- Home

- »

- Medical Devices

- »

-

North America Disposable Endoscopes Market, Report, 2030GVR Report cover

![North America Disposable Endoscopes Market Size, Share & Trends Report]()

North America Disposable Endoscopes Market (2025 - 2030) Size, Share & Trends Analysis Report By Type (Laparoscopes, Arthroscopes, Ureteroscopes, Cystoscopes, Gynecology Endoscopes), By End-use, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-919-5

- Number of Report Pages: 150

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

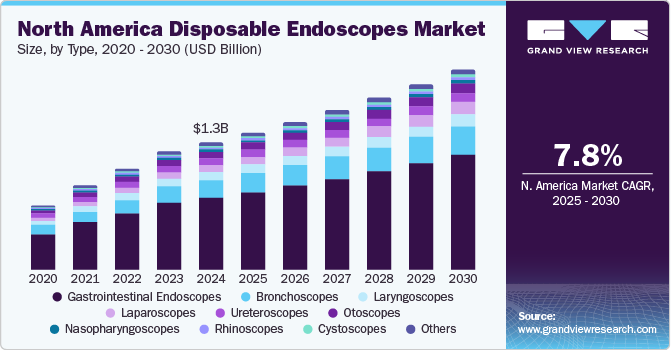

The North America disposable endoscopes market size was estimated at USD 1.28 billion in 2024 and is expected to grow at a CAGR of 7.85% from 2025 to 2030. The rise in the prevalence of gastrointestinal disorders and various cancer cases is boosting the adoption & market growth of disposable endoscopes. For instance, according to the American Cancer Society, colorectal cancer is the second leading cause of cancer-related deaths in the U.S., with an estimated number of 153,020 individuals diagnosed with colorectal cancer in 2023. Furthermore, growing respiratory and chronic disorders fuel the market growth.

The increasing prevalence of cancer and cancer-related mortality in this region is one of the factors anticipated to propel the market. For instance, according to the Cancer Progress Report 2023 published by the American Cancer Society, in 2023, around 1,958,310 new cancer cases were diagnosed in the U.S. Projections indicate that by 2040, the number of new cancer cases is expected to reach 2.3 million. As the prevalence of cancer increases, there is a rising need for effective diagnostic and treatment procedures. Disposable endoscopes play a crucial role in offering minimally invasive options to accurately diagnose, stage, and treat various forms of cancer.

Furthermore, to eliminate the risk of pathogen contamination from the reusable endoscopes, the clinical staff undergo lengthy sterilization steps, which are tedious and become more time-consuming. For instance, according to Boston Scientific Corporation, more than 100 series of manual steps are required to clean endoscopes during ERCP procedures to reuse, which is susceptible to manual errors. In addition, the increasing recommendation by the regulatory authorities, such as the U.S. FDA, for developing disposable endoscopic devices and components to improve cleaning and reduce the risk of patient infection is supporting market growth.

In addition, factors such as favorable reimbursement policies and commercialization of new products are anticipated to fuel market growth. For instance, in July 2022, Zsquare, a manufacturer of single-use endoscopes, received a U.S. FDA 510K clearance for its Zsquare ENT-Flex Rhinolaryngoscop to use in diagnostic ENT procedures. The improved design offers physicians with high-resolution imaging with a cost-effective option for single-use endoscopy, featuring the smallest diameter endoscope shaft.

Furthermore, the demand for disposable endoscopes is growing due to the rising concerns regarding cross-contamination risks associated with reusable endoscopes. This growing focus on patient safety has increased innovation and regulatory actions aimed at enhancing the availability & quality of disposable endoscopes. For instance, in August 2021, Boston Scientific’s EXALT Model B Bronchoscope received 510(k) clearance from the FDA. This single-use bronchoscope is designed for bedside procedures in Intensive Care Units (ICUs) and Operating Rooms (ORs), addressing the need for safer alternatives to reusable devices.

The advantages of using disposable endoscopes, such as the lower chance of cross-contamination, cost-effectiveness, and minimum resource utilization, are anticipated to accelerate market growth. Increasing technological advancements and growing manufacturer investments to innovate and develop new single-use endoscopic devices are significant factors supporting the market's growth during the forecast period.

