- Home

- »

- Next Generation Technologies

- »

-

North America Commercial And Medical Refrigerators And Freezers Market, Report, 2030GVR Report cover

![North America Commercial And Medical Refrigerators And Freezers Market Size, Share & Trends Report]()

North America Commercial And Medical Refrigerators And Freezers Market Size, Share & Trends Analysis Report By Offering (Commercial Sector, Medical Sector), By End Use, By Capacity, Distribution Channel, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-485-2

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Market Size & Trends

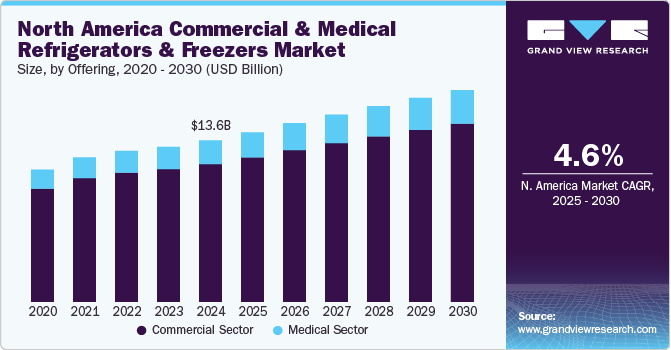

The North America commercial and medical refrigerators and freezers market size was estimated at USD 13,552.9 million in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2030. The market is primarily driven by the increasing demand for temperature-sensitive products in the healthcare and pharmaceutical industries, such as vaccines, blood samples, and medications, which require reliable refrigeration solutions. In addition, the rise in food safety standards and the expansion of the food and beverage industry are fueling the demand for advanced refrigeration technologies that ensure the preservation of perishable goods, which is expected to further fuel the market growth in the coming years.

Rising disposable incomes, rapid urbanization, and changing lifestyles have resulted in a considerable change in food consumption over the past few years. Improved food supply chains across the globe, coupled with economic development and growing consumer awareness about the importance of a healthy lifestyle and nutritional diets, have drastically changed consumption patterns over the last decade. This factor is driving the need for a well-established frozen foods chain, which is likely to fuel the market demand in the coming years.

The growing demand for pharmaceuticals in North America is driving the market growth. With the pharmaceutical industry experiencing rapid expansion, especially in the areas of biologics, vaccines, and specialty drugs, there has been an increased need for reliable and advanced refrigeration systems. These systems ensure that pharmaceuticals remain effective and safe by keeping them at specific temperature ranges. As pharmaceutical products become more specialized, the demand for high-quality, temperature-controlled storage solutions continues to rise. This trend is expected to drive the market expansion.

The growing awareness about sustainability and rising energy costs are urging manufacturers to focus on technological improvements and build energy-efficient refrigerators and freezers. Stringent government regulations pertaining to energy consumption are also driving the adoption of smart refrigeration equipment as they help track energy consumption. The emergence of low-voltage equipment that offers better energy efficiency is anticipated to drive the demand for commercial food refrigerators and freezers across the region, thereby driving market growth.

The rising demand for personalized medicine, which provides treatments to individual patients, requires specialized medical freezers with ultra-low temperatures to store samples. In addition, increasing inclination toward medical research to develop new medicines, vaccines, and treatments is creating significant growth opportunities for the market. For instance, in June 2024, the National Institutes of Health (NIH) of the U.S. announced that it would invest nearly USD 30 million over the fiscal years 2024 and 2025 to support Communities Advancing Research Equity for Health (CARE for Health) initiative that brings together clinical research with community-based primary care. Such initiatives are expected to enhance the overall market outlook over the forecast period.

Offering Insights

Based on offering, the commercial sector segment led the market with the largest revenue share of 88.2% in 2024. The thriving food service industry, including restaurants, hotels, and catering services, is bolstering the demand for various refrigeration solutions in the commercial sector. Stringent food safety regulations are pushing businesses to invest in advanced cooling systems. The trend toward fresh, organic, and locally sourced ingredients requires efficient cold storage, which is bolstering the market demand. Energy-efficient models with smart monitoring capabilities are gaining traction as businesses seek to reduce operational expenses. Customizable and modular designs are becoming popular to meet diverse storage needs across different food industry segments. These factors are expected to drive segmental growth in the coming years.

