- Home

- »

- Next Generation Technologies

- »

-

North America Digital Avatar Market, Industry Report 2030GVR Report cover

![North America Digital Avatar Market Size, Share & Trends Report]()

North America Digital Avatar Market Size, Share & Trends Analysis Report By Product (Interactive Digital Avatar, Non-Interactive Digital Avatar), By Category, By Industry Vertical, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-285-7

- Number of Report Pages: 80

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

North America digital Avatar Market Trends

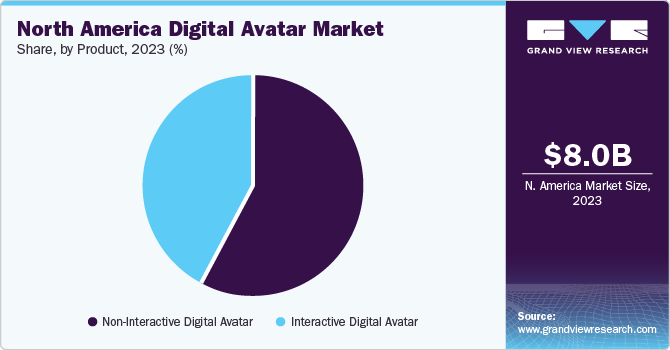

The North America digital avatar market size was valued at USD 8.01 billion in 2023 and is expected to grow at a CAGR of 46.2% from 2024 to 2030. The market demand is rapidly evolving within the broader landscape of digital and virtual reality (VR) technologies. It encompasses creating, selling, and using digital representations of individuals or characters, which can be used in various applications, from social media and online gaming to VR experiences and beyond. Digital avatars have now become integral to digital identities and interactions. Advancements in technology are expected to significantly contribute to market expansion, with augmented reality (AR) integration providing immersive avatar experiences.

The utilization of AI and AR in avatars progressively extends to customer interactions in retail and sales settings, enhancing the overall customer experience. A growing demand for highly personalized avatars that mimic a user’s physical appearance, expressions, and voice supports market growth. This personalization is critical in social media applications, where users seek a digital representation resembling their real persona. For instance, in December 2023, Snap Inc. partnered with e.l.f Cosmetics, Inc. and launched a Bitmoji make-up drop that lets users update their characters with the latest lipstick shades to give Bitmoji a fresh look.

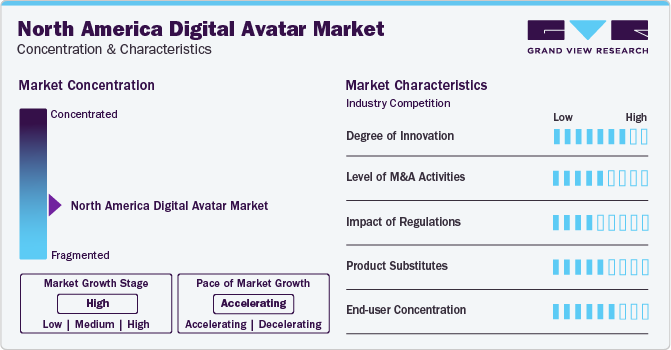

Market Concentration & Characteristics

The North America digital avatar industry is consolidated. However, the growth stage is high and market growth is accelerating. The degree of innovation is high due to rapid technological advancements and changing user demands. The innovations transform avatars' creation, personalization, and utilization across various platforms and industries. For instance, in January 2024, Ready Player Me, Inc. developed a solution to generate unique textures for digital avatar outfits.

The level of merger and acquisition (M&A) activities is significantly high as companies make strategic moves to enhance their product & service offerings and technological capabilities and gain a competitive advantage in the market. For instance, Didimo Inc. partnered with Avalon Games Studio S.L. to enhance the gaming world with unique characters in no time and at less cost.

The end-user concentration is high as the market is diverse and encompasses many users from different demographic segments and interests. The industry caters to segments, such as healthcare, gaming & entertainment, automotive, IT & telecom, BFSI, and others.

