North America Drywall Hooks, Fasteners, And Boards Market Size, Share & Trends Analysis Report By End-use (Residential, Commercial), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-333-3

- Number of Report Pages: 101

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

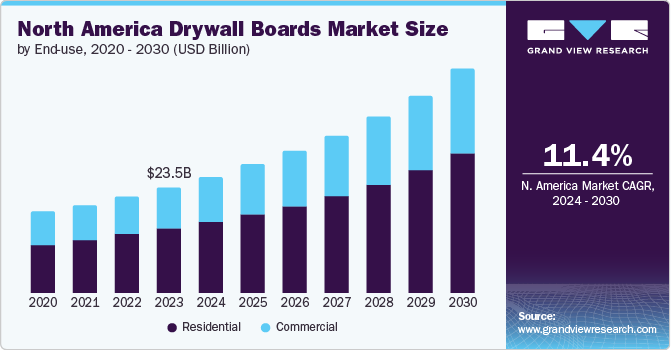

The North America drywall hooks, fasteners, and boards market size was estimated at USD 24.76 billion in 2023 and is projected to grow at a CAGR of 11.2% from 2024 to 2030. The growth of the market can be attributed to the rising construction industry, population growth, increasing investments in commercial and residential buildings, and ongoing remodeling projects. In addition, the rising trend of sustainable development and energy efficient homes has surged the need for durable, high quality, and eco-friendly drywall products.

Competitors in the market are opting for various strategies such as research and development to innovate high performance products to meet customer needs. They are also enhancing their product portfolios to offer comprehensive solutions, improving distribution channels to ensure wider market reach. In addition, companies are also focusing on mergers and acquisitions, strategic partnerships to expand their presence and capabilities.

Market Concentration & Characteristics

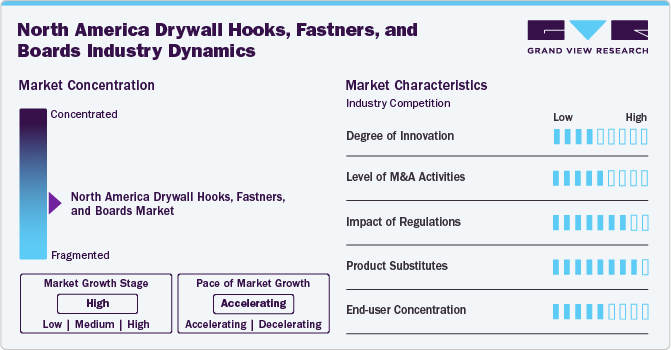

Market growth stage is high, and pace is accelerating. The advancements in manufacturing processes, driving innovation in material and design, and improving product quality. Advanced manufacturing techniques including precision engineering and automation are expected to lead to more durable and reliable products. This includes innovation of materials such as eco-friendly and lightweight composites, improve performance and sustainability.

The market is governed by several stringent safety and building codes, environmental standards, and occupational health requirements. These regulations are formulated to ensure product quality and safety, mandate compliance with certifications, and drive innovation towards eco-friendly and durable materials, which can increase the cost of production and complexity for manufacturers.

Industry witnesses a wide range of substitutes marked by increased competition and the need for innovation. Alternatives such as wood panels, metal studs, and advanced composites post a challenge to traditional drywall products by offering different benefits including greater durability and ease of installation. In addition, the availability of substitutes can influence pricing dynamics and consumer preferences.

End Use Insights

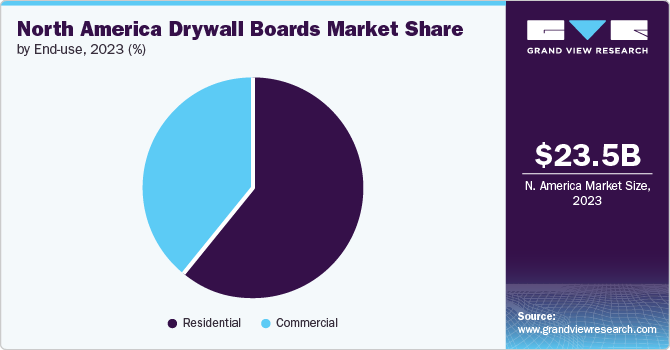

Based on end use, the-residential segment led the market with the largest revenue share of 60.7% in 2023. Population expansion coupled with rapid urban migration is anticipated to fuel residential construction spending in countries over the forecast period. The U.S. residential housing industry has witnessed rapid growth in recent years owing to easy access to mortgage loans, continued employment growth, and the rising demand for apartments due to the burgeoning population.