Market Concentration & Characteristics

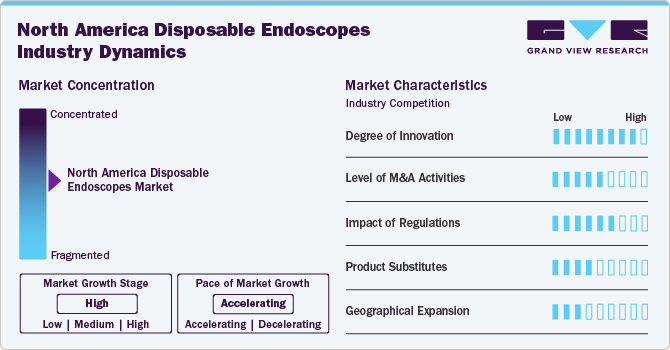

The North America disposable endoscopes market is characterized by a high degree of innovation, owing to rising research activities, approvals from governments and regulatory bodies, and increasing investments to improve healthcare infrastructure and advance research in the endoscopes field.

The endoscopes market is characterized by medium merger and acquisition activity. Market players are adopting this strategy to expand their distribution network and product portfolio. For instance, in November 2022, Boston Scientific Corporation acquired Apollo Endosurgery, Inc. for USD 10 per share, valuing the enterprise at USD 615 million. Through this acquisition, the company would fully control the endoluminal surgery product portfolio, further enhancing its resources in the endoscopy business division.

Companies actively invest substantial resources in regulatory submissions to receive regulatory approval for pipeline products. Moreover, the Medical Devices Bureau of the Therapeutic Products Directorate (TPD) regulates medical devices, including endoscopes, in Canada. In addition, the Public Health Agency of Canada (PHAC) creates national guidelines for preventing and controlling infections. These guidelines are based on evidence and are meant to support the efforts of provincial & territorial governments in monitoring, preventing, and controlling healthcare-associated infections.

Various product substitutes are available in the market for disposable endoscopes, such as reusable endoscopes and capsule endoscopes. Capsule endoscopes are small and swallowable devices equipped with a camera that captures images as they pass through the gastrointestinal tract. Moreover, reusable endoscopes are developed for multiple uses after proper sterilization.

Several market players are expanding their business by entering new geographical regions to strengthen their market position. For instance, in February 2022, Medtronic, an Ireland-based company, collaborated with the American Society for Gastrointestinal Endoscopy (ASGE) to offer AI-powered colonoscopy technology for colorectal cancer screening in underserved communities of the U.S.

Type Insights

The gastrointestinal endoscopes segment dominated the market with revenue share of 56.6% in 2024. The U.S. dominated the disposable endoscopes market in North America in 2024. Factors such as the shift towards minimally invasive surgeries, technological advancements, a growing prevalence of gastrointestinal disorders, and healthcare settings and government encouraging individuals to perform routine screenings for cancer increase the demand for diagnostic procedures. For instance, according to the American Cancer Society estimates , approximately 26,890 new cases and 10,880 deaths from stomach cancer in the U.S. in 2024.

The laparoscopes segment is expected to witness fastest CAGR growth during the forecast period. The U.S. FDA recently approved various disposable bronchoscopes, which are anticipated to increase the availability of these devices in the market and drive segment growth. For instance, in 2023, Xenocor, a medical device company, received U.S. FDA clearance for its Saberscope, an articulating, fog-free, single-use laparoscope.

End-use Insights

The outpatient facilities’ segment dominated the market in 2024 and accounted for the largest revenue share of 53.3%. Favorable government initiatives and reimbursement policies boost the segment growth. For instance, In the U.S., as per the 2022 GI Endoscopy Coding and Reimbursement Guide, outpatient hospitals receive the highest reimbursement of USD 3,135.9 for diagnostic therapy, according to CPT code 43260. This reimbursement is the National Medicare Average. In addition, the reimbursement for facilities at the ambulatory surgery center is USD 1,400.9. The increase in reimbursement from 2019 to 2022 signifies better reimbursement frameworks for GI endoscopy, along with an increasing number of patients opting for the same

The hospitals segment is anticipated to register a significant growth over the forecast period. Factors such as the rise in patients suffering from various chronic diseases and the consequent increase in surgical procedures fuel the segment growth. Compared to other healthcare settings, hospitals witness a significantly higher inflow of patients for bariatric surgeries or other endoscopic procedures, owing to the ease of handling any emergencies that may arise during surgical procedures and the availability of a wide range of treatment options in such facilities. For instance, according to an article published by Becker’s Hospital Review, over 3,000 hospitals utilize disposable bronchoscopes provided by Ambu A/S.

Country Insights

North America Disposable Endoscopes Market Trends

The market is fueled by rapid technological advancements, leading to the development of new and innovative endoscopic devices in this region. These technological breakthroughs have improved the adoption of endoscopes. For instance, in October 2022, OMNIVISION, a manufacturer of semiconductor solutions, collaborated with AdaptivEndo, a technology disruptor in single-use endoscopes, to develop a flexible and unified platform. This new platform is designed to apply single-use and hybrid endoscopes across various medical specialties, such as urology, gastroenterology, gynecology, and sophisticated endoscopic surgery.

U.S. Disposable Endoscopes Market Trends

The U.S. dominated the disposable endoscopes market in North America in 2024. The high prevalence of several diseases, such as gastrointestinal (GI) disorders, respiratory conditions, urological problems, gynecological issues, and cancer, is increasing the need for endoscopic procedures for diagnosis & treatment in North America. For instance, according to a report by ResearchGate, it is projected that there will be 2,001,140 new cases of cancer and 611,720 cancer-related deaths in the U.S. in 2024. Thus, the growing need for accurate and minimally invasive diagnostic tools drives market growth.

Key North America Disposable Endoscopes Company Insights

Key participants in the North America disposable endoscopes market are focusing on developing innovative business growth strategies in the form of product portfolio expansions, mergers & acquisitions, partnerships & collaborations, and geographical expansions.

Key North America Disposable Endoscopes Companies:

- Olympus Corporation

- Boston Scientific Corporation

- PENTAX Medical (Hoya Corporation)

- FUJIFILM Holdings Corporation

- Karl Storz GmbH & Co., KG

- Stryker

- Medtronic

- Ambu A/S

- STERIS plc.

Recent Developments

-

In April 2024, Ambu A/S received U.S. FDA approval for its aScope Gastro Large, a single-use therapeutic gastroscope. It enables healthcare practitioners to manage a broader range of clinical needs across operating rooms (ORs), intensive care units (ICUs), and endoscopy suites.

-

In April 2023, Verathon, a medical device company , launched the BFlex2, a single-use bronchoscope series. It offers four distinct scope sizes and incorporates novel features to improve clinicians' capabilities in managing the diverse needs of pediatric and adult patients.

North America Disposable Endoscopes Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.38 billion

Revenue forecast in 2030

USD 2.01 billion

Growth rate

CAGR of 7.85% from 2025 to 2030

Actual data

2018 - 2024

Forecast data

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, end-use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Olympus Corporation; Boston Scientific Corporation; PENTAX Medical (Hoya Corporation); FUJIFILM Holdings Corporation; Karl Storz GmbH & Co., KG; Stryker; Medtronic; Ambu A/S; STERIS plc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Disposable Endoscopes Market Report Segmentation

This report forecasts revenue and volume growth at regional, and country level and provides an analysis on industry trends in each of the sub segments from 2018 to 2030. For the purpose of this study, Grand View Research, Inc. has segmented the North America disposable endoscopes market report based on type, end-use, and country:

-

Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Laparoscopes

-

Arthroscopes

-

Ureteroscopes

-

Cystoscopes

-

Gynecology Endoscopes

-

Neuroendoscopes

-

Bronchoscopes

-

Hysteroscopes

-

Laryngoscopes

-

Otoscopes

-

Nasopharyngoscopes

-

Rhinoscopes

-

Gastrointestinal Endoscopes

-

Gastroscope (Upper GI Endoscope)

-

Enteroscope

-

Sigmoidoscope

-

Duodenoscope

-

Colonoscope

-

-

-

End-use Outlook (Revenue, USD Million, 2018 - 2030)

-

Hospitals

-

Outpatient facilities

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America disposable endoscopes market size was valued at USD 1.28 billion in 2024 and is expected to reach USD 1.38 billion in 2025.

b. The North America disposable endoscopes market is expected to grow at a compound annual growth rate of 7.85% from 2025 to 2030 to reach USD 2.01 billion by 2030.

b. Outpatient facilities dominated the North America disposable endoscopes market with a share of 53.3% in 2024. This is attributable to growing adoption of these facilities for various diagnostic and therapeutic procedures.

b. Some key players operating in the North America disposable endoscopes market include Boston Scientific Corporation, Inc.; Flexicare Medical Ltd; Ambu A/S; Hill Rom Holdings.; and OBP Medical.

b. The gastrointestinal endoscopy application segment dominated the North America disposable endoscopes market and held the largest revenue share of 56.6% in 2024.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.