- Home

- »

- Petrochemicals

- »

-

North America DIY & Household Adhesives And Sealants Market, Report, 2030GVR Report cover

![North America DIY & Household Adhesives And Sealants Market Size, Share & Trends Report]()

North America DIY & Household Adhesives And Sealants Market Size, Share & Trends Analysis Report By Form, By Application, By Product, By Technology, By Surface Type, By Packaging Type, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-328-4

- Number of Report Pages: 158

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

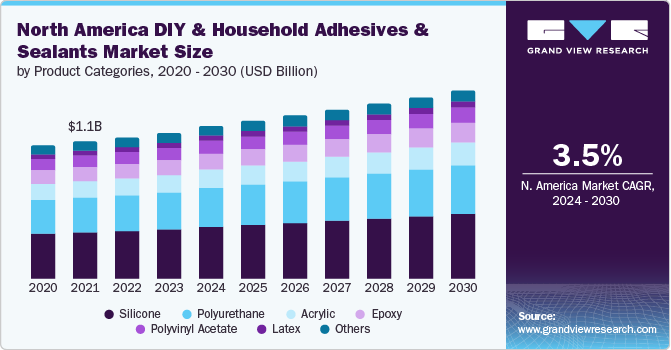

The North America DIY & household adhesives and sealants market size was valued at USD 1.38 billion in 2023 and is projected to grow at a CAGR of 3.5% from 2024 to 2030. The surge in home renovation activities in North America has significantly boosted the demand for adhesives and sealants, which are essential for ensuring the durability and functionality of renovation projects.

Adhesives are used to bond tiles, flooring, and cabinetry, enhancing structural integrity and longevity. Paste adhesives and sealants are bodied formulations that can serve as effective gap fillers. The U.S. government plans to build or preserve over 1 million affordable homes by 2026, stimulating the demand for construction materials such as adhesives and sealants.

Drivers, Opportunities & Restraints

The surge in home renovation activities in the U.S. has significantly boosted the demand for adhesives and sealants essential for ensuring the durability and functionality of renovation projects. Adhesives are used to bond tiles, flooring, and cabinetry, enhancing structural integrity and longevity. Sealants provide watertight and airtight barriers, crucial in moisture-prone areas like kitchens and bathrooms; for instance, silicone sealants effectively prevent water damage around sinks and bathtubs.

A myriad range of adhesives and sealants are used in homes for renovation, such as attaching carpets, tiles, kitchen fittings, and more. However, these products release harmful chemicals into the air, impacting health and the environment. Consumers spend 90% of their time indoors, especially at home, so addressing VOC concentrations at home is essential. The U.S. EPA has found that these products can release volatile organic compounds (VOCs) that can lead to health issues like headaches, irritation of the eyes, nose, and throat, and even long-term damage to the liver and kidneys. Some of the harmful components found in these products include formaldehyde, VOCs, isocyanates, and phthalates. Formaldehyde, a known carcinogen, is often found in wood products and can cause respiratory and eye irritation.

Cordless dispensers have revolutionized the way adhesives and sealants are applied. These battery-powered tools eliminate the need for cumbersome cords, making them more convenient and portable for DIY applications.

Volumetric dispensing systems offer high precision and repeatability, making them ideal for applications that require an exact amount of adhesive. These systems can be programmed to dispense a specific volume of adhesive, reducing waste, and improving the quality of the application.

Industry Dynamics

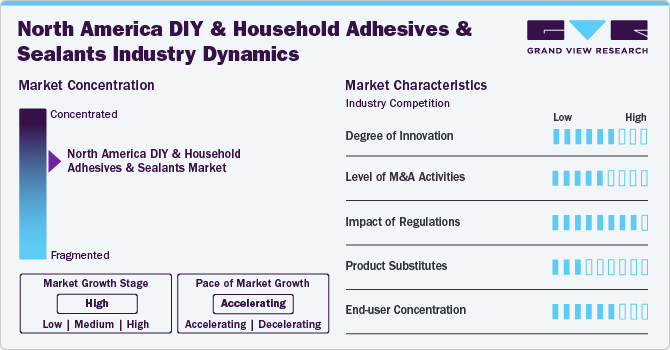

The DIY & Household adhesives & sealant market is moderately consolidated in North America with intense competition among the tier-1 and tier-2 players.

