- Home

- »

- Advanced Interior Materials

- »

-

North America Contract Manufacturing Services Market, 2030GVR Report cover

![North America Contract Manufacturing Services Market Size, Share & Trends Report]()

North America Contract Manufacturing Services Market Size, Share & Trends Analysis Report By Service (3D Printing, CNC Machining, Sheet Metal Fabrication), By End-use (Medical Devices, Industrial Machinery), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-495-0

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

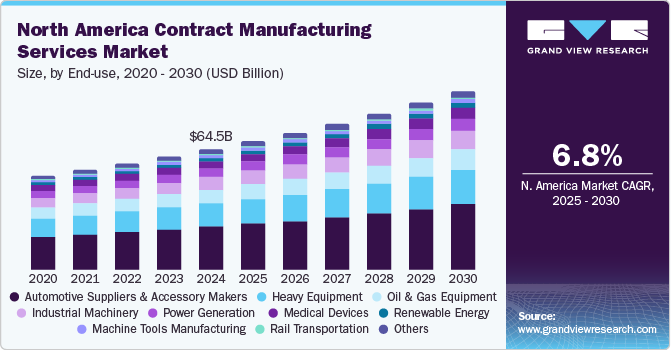

The North America contract manufacturing services market size was estimated at USD 64.5 billion in 2024 and is anticipated to grow at a CAGR of 6.8% from 2025 to 2030. Stringent quality control standards and increasing demand for customized products have driven industries in North America to rely heavily on contract manufacturing services. These services enable companies to streamline production processes, reduce costs, and enhance efficiency while maintaining compliance with various regulatory requirements.

Moreover, the rapid advancement in technology and the growing emphasis on innovation have spurred the industry’s growth, as contract manufacturers are increasingly adopting automation and advanced manufacturing techniques to meet the diverse needs of their customers.

The North America contract manufacturing services market is characterized by a highly competitive and fragmented landscape, with a diverse range of players catering to industries such as electronics, automotive, healthcare, and consumer goods. As companies seek to reduce costs, improve production efficiency, and focus on core competencies, there is a growing shift toward outsourcing manufacturing. This trend is particularly prevalent in sectors requiring specialized expertise, such as precision electronics, medical devices, and automotive parts, where contract manufacturers offer tailored solutions to meet the increasingly complex demands of these industries.

The market is also witnessing a surge in technological innovation, with contract manufacturers adopting automation, robotics, and artificial intelligence (AI) to enhance productivity and reduce operational costs. Additionally, the need for faster time-to-market, customization, and low-volume production is pushing the demand for flexible, high-quality contract manufacturing solutions. Manufacturers are investing in smart manufacturing technologies, including the integration of the Internet of Things (IoT), cloud-based platforms, and data analytics, to optimize operations and improve product quality while minimizing waste and downtime.

As competition intensifies, companies in North America are focusing on differentiation through product innovation and sustainability initiatives. The push for greener manufacturing processes, driven by both regulatory requirements and consumer demand for environmentally responsible products, is prompting contract manufacturers to adopt energy-efficient systems, reduce waste, and embrace eco-friendly materials. Regulatory compliance remains a crucial factor in the industry, with companies needing to adhere to stringent safety, environmental, and quality standards, such as those enforced by the FDA in the U.S. and other regional authorities. These factors are propelling the market forward, as contract manufacturers continue to innovate and adapt to the changing needs of their clients in a rapidly evolving global marketplace

Drivers, Opportunities & Restraints

The consistent growth in vehicle production across these three countries is an indication of a healthy contract manufacturing services industry in the region. Companies such as General Motors, Ford, and Stellantis are known to leverage contract manufacturing partnerships with local suppliers and OEMs to manage the rising demand for automotive components and assembly.

The consistent growth in vehicle production across these three countries indicates that automakers are increasingly relying on contract manufacturing services to scale operations efficiently. Companies such as General Motors, Ford, and Stellantis are known to leverage contract manufacturing partnerships with local suppliers and OEMs to manage the rising demand for automotive components and assembly.

As the machine tool market expands, there is a rising need for contract manufacturing services to meet the growing demand for precision components and complex assemblies. Contract manufacturers are increasingly relied upon to produce critical parts like gears, spindles, and CNC machine components, as well as to handle high-precision machining and assembly tasks, enabling OEMs to scale products efficiently without significant investments in in-house facilities.

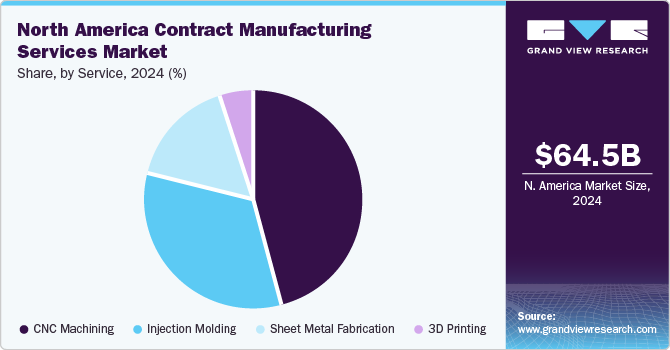

Service Insights

The increasing adoption of 3D printing services in North America is driven by the demand for shorter lead times, reduced waste, and sustainable manufacturing practices. This technology's ability to create parts with complex geometries using a wide range of materials, including metals, polymers, and composites, ensures its relevance across diverse industries.

The CNC Machining segment accounted for market share of 45.8% of the market share in 2024. CNC machining services play a crucial role in various industries, such as automotive, aerospace, and electronics, where precision and quality are paramount. CNC machining allows highly accurate production of complex parts and components, meeting the demanding specifications required in these sectors.

End-use Insights

The renewable energy equipment segment in the North America contract manufacturing service market has gained significant momentum, driven by the rising demand for sustainable energy solutions. This end-use segment includes the manufacturing of components and systems for solar panels, wind turbines, energy storage solutions, and hydroelectric equipment. The growing emphasis on reducing carbon emissions and adopting clean energy has created an environment where contract manufacturers play a crucial role in supporting renewable energy companies with efficient, cost-effective production capabilities.

The automotive suppliers and accessory makers segment led the market and accounted for 35.4% of the overall revenue share in 2024. The growth of the automotive sector has significantly contributed to the expansion of the contract manufacturing service market. As automotive manufacturers increasingly outsource production to enhance efficiency and reduce costs, the demand for specialized contract manufacturing services, such as assembly and parts fabrication, has surged.Bottom of Form

Country Insights

The focus on energy efficiency and sustainability in North America is prompting businesses to adopt contract manufacturing services that utilize advanced technologies. Regulatory frameworks supporting infrastructure development and the increasing prevalence of outdoor events also contribute to the growth of the contract manufacturing services industry across the region.

U.S. Contract Manufacturing Services Market Trends

The market in the U.S. accounted for 83.5% of the market share in 2024. The U.S. contract manufacturing services market is growing due to a combination of factors, including rising demand for cost-effective production, advancements in technology, and the increasing need for specialized manufacturing capabilities. The shift towards outsourcing by large corporations to reduce operational costs and improve efficiency is a key driver.

Canada Contract Manufacturing Services Market Trends

The market in Canada is expected to grow at a CAGR of 8.0% over the forecast period. In Canada, the growth of the contract manufacturing services market is primarily fueled by the availability of skilled labor, access to advanced manufacturing technologies, and the country's proximity to the U.S. market. Canada’s strong focus on innovation and research, particularly in sectors like aerospace, automotive, and medical devices, is driving demand for specialized contract manufacturing services.

Mexico Contract Manufacturing Services Market Trends

Mexico's contract manufacturing market is expanding due to its competitive labor costs, proximity to the U.S., and established manufacturing infrastructure. The country is a preferred destination for companies looking to optimize production costs while maintaining high quality standards, especially in industries like automotive, electronics, and medical devices.

Bottom of Form

Key North America Contract Manufacturing Services Company Insights

Some of the key players operating in the market include Proto Labs and Xometry among others.

- Proto Labs specializes in digital manufacturing, offering rapid prototyping, low-volume production, and on-demand manufacturing. Its core services include CNC machining, injection molding, 3D printing, and sheet metal fabrication, catering to industries like aerospace, automotive, and healthcare..

- Xometry offers a unique manufacturing-as-a-service (MaaS) model, connecting businesses with a network of vetted manufacturers across North America to provide custom manufacturing solutions, including CNC machining, injection molding, and sheet metal fabrication.

Key North America Contract Manufacturing Services Companies:

- Proto Labs

- Xometry

- Fictive

- Fathom

- Fast Radius

- Machining USA, LLC.

- American Micro Industries

- Celestica Inc.

- Benchmark Electronics, Inc.

- SMTC Corporation

- Penton (Informa PLC)

- Methode Electronics, Inc.

- Astro Machine Works

- COX Manufacturing.

- METRO STEEL USA

- Flextronics International, Ltd

- Jabil Inc.

- Viant

- Technimark LLC

- Roberson Machine

Recent Developments

-

In November 2023, Protolabs opened a new Direct Metal Laser Sintering (DMLS) facility to address the growing demand for additive manufacturing services. The state-of-the-art facility is equipped with advanced metal 3D printing technology, allowing Protolabs to deliver high-quality, complex metal parts with greater speed and precision.

-

In October 2024, Celestica launched the DS4100, its latest 800G switch designed to optimize performance for AI and machine learning (ML) data center workloads. With advanced features tailored for AI/ML applications, the switch enables faster data processing and improved resource utilization, empowering organizations to accelerate innovation in data-driven industries

North America Contract Manufacturing Services Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 72.97 billion

Revenue forecast in 2030

USD 101.6 billion

Growth Rate

CAGR of 6.8% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company market position analysis, competitive landscape, growth factors, and trends

Segments covered

Service, end-use

Country scope

U.S.; Canada; Mexico

Key companies profiled

Proto Labs; Xometry; Fictive; Fathom; Fast Radius; Machining USA, LLC.; American Micro Industries; Celestica Inc.; Benchmark Electronics, Inc.; SMTC Corporation; Penton (Informa PLC); Methode Electronics, Inc.; Astro Machine Works; COX Manufacturing; METRO STEEL USA; Flextronics International, Ltd; Jabil Inc.; Viant; Technimark LLC; Roberson Machine

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Contract Manufacturing Services Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America contract manufacturing services market on the service, end-use, and country:

-

Service Outlook (Revenue, USD Billion, 2018 - 2030)

-

3D Printing

-

CNC Machining

-

Sheet Metal Fabrication

-

Injection Molding

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Medical Devices

-

Industrial Machinery

-

Heavy Equipment (Construction, Mining, Agriculture)

-

Oil and Gas Equipment

-

Renewable Energy Equipment

-

Machine Tools Manufacturing

-

Rail Transportation Equipment

-

Marine Equipment and Shipbuilding

-

Power Generation Equipment

-

HVAC Systems

-

Automotive Suppliers and Accessory Makers

-

-

Country Outlook (Revenue, USD Billion; 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America contract manufacturing services market size was estimated at USD 64.5 billion in 2024 and is expected to reach USD 72,976.0 billion in 2025.

b. The North America contract manufacturing services market, in terms of revenue, is expected to grow at a compound annual growth rate of 6.8% from 2025 to 2030 to reach USD 101.6 billion by 2030.

b. The CNC Machining segment dominated the market in 2024 accounting for 45.8% of the overall revenue share. driven by its ability to produce highly precise and complex parts with consistent quality. CNC machining offers greater automation, reducing human error and improving efficiency, making it ideal for industries such as aerospace, automotive, medical devices, and electronics.

b. Some of the key players operating in the North America Contract Manufacturing Services Market are Proto Labs, Xometry, Fictive, Fathom, Fast Radius, Machining USA, LLC., American Micro Industries, Celestica Inc., Benchmark Electronics, Inc., SMTC Corporation, Penton (Informa PLC), Methode Electronics, Inc., Astro Machine Works, COX Manufacturing, METRO STEEL USA, Flextronics International, Ltd, Jabil Inc., Viant, Technimark LLC, and Roberson Machine.

b. Key factors driving the North America contract manufacturing services market include cost-efficiency through outsourcing, advancements in technology like automation and 3D printing, and growing demand for customized, high-quality products across industries. Additionally, favorable trade agreements and a skilled labor force contribute to market expansion.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."