- Home

- »

- Advanced Interior Materials

- »

-

North America Commercial Facility Maintenance Market, Industry Report, 2030GVR Report cover

![North America Commercial Facility Maintenance Market Size, Share & Trends Report]()

North America Commercial Facility Maintenance Market Size, Share & Trends Analysis Report By Service Type (Exterior, Interior), By Execution (Self-perform, Outsourced), By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-270-5

- Number of Report Pages: 152

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Advanced Materials

Market Size & Trends

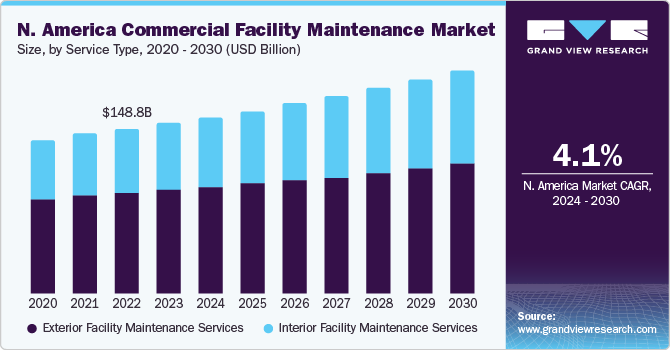

The North America commercial facility maintenance market size was estimated at USD 153.60 billion in 2023 and is anticipated to grow at a CAGR of 4.1% from 2024 to 2030. Commercial facility maintenance encompasses various maintenance activities to preserve the functionality, safety, and appearance of commercial buildings and facilities. These include routine, preventive, emergency, landscaping & ground, electrical system, and security maintenance activities. As a large number of commercial properties are being developed in North America, there is a corresponding increase in the demand for maintenance services to ensure their smooth and efficient operations.

Exterior facility maintenance refers to the continuous process of keeping the external component of the commercial facility in good condition. Regular exterior maintenance can reduce costly repairs and significant damage to commercial property. An exterior building maintenance plan can prevent these problems by outlining the frequency of maintenance for each component of the building exterior. The exterior of the facilityfacility's exterior is constantly exposed to various weather elements, such as wind, rain, snow, and sun. These elements are expected to cause damage to the roof, walls, and other exterior components of the facility over time. Therefore, it is important to carry out regular maintenance to prevent such damage from occurring. This can help to protect the protect investments and save money in the long run.

Parking lot maintenance refers to the activities intended to extend the pavement’s lifespan. Parking lot maintenance includes various types of treatments and repairs, which are designed to prolong the life of the pavement. A well-maintained parking lot enhances the safety of pedestrians and drivers alike. Cracks, potholes, and uneven surfaces can be a tripping hazard for pedestrians, while poor drainage can lead to slippery conditions and an increased risk of accidents for vehiclesvehicle accidents. Regular maintenance helps mitigate these risks by repairing damage, maintaining proper drainage, and ensuring clear markings and signage.

According to the National League of Cities, in 2023, the U.S. displayed between 800 million and 2 billion parking spaces, with over 5% of urban land occupied by surface parking lots. Furthermore, estimates from the International Parking Institute indicate that there are approximately 2 parking spaces approximately two parking spaces are available for every registered vehicle in the U.S. As of 2021, over 276 million listed vehicles equaled to a staggering 552 million parking spaces in commercial lots alone. Further, in the City of Los Angeles, the land dedicated to parking exceeds that allocated for housing. A study conducted in the City of Jackson revealed a ratio of 27 parking spaces (including on-street, off-street surface, and off-street parking) to every household. As more businesses, residential complexes, shopping centers, and public facilities are being constructed or expanded, the need for well-maintained parking facilities is also increasing.

