- Home

- »

- IT Services & Applications

- »

-

North America Deck Design Software Market, Report, 2030GVR Report cover

![North America Deck Design Software Market Size, Share & Trends Report]()

North America Deck Design Software Market (2025 - 2030) Size, Share & Trends Analysis Report By Deployment (Cloud-Based, On-Premise), By Application (Residential, Commercial), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-468-0

- Number of Report Pages: 60

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

Market Size & Trends

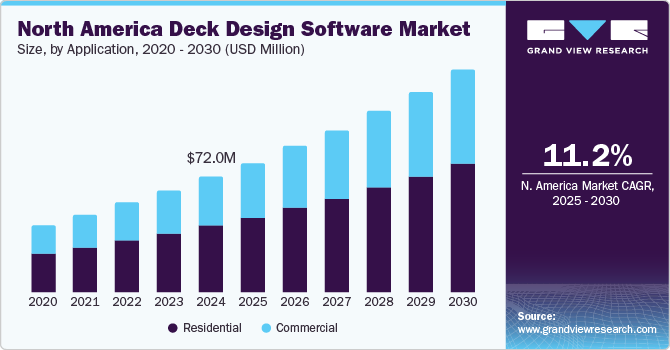

The North America deck design software market size was valued at USD 72.0 million in 2024 and is projected to grow at a CAGR of 11.2% from 2025 to 2030. Digital disruption in the field of deck-building and architectural services has enabled the real estate industry to provide more time-efficient and better quality services. Such disruption has paved the way for the larger use of communication and design sharing tools among deck suppliers and designers.

Realizing the potential benefits of digital tools, many architects and designers continue to use deck-building tools to reduce time, congestion, and costs related to the design process. Furthermore, the integration of technologies such as AI and machine learning, along with the addition of creative design layouts, is expected to improve the efficiency of these solutions in the near future, which could, in turn, drive the market over the forecast period.

Deck design is a complex process that requires consideration of several rules and the latest technological requirements. Implementing decks manually requires extensive effort to comply with all the requirements, and the process is prone to errors and has a high risk of failure. Manual design efforts also require extensive time and dedicated efforts. The need to accommodate such a complicated process has led to the demand for deck design software with in-built design templates from architects and homeowners.

Over the years, decks have become an integral part of real estate and home renovation projects due to the changing consumer preference for aesthetic materials that enhance the appearance of the house. In addition to aesthetics, several residential and commercial users continue to build decks as part of outdoor extensions, such as outdoor kitchens and shade arbors, to host events. The growing popularity of DIY home décor or renovation projects, along with the steady growth of the real estate sector, has been instrumental in driving the market in the region.

Deployment Insight

Based on deployment, the cloud-based deployment of deck design software dominated this market with a revenue share of 54.5% in 2024. The adoption of cloud computing technologies is growing, and advanced deck design software solutions are available. Cloud deployment also has benefits such as scalability, cost savings, flexibility, and others. Advancements in cloud security infrastructure and the promise of added security to share, deploy, and integrate design plans easily favor segment growth. Additionally, the introduction of several stringent data protection policies to safeguard critical consumer data over the cloud and remote devices is expected to drive the segment over the forecast period. Moreover, the growing use of the internet to procure and communicate information about raw materials across enterprises is another key factor driving the cloud segment.

The on-premises deployment segment is expected to experience significant CAGR during the forecast period. On-premise deck design software is a standalone application that requires dedicated system requirements and often consists of several modules and pre-loaded templates to allow users to install the software across several endpoints. Standalone applications also carry the benefit of not requiring a cloud-based deployment interface to store and share data among users. Such benefits allow individual users and engineers to explore features without investing in complex internet infrastructural elements, such as servers, and can easily generate the bill of materials and design layouts, thereby driving the demand for on-premise solutions. Furthermore, growing concerns about cyber threats and data privacy when sharing designs across web or cloud servers drive the adoption of on-premise solutions.

Application Insights

Residential applications dominated the North America deck design software market in 2024. Increased demand from remodelers to design gardens/backyards for recreation and dining has provided new opportunities for deploying deck design software. The industry has witnessed an inclination toward using cloud-based and app-based deck design tools, primarily among homeowners, which is expected to create avenues for future growth. According to the U.S. Census Bureau and the U.S. Department of Commerce, construction spending in August 2024 was USD 2,131.9 billion, which marked a 4.1% increase from spending in August 2023. The growth in private constructions, the renovation of residential buildings, and the focus of multiple companies on adopting innovation-based software technology are expected to drive the growth of this market in the coming years.

The commercial applications segment is projected to experience a noteworthy CAGR from 2025 to 2030. The growing popularity of composite and wood decks in extended office spaces, resorts, hotels, docks, and restaurants to enhance aesthetic appearance is expected to stimulate the growth of the segment over the forecast period. Rising demand for newly designed smart commercial buildings equipped with advanced technologies, smart sensors, enhanced assistance tools, and more is adding to the growth opportunities for this segment. Moreover, ongoing investments in the renovation of aging commercial properties are expected to contribute to the growth of the segment.

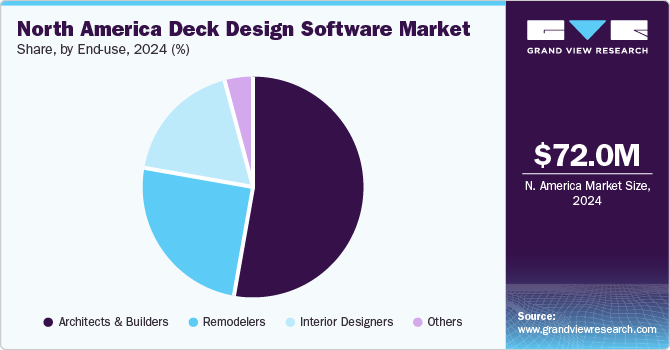

End Use Insights

The architects and builders segment held the largest revenue share of the North America deck design software market in 2024. Architects and builders were the major end-users of deck design software. Deck design solutions help architects identify and evaluate structural issues while determining project costs and handle large-scale real estate projects effortlessly. In addition to cost, deck design software eases the process of visualizing design specifications, subsequently contributing to their increased demand.

The remodelers segment is expected to experience the fastest CAGR of 12.7% from 2025 to 2030. The demand for deck design solutions among remodelers has witnessed growth in recent times. With a rise in home improvement or renovation activities, the demand for remodeling software solutions has gained prominence. Remodelers adopt deck design software to visualize existing and new deck models per the existing infrastructure. With the increasing investments in renovation activities, the segment is expected to grow over the forecast period. Increasing inclination towards adding sustainability features, a rising number of makeovers for bathrooms, bedrooms, multi-functional spaces, and others, adding aesthetic value through bold colors, and a rise in remodeling budgets are projected to generate an upsurge in demand for this market in the coming years.

Country Insights

U.S. Deck Design Software Market Trends

The U.S. deck design software market dominated the North America industry with a revenue share of 69.8% in 2024. The presence of numerous key market participants and the continuous introduction of advanced deck design tools, substantial growth in deck installations across households, especially to host events outdoors, large scale investments in new construction projects and building renovation in numerous cities of the U.S., growing adoption of cloud-based technology adoptions and current infrastructure competencies, coupled by positive government policies and regulation scenarios to ensure the protection of consumer data are presenting lucrative opportunities.

Canada Deck Design Software Market Trends

Canada deck design market is expected to experience fastest CAGR of 12.7% from 2025 to 2030. Composites and wooden decks are largely preferred on new housing construction and renovation projects. As building materials are exposed to the extreme environmental conditions typically observed in the country, several renovations create avenues for market growth. The growing investments in deck-building and new constructions in the country are expected to drive the market over the forecast period.

Key North America Deck Design Software Company Insights

Some of the key companies operating in the North American deck design software market include The AZEK Company Inc., MiTek Inc., Fiberon, Trex Company, Inc., Autodesk Inc., and others. Key companies are adopting strategies such as enhanced portfolio offerings, collaborations, partnerships, and more to address growing competition and increasing demand.

-

AZEK Company Inc., one of the prominent companies in this market, offers a deck designer application for iPad. This application allows users to develop 3D designs while leveraging AZEK and TimberTech offerings. It also allows users to attach deck designs to photos of existing structures and includes augmented reality-based features.

-

Autodesk Inc., a major market participant in the 3D design industry, offers a range of solutions for the architecture, engineering, construction, product design, manufacturing, media, and entertainment industries.

Key North America Deck Design Software Companies:

- The AZEK Company Inc.

- Fiberon

- MiTek Inc.

- Simpson Strong-Tie Company, Inc.

- Trex Company, Inc.

- Chief Architect, Inc.

- DrawPRO

- Luxwood Software Tools

- Dassault Systèmes

- Autodesk Inc.

North America Deck Design Software Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 81.0 million

Revenue forecast in 2030

USD 137.4 million

Growth Rate

CAGR of 11.2% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Report updated

October 2024

Quantitative units

Revenue in USD million and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Deployment, application, end use, country

Country scope

U.S., Canada, Mexico

Key companies profiled

The AZEK Company Inc.; Fiberon; MiTek Inc.; Simpson Strong-Tie Company, Inc.; Trex Company, Inc.; Chief Architect, Inc.; DrawPRO; Luxwood Software Tools; Dassault Systèmes; Autodesk Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Deck Design Software Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global North America deck design software market report based on deployment, application end use and country.

-

Deployment Outlook (Revenue, USD Million, 2018 - 2030)

-

Cloud-Based

-

On-Premise

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Residential

-

Commercial

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Architects & Builders

-

Remodelers

-

Interior Designers

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.