- Home

- »

- Advanced Interior Materials

- »

-

North America Dehumidifier Market, Industry Report, 2030GVR Report cover

![North America Dehumidifier Market Size, Share & Trends Report]()

North America Dehumidifier Market (2025 - 2030) Size, Share & Trends Analysis Report By Product (Fixed, Portable), By Application (Residential, Commercial), By Technology, By Country, And Segment Forecasts

- Report ID: GVR-4-68040-039-1

- Number of Report Pages: 114

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Dehumidifier Market Trends

The North America dehumidifier market size was estimated at USD 1.23 billion in 2024 and is anticipated to grow at a CAGR of 7.3% from 2025 to 2030. Rising awareness among consumers regarding maintaining a healthy lifestyle at home and the workplace is anticipated to increase the demand for dehumidifiers. Increasing food manufacturing sales is expected to positively impact the market, as dehumidifiers help maintain ideal moisture levels, thereby preventing the degradation of food quality. In addition, dehumidifiers keep the air dry and crisp, making the entire process smooth and efficient. These factors are expected to influence the North American market positively.

According to Lodging Magazine Q3 2022 report, over 5,300 hotels are in the construction phase in the U.S., totaling 629,489 rooms. This number has increased by 6% in terms of rooms and 10% in terms of projects compared to 2021. The lodging sector is expected to grow at a healthy rate owing to the significant changes in lending rates and increasing investment in new hotel constructions or renovations. In 2022, conversion and renovation combined account for 239,914 rooms across the U.S. This is expectedto further drive the demand for North American dehumidifiers.

Drivers, Opportunities & Restraints

The refrigerative dehumidifier technology segment’s growth is also anticipated to be driven by the increasing health consciousness and awareness among the masses about maintaining indoor air quality at homes, offices, and other commercial places. According to the Centers for Disease Control and Prevention, indoor airquality is a crucial factor that triggers indoor asthma among occupants. Moreover, the presence of high humidity in the air is ideal for the growth of mold and dust mites.

Dehumidifiers from various manufacturers have regularly witnessed product recalls owing to technical issues. These issues include overheating parts, breaking out of the fire, etc., which result in the recalling of dehumidifiers, which hampers market growth in North America.

Rising awareness among consumers regarding maintaining a healthy lifestyle at home and the workplace is anticipated to increase the demand for dehumidifiers and other humidity control systems, such as air conditioners and HVAC systems. Building owners are compelled to offer a healthier environment to corporate and residential occupants to avoid any legal hurdles that may arise due to inadequate building conditions. Moreover, corporates and other businesses ensure that IAQ guidelines are met on their premises to ensure good air quality in the workplace.

Technology Insights

“The demand for desiccant dehumidifier is expected to grow at a notable CAGR of 7.5% from 2025 to 2030 in terms of revenue.”

Desiccant dehumidifiers have gained widespread acceptance in various commercial and industrial contexts across the globe, particularly in scenarios where specific humidity levels are crucial. These systems find applications in sectors like food processing, pharmaceuticals, and storage facilities. Increasing the construction of manufacturing plants, storage areas, water treatment plants, and lithium-ion battery factories will likely boost the desiccant dehumidifier market.

The desiccant dehumidifier segment dominated the market in 2023, accounting for 56.5% of the revenue share. The expansion of manufacturing units, warehouses, water treatment facilities, and lithium-ion battery production plants is anticipated to drive the demand for desiccant dehumidifiers. For instance, companies in North America announced 172 new capital projects for supply chain operations and distribution, including

new building and facility development. This is expected to surge the demand for

dehumidifiers used in industrial facilities in the coming years.Application Insights

“The demand for the residential segment is expected to grow at a notable CAGR of 7.6% from 2025 to 2030 in terms of revenue.”

The growth of the residential segment is significantly attributed to the expansion of industrial manufacturing over the forecast period. The growing population increases the need for processed food, clothes, medicines, and other consumer goods. The rising demand for dehumidifiers is, in turn, expected to boost the demand from the new manufacturing facilities. The market is also driven by the strategic initiative introduced by the U.S. government, which focuses on funding and strengthening domestic manufacturing.

The industrial segment accounted for 44.6% of the market share in 2023. The demand for dehumidifiers for industrial applications is rising due to the need for precise humidity control in sectors like pharmaceuticals and food and beverage. Companies seek these solutions to ensure product quality and reduce maintenance costs. Advances in energy-efficient and smart technologies enhance their appeal, driving robust market growth.

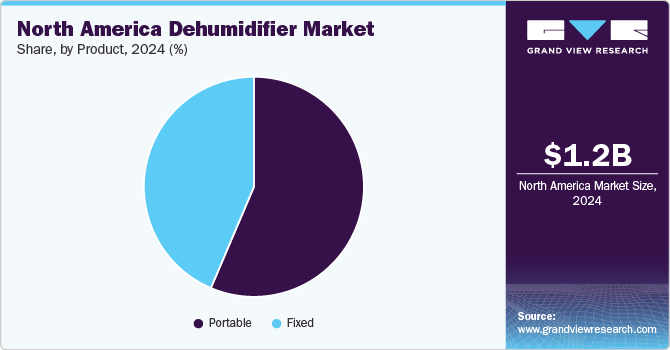

Product Insights

“The demand for the portable segment is expected to grow at a notable CAGR of 7.5% from 2025 to 2030 in terms of revenue.”

The portable segment is expected to grow 7.5% from 2025 to 2030. These movable dehumidifiers offer the convenience of being transported from place to place without the need for permanent duct installation, though there is the option to add one if necessary. They are frequently utilized in both home settings and various commercial environments, including hotels, dining establishments, and healthcare centers.

In 2024, the fixed segment represented 56.7% of the market revenue. Growth in water and wastewater treatment plants is also anticipated to augment the market growth over the projected period. Dehumidifiers are needed to lower the moisture content in wastewater treatment facilities because corrosion occurs when water droplets condense on metal pieces.

Country Insights

The U.S. dehumidifier market is expected to hold 88.0% of the North America market in 2024, owing to increasing population and rising disposable incomes, along with improving urbanization, which is expected to augment the food & beverage industry’s growth in the U.S. In addition, rising construction spending due to economic & industrial development and rapid population growth is expected to boost the demand for dehumidifiers over the forecast period. Dehumidifiers are essential in food and beverage applications. Excess humidity in the product causes condensation and a variety of hygiene issues. Spices, snack foods, processed meat, breweries, and confectionery products all require consistent and controlled moisture conditions. Using dry air from a dehumidifier can aid in moisture control, resulting in perfect coating and longer shelf-life of food products. Growing demand for industrial dehumidifiers is expected to drive the demand for dehumidifiers over the forecast period.

The dehumidifier market in Canada is expected to grow significantly over the forecast period owing to rising consumption of domestically manufactured food. According to Statistics Canada, restaurant and fast-food retail food sales increased by 23.6 % and 15.6%, respectively, in 2021 compared to 2020.Diverse municipal infrastructure investments, certified site programs, and streamlined regulations fuel private sector industrial investments and expansions across Canada.

Mexico dehumidifier market is projected to expand at a rapid CAGR of 8.1% over the forecast period. This growth is attributed to rising consumer awareness regarding air quality, rising prevalence of airborne diseases, and increasing death rates, forcing manufacturers to invest in technologies to restrict pollution levels in Mexico. In addition, easy installation, low maintenance, and lower operating costs are anticipated to drive market growth.

Key North America Dehumidifier Company Insights

Some of the key players operating in the market include Ingersoll Rand and SLB.

-

LG Electronics Inc. primarily manufactures home appliances, consumer electronics, and mobile communications. The company operates through four business units, namely, Mobile Communications, Home Entertainment, Home Appliance & Air Solutions, and Vehicle Components. Home Appliance & Air Solutions business unit produces and sells residential and commercial air conditioners, vacuum cleaners, refrigerators, and washing machines.

-

Honeywell International Inc.operates through four business segments, namely, aerospace, performance Materials and technologies, Honeywell Building Technologies, and Safety and Productivity Solutions. The dehumidifier products are offered under the Honeywell Building Technologies segment. The company sells and distributes its products through a chain of distributors, wholesalers, retailers, and various e-commerce websites.

Key North America Dehumidifier Companies:

- LG Electronics Inc.

- Honeywell International Inc.

- GE Appliances, a Haier Company

- De’Longhi Appliances S.r.l.

- Bry-Air Inc.

- Danby Products Ltd

- Whirlpool Corporation

- Munters Group

- STULZ Air Technology Systems, Inc.

- CondAir Group

Recent Developments

-

In December 2023, Munters AB partnered with LumenRadio to integrate advanced wireless technology into their air treatment systems. This collaboration aims to enhance climate control efficiency, particularly for humidity and temperature management. LumenRadio's reliable, low-power wireless mesh technology allows for seamless data transmission and remote monitoring through a network of sensor nodes. The resulting product, AirC Wireless, enables effective climate management while simplifying implementation.

-

In May 2024, Nature’s Miracle Holding Inc. introduced a new brand of smart dehumidifiers designed specifically for the horticultural industry. These dehumidifiers utilize advanced technology to monitor and control humidity levels, ensuring optimal growing conditions for plants. The brand aims to enhance energy efficiency and reduce operational costs while providing real-time data and insights to users. This innovation is expected to significantly benefit growers by improving crop quality and yield through better climate management.

North America Dehumidifier Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 1.31 billion

Revenue forecast in 2030

USD 1.86 billion

Growth rate

CAGR of 7.3% from 2025 to 2030

Actual data

2018 - 2024

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Technology, product, application, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

LG Electronics Inc.; Honeywell International Inc.; GE Appliances, a Haier Company; De’Longhi Appliances S.r.l.; Bry-Air Inc.; Danby Products Ltd; Whirlpool Corporation; Munters AB; STULZ Air Technology Systems, Inc.; CondAir Group.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Dehumidifier Market Report Segmentation

This report forecasts revenue growth at the country levels and provides an analysis of the industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America dehumidifier market based on technology, product, application, and country:

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Refrigerative Dehumidifier

-

Desiccant Dehumidifier

-

Electronic/Heat Pump Dehumidifier

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Portable

-

Fixed

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Industrial

-

Commercial

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America dehumidifier market size was estimated at USD 1.23 billion in 2024 and is expected to be 1.31 billion in 2025.

b. The North America dehumidifier market, in terms of revenue, is expected to grow at a compound annual growth rate of 7.3% from 2025 to 2030 to reach USD 1.86 billion by 2030

b. U.S. dominated the dehumidifier market with a revenue share of 88.0% in 2024. The extensive industrial manufacturing, the strong establishment of commercial businesses, and growing awareness among the homeowners attributed to the position the market holds in the country.

b. Some of the key players operating in the Dehumidifier Market include LG Electronics Inc., Honeywell International Inc., GE Appliances, a Haier Company, De’Longhi Appliances S.r.l., Bry-Air Inc., Danby Products Ltd, Whirlpool Corporation, Munters Group, STULZ Air Technology Systems, Inc., and CondAir Group.

b. Key factors driving market growth for dehumidifiers in North America include increasing regulatory requirements for humidity control in industries like pharmaceuticals and food processing, rising awareness of health and safety concerns related to indoor air quality, and technological advancements in energy-efficient and smart dehumidification solutions further bolster demand.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.