While You're here, you should explore Horizon Databook and instantly access over a million market statistics.

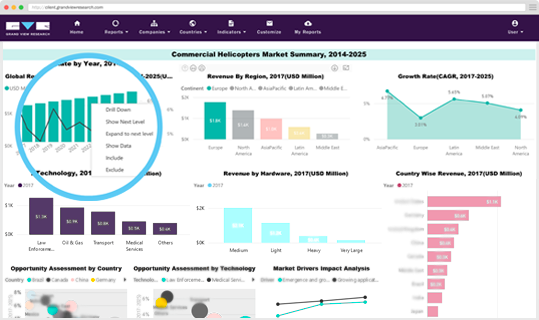

Horizon is the most expansive market research solution. With over 20,000 market reports & 1 million+ statistics at your fingertips and a platform to tell you what to do, this subscription will help you stay informed, all the time.

Get Free AccessWhy us?

- Experienced Professionals - we know what we are talking about!

- Fast Turnaround - we deliver intel, when you need it the most!

- Intuitive Online Interface – cloud access to a world of information

- Free Consultation via phone, chat, and email

- 24x5 Customer Support – Always there to assist you

- Great Place To Work Certified - we strive for the highest standards

As a multi-national company in search of specific market insights spanning different sectors and platforms, Grand View Research delivered great research information that met our needs. They were able to customize reports to our specifications, and despite...

Thank you for the kind support of your team !!! I have received the final report, and the report is really helpful for me. Moreover, I will contact you, if I have any new need for market research materials, of course. Thank you again.

We have worked on several projects with Grand View over the past two years. Much of the research we requested was customization and difficult to find. The quality of research on everything they have done for us has been excellent. Grand View not only met our expectations...

We are very grateful to Grand View Research for helping us gather some of the data our team needed on market use of various chemicals. We used the information from their studies “Global solvents market volume share by application, 2013 and...