- Home

- »

- Homecare & Decor

- »

-

North America Contract Furniture Market Size, Report, 2030GVR Report cover

![North America Contract Furniture Market Size, Share & Trends Report]()

North America Contract Furniture Market Size, Share & Trends Analysis Report By Product (Seating, Tables & Desks), By End-use (Corporate Offices, Hospitality), By Distribution Channel, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-322-8

- Number of Report Pages: 85

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Consumer Goods

Market Size & Trends

The North America contract furniture market size was estimated at USD 38.56 billion in 2023 and is projected to grow at a CAGR of 4.3% from 2024 to 2030. The demand for commercial spaces like office buildings, retail stores, and industrial parks has increased, driven by a combination of economic factors, government initiatives, and evolving business trends. Moreover, innovation in furniture technology, such as smart standing desks with electronic height adjustment for seamless transitions between sitting and standing, caters to the current needs of workplaces and other commercial facilities.

The increase in commercial development is a significant factor driving the growth of the market. This surge in commercial development is fueled by factors such as population growth, urbanization, economic expansion, and evolving workplace trends. As commercial spaces such as offices, hotels, restaurants, healthcare facilities, and educational institutions continue to expand and evolve, there is a growing demand for furniture solutions that meet the unique needs of these environments. This includes optimizing space utilization, fostering collaboration, and supporting flexible work arrangements, such as hot desking and remote work integration.

According to the American business news channel, CNBC, there has been a push for employees to return to the office, as shown by stricter in-office requirements by companies such as Goldman Sachs and Google. According to a Resume Builder survey of 1,000 company leaders, 90% of companies planned to implement return-to-office policies by the end of 2024. This will result in an increase in the demand for furniture solutions that accommodate the needs of modern office environments.

As technology continues to evolve, it has enabled furniture manufacturers to design and produce innovative products that cater to the changing needs of modern workplaces. For example, the integration of smart technologies in furniture, such as adjustable desks with built-in charging stations and sensors for monitoring usage, has become increasingly popular. In addition, advancements in materials science and manufacturing processes have enabled the creation of more durable, sustainable, and aesthetically pleasing furniture designs.

Smartdesks, an office furniture manufacturer, is increasingly integrating smart solutions into workplace furniture, such as adjustable desks, motorized lift base, modularized displays, and wireless & USD charging, to enhance comfort, efficiency, and collaboration. The adoption of wireless solutions like Wi-Fi is also on the rise, enabling greater mobility within the workspace. Embracing these innovations leads to improved productivity and a more dynamic work environment.

Furthermore, the adoption of technology platforms by vendors to streamline operations has a significant impact on the contract furniture market in North America, driving efficiency, innovation, and customer satisfaction. By leveraging technology solutions such as enterprise resource planning (ERP) systems, customer relationship management (CRM) software, and digital design tools, furniture vendors can streamline various aspects of operations, including inventory management, order processing, project management, and customer communication. This enhanced efficiency allows vendors to respond more quickly to customer inquiries, customize furniture solutions, and expedite order fulfillment, ultimately improving the overall customer experience. Technology platforms also enable vendors to collect and analyze data on market trends, customer preferences, and product performance, informing strategic decision-making and product development efforts.

Market Concentration & Characteristics

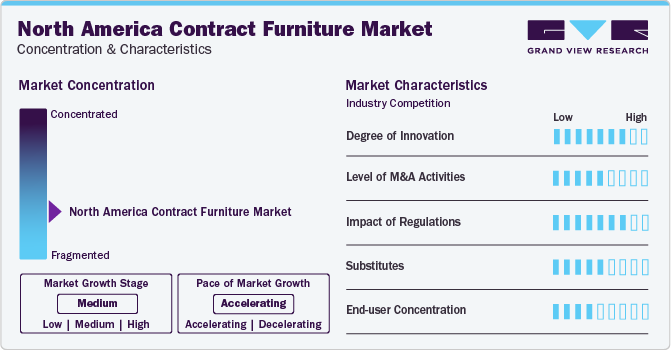

The degree of innovation in the industry is high, driven by advancements in ergonomic designs, sustainable materials, and smart office solutions. There is an increasing emphasis on sustainability and environmental responsibility in the North America contract furniture industry. Manufacturers are capitalizing on this by incorporating eco-friendly materials, reducing waste through recycling and circular design principles, and offering products with a lower environmental footprint. For instance, Global Furniture Group, a key market player, reduced electricity consumption by over 18% over the last four years, eliminated harmful chemicals such as CFCs and HCFCs in the manufacturing process, and implemented comprehensive waste management and recycling programs to minimize environmental impact throughout its operations.

Regulations significantly impact the market in North America, shaping product standards, safety, and sustainability practices. Compliance with stringent safety standards, such as flammability regulations and indoor air quality certifications, ensures that contract furniture meets high-quality benchmarks, essential for industries like healthcare, education, and hospitality. Additionally, sustainability regulations, including those promoting the use of eco-friendly materials and processes, drive manufacturers to adopt greener practices, catering to the growing demand for environmentally responsible products.