The commercial segment is expected to grow at the fastest CAGR of 10.9% over the forecast period. Drywall boards are widely used in various non-residential buildings, such as offices, retail spaces, and hotels, as they offer versatility, cost-effectiveness, and ease of installation. Drywall boards are utilized for interior partitions, ceilings, and decorative elements. Drywalls are also favored in institutional buildings, such as schools, hospitals, and government facilities, as they offer fire resistance and acoustic insulation.

In industrial buildings, such as warehouses and manufacturing facilities, drywall serves as a lightweight, durable, and cost-effective solution for interior walls and enclosures. Hence, the adaptability and versatility of drywall boards make them a preferred option for a wide range of commercial end uses, which is expected to drive their demand over the forecast period.

Country Insights

North America Drywall Hooks, Fasteners, And Boards Market Trends

North America drywall hooks, fasteners, and boards market was valued at USD 24.76 billion in 2023. Factors, such as increasing investment in affordable housing, smart city construction, upgrade and construction of infrastructure, and investment in the tourism sector, are expected to boost the demand for drywall hooks, fasteners, and boards over the forecast period.

U.S. Drywall Boards Market Trends

The drywall boards market in U.S. accounted for the largest revenue share of 66.5% in 2023. Increasing awareness regarding sustainable construction in the U.S. is expected to boost the demand for drywall boards over the forecast period. These boards help in increasing the energy efficiency of a structure, lowering the energy requirement for heating, ventilation, and air conditioning. A few benefits contributing to the expanding use of drywall in residential and commercial buildings are cost-effectiveness, ease of installation, and sustainability.

Canada Drywall Boards Market Trends

The Canada drywall boards market is anticipated to grow at the fastest CAGR of 15.0% over the forecast period. Initiatives introduced by the Canadian government such as New Building Canada Plan (NBCP) supporting building & construction projects in the country to enhance economic growth and job creation is expected to have a positive impact on the demand for drywall boards over the forecast period.

U.S. Drywall Fasteners Market Trends

The drywall fasteners market in U.S. is anticipated to grow at the rapid CAGR over the forecast period. The country is witnessing increased investments in the construction industry. According to the U.S. Census Bureau, the construction of new homes increased by 9.8% in February 2023 compared to January 2023, which is expected to fuel the consumption of drywall in the construction, thereby driving the U.S. drywall fasteners demand. Drywalls offer an advantage over conventional construction materials as they require less labor and installation time, which is essential in the U.S. due a shortage and high cost of skilled labor. With increasing demand for drywall sheets & panes, the U.S. market for drywall fasteners is likely to witness rapid growth over the coming years.

Canada Drywall Fasteners Market Trends

The Canada drywall fasteners market is expected to grow at the fastest CAGR of 5.0% over the forecast period. The use of drywalls in Canada is lower compared to their utilization in the U.S. construction industry due to the excessively cold climate in the country. Cold temperatures can result in the shrinking and cracking of drywall compounds, due to which it’s not primarily used in building structures. However, drywall is one of the most affordable construction materials. With the growing demand for affordable housing due to the increasing population, the demand for drywalls is expected to grow in Canada over the coming years. This is further expected to propel the market growth over the coming years.

U.S. Drywall Hooks Market Trends

The drywall hooks market in the U.S.accounted for the largest revenue share of 66.5% in 2023. The demand for drywall hooks in the U.S. is driven by the popularity of drywalls in residential and commercial construction projects. The lack of skilled labor coupled with the cost efficiency of drywalls has inclined various customers and builders toward the product. Even when the housing units are constructed with wood, drywalls are applied on the top of the structure to provide an aesthetic appeal. Therefore, increasing application of drywall in the country is expected to fuel the demand for drywall hooks in the coming years.

Canada Drywall Hooks Market Trends

The drywall hooks market in the Canada is expected to grow at a CAGR of 5.7% over the forecast period. Drywall has replaced plasters to become the most common and popular product for interior wall surfaces in houses. As per the Gypsum Association, 97% of the newly constructed homes have gypsum boards for interiors in Canada. Furthermore, Canada is characterized by high seismic activity zones. Most earthquake-prone areas in Canada include Eastern Northern Ontario, Offshore BC Region, Southern Great Lakes, and Northern & Southern Cordillera.

