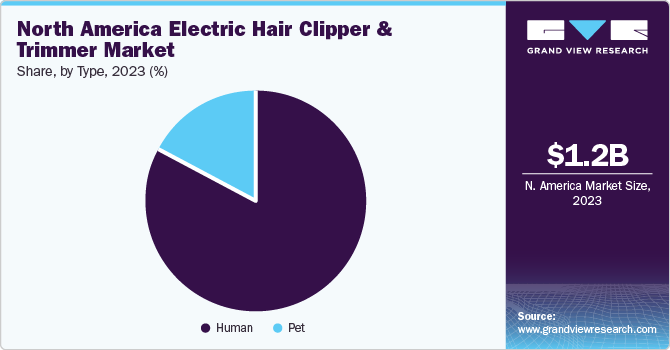

Based on type, the human electric hair clipper & trimmer segment accounted for the largest share in 2023. Growing awareness among consumers of the importance of proper and regular grooming is a major factor driving the demand for electric hair clippers and trimmers. As grooming styles evolve and change over time, consumers are increasingly investing in electric trimmers and clippers to achieve the latest trends or emulate the grooming styles of influencers, celebrities, or cultural icons. For example, in September 2022, a survey by U.S.-based The Benchmarking Company showed that among the 800 surveyed men aged 18 and above, 56% spend between USD 26 and USD 100 per month on their personal care products.

Manufacturers are continually innovating to improve the performance, efficiency, and user experience of these devices. Modern electric trimmers and clippers include longer battery life, rapid charging capabilities, quieter operation, and ergonomic designs that reduce hand fatigue during extended use. Some models also incorporate smart technologies such as a motorized comb, Bluetooth connectivity, or companion apps, providing users with personalized grooming recommendations and tracking capabilities.

The pet electric hair clipper & trimmer segment is expected to grow at a CAGR of 5.1% from 2024 to 2030. The increase in pet ownership, coupled with the rise of pet humanization and the growing demand for premium pet products, is significantly influencing the demand for electric trimmers and clippers for pets.

Pet owners increasingly view their pets as family members and are willing to spend more on grooming products and services to ensure their pets' appearance and overall well-being. For instance, in June 2023, a survey by LendEDU, a provider of financial educational resources in the U.S., surveyed 1,000 adult Americans aged 18 and up, revealing that 46% of survey respondents spend the same or more on their pet’s healthcare than their own.

Several companies offer trimmers and clippers for pets. For instance, U.S.-based Wahl Clipper offers the Deluxe Pro Series Cordless Rechargeable Pet Clipper. The kit is ideal for full-body clippings of all breeds of cats and dogs. Lithium-ion power offers excellent cutting performance and flexibility to groom anywhere. The cordless operation of the device makes it easy to groom outdoors or indoors, especially in spaces where electrical outlets are scarce. The device has a quick charge option and up to 2 hours of run-time.

Distribution Channel Insights

Sales through retail channels accounted for the largest market share in 2023. Retail channels like hypermarkets & supermarkets, specialty stores, and online platforms offer convenient access to a wide range of grooming products, including electric clippers and trimmers. Consumers can easily find these items while shopping for other pet supplies or household essentials, in-store or online, without needing to visit specialized grooming stores.

These devices are sold by offline stores such as Walmart and Amazon in North America. The rising presence of these retailers across the region will increase the product’s visibility and, thus, is expected to drive the electric hair clippers & trimmers market through these channels. In addition, retail channels frequently offer promotional offers and discounts during peak shopping seasons or holidays. These promotions incentivize consumers to purchase electric clippers and trimmers as standalone products or as part of bundled deals, further stimulating demand.

Sales through wholesale sector are anticipated to grow at a CAGR of 3.3% from 2024 to 2030. Wholesale stores offer bulk purchasing options at discounted prices. This appeals to businesses such as grooming salons and pet supply retailers, allowing them to acquire electric clippers and trimmers in large quantities at lower unit costs.

As the pet grooming industry continues to expand, there is a growing number of grooming businesses and pet care facilities requiring reliable and efficient grooming equipment. Electric clippers and trimmers purchased through wholesale channels enable these businesses to meet the needs of their clients while managing operational costs effectively.

Sales through online channel is expected to grow at a CAGR of 5.4% from 2024 to 2030. Enhanced product visibility is the major factor driving the demand for electric hair clippers and trimmer through online channels like Amazon and Walmart. These online channels provide round-the-clock assistance, boast a wide array of products for consumers to choose from, and frequently offer substantial discounts on branded items.

Further, online stores provide detailed product information, specifications, and customer reviews that help consumers make informed purchasing decisions. Shoppers can read reviews from other users, learn about product features, and gauge overall satisfaction before deciding on a particular electric trimmer or clipper. Several companies operating in the industry are actively expanding their presence online. For instance, a key player in the market, Andis, offers hair clippers, trimmers, shavers, and pet grooming tools through its online store.

Country Insights

U.S. Electric Hair Clipper And Trimmers Market Trends

The electric hair clipper & trimmer market in the U.S. is expected to grow at a CAGR of 3.7% from 2024 to 2030. The growing focus on hair grooming trends among millennials and young men and increasing pet ownership in the U.S. are significantly influencing the demand for electric trimmers and clippers. Several men are increasingly conscious of their appearance and grooming habits. With the rise of social media and the emphasis on self-presentation, there is a growing demand for grooming products that help individuals achieve stylish and well-groomed looks. According to a November 2021 survey by LendingTree, a financial data provider, 31% of men stated that they spend more on self-grooming or self-care than on sports.