The threat of substitutes in the market is relatively moderate, driven by the availability of alternative solutions such as multifunctional and adaptable furniture, as well as the rising trend of flexible workspaces. Companies and institutions might opt for less traditional furniture options like modular systems, ergonomic chairs, and collaborative furniture that better meet the evolving needs of modern work and learning environments. Additionally, the increasing adoption of remote and hybrid work models reduces the dependence on conventional office furniture, presenting a challenge for traditional contract furniture manufacturers.

End-use concentration in the market is diverse, with a range of sectors including corporate offices, healthcare, hospitality, and education. Corporate offices represent a significant portion, but no single sector dominates the market, contributing to its stability and resilience to sector-specific economic fluctuations.

Product Insights

Seating furniture dominated the market with the largest revenue share of about 54% in 2023. As commercial spaces, such as offices, hospitality venues, healthcare facilities, and educational institutions, grow and evolve, there is a continuous need for seating solutions that offer comfort, durability, and functionality. Moreover, trends like flexible work environments, collaborative spaces, and the incorporation of ergonomic design principles further contribute to the demand for contract seating furniture, driving manufacturers to innovate and offer a diverse range of seating options to meet the varied needs of commercial clients across North America.

The storage cabinets & shelves segment is projected to grow at the highest CAGR of 6.3% from 2024 to 2030. Apart from being functional, storage and organization furniture creates a clean, attractive, and well-organized environment, making it easier for staff to find and access resources quickly, subsequently increasing productivity. Contract furniture manufacturers have been introducing various products in response to the need for secure and spacious lockers in workplaces. For instance, in February 2023, California-based office furniture company Pair introduced SOMA, a contemporary line of office lockers designed to meet the needs of unassigned desks and hybrid work. These stylish lockers, equipped with badge-controlled access, offer a dedicated space for mobile employees to store their essential items throughout the day.

End-use Insights

The corporate offices segment dominated the market with the largest revenue share in 2023. The demand for contract furniture in corporate offices is driven primarily by the need for ergonomic and adaptable workspaces that enhance employee productivity and well-being. Modern workplaces are increasingly focusing on creating environments that support various work styles and promote collaboration. Major players in the market are enhancing their portfolios by incorporating advanced ergonomic designs, sustainable materials, and smart furniture technologies to meet the evolving needs of modern workspaces. For instance, in December 2021, Alumil debuted three innovative partition systems, expanding its portfolio to cater to diverse indoor space requirements.

The hospitality segment is projected to grow at the highest CAGR from 2024 to 2030. In the hospitality industry, contract furniture is used in various settings, including hotel rooms, lobbies, outdoor areas, lounges, and conference rooms. This includes a variety of items such as table tops, beds, sofas, dining tables, chair units, and lounge chairs. Hotel furniture serves as an aesthetically significant aspect of hotels, setting high-end establishments apart from others to a considerable degree due to its customization and design standards.

Distribution Channel Insights

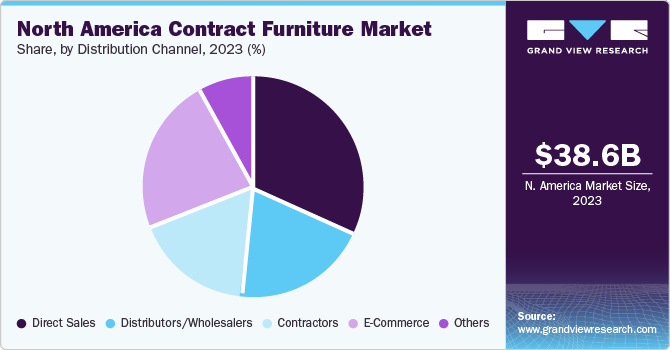

The direct sales segment dominated the market with the largest revenue share in 2023. The demand for contract furniture through direct sales in North America is driven by the need for personalized service, customization, and cost-efficiency. Direct sales channels enable businesses to engage closely with manufacturers, ensuring that specific design and functionality requirements are met, which is particularly crucial for sectors like corporate offices, healthcare, and education. This direct interaction also facilitates quicker turnaround times and more streamlined communication, enhancing customer satisfaction and fostering long-term relationships between buyers and suppliers.

Demand through e-commerce is expected to expand at the highest CAGR from 2024 to 2030. Due to convenience, wider product selection, and reduced physical interactions, e-businesses have increasingly turned to e-commerce platforms to source contract furniture for B2B. In January 2023, Walmart established an e-commerce website called Walmart Business, with a focus on small- and medium-sized businesses and not-for-profit organizations. It offers more than 100,000 items, including office supplies, electronics, food, and furniture. Walmart also launched a business membership program called Walmart Business+, under which customers can receive additional savings in the form of free shipping on all orders for an annual charge of USD 98.

Regional Insights

U.S. Contract Furniture Market Trends

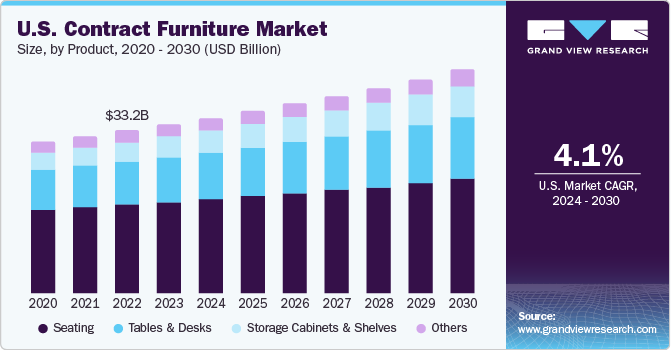

The contract furniture market in the U.S. is expected to expand at a CAGR of about 4.1% over the forecast period. The Bipartisan Infrastructure Law allocated USD 25 billion toward the enhancement and modernization of airports and air traffic facilities across the country in November 2021. This investment aims to enhance the overall passenger experience by enlarging capacity, improving accessibility, and minimizing delays. This initiative emphasizes the expansion of seating options for travelers, leading to increased demand for contract furniture throughout the U.S.

Canada Contract Furniture Market Trends

Canada contract furniture market was valued at about USD 4.08 billion in 2023. In Canada's diverse economic landscape, the hospitality sector emerges as a key driver of growth and opportunity. With the nation embracing its multicultural identity and attracting a wide range of visitors, there is a growing demand for contract furniture within hospitality management.According to the Lodging Econometrics (LE) Construction Pipeline Trend Report for Canada, at the close of 2023, 25 new hotels with 3,278 rooms were opened.

Key North America Contract Furniture Company Insights

The North America contract furniture industry is highly competitive, marked by the presence of numerous prominent players.Some of the key players operating in the market include Haworth Inc.; Herman Miller Inc.; Kinnarps Group; Steelcase Inc.; and HNI Corporation among others.

Key North America Contract Furniture Companies:

- Haworth Inc.

- MillerKnoll, Inc.

- Kinnarps Group

- Steelcase Inc.

- HNI Corporation

- KI

- Global Furniture Group

- Teknion

Recent Developments

-

In May 2024, Teknion announced a partnership with the U.K.-based furniture maker Modus. Modus is the first British-based partner with Teknion, and this new venture enabled both parties to expand their global presence and localize their manufacturing capabilities. This move aimed to assist the companies in reducing the carbon footprint of their products for the North American and European markets simultaneously driving sales.

-

In November 2023, the MillerKnoll, Inc. brands Herman Miller and Design Within Reach unveiled 3D product configurators on their North American retail websites. These configurators allow designers, customers, and trade professionals to utilize a self-service product configuration tool to visualize every possible combination, obtain accurate pricing during the design process, download images at any stage, and effortlessly share their designs with customers. This innovative tool empowers customers to co-create their ideal pieces, enhancing their shopping experience with self-service customization options and interactive features.

-

In June 2023,HNI Corporation announced the completion of its acquisition of Kimball International, Inc., a prominent commercial furnishings company specializing in workplace, health, and hospitality solutions. The strategic move was intended to enable both companies to align their products with emerging post-pandemic trends.

North America Contract Furniture Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 40.09 billion

Revenue forecast in 2030

USD 51.58 billion

Growth Rate

CAGR of 4.3% from 2024 to 2030

Actuals

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Regional scope

North America

Country scope

U.S., Canada, Mexico

Key companies profiled

Haworth Inc.; MillerKnoll, Inc.; Kinnarps Group; Steelcase Inc.; HNI Corporation; KI; Global Furniture Group; and Teknion

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Contract Furniture Market Report Segmentation

This report forecasts revenue growth at regional & country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America contract furniture market based on product, end-use, distribution channel, and country:

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Seating

-

Tables & Desks

-

Storage Cabinets & Shelves

-

Others

-

-

End-use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Government

-

Corporate Offices

-

Institutional

-

Healthcare/Medical Facilities

-

Inpatient

-

Outpatient

-

-

Hospitality

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Direct Sales

-

Distributors/Wholesalers

-

Contractors

-

E-Commerce

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America contract furniture market was estimated at USD 38.56 billion in 2023 and is expectd to reach USD 40.09 billion in 2024.

b. The North America contract furniture market is expected to grow at a compound annual growth rate of 4.3% from 2024 to 2030 to reach USD 51.58 billion by 2030.

b. U.S. dominated the North America contract furniture marker with a share of around 89% in 2023. The expansion of commercial real estate, growth in the hospitality sector, increasing demand for healthcare facilities, and the evolution of educational spaces are some factors driving the U.S. contract furniture market

b. Some key players operating in the North America contract furniture market includes Haworth Inc.; Herman Miller Inc.; Kinnarps Group; Steelcase Inc.; HNI Corporation; KI; Global Furniture Group; and Teknion.

b. Key factors that are driving the North America contract furniture market growth include increased office space demand due to economic growth, rising remote and hybrid work trends, the emphasis on ergonomic and sustainable furniture, technological advancements, and a growing focus on workplace wellness and productivity.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."