The medical sector segment is expected to witness at the fastest CAGR from 2025 to 2030. The segmental growth is driven by the increasing demand for healthcare services, advancements in medical technology, and a growing emphasis on patient safety. Moreover, the increasing cases of chronic diseases and the aging population are contributing to the demand for medical storage solutions. Regulatory compliance regarding the safe storage of biological materials and pharmaceuticals is also a key driver of the segment. In addition, innovations in energy-efficient technologies and smart refrigeration systems are becoming prevalent, enhancing operational efficiency while reducing costs. The integration of IoT (Internet of Things) in monitoring systems is further transforming how medical facilities manage their refrigeration needs, thereby driving segmental growth.

End Use Insights

Based on end use, the food & beverage retail segment led the largest market share of 50.0% in 2024, owing to changing consumer behaviors favoring convenience foods and ready-to-eat meals. The rise of e-commerce has also transformed how groceries are sold; retailers are investing heavily in refrigerated display cases that enhance product visibility while maintaining optimal temperatures. In addition, there is an increasing focus on health-conscious products that require specialized refrigeration solutions to extend shelf life without compromising quality. The integration of technology into retail environments, such as smart refrigerators equipped with sensors that monitor temperature fluctuations, has become essential for ensuring compliance with health regulations while improving operational efficiency. These factors are expected to drive segmental growth in the coming years.

The pharmaceuticals segment is expected to register at the fastest CAGR from 2025 to 2030. The segmental growth can be attributed to stringent requirements for temperature-controlled environments necessary for storing sensitive drugs and vaccines. As regulatory standards become more rigorous, pharmaceutical companies are increasingly investing in advanced commercial refrigerators that ensure compliance with safety protocols while preserving product efficacy. The rise of biologics and personalized medicine further highlights the need for specialized cold storage solutions within this sector, thereby driving segmental growth.

Capacity Insights

Based on capacity, the less than 50 cu ft segment led the market with the largest revenue share of 45.5% in 2024, driven by the rising demand in small retail outlets, convenience stores, and food service establishments. These smaller units are ideal for limited spaces while still providing essential refrigeration capabilities for beverages, snacks, and other perishable items. Compact and energy-efficient designs are also driving segment growth as businesses seek to optimize their operational costs while adhering to sustainability practices. In addition, the increasing popularity of food delivery services has led to a higher demand for smaller refrigeration units in urban areas where space is at a premium.

The 100-250 cu ft segment is expected to register at the fastest CAGR from 2025 to 2030. This growth can be attributed to the increasing scale of operations in large supermarkets, warehouses, and food distribution centers. The demand for bulk storage solutions is rising as businesses aim to streamline their supply chains and reduce food waste through improved cold chain logistics. In addition, stringent food safety regulations are prompting establishments to invest in larger refrigeration units that can maintain optimal conditions for perishable goods over extended periods. The trend toward automation in the food service industry is also contributing to the need for high-capacity refrigeration systems equipped with advanced technologies for monitoring and control.

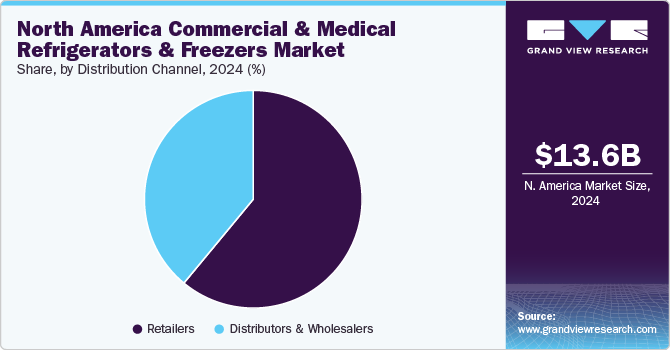

Distribution Channel Insights

Based on the distribution channel, the retailers segment led the market with the largest revenue share of 61.0% in 2024. The increasing focus on health and wellness has led to a surge in demand for refrigerated items, compelling retailers to invest in modern refrigeration systems that can effectively showcase these products while maintaining optimal storage conditions. Furthermore, advancements in refrigeration technology, such as smart refrigerators with IoT capabilities, are appealing to retailers looking to enhance operational efficiency and reduce energy costs. This trend is particularly pronounced in supermarkets and specialty food stores, where the need for high-quality refrigeration solutions is critical for maintaining product quality and customer satisfaction, thereby driving segmental growth.

The distributors & wholesalers segment is expected to register at the fastest CAGR from 2025 to 2030. This growth can be attributed to the increasing demand for efficient supply chain solutions. Food retail chains are expanding in North America, and to meet the supply and demand, distributors are crucial for ensuring that refrigeration equipment reaches various retail outlets efficiently. In addition, the thriving e-commerce sector has necessitated robust distribution networks to manage the logistics of temperature-sensitive products, thereby enhancing the role of wholesalers in maintaining product integrity during transit. The ongoing trend towards energy-efficient and sustainable refrigeration solutions also compels distributors to stock advanced equipment that meets evolving regulatory standards, further propelling segment growth.

Regional Insights

North America is expected to grow at a CAGR of 4.6% from 2025 to 2030, driven by the increasing demand for reliable cold storage solutions across various sectors. The increasing need for the efficient storage of medications, vaccines, and biological samples has driven the market growth. In addition, advancements in refrigeration technology, such as energy-efficient and environmentally friendly cooling systems, are gaining traction, with government regulations promoting the adoption of greener alternatives. The burgeoning food and beverage industry in the region also plays a pivotal role, with restaurants, supermarkets, and food service establishments investing in high-performance refrigeration solutions to meet the growing consumer demand for fresh and frozen foods.

U.S. Commercial And Medical Refrigerators And Freezers Market Trends

The U.S. household refrigerators and freezers market is expected to grow at a CAGR of 4.3% from 2025 to 2030. In the U.S., the market for commercial and medical refrigerators and freezers is driven by stringent regulations in the healthcare sector. The need for compliance with strict storage requirements for temperature-sensitive pharmaceuticals, particularly with the surge in biologics and specialty drugs, is driving the demand for advanced refrigeration systems. In addition, the expansion of the retail sector, including supermarkets and convenience stores, has led to increased investments in refrigeration equipment to meet the consumer demand for fresh produce and frozen goods.

Canada Commercial And Medical Refrigerators And Freezers Market Trends

The Canadian household refrigerators and freezers market is expected to grow at a considerable CAGR from 2025 to 2030. Canada's commercial and medical refrigeration market is being driven by a growing emphasis on healthcare infrastructure development, particularly in remote and underserved areas. The Canadian government has made substantial investments in upgrading hospitals and clinics, which require sophisticated refrigeration systems for storing vaccines, blood samples, and medications.

Key North America Commercial And Medical Refrigerators And Freezers Company Insights

Some of the key players operating in the market are Samsung Electronics Co. Ltd, Panasonic Corporation, and Carrier Global Corporation, among others.

-

Samsung Electronics Co., Ltd. is a subsidiary of the Samsung Group. The company provides various products that cater to consumer electronics, IT & mobile communications, device solutions, visual displays, and digital appliances. The company offers a range of refrigeration products that cater to both residential and commercial needs. These refrigeration solutions are designed to be energy-efficient, reliable, and technologically advanced, meeting the demands of modern consumers and businesses.

-

Panasonic Corporation is a diversified electronics and appliances company organized into several major business units, including China & Northeast Asia Company, Living Appliances and Solutions Company, Heating & Ventilation A/C Company, Panasonic Commercial Equipment Systems, Lighting Business Division, and Consumer Marketing Division.

Electrolux AB and Liebherr Group are some of the emerging participants in the North American market.

-

Electrolux AB offers a wide range of household products, including refrigerators, dishwashers, washing machines, cookers, vacuum cleaners, air conditioners, and small domestic appliances. The company has categorized its innovation areas under taste, care, and well-being.

-

Liebherr Group is a diversified industrial company and offers a wide range of products categorized under construction machines, refrigeration & freezing, mining equipment, maritime cranes, and aerospace and transportation systems. The company provides commercial refrigerators and freezers engineered to accommodate flexible design and installation options for commercial kitchens and food service applications.

Key North America Commercial And Medical Refrigerators And Freezers Companies:

- Ali Group S.r.l. (a Socio Unico)

- American Cooler Technologies Corporation

- Burkett Restaurant Equipment

- Carrier Global Corporation

- Clauger

- DAIKIN Industries Ltd.

- Dover Corporation

- Electrolux AB

- Hussmann Corporation

- Illinois Tools Works Inc.

- Johnson Controls International PLC

- Lennox International, Inc.

- Liebherr Group

- Ojeda USA Inc.

- Panasonic Corporation

- Samsung Electronics Co., Ltd.

Recent Developments

-

In September 2024, Liebherr Group unveiled its new product line of freestanding bottom freezers, offering enhanced features and improved energy efficiency, thereby expanding its portfolio in North America. With a focus on user-friendly operation and energy savings, these bottom freezers are set to provide a convenient and eco-friendly refrigeration solution for modern households.

-

In April 2024, Samsung Electronics Co. Ltd launched its first EU energy A-rating, energy-efficient extra-wide bottom-mount freezer. The new appliance was designed to provide consumers with a more energy-efficient option for storing their food while also offering a spacious interior for better organization.

-

In January 2024, Hussmann Corporation announced the launch of Evolve Technologies, innovative technologies aimed at revolutionizing the food retail industry by offering advanced solutions that enhance the shopping experience for customers while also improving operational efficiency for retailers.

North America Commercial And Medical Refrigerators And Freezers Market Report Scope:

Report Attribute

Details

Market size value in 2025

USD 14,227.6 million

Revenue forecast in 2030

USD 17,774.8 million

Growth rate

CAGR of 4.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD million/billion; Volume in Thousand Units and CAGR from 2025 to 2030

Report Product

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Offering, end use, capacity, distribution channel

Regional scope

North America

Country Scope

U.S.; Canada; Mexico

Key companies profiled

Ali Group S.r.l. (a Socio Unico); American Cooler Technologies Corporation; Burkett Restaurant Equipment; Carrier Global Corporation; Clauger; DAIKIN Industries Ltd.; Dover Corporation; Electrolux AB; Hussmann Corporation; Illinois Tools Works Inc.; Johnson Controls International PLC; Lennox International, Inc.; Liebherr Group; Ojeda USA Inc. (The Ojeda Group); Panasonic Corporation (Parent Organization; Panasonic Holdings Corporation); Samsung Electronics Co., Ltd.

Customization scope

Free report customization (equivalent to up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Commercial And Medical Refrigerators And Freezers Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest technology trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America commercial and medical refrigerators and freezers market report based on offering, end use, capacity, and distribution channels:

-

Offering Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Commercial Sector

-

Refrigerators

-

Walk-in Refrigerators

-

Reach-in Refrigerators

-

Display Refrigerators

-

Undercounter Refrigerators

-

Blast Chillers

-

-

Freezers

-

Walk-in Freezers

-

Reach-in Freezers

-

Display Freezers

-

Undercounter Freezers

-

Chest Freezers

-

-

-

Medical Sector

-

Refrigerators

-

Blood bank Refrigerators

-

Laboratory/Pharmacy/Medical Refrigerators

-

-

Freezers

-

Shock Freezers

-

Plasma Freezers

-

Ultra Low Temperature Freezers

-

Laboratory/Pharmacy/Medical Freezers

-

-

-

-

End Use Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Food Service

-

Hospitality

-

Hotels & Resorts

-

Restaurants

-

Others

-

-

Food & Beverage Retail

-

Hypermarket & Supermarkets

-

Convenience Stores

-

Specialty Food Store

-

Grocery Store

-

-

Healthcare & Lifesciences

-

Hospitals

-

Research Laboratories

-

Diagnostic Centers

-

Blood Banks

-

Others

-

-

Pharmaceuticals

-

Chemicals

-

Others

-

-

Capacity Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Less than 50 Cu Ft

-

50-100 Cu Ft

-

100-250 Cu Ft

-

Above 250 Cu Ft

-

-

Distribution Channel Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

Distributors and Wholesalers

-

Retailers

-

-

Country Outlook (Revenue, USD Million; Volume, Thousand Units, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America commercial and medical refrigerators and freezers market size was estimated at USD 13,552.9 million in 2024 and is expected to reach USD 14,227.6 million in 2025.

b. The North America commercial and medical refrigerators and freezers market is expected to grow at a compound annual growth rate of 4.6% from 2025 to 2030 to reach USD 17,774.8 million by 2030.

b. The commercial sector segment accounted for the largest market share of over 85% in 2024, owing to the trend toward fresh, organic, and locally sourced ingredients requiring efficient cold storage.

b. Some of the key players in the North America commercial and medical refrigerators and freezers market include Ali Group S.r.l. (a Socio Unico), American Cooler Technologies Corporation, Burkett Restaurant Equipment, Carrier Global Corporation, Clauger, DAIKIN Industries Ltd., Dover Corporation, Electrolux AB, Hussmann Corporation, Illinois Tools Works Inc., Johnson Controls International PLC, Lennox International, Inc., Liebherr Group, Ojeda USA Inc. (The Ojeda Group), Panasonic Corporation (Parent Organization: Panasonic Holdings Corporation), and Samsung Electronics Co., Ltd.

b. Key factors that are driving the North America commercial and medical refrigerators and freezers market growth include increasing demand for temperature-sensitive products in the healthcare and pharmaceutical industries, and growing awareness about sustainability and rising energy costs.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."