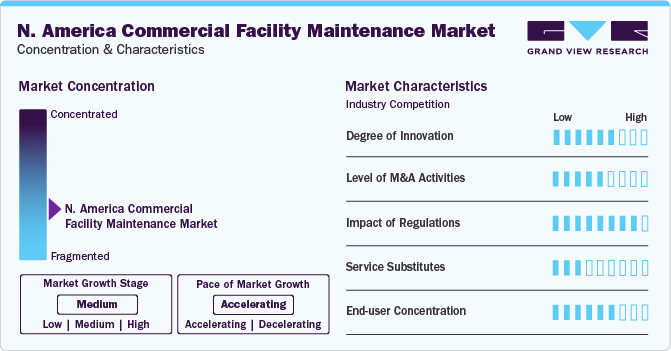

Market Concentration & Characteristics

The market growth stage is medium, and the pace is accelerating. The market players are adopting organic and inorganic growth strategies, such as expansions, service launches, and partnerships & /collaborations, and mergers & acquisitions, to strengthen their position in the U.S. market. For instance, in February 2022, BrightView Holdings, Inc. acquired Winter Services Inc., a snow & ice management company located in Ringwood, New Jersey. The financial details of the transaction were not made public. With the acquisition of Winter Services, one of the top-rated snow and ice management firms in the Northeast, BrightView Holdings, Inc. extended its services in this region and enhanced its existing snow removal operations in the Tri-State Area.

The regulatory framework for the commercial facility maintenance market encompasses a variety of laws, regulations, standards, and guidelines aimed at ensuring the safety, efficiency, and sustainability of commercial facilities. For instance, under the Alaska Landlord Tenant Act, landlords are obligated to clear snow and ice from common areas of the property, as established in the legal case Coburn v. Burton, 790 P.2d 1355 (Alaska 1990). However, leases can stipulate that tenants are responsible for snow removal in their private areas of the property.

The technological landscape for commercial facility maintenance is rapidly evolving, driven by advancements in various fields such as automation, data analytics, and the Internet of Things (IoT). These technologies are revolutionizing how facility managers approach maintenance tasks, offering opportunities for improved efficiency, cost savings, and better asset management. For instance, Computerized Maintenance Management Systems (CMMS) software optimizes and automates commercial maintenance management procedures by facilitating the organization of tasks, tracking work orders, scheduling preventive maintenance, overseeing inventory, and generating reports. Through the digitization ofdigitizing maintenance operations, CMMS boosts efficiency, reduces paperwork, enhances communication, and empowers data-informed decision-making.

The regulatory framework for the commercial facility maintenance market encompasses a variety of laws, regulations, standards, and guidelines aimed at ensuring the safety, efficiency, and sustainability of commercial facilities. For instance, under the Alaska Landlord Tenant Act, landlords are obligated to clear snow and ice from common areas of the property, as established in the legal case Coburn v. Burton, 790 P.2d 1355 (Alaska 1990). However, leases can stipulate that tenants are responsible for snow removal in their private areas of the property.

Service Type Insights

The Exterior commercial facility maintenance services service type segment led the market and accounted for the largest revenue share for of 60.9% of the North America commercial facility maintenance market in 2023. The exterior of the facility is constantly exposed to various weather elements, such as wind, rain, snow, and sun. These elements are expected to cause damage to the roof, walls, and other exterior components of the facility over time. Therefore, it is important to carry out regular maintenance to prevent such damage from occurring. This can help to protect the protect investments and save money in the long run.

Interior facility maintenance services refers to the management and maintenance of the interior aspects of a facility on the assigned premises. It involves different types of functions to ensure smooth, safe, and esthetic indoor spaces. A well-maintained commercial facility is energy-efficient and cost-effective to operate. Regular internal maintenance undertaken at various commercial facilities prolongs the lifespan of the equipment used in the facility. This well-maintained equipment operates more reliably and experiences fewer breakdowns, which reduces the need for costly repairs. AdditionallyIn addition, facilities that prioritize maintenance often implement energy monitoring systems, thereby observing efficient use of electricity.