Drywalls offer high earthquake safety compared to brick walls and can withstand high vibrations when compared to concrete. These factors are driving the application of drywalls in the country. This is leading to increased consumption of drywall hooks for storage purposes.

Key North America Drywall Hooks, Fasteners, And Boards Company Insights

Some of the key players operating in the market include Amazon.com, Inc, Walmart Inc., and Lowe's:

-

Amazon.com, Inc., is a global leader in e-commerce and technology. North America, International, and Amazon Web Services (AWS). Amazon.com, Inc. serves a wide range of customers, including consumers, sellers, developers, enterprises, content creators, and advertisers. The company offers a vast selection of products and services through its online and physical stores, including websites, mobile apps, Alexa-enabled devices, and streaming platforms

-

Walmart's runs more than 10,500 stores along with various eCommerce sites across 19 countries, with a global workforce of 2.1 million employees, nearly 1.6 million of whom are in the U.S. The company’s retail operates through three main store formats: Supercenters, Discount Stores, and Neighborhood Markets.

Hobby Lobby and Michaels Stores are some of the emerging market participants in North America market.

-

Hobby Lobby is also involved in manufacturing, distribution, and office operations, with corporate headquarters encompassing over 12 million square feet in Oklahoma City. The company offers a wide range of products, including arts and crafts, hobbies, home décor, holiday, and seasonal items. The company offers a vast selection of products under its Super Savings & Super Selection motto, aiming to provide everything customers need to live a creative life

-

Michaels Stores operates over 300 stores across 49 states and Canada, as well as an online presence at Michaels.com and Michaels.ca, Michaels Stores offers a wide array of products for arts, crafts, framing, floral, wall décor, and seasonal merchandise. The company also owns Artistree, a manufacturer of custom and specialty framing merchandise, and MakerPlace by Michaels, a marketplace dedicated to handmade goods. It offers different types of wall décor items such as accent pieces, canvas art, clocks, hooks, knobs, shelves, signs, and posters among others

Key North America Drywall Hooks, Fasteners, And Boards Companies:

- Target Corporation

- Hobby Lobby

- Michaels Stores, Inc.

- Amazon.com, Inc.

- Walmart Inc.

- Bed Bath & Beyond

- Inter IKEA Systems B.V.

- HomeGoods

- West Elm

- The Home Depot

- Lowe’s

Recent Developments

-

In April 2023, Hillman Solutions Corp., a leading hardware and merchandising solution provider, opened its new distribution center in Missouri. The facility is approximately 305,000 square feet, which has enhanced the distribution access of the company to about 85% of the U.S. population. This strategy will allow them to distribute their products at a lesser time and better serve their customers

North America Drywall Hooks, Fasteners, And Boards Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 27.10 billion |

|

Revenue forecast in 2030 |

USD 49.35 billion |

|

Growth rate |

CAGR of 11.2% from 2024 to 2030 |

|

Base year for estimation |

2023 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

End use, region |

|

Regional scope |

North America |

|

Country scope |

U.S.; Canada |

|

Key companies profiled |

Target Corporation; Hobby Lobby; Michaels Stores, Inc.; Amazon.com, Inc.; Walmart Inc.; Bed Bath & Beyond; Inter IKEA Systems B.V.; HomeGoods; West Elm; The Home Depot; Lowe’s |

|

Customization scope |

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Drywall Hooks, Fasteners, And Boards Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America drywall hooks, fasteners, and boards market report based on end use, and region:

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America drywall hooks, fasteners, and boards market size was estimated at USD 24.76 billion in 2023 and is expected to reach USD 27.10 billion in 2024.

b. The North America drywall hooks, fasteners, and boards market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 51.13 billion by 2030.

b. Based on end-use, the residential segment dominated the market and was valued at USD 14.25 billion in 2023. Population expansion coupled with rapid urban migration is anticipated to fuel residential construction spending in countries over the forecast period.

b. Key retailers operating in the market are Target Corporation, Hobby Lobby, Michaels Stores, Inc., Amazon.com, Inc., Walmart Inc., Bed Bath & Beyond, Inter IKEA Systems B.V., HomeGoods, West Elm, The Home Depot, Lowe’s.

b. The key factors that are driving the North America drywall hooks, fasteners, and boards include rising construction industry, population growth, increasing investments in commercial and residential buildings, and ongoing remodeling projects.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."