- Home

- »

- Healthcare IT

- »

-

North America Digital Pathology Market, Industry Report, 2030GVR Report cover

![North America Digital Pathology Market Size, Share & Trends Report]()

North America Digital Pathology Market (2025 - 2030) Size, Share & Trends Analysis Report By Application (Academic Research, Disease Diagnosis), By Product (Software, Device), By Type, By End Use (Diagnostic Labs, Hospitals), By Country, And Segment Forecasts

- Report ID: GVR-4-68039-288-0

- Number of Report Pages: 160

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Healthcare

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

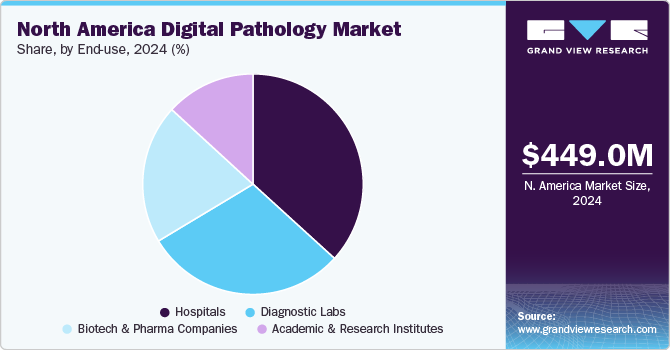

The North America digital pathology market size was valued at USD 449.0 million in 2024 and is expected to grow at a CAGR of 7.8% from 2025 to 2030. The growth is due to the rising adoption of AI-driven diagnostics, increasing cancer prevalence, growing telepathology demand, technological advancements in scanning and cloud storage, regulatory support, integration with laboratory information systems, and the need for faster, cost-effective diagnostic solutions.

As a consequence of the high prevalence of cancer, pathologists require pathology data that can facilitate customizing of therapies for patients. As cited in GE healthcare publications, digital pathology allows a pathologist to study approximately 150 slides in a day and, therefore, increases the overall laboratory efficiency by 13.0%. Thereby, digital pathology is increasingly being preferred by pathologists, as it accelerates the rate of diagnosis, increases diagnostic accuracy, and provides therapeutic recommendations to improve patient outcomes. For instance, as per a study published in the National Library of Medicine in 2022, deep learning-based solutions have provided impressive results in the digital pathology of breast cancer. Such instances signify the growth potential of the market.

Moreover, rising U.S. Food and Drug Administration FDA approvals significantly for digital pathology systems primarily for cancer detection drive the market growth. For instance, in January 2025, Roche received another 510(k) clearance from the FDA for its whole slide imaging system (Roche Digital Pathology Dx).

"The VENTANA DP 600 high-capacity slide scanner creates high-resolution, digital images of stained tissue samples that help clinicians diagnose cancer and determine a patient's treatment," said Jill German, Head of Pathology Lab for Roche Diagnostics. "The recent FDA clearances continue our momentum to advance the pathology lab's digital transformation and reinforce our commitment to enhance patient care and healthcare efficiency through streamlining the digital workflow."

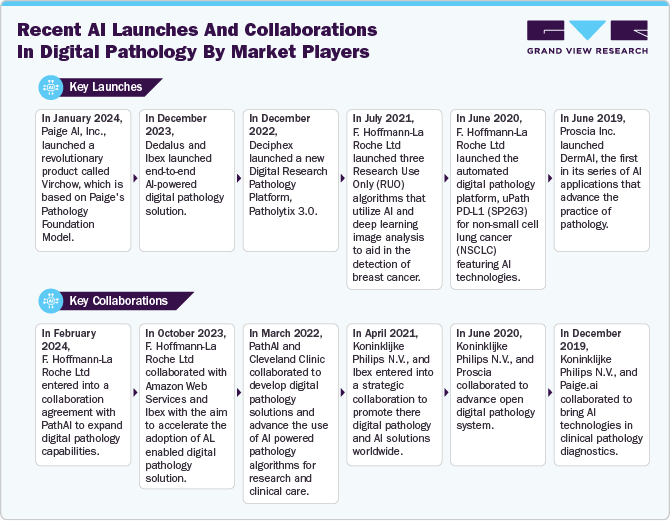

Furthermore, increasing technological advancement in digital pathology is further fueling the market growth. The use of AI in digital pathology has gained momentum in the past years. The growing need for lowering healthcare costs, increasing importance of big data in healthcare, rising adoption of precision medicine, and declining hardware costs are some factors expected to drive the market. In addition, the increasing applicability of AI-based tools in medical care and the rise in venture capital investments is fueling the demand for this technology.

Market Concentration & Characteristics

North America digital pathology market is currently experiencing significant growth, at an accelerating pace. The growth is driven by factors such as the rising prevalence of chronic diseases and rapid technological advancements.

The degree of innovation is high. The advancements in AI, machine learning, and cloud-based solutions are fueling market growth. Key developments focus on automated image analysis, diagnostic accuracy, and data integration, enabling improved workflow efficiencies and precision in pathology practices, as demand for digital transformation in healthcare continues to grow. For instance, in August 2023, PathAI launched the AISight Digital Pathology Image Management System for the next generation of pathology labs. AISight, a cloud-based platform, streamlines digital pathology workflows, providing advanced image and case management, viewing, ingestion, and seamless integration of AI applications.

Mergers and acquisitions within the North America digital pathology industry are increasing. Companies are strategically utilizing multiple acquisitions to strengthen their product offerings, extend their reach, diversify portfolios, integrate technologies, and bolster their positions within the industry. For instance, in February 2023, Fujifilm acquired the North America digital pathology business of Inspirata, including its Dynamyx digital pathology system.

“Acquiring Inspirata’s digital pathology business allows Fujifilm to be an even stronger healthcare partner-bridging a technological gap between pathology, radiology, and oncology to facilitate a more collaborative approach to care delivery across the enterprise,”

- Fujifilm CEO and president Teiichi Goto

North America digital pathology market is regulated by different committees. For instance, for new players in the market. a regulatory committee has been set up by the Digital Pathology Association with the aim of establishing a sense of urgency within regulatory agencies and bringing clarity to the process of clearance & approval of digital pathology.

Geographical expansion in the market is marked by increasing adoption across the U.S. and Canada, with growing investments in rural and underserved areas. This trend is driven by the need for enhanced diagnostic access, alongside the expansion of telepathology services, as healthcare systems prioritize digital solutions across diverse regions. For instance, in November 2024, OptraSCAN, a digital pathology solutions provider, closed a USD 30 million Series B funding round, led by Molbio Diagnostics. This investment is expected to support OptraSCAN’s ongoing advancements in digital pathology and facilitate the global expansion of its AI-driven diagnostic solutions, aiming to enhance accessibility and affordability for healthcare providers.

Product Insights

The device segment held the largest share of 52.07% in 2024. The device segment includes a slide management system and scanner. The segment growth is attributed to the increasing adoption of digital pathology in academic research activities with enhanced resolution. For instance, in March 2023, OptraSCAN launched the OnDemand Digital Pathology solution to address the increasing demand for digital transformation in pathology laboratories across North America. This subscription-based service provides access to OptraSCAN's whole slide digital scanners (Brightfield/Fluorescence), capable of loading 15-480 slides with scanning speeds of approximately 58 seconds at 40x magnification.

The software segment is expected to register fastest growth rate from 2025 to 2030. This growth is attributed to the increasing government support in the form of approvals and key players focusing on the development of novel digital pathology systems in the industry. In October 2024, INFINITT North America received a Medical Device License from Health Canada for its INFINITT Digital Pathology Solution (IDPS). The IDPS is a web-based application that allows pathologists to view, interpret, and share digital pathology images remotely.

Type Insights

The human pathology segment held the largest share in 2024. The adoption of digital pathology to reduce turnaround time for disease diagnosis and enhance lab productivity is fueling segment growth. In addition, increasing approvals from the regulatory bodies is also encouraging market players to develop technologically advanced solutions. For instance, in June 2024, Roche received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its whole-slide imaging system, the Roche Digital Pathology Dx VENTANA DP 200. This system is designed to assist pathologists in reviewing and interpreting digital images of scanned pathology slides to support diagnostic processes.

Veterinary digital pathology is anticipated to experience substantial growth over the forecast period. The implementation of digital pathology in the veterinary sector is facilitated by fewer restrictions on veterinary diagnoses using virtual scanned slides. Furthermore, the proactive push for automation is driving the demand for the use of digital pathology in the veterinary field. For instance, in April 2024, a U.S.-based global leader in veterinary health and diagnostic devices selected Aiforia Technologies Plc as its partner for AI-assisted image analysis of animal samples. The contract is valued at approximately USD 200,000.

Application Insights

The academic research segment dominated the market in 2024. The growth is attributed to the increasing research activities focused on the development of cancer therapies and the high adoption of digital pathology in various research studies. A number of academic research institutes are collaborating with digital pathology providers to incorporate the technology into research activities. In November 2022, the University Medical Center Utrecht entered into a partnership with Paige for the deployment of the company’s application in clinical use and to conduct a clinical health economics study to support reimbursement and adoption of AI applications in pathology.

Disease diagnosis is anticipated to witness the fastest growth rate from 2025 to 2030 owing to the increasing focus of manufacturers on the development of rapid and novel diagnostics techniques for ease in the circulation of inter and intra-departmental information. Therefore, increasing participating in funding rounds aimed at advacneing their research in disease diagnosis. For instance, in August 2024, Cancer diagnostics startup PreciseDx secured USD 20.7 million in Series B funding to advance the commercialization of its AI-based breast cancer risk assessment technology.

End Use Insights

The hospitals segment dominated the market with the largest revenue share in 2024. Hospitals are the primary healthcare setting for disease diagnosis and care. Advances in hospital laboratories are essential to meet patients' evolving needs, with many hospitals expanding services to offer comprehensive in-house care. The increasing awareness regarding the benefits associated with digital pathology among hospitals is enhancing the adoption of digital scanning techniques to enhance patient compliance and expedite diagnosis. For instance, in March 2023, Ibex (Ibex Medical Analytics) received a PathLAKE contract to provide AI-enabled solutions at 25 NHS to support cancer diagnosis.

The diagnostic labs segment is expected to grow at the fastest growth rate from 2025 to 2030, owing to increasing focus on preclinical GLP pathology, oncology clinical trials, and drug development. Moreover, the increasing prevalence of cancer and the adoption of digital pathology in diagnostics labs is fueling the market growth. For instance, in March 2023, PathAI announced the early adoption of its digital pathology platform and algorithms by prominent anatomic pathology laboratories across the United States.

Country Insights

U.S. Digital Pathology Market Trends

The digital pathology market in the U.S. dominated the regional market with the largest share in 2024. The presence of well-established healthcare infrastructure & high per capita healthcare expenditure in the U.S. is a major factor contributing to the high adoption rate of advanced digital pathology systems. Growing approval of AI-powered tools designed by AI-based, digital pathology-focused companies to identify invasive breast cancer and skin lesions is another factor boosting the market growth in the country.

For instance, in February 2024, Proscia, a software company headquartered in Philadelphia, obtained FDA 510(k) clearance for its Concentriq AP-Dx pathology system. This diagnostic software offers a more immersive environment for clinicians compared to other pathology systems. This clearance is anticipated to boost the adoption of digital pathology solutions significantly.

Canada Digital Pathology Market Trends

The digital pathology market in Canada is anticipated to grow at a significant rate over the forecast period. Key factors such as a relatively smaller patient population & few pathologists, rising awareness resulting in shifting the preference toward digital image transmission, and advanced healthcare infrastructure are expected to facilitate the early adoption of digital pathology in Canada. Moreover, in November 2023, Dr. Gillian Muir, Dean of the Western College of Veterinary Medicine (WCVM), supported by the Canadian Veterinary Medical Association, submitted a briefing note to the federal government, seeking funding for a National Testing Centre to assist internationally trained veterinarians at the WCVM. Such initiatives are anticipated to fuel the demand for veterinary digital pathology solutions over the forecast period.

Key North America Digital Pathology Company Insights

The market is experiencing notable growth owing to the market players engaging in strategies like new software launches, partnerships, geographical expansions, and mergers & acquisitions to increase their market share.

Key North America Digital Pathology Companies:

- Leica Biosystems Nussloch GmbH (Danaher)

- Hamamatsu Photonics, Inc

- Koninklijke Philips N.V.

- Olympus Corporation

- F. Hoffmann-La Roche Ltd

- Mikroscan Technologies, Inc

- Inspirata, Inc.

- Epredia (3DHISTECH Ltd.)

- Huron Technologies International Inc.

- CellaVision

- Morphle Labs, Inc

- Bionovation Biotech, Inc

Recent Developments

-

For instance, in January 2025, Diagnexia launched its enterprise-grade digital pathology platform, designed to seamlessly connect U.S. laboratories with a vast network of board-certified sub-specialty pathologists.

"US laboratories are facing challenges with rising locum costs and growing coverage gaps. Our platform eliminates these constraints, delivering immediate access to qualified pathologists at a fraction of traditional costs."

- Donal O'Shea, CEO of Diagnexia.

-

In July 2024, AGFA HealthCare launched its Enterprise Imaging for Pathology solution in North America, powered by Corista DP3. This solution is designed to support pathologists with an interface tailored to their workflow needs.

“Corista’s DP3 image management system and the AGFA HealthCare Enterprise Imaging Platform are accelerating the digital transformation in Pathology to unlock better access to care, improve care collaboration and optimize efficiency. This integrated solution is designed to meet the growing demand for Pathology services under the constrained availability of Pathologists who play an essential role in patient care, diagnoses, and research. Furthermore, the ability to layer AI over whole slide imaging is opening new dimensions in research, innovation and better delivery of care for all.”

-Mark Burgess, President, AGFA HealthCare, North America. -

In May 2024, Aiforia Technologies Plc announced that it has made its AI-powered pathology image analysis software solutions available on the Google Cloud Marketplace.

“By opening a new sales and marketing channel for our AI-powered image analysis solutions, we are aiming to expedite the promotion of our offering. Through Marketplace we envision having better access to Google Cloud’s enterprise healthcare customers globally.”

-Jukka Tapaninen, CEO of Aiforia. -

In May 2024, Paige specializes in comprehensive digital pathology solutions and AI applications, launched a new service line based on its Foundation Models, which include the largest multi-modal AI model in pathology and oncology.

North America Digital Pathology Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 477.3 million

Revenue forecast in 2030

USD 693.9 million

Growth rate

CAGR of 7.8% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR in % from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, type, end-use, country

Country scope

U.S.; Canada; Mexico

Key companies profiled

Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc; Koninklijke Philips N.V.; Olympus Corporation; F. Hoffmann-La Roche Ltd; Mikroscan Technologies, Inc; Inspirata, Inc.; Epredia (3DHISTECH Ltd.); Huron Technologies International Inc.; CellaVision; Morphle Labs, Inc; Bionovation Biotech, Inc.

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Digital Pathology Market Report Segmentation

This report forecasts revenue growth at the regional level and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America digital pathology market report based on product, application, type, end-use, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Software

-

Device

-

Scanners

-

Slide Management System

-

-

Storage System

-

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Human Pathology

-

Veterinary Pathology

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Drug Discovery & Development

-

Academic Research

-

Disease Diagnosis

-

Cancer Cell Detection

-

Others

-

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hospitals

-

Biotech & Pharma Companies

-

Diagnostic Labs

-

Academic & Research Institutes

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America digital pathology market size was estimated at USD 449.0 million in 2024 and is expected to reach USD 477.3 million in 2025

b. The North America digital pathology market is expected to grow at a compound annual growth rate of 7.8% from 2025 to 2030 to reach USD 693.9 million by 2030.

b. The device segment held the largest share of 52.07% in 2024. This growth is attributed to increasing adoption of digital pathology in academic research activities with enhanced resolution.

b. Some key players operating in the North America digital pathology market include Leica Biosystems Nussloch GmbH (Danaher); Hamamatsu Photonics, Inc; Koninklijke Philips N.V.; Olympus Corporation; F. Hoffmann-La Roche Ltd; Mikroscan Technologies, Inc; Inspirata, Inc.; Epredia (3DHISTECH Ltd.); Huron Technologies International Inc.; CellaVision; Morphle Labs, Inc; Bionovation Biotech, Inc.

b. Key factors driving the market include continual R&D investments, rising implementation of digital imaging, supportive government initiatives, and the presence of prominent players domiciled in this region are major drivers promoting the dominance of this regional market.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.