Such trends have compelled market players in the country to offer advanced hair trimmers and clippers. In November 2023, U.S.-based Wahl Clipper Corporation announced the launch of the Hi-Viz Trimmer, designed to offer barbers improved visibility and more precise cuts. The trimmer boasts advanced precision blades, adaptive speed control, and an ergonomic design, specifically catering to professional barbers striving for flawless results. Equipped with a wide T-blade to enhance visibility and a diamond-like carbon coating for precision cuts, the trimmer incorporates adaptive speed control to achieve the cleanest cuts possible. Moreover, it is lightweight and well-balanced, ensuring full control during use, and features a long battery life.

Canada Electric Hair Clipper And Trimmer Market Trends

Canada electric hair clipper & trimmer market is expected to grow at a CAGR of 4.6% from 2024 to 2030. The changing perception of self-grooming and increasing interest and efforts by men to groom themselves are key factors contributing to the growth of the electric hair clippers and trimmers market in Canada. Men are increasingly investing in grooming products to maintain the quality and texture of their beards over time, and electric trimmers and clippers are used to trim and shape beards, while also preventing split ends and maintaining overall beard health.

The growing demand for electric trimmers and clippers in Canada has spurred a rise in the number of companies offering unique grooming products in the country. U.S.-based Caliber Pro USA, which has a growing presence in Canada, offers various innovative grooming tools with advanced features to enhance precision, efficiency, and convenience in beard and hair grooming routines. These electric clippers and trimmers feature adjustable settings, ergonomic designs, precision blades, long-lasting battery life, and other cutting-edge technologies to deliver professional-level results at home.

Key North America Electric Hair Clipper And Trimmer Company Insights

The market is highly competitive in nature. The market is identified by several strategic activities such as expansions, mergers and acquisitions, and product and technological innovations attempted by key manufacturers of electric trimmers. Wahl Clipper Corporation, Andis Company, Inc. and Conair LLC (BaBylissPRO) are expected to hold a significant share in the North America electric hair clippers and trimmers market.

-

Wahl's clippers and trimmers are known for their robust motors and sharp blades, delivering salon-quality results for haircuts and styling needs. The company's reach extends globally, with distribution networks spanning Europe, Asia, Africa, and South America.

-

The product portfolio of Andis is diverse, with a strong emphasis on electric trimmers, clippers, and blades. Its electric trimmers are known for their precision, ease of use, and durability, making them popular among professionals for detailed work and fine lines.

-

Conair's electric trimmers and clippers are known for their innovation, reliability, and high performance. They often come with various attachments and settings to cater to different hair types and grooming preferences.

Key North America Electric Hair Clipper And Trimmer Companies:

- Wahl Clipper Corporation

- Andis Company, Inc.

- Conair LLC (BaBylissPRO)

- Oster Professional Products (Sunbeam Products, Inc.)

- Koninklijke Philips N.V.

- Panasonic Corporation

- Remington Products (Spectrum Brands, Inc.)

- Oneisall, Inc.

- Skull Shaver, LLC

- Supreme Trimmer

Recent Developments

-

In February 2024, Andis Company, Inc. announced the launch of the professional grade eMERGE clipper. Engineered for efficient cutting in high-volume settings, this stylish clipper boasts a precision-engineered, high-speed rotary motor capable of delivering 4,500 strokes per minute, facilitating swift and impeccable grooming.

-

In August 2023, Panasonic Marketing Middle East & Africa (PMMAF) announced the launch of the ES-WV62 Bikini Trimmer and Shaver, marking a significant addition to its premium personal care portfolio. This innovative product is designed to enhance the at-home grooming experience, offering a combination of features that cater specifically to the delicate needs of the bikini zone.

-

In August 2023, Royal Philips, a player in health technology, introduced the Philips Beard Trimmer Series 1000 and Philips Hair Straightening Brush, specifically designed to cater to the preferences of Indian consumers and manufactured locally.

North America Electric Hair Clipper And Trimmer Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.22 billion

Revenue forecast in 2030

USD 1.53 billion

Growth rate

CAGR of 3.8% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, type, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada

Key companies profiled

Wahl Clipper Corporation; Andis Company, Inc.; Conair LLC (BaBylissPRO); Oster Professional Products (Sunbeam Products, Inc.); Koninklijke Philips N.V.; Panasonic Corporation; Remington Products (Spectrum Brands, Inc.); Oneisall, Inc.; Skull Shaver, LLC; Supreme Trimmer.

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Electric Hair Clipper And Trimmer Market Report Segmentation

This report forecasts revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America electric hair clipper & trimmer market report based on product, type, distribution channel, and region:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Hair Clipper

-

Hair Trimmer

-

Blades

-

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Human

-

Pet

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Wholesale

-

Retail

-

Hypermarkets & Supermarkets

-

Specialty Stores

-

Online

-

Others

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. North America hair clippers and trimmers market size was estimated at USD 1.18 billion in 2023 and is expected to reach USD 1.22 billion in 2024.

b. North America hair clippers and trimmers market is expected to grow at a compounded growth rate of 3.8% from 2024 to 2030 to reach USD 1.53 billion by 2030.

b. The market in U.S. accounted for more than 91.1% share of the global revenue in 2023.

b. Some key players operating in North America hair clippers and trimmers market include Wahl Clipper Corporation; Andis Company, Inc.; Conair LLC (BaBylissPRO); Oster Professional Products (Sunbeam Products, Inc.); Koninklijke Philips N.V.; Panasonic Corporation; Remington Products (Spectrum Brands, Inc.); Oneisall, Inc.; Skull Shaver, LLC; Supreme Trimmer.

b. Increased spending on grooming products has significantly fueled the growth of the hair trimmer and clipper market in North America. As individuals place more emphasis on personal grooming and self-care, the demand for advanced and efficient grooming tools has seen a significant surge.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."