Application Insights

Workspaces/office buildings application segment held the largest revenue market share for North America commercial facility maintenance market in 2023. According to a report published by the U.S. Census Bureau in February 2024, the value of non-residential office construction remained at USD 101.40 billion, which is 5.3% more than the non-residential office construction witnessed in December 2022. Commercial landscaping, parking maintenance, electrical maintenance, locksmith, and commercial handyman handyperson services are carried out for the maintenance ofto maintain workspaces/office buildings.

The maintenance of retail stores refers to the wide range of strategically planned activities to keep their infrastructure functional and safe. It also involves ensuring that the store area is secure and appealing. The appealing exterior of retail stores creates a positive perception in the mind of customerscustomers' minds, thereby strengthening the reputation of these stores. The retail establishments are generally supported by the facility maintenance teams, who undertake both, internal and exterior facility maintenance. Timely maintenance of retail stores reduces their operational costs as it helps in the optimal optimize the operations of all assets.

Execution Insights

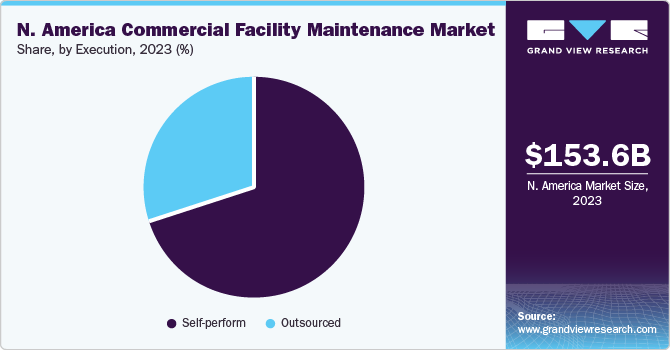

The Self-perform execution segment dominated the North America commercial facility maintenance market and held the largest revenue share in 2023. Self-performed commercial facility maintenance is done by company-owned employees or teams in different commercial facilities such as hospitals, retail stores, convenience stores, office buildings, and public buildings. Commercial facility maintenance companies perform the maintenance tasks by themselves without hiring outside contractors; this can offer significant cost reductions for businesses, eliminating the need to consider overhead and markup costs and, which directly improvesdirectly improving the company’s profit percentage.

The outsourced segment includes maintenance activities, where the company responsible for maintaining the commercial facility assigns maintenance work to independent third-party external service providers with defined service contracts. In this type of commercial facility maintenance, the company directly supervises the services provided by third-party external service providers.

Country Insights

U.S. Commercial Facility Maintenance Market Trends

U.S. dominated the North America commercial facility maintenance market and accounted for the largest revenue share of 77.5% in 2023. According to the Commercial Buildings Energy Consumption Survey (CBECS), the total number of commercial buildings in the U.S. equaled 5.9 million in 2018, containing a total of 96 billion square feet of floor space. As per the projections, the total floor space of commercial buildings is expected to reach nearly 125 billion square feet by 2050, a 29% increase as compared to 2022, thus driving the demand for commercial facility maintenance services over the forecast period.

Canada Commercial Facility Maintenance Market Trends

Canada is expected to grow at the fastest CAGR of 4.6% during the forecast period. Commercial landscaping is one of the most demanded maintenance services across Canada Canada's most demanded maintenance services among exterior facility maintenance services, followed by snow & ice management. The growing demand for public buildings and commercial places to cater to the increasing population in the country is expected to boost construction projects across the country. This factor is anticipated to boost the demand for commercial facility maintenance services as wellalso anticipated to boost the demand for commercial facility maintenance services.

Key North America Commercial Facility Maintenance Company Insights

The market is fragmented, with various regional service manufacturers adopting innovative strategies. Various market participants' strategies typically involve new service launches, mergers & acquisitions, partnerships/collaborations, and expansions to boost market penetration. Moreover, service providers implement quality assurance processes to ensure that sourced materials and equipment meet industry standards and regulatