- Home

- »

- Advanced Interior Materials

- »

-

North America Commercial Facility Snow And Ice Management Service Market, Report, 2030GVR Report cover

![North America Commercial Facility Snow And Ice Management Service Market Size, Share & Trends Report]()

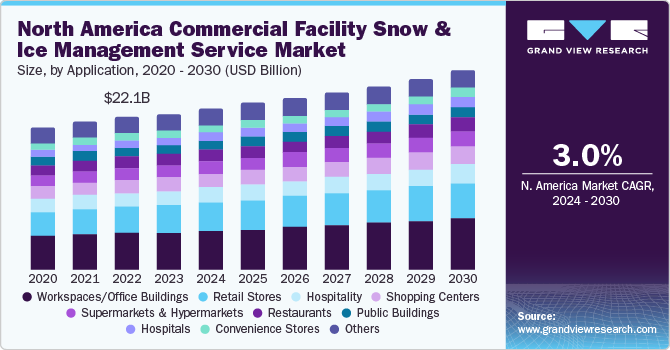

North America Commercial Facility Snow And Ice Management Service Market Size, Share & Trends Analysis Report By Application (Workspaces/Office Buildings, Retail Stores), By Execution (Self-perform, Outsourced), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-309-9

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

The North America commercial facility snow and ice management service market size was estimated at USD 22.53 billion in 2023 and is anticipated to grow at a CAGR of 3.0% from 2024 to 2030. The growing snowfall necessitates more frequent and intensive snow removal efforts to ensure the safety of pedestrians and vehicles. Accumulated snow & ice pose significant hazards, increasing the risk of slips, falls, and accidents. Consequently, commercial property owners and facility managers are under heightened pressure to promptly clear snow & ice from walkways, parking lots, and entry points to mitigate liability and ensure the well-being of occupants. These factors are expected to drive the demand for commercial facility snow & ice management services in North America.

Snow, ice, and the winter weather present numerous challenges for commercial property owners and managers. They need to have access to reliable commercial snow removal services to ensure their businesses remain open and operational. Scheduling these services in advance, rather than waiting for severe winter conditions, is crucial. Maintaining a regular snow removal schedule helps commercial business owners stay on course, thereby creating substantial opportunities for snow & ice maintenance services.

In addition, the growing snowfall necessitates more frequent and intensive snow removal efforts to ensure the safety of pedestrians and vehicles. A significant driving force behind the winter weather patterns anticipated for the winter season 2024 is the intensification of the El Niño-Southern Oscillation (ENSO). This climatic phenomenon is expected to exert considerable influence over weather conditions across the U.S. throughout the entire winter period. Accumulated snow & ice pose significant hazards, increasing the risk of slips, falls, and accidents. Consequently, commercial property owners and facility managers are under heightened pressure to promptly clear snow & ice from walkways, parking lots, and entry points to mitigate liability and ensure the well-being of occupants.

The surge in snowfall drives the demand for professional snow & ice maintenance services due to the sheer volume of work required. Many businesses lack the equipment, expertise, and manpower necessary to manage heavy snowfall events efficiently. As a result, they turn to specialized snow removal companies to handle the task effectively and expediently. For instance, companies such as MCS360; Lessen; Divisions Maintenance Group; Powerhouse; EMCOR Group Inc.; ABM INDUSTRIES INCORPORATED; and Trillium Facility Solutions are some of the few snow & ice maintenance service providers.

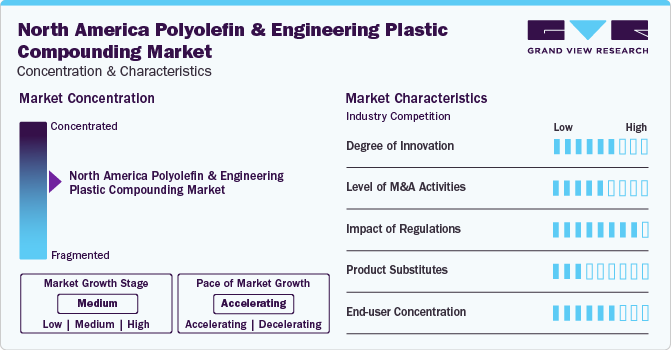

Market Concentration & Characteristics

The market growth stage is medium, and the pace of growth is accelerating. The industry players are adopting organic and inorganic growth strategies, such as expansions, service launches, and partnerships/collaborations, and mergers & acquisitions, to strengthen their position in the U.S. market. For instance, in February 2022, BrightView Holdings, Inc. acquired Winter Services Inc., a snow & ice management company located in Ringwood, New Jersey. The financial details of the transaction were not made public. With the acquisition of Winter Services, one of the top-rated snow and ice management firms in the Northeast, BrightView Holdings, Inc. can now extend its services in this region and enhance its existing snow removal operations in the Tri-State Area.

The regulatory framework for the commercial facility snow & ice management service market encompasses a variety of laws, regulations, standards, and guidelines aimed at ensuring the safety, efficiency, and sustainability of commercial facilities. For instance, property owners in New York are tasked with the duty of removing snow & ice from paved walkways & sidewalks outside their property to ensure the safety of pedestrians. In addition, if a property owner's premises include a bus stop or fire hydrant, they are obligated to clear snow & ice from the sidewalks surrounding these areas. This proactive measure helps maintain accessibility and safety for pedestrians and facilitates efficient use of public infrastructure such as bus stops and fire hydrants.

The technological landscape for North America commercial facility snow & ice management service market is rapidly evolving, driven by advancements in various fields such as automation, data analytics, and the Internet of Things (IoT). These technologies are revolutionizing how facility managers approach maintenance tasks, offering opportunities for improved efficiency, cost savings, and better asset management.

For instance, Computerized Maintenance Management Systems (CMMS) software optimizes and automates commercial maintenance management procedures by facilitating the organization of tasks, tracking work orders, scheduling preventive maintenance, overseeing inventory, and generating reports. Through the digitization of maintenance operations, CMMS boosts efficiency, reduces paperwork, enhances communication, and empowers data-informed decision-making. These aforementioned factors are anticipated to augment the demand for commercial facility snow & ice management services in North America over the forecast period.

Application Insights

The workspaces/office buildings application segment dominated the market and accounted for 24.6% of the North America commercial facility snow & ice management service market in 2023. According to a report published by the U.S. Census Bureau in February 2024, the value of non-residential office construction remained at USD 101.40 billion, which is 5.3% more than the non-residential office construction witnessed in December 2022. Thus, the commercial construction is expected to drive the demand for commercial facility snow & ice management services in North America over the forecast period.

According to the data published by the American Hospital Association in 2024, 6,093 hospitals are present in the U.S., and out of that, 84% are community hospitals. Patient visits to these community hospitals are high; hence, there is a frequent requirement for timely snow & ice removal during the winter season. Furthermore, the demand for snow & ice management is likely to grow over the forecast period, as the U.S. government focuses on improving its health infrastructure. These aforementioned factors are anticipated to drive the demand for commercial facility snow & ice management services in North America over the forecast period.

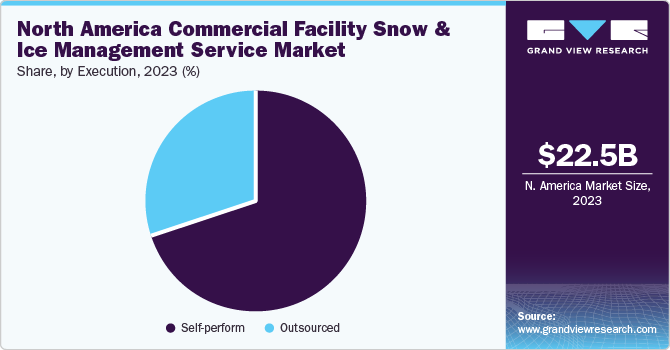

Execution Insights

The self-perform execution segment dominated the North America commercial facility snow & ice management service market in 2023. Self-performed commercial facility snow & ice management service is done by company-owned employees. Commercial facility snow & ice management service companies perform the maintenance tasks by themselves without hiring outside contractors; this can offer significant cost reductions for companies, eliminating the need to consider overhead and markup costs, which directly improves the company’s profit percentage. These aforementioned factors are expected to drive the market growth.

Companies that provide commercial facility snow & ice management service use outsourced execution to expand their share in unexplored markets. In addition, this type of commercial facility snow & ice management services offer ideal operational flexibility, as companies can easily scale up maintenance services by signing multiple contracts with third-party external service providers.In this type of commercial facility snow & ice management services, the company directly supervises the services provided by third-party external service providers. These aforementioned factors are expected to demand for commercial facility snow & ice management services in North America over the forecast period.

Country Insights

U.S. Commercial Facility Snow And Ice Management Service Market Trends

The U.S. dominated the North America commercial facility snow & ice management service market and accounted for 74.4% in 2023. The presence of snow & ice in parking lots increases the risk of trips, slips, and falls, due to the lack of friction. For instance, according to the AccuWeather meteorologist, the snowfall is predicted to increase from 12.4 inches in 2023 to 44 inches in 2024. Further, for commercial properties, the accumulation of snow & ice can make an area of property inaccessible and may disrupt day-to-day operations. Additionally, heavy snowfall & ice can cause damage to the property, such as water leaks, structural damage, and cracks in pavement. These aforementioned factors are anticipated to propel the demand for services in the coming years.

Canada Commercial Facility Snow And Ice Management Service Market Trends

The growing demand for public buildings and commercial places to cater to the increasing population in Canada is expected to boost construction projects across Canada. This factor is anticipated to boost the market demand for over the forecast period. For instance, according to Statistics Canada, the total investment in Canada in November 2023 increased by 0.4% as compared to October 2023, reaching USD 6,040.8 million. Out of all the non-residential building construction investments, the commercial sector accounted for 52.3% of the market share by revenue. These factors are expected to drive the demand for commercial facility snow & ice management services in North America over the forecast period.

Key North America Commercial Facility Snow And Ice Management Service Company Insights

Some of the key players operating in the market include MCS360, BrightView Holdings, Inc., and Lessen.

-

The company is a property services provider that operates across commercial properties, single-family rentals, and the property preservation industry. Its offerings encompass preservation, property inspections, renovations, maintenance, and various other interior and exterior property-related services. Moreover, to enhance its commercial property service offerings, the company acquired industry-leading Chain Store Maintenance in early 2023. With a portfolio comprising 1.6 million properties annually and more than 30,000 certified service partners, the company caters to a diverse range of commercial and residential end users.

-

BrightView Holdings, Inc. offers a variety of landscape-related services to commercial customers across the U.S. The company is divided into two main segments, Maintenance Services and Development Services. The Maintenance Services segment primarily generates revenues from tasks such as landscape maintenance services and snow removal services. Snow removal services may also offer enhancement services. BrightView's Development Services segment generates most of its revenues from landscape architecture and development services. The company serves a broad range of markets, including commercial, education, healthcare, hospitality, residential, retail, and sports & leisure. Additionally, the company operates in 34 U.S. states, serving a diverse group of customers.

Trillium Facility Solutions, Grounds Control USA, and Retail Contracting Service are some of the emerging market participants.

-

Trillium Facility Solutions provides a diverse array of building maintenance services, including electrical, plumbing, HVAC, seasonal landscaping, and others. In addition, it offers facility management software to enhance the efficiency and convenience of its facility maintenance services. Trillium Facility Solutions offers plumbing, electrical, HVAC & refrigeration, window cleaning, parking lot & sidewalk maintenance, snow & ice management, seasonal landscaping, and commercial facility maintenance services.

-

Grounds Control USA deals in exterior facility management. It specializes in providing parking lot maintenance, landscape maintenance, and snow & ice removal services. Managing thousands of properties across the U.S., the company has a network of over 800 vetted field partners as of 2024. The company also offers snow & ice removal services. It provides snow hauling, ice treating, and plowing & shoveling services, along with 24/7 emergency services.

Key North America Commercial Facility Snow And Ice Management Service Companies:

- MCS360

- Lessen

- Divisions Maintenance Group

- Ferrandino & Son, Inc.

- Powerhouse

- EMCOR Group Inc.

- ABM INDUSTRIES INCORPORATED

- Trillium Facility Solutions

- Grounds Control USA

- Retail Contracting Service.

- Facility Maintenance USA

- CBM Commercial Maintenance Company

- Kleenway Building Maintenance Inc.