Product Insights

Based on the product, the market is bifurcated into interactive and non-interactive digital avatars. The non-interactive digital avatar segment accounted for the largest revenue share of 57.8% in 2023. Digital avatars are utilized across sectors, such as movies, video games, and virtual reality (VR). Businesses use non-interactive avatars as website welcoming hosts to present products/services and introduce the company. Nevertheless, the lack of effectiveness in reassuring customers and the restricted capabilities may impede the segment's expansion in the future.

The interactive digital avatar segment is anticipated to register the fastest CAGR over the forecast period. The ability to deliver a lifelike and authentic experience is expected to offer lucrative growth opportunities in the market. Advancements in AI and machine learning (ML) algorithms that enable avatars to understand and respond to user queries, mimic human emotions, and learn from interactions fuel the market demand.

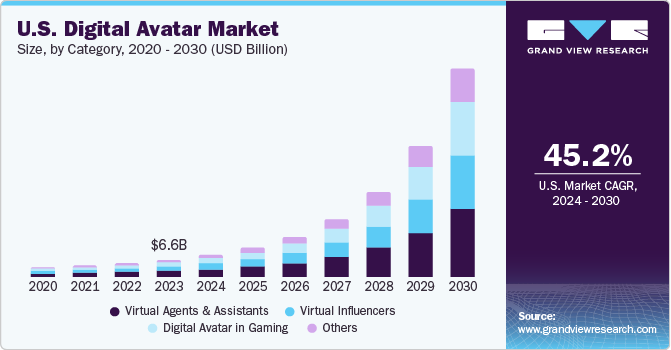

Category Insights

The virtual agents & assistants segment accounted for the largest share in 2023. Virtual agents, powered by AI, are conversational software tools that enable businesses to engage with customers efficiently by leveraging AI, thereby reducing response times. Firms integrate virtual agents into their websites to offer round-the-clock support, enhancing customer contentment. These agents proficiently manage various customer inquiries, improving responsiveness and cutting operational expenses.

The digital avatar in the gaming segment is anticipated to register the fastest CAGR over the forecast period. Using digital avatars in gaming allows for a more immersive and personalized experience where players can project their identity and experiment with new digital avatars, engaging more deeply with the gaming world and other players.

Industry Vertical Insights

The gaming & entertainment segment accounted for the largest revenue share in 2023. Digital avatars play a crucial role in gaming and entertainment, allowing players to represent distinct virtual personas and enriching their engagement and social connections in multiplayer games, virtual environments, and online activities. Gaming enterprises, such as Epic Games Inc., Meta, Microsoft, NVIDIA Corp., and Tencent, have incorporated digital avatars to enhance the user experience.

The healthcare segment is anticipated to register the fastest CAGR over the forecast period. Digital avatars in healthcare can take various forms, from the virtual representations of patients in telemedicine to sophisticated simulations for medical training and personalized health assistants. For instance, in June 2023, AVATAR MEDICAL SAS received clearance for an innovation on converting CT scans and MRI images into patient 3D avatars from the Food and Drug Administration (FDA).

Country Insights

U.S. Digital Avatar Market

The U.S. digital avatar market accounted for the largest market revenue share of 82.2% in 2023. The market growth is led by robust technological infrastructure, high adoption rates of digital technologies, and major companies developing digital avatars. In addition, the U.S. accounted for over 35% of the global mixed-reality headset market in 2023 and is expected to witness rapid growth over the forecast period.

Canada Digital Avatar Market

The digital avatar market in Canada is anticipated to register the fastest CAGR over the forecast period. The strong presence of the country's gaming industry drives the demand and need for digital avatars for content creators. The rise of digital avatars across sectors, such as gaming, entertainment, healthcare, and education, allows Canadian companies to utilize this technology to improve user interaction and create more immersive experiences.

Key North America Digital Avatar Company Insights

Some of the key players operating in the market include Epic Games, Inc., NVIDIA Corporation, and Microsoft.

-

Epic Games, Inc. is widely known for one of its most popular games, Fortnite. The Unreal Engine technology of Epic Games, Inc. is a powerful and versatile game engine that supports the creation of high graphic environments and characters. It offers advanced tools for developers to create detailed and realistic digital avatars, making it a popular choice for game development and virtual production projects

-

NVIDIA Corporation, known for its graphics processing units (GPUs) for gaming and professional markets, has also significantly developed digital avatars and AI-driven technologies. The company has been leveraging its graphics, AI, and computing expertise to push the boundaries of digital avatar creation, animation, and interaction

Key North America Digital Avatar Companies:

- AI Foundation

- DeepBrain AI

- Didimo, Inc.

- Epic Games, Inc.

- Microsoft

- NEON

- NVIDIA Corporation

- Pinscreen

- Ready Player Me, Inc.

- Soul Machines

- Spatial Systems, Inc.

- UneeQ

- Wolf3D

Recent Developments

-

In January 2024, NVIDIA Corp. introduced new NVIDIA Avatar Cloud Engine (ACE) production microservices that allow game developers to generate AI models into digital avatars and incorporate them into their applications and games. The latest ACE microservices enable developers to construct interactive avatars by utilizing AI models like NVIDIA Omniverse Audio2Face (A2F) for generating lively facial animations from audio inputs and NVIDIA Riva automatic speech recognition (ASR) to develop adaptable translation applications and multilingual speech through generative AI

-

In October 2023, the AI Foundation partnered with the College of Southern Nevada to deploy digital avatars for better student engagement. The avatar provides students with personalized administrative services and a new level of engagement experience

-

In October 2022, Microsoft launched Mesh avatars, digital avatars for Microsoft Teams, to provide customer metaverse experiences. Employees using Mesh avatars in Microsoft Teams meetings can establish their presence without using their cameras and customize their representation based on the meeting’s casual, professional, or day-to-day tone

North America Digital Avatar Market Report Scope

Report Attribute

Details

Market size value in 2023

USD 8.01 billion

Revenue forecast in 2030

USD 100.61 billion

Growth rate

CAGR of 46.2% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, category, industry vertical

Country scope

U.S.; Canada

Key companies profiled

AI Foundation; DeepBrain AI.; Didimo, Inc.; Epic Games, Inc.; Microsoft; NEON; NVIDIA Corp.; Pinscreen; Ready Player Me, Inc.; Soul Machines; Spatial Systems, Inc.; UneeQ; Wolf3D

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Digital Avatar Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America digital avatar market report based on product, category, and industry verticals:

-

Product (Revenue, USD Million, 2018 - 2030)

-

Interactive Digital Avatar

-

Non-Interactive Digital Avatar

-

-

Category (Revenue, USD Million, 2018 - 2030)

-

Virtual Agents & Assistants

-

Virtual Influencers

-

Digital Avatar in Gaming

-

Others

-

-

Industry Vertical (Revenue, USD Million, 2018 - 2030)

-

BFSI

-

Retail & E-commerce

-

Healthcare

-

Gaming & Entertainment

-

Education & Training

-

Automotive

-

IT & Telecom

-

Others

-

Frequently Asked Questions About This Report

b. The North America digital avatar market size was estimated at USD 8.01 billion in 2023 and is expected to reach USD 10.32 billion in 2024

b. The North America digital avatar market is expected to grow at a compound annual growth rate of 46.2% from 2024 to 2030 to reach USD 100.61 billion by 2030

b. The U.S. digital avatar market accounted for the largest market revenue share of 82.2% in 2023. The market is fuelled by robust technological infrastructure, high adoption rates of digital technologies, and major companies developing digital avatars.

b. Some key players operating in the North America digital avatar market include AI Foundation; DeepBrain AI.; Didimo, Inc.; Epic Games, Inc.; Microsoft; NEON; NVIDIA Corporation; Pinscreen; Ready Player Me, Inc.; Soul Machines; Spatial Systems, Inc.; UneeQ; Wolf3D

b. Factors such as the increasing adoption of digital avatars as digital identities & interactions and advancements in technology are expected to drive market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."