Companies such as Henkel AG & Co. KGaA, RPM International, Inc., PPG Industries, Inc., Gorilla Glue, Inc., and Franklin International accounted for significant shares of the DIY & Household adhesives & sealants market in 2023.

These players are anticipated to continue retaining their positions in the market over the forecast period owing to their established reputation, robust distribution network in retail, home improvement sectors, online channels, extensive resources, and strong brand recognition.

Product Categories Insights & Trends

“Silicone segment is expected to witness growth at 3.9% CAGR”

The silicone segment of the market was valued at USD 458.0 million in 2023 and is projected to reach USD 606.9 million by 2030. Liquid silicones have a very low surface tension, which allows them to easily cover many surfaces, even those with very low surface energy, like Polytetrafluoroethylene (PTFE). It's no surprise that silicone caulk sticks well to almost every surface in a home, from the kitchen to the bathroom. Silicone liquid adhesives are widely used as sealants in many industries. Their ability to bond different materials and withstand high temperatures and chemical exposure makes them suitable for various industrial bonding applications.

Polyurethane adhesives and sealants segment are versatile and suitable for indoor and outdoor projects. They can withstand various chemicals and weather conditions, such as UV radiation, extreme temperatures, rain, snow, and humidity. Polyurethane is an organic material that can be easily adjusted for hardness, adhesion strength, thixotropy, and flexibility to meet different requirements. Compared to silicone, polyurethane can achieve very high mechanical strength and adhesion levels. It is a highly adaptable substance commonly used in numerous DIY and construction projects.

Technology Insights & Trends

“Water-based segment is expected to witness growth at 3.7% CAGR”

Hotmelt adhesives are solid materials that are applied in a molten state. They are one-part, solvent-free thermoplastic adhesives that are solid at room temperature and have low to medium viscosity (ranging from 750 to 10,000 centipoise) at dispensing temperatures (typically greater than 195°C).

Water-based adhesives are very versatile and offer advanced bonding for a wide range of applications across various industries. These adhesives are made using water, polymers, and additives and work well with porous or non-porous surfaces. They can be applied as solutions and are activated as the water evaporates or is absorbed by the substrate. Water-based adhesives come in various chemistries, including natural-based and synthetic-based materials.

Surface Types Insights & Trends

“Metals segment is expected to witness growth at 3.7% CAGR”

Wood adhesives and sealants focus on products adept at bonding with wood, ensuring durability and strength in joinery, furniture repairs, and various woodworking projects. The selections typically include wood glues, epoxies, and polyurethane-based products designed to withstand wood's natural expansion and contraction. These adhesives and sealants provide strong bonds and offer features like water resistance and quick drying times, making them ideal for indoor and outdoor applications.

This metal surface-type adhesive and sealant addresses the specific needs of various metal surfaces in home improvement and repair projects. This acknowledges that different metals have unique characteristics requiring tailored adhesive or sealant formulas for optimal bonding and sealing. For example, products intended for aluminum might differ in composition from those suitable for copper or steel, ensuring that an effective solution is available whether the task involves repairing metal fixtures, bonding metal parts, or sealing gaps. This targeted approach helps consumers select the most appropriate product, maximizing the durability and effectiveness of their DIY and household repairs.

Packaging Types Insights & Trends

“Tubes segment is expected to witness growth at 3.5% CAGR”

Cartridges are a favored packaging choice for multiple-component or single adhesives and sealants. They offer an efficient, cost-effective dispensing method, helping manufacturers reduce waste and providing users with a convenient way to apply products. Cartridges available in the market come in various sizes and can be used with mixing nozzles to ensure the correct mix ratio and thorough blending of two-part formulations. They can be designed for manual or pneumatic dispensing. Nozzles, caps, and plungers are also available to improve the cartridges' dispensing capabilities.

In the case of choosing packaging for adhesives or sealants, it's important to consider the typical application quantity, especially for direct-to-consumer use. For instance, cyanoacrylate adhesives are used in small amounts for typical consumer applications. Adhesives sensitive to atmospheric conditions are well-suited for tube packaging, such as aluminum tubes for moisture-sensitive products. Adhesive and sealant manufacturers must evaluate costs, dispensing specifications, variables in the application environment, typical application quantity, formulating requirements, and ease of disposal/recyclability when deciding on product packaging.

Form Types Insights & Trends

“Liquid segment is expected to witness growth at 3.7% CAGR”

DIY and household adhesives and sealants in paste form are essential for various repair and maintenance tasks around the home. They offer a robust and durable bond for wood, metal, glass, and plastic materials. These pastes are easy to apply, allow for precise application with minimal mess, and can fill gaps for a smoother finish. They are also versatile, making them suitable for indoor and outdoor projects, ensuring repairs last long.

DIY and household adhesives and sealants in liquid form are versatile products designed for a wide range of home repair and improvement projects. They offer a strong and durable bond for various materials, ensuring a reliable seal and adherence for your DIY tasks.

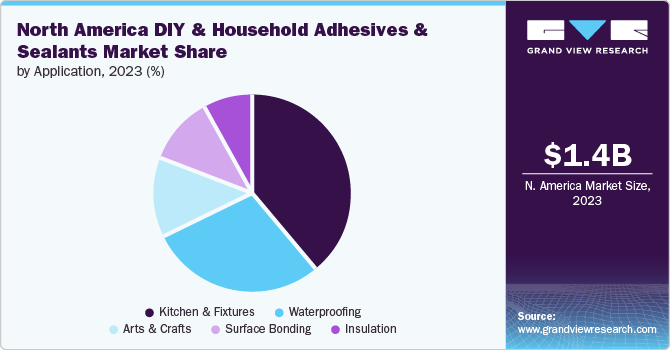

Application Insights & Trends

“Kitchen & Fixtures segment is expected to witness growth at 3.7% CAGR”

Adhesives and sealants for the DIY and household sectors are engineered for seamless integration, allowing users to achieve professional-level results in attaching or sealing countertops, sinks, and cabinetry. Their formulation is specifically designed to resist moisture and temperature variations, ensuring a durable and long-lasting bond in the high-demand environment of kitchens. The array of products available cater to various materials such as stone, metal, and wood, underscoring the versatility and necessity of these adhesives and sealants in creating functional and aesthetically pleasing kitchen spaces.

DIY & household adhesives and sealants are essential tools for waterproofing. Specifically formulated to create strong bonds, these remarkable products can withstand water and humidity, making them ideal for application in bathrooms and kitchens. To prevent water infiltration or safeguarding outdoor wooden structures from environmental elements, adhesives, and sealants stand as reliable allies in maintaining the durability and aesthetics of various materials.

Country Insights & Trends

“The U.S. to witness market growth of CAGR 3.5%”

The U.S. is expected to dominate the market during the forecast period. This growth is due to surge in home renovation and increase use of adhesives and sealants in the renovations.

North America DIY & Household Adhesives And Sealants Market Trends

North America market is expected to grow over the forecast period. This growth is attributed to homeowners becoming more aware of the importance of regular maintenance to preserve the value and safety of their homes. This awareness leads to higher consumption of maintenance products, including sealants and adhesives.

Key North America DIY & Household Adhesives And Sealants Company Insights

Some of the key players operating in the market include Henkel AG & Co. KGaA, RPM International Inc., DuPont, and 3M, Ltd. among others.

-

Henke AG & Co. KGaA is a multinational company that operates in various industries including adhesives, sealants, surface treatments, and other industrial chemicals. The company is known for its well-known brands such as Loctite, Bonderite, Teroson, Technomelt, Aquence, and Schwarzkopf. The company holds leading positions in both industrial and consumer businesses, offering a diverse portfolio that includes hair care products, laundry detergents, fabric softeners, adhesives, sealants and functional coatings.

-

DuPont is a specialty solutions company with a global business that is aligned with growing and attractive end markets such as the construction, automotive, and electrical industries. The company's main business segments are Electronics & Industrial, Mobility & Materials, and Water & Protection. It manufactures various specialty chemicals, synthetic fibers, and high-performance materials. Its manufacturing, processing, marketing, and purchasing offices and the company's R&D facilities and distribution centers are located worldwide. DuPont's manufacturing and other sites are in Asia Pacific, North America, Central & South America, Europe, and the Middle East & Africa.

DOW, Electric Products, LLC., and Bossil, among others, are some of the emerging market participants in the North America DIY & household adhesives and sealants market.

-

Dow, Inc. specializes in material science. The company’s product portfolio includes plastics, performance materials, coatings, silicones, and industrial intermediates. It offers a wide range of products and solutions in packaging, infrastructure, mobility, and consumer care segments. Dow’s products are used in various sectors such as homes and personal care, durable goods, adhesives and sealants, coatings and food & specialty packaging.

-

Electric Products LLC, is a company that specializes in providing customized solutions for the woodworking and craft industries. Electric products are known for its line of wood fillers and adhesives, catering to the need of DIY, crafters, woodworkers, and professionals.

Key North America DIY & Household Adhesives And Sealants Companies:

- Henkel AG & Co. KGaA.

- RPM International Inc.

- Gorilla Glue, Inc.

- 3M

- PPG Industries

- DuPont

- Sika AG

- Franklin International

- Dow

- American Sealants Inc.

- General Electric

- Electric Products, LLC

- MightyLoc

- Bossil

- Elmer’s

- Flex Seal

- Aleene’s

- J-B Weld

Recent Developments

-

In May 2024, Bostik announced a price increase for its pressure sensitive adhesives (PSA) products in North America. This decision will impact on the prices of Bostik’s Pressure Sensitive Adhesives (PSA) products in North America. Bostik’s PSA products are used in various industries, including industrial, construction, and consumer markets.

-

In April 2023, DAP Global Inc. launched three new concrete products to simplify concrete repairs and projects. These products are designed to ensure reliability and offer ease of use for both professionals and DIY enthusiasts.

North America DIY & Household Adhesives And Sealants Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 1.45 billion

Revenue forecast in 2030

USD 1.78 billion

Growth Rate

CAGR of 3.5% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product Categories, technology, surface types, packaging types, form types, application, and region

Regional scope

North America

Country scope

U.S., Canada.

Key companies profiled

Henkel AG & Co. KGaA.; RPM International Inc.; Gorilla Glue, Inc.; 3M; PPG Industries; DuPont; Sika AG; Franklin International; Dow; American Sealants Inc.; General Electric; Electric Products, LLC; MightyLoc; Bossil; Elmer’s; Flex Seal; Aleene’s; and J-B Weld

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America DIY & Household Adhesives And Sealants Market Report Segmentation

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America DIY & household adhesives and sealants market report based on product categories, technology, surface types, packaging types, form types, application, and country:

-

Product Categories Outlook (Revenue, USD Million, 2018 - 2030)

-

Epoxy

-

Polyurethane

-

Silicone

-

Acrylic

-

Polyvinyl Acetate

-

Latex

-

Others

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Water-based

-

Solvent-based

-

Hotmelt

-

Reactive

-

-

Surface Types Outlook (Revenue, USD Million, 2018 - 2030)

-

Metals

-

Woods

-

Concrete

-

Natural Stone

-

Others

-

-

Packaging Types Outlook (Revenue, USD Million, 2018 - 2030)

-

Tubes

-

Bottles

-

Cans

-

Cartridges

-

Others

-

-

Form Types Outlook (Revenue, USD Million, 2018 - 2030)

-

Liquid

-

Paste

-

Tapes

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Insulation

-

Kitchen & Fixtures

-

Waterproofing

-

Surface Bonding

-

Arts & Crafts

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America DIY & household adhesives and sealants market size was estimated at USD 1.38 billion in 2023 and is expected to reach USD 1.45 billion in 2024

b. The North America DIY & household adhesives and sealants market is expected to grow at a compound annual growth rate of 3.5% from 2024 to 2030 to reach USD 1.78 billion in 2030

b. The Kitchen and Fixtures segment dominated the North America DIY & household adhesives and sealants market with a share of 39.6% in 2023. This is attributable to array of products available cater to various materials such as stone, metal, and wood, underscoring the versatility and necessity of these adhesives and sealants in creating functional and aesthetically pleasing kitchen spaces

b. Some key players operating in the North America DIY & household adhesives and sealants market include Henkel AG & Co., KGaA; 3M; DuPont; DOW; Gorilla Glue, Inc.; General Electric; and American Sealants Inc.

b. Key factors that are driving the market growth include, the surge in home renovation activities in the north america has significantly boosted the demand for adhesives and sealants, which are essential for ensuring the durability and functionality of renovation projects.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."