- Neighborly Company

- Neighborly Company

Recent Developments

-

In December 2023, ABM INDUSTRIES INCORPORATED introduced an Energy Performance Contracting initiative for Orange County Public Schools in central Virginia. This program signifies ABM's third energy savings project for OCPS. Alongside this, OCPS underwent a comprehensive enhancement of a crucial HVAC mechanical system and received LED lighting upgrades, enriching the learning environments across all its schools. Beyond the benefits of energy savings & operational cost reductions resulting from improved lighting, water conservation HVAC upgrades the contract encompasses maintenance services.

-

In February 2023, MCS360 acquired Chain Store Maintenance, a prominent commercial facilities services firm. As part of this acquisition, the former’s interior commercial facility services platform operates under the brand name Chain Store Maintenance. Meanwhile, exterior facility services will remain under the MCS brand. This strategic move broadens the former’s commercial service portfolio and strengthens its capacity to cater to residential clients in the mortgage servicing and single-family rental sectors.

-

In March 2022, BrightView Holdings, Inc. acquired TDE Group, a commercial landscaping and snow removal company based in suburban Detroit with operations in Windsor, Ontario. The terms of the transaction were not disclosed. This acquisition has greatly enhanced BrightView Holdings, Inc.'s operations in the Upper Midwest region, as TDE Group brings a skilled crew and expertise.

-

In February 2022, BrightView Holdings, Inc. acquired Winter Services Inc., a snow & ice management company located in Ringwood, New Jersey. The financial details of the transaction were not made public. With the acquisition of Winter Services, one of the top-rated snow and ice management firms in the Northeast, BrightView Holdings, Inc. can now extend its services in this region and enhance its existing snow removal operations in the Tri-State Area.

North America Commercial Facility Snow And Ice Management Service Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 23.02 billion

Revenue forecast in 2030

USD 27.42 billion

Growth rate

CAGR of 3.0% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, execution, country

Country scope

U.S.; Canada

Key companies profiled

MCS360; Lessen; Divisions Maintenance Group; Ferrandino & Son, Inc.; Powerhouse; EMCOR Group Inc.; ABM INDUSTRIES INCORPORATED; Trillium Facility Solutions; Grounds Control USA; Retail Contracting Service; Facility Maintenance USA; CBM Commercial Maintenance Company; Kleenway Building Maintenance Inc.; Neighborly Company; BrightView Holdings, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Commercial Facility Snow And Ice Management Service Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America commercial facility snow & ice management service market report based on application, execution, and country:

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Retail Stores

-

Restaurants

-

Hospitals

-

Public Buildings

-

Workspaces/Office Buildings

-

Hospitality

-

Banks

-

Convenience Stores

-

Shopping Centers

-

Other Commercial Applications

-

-

Execution Outlook (Revenue, USD Billion, 2018 - 2030)

-

Self-perform

-

Outsourced

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America commercial facility snow and ice management service market size was estimated at USD 22.53 billion in 2023 and is expected to reach USD 23.02 billion in 2024.

b. The North America commercial facility snow and ice management service market, in terms of revenue, is expected to grow at a compound annual growth rate of 3.0% from 2024 to 2030 to reach USD 27.42 billion by 2030.

b. Workspaces/office buildings application segment dominated the market of the North America commercial facility snow & ice management service market in 2023. Failure to properly manage snow & ice can lead to hazardous conditions, including slips, falls, and accidents which is crucial for commercial facilities to implement a comprehensive snow & ice management plan to prevent dangerous situations from occurring.

b. Some of the key players operating in the North America commercial facility snow and ice management service market include MCS360, Lessen, Divisions Maintenance Group, Ferrandino & Son, Inc., Powerhouse, EMCOR Group Inc., ABM INDUSTRIES INCORPORATED, Trillium Facility Solutions, Grounds Control USA, Retail Contracting Service, Facility Maintenance USA, CBM Commercial Maintenance Company, Kleenway Building Maintenance Inc., Neighborly Company, BrightView Holdings, Inc.

b. Rising demand for commercial facility snow & ice management services due to legal obligation to maintain a safe environment for people who visit their premises is one of the factors driving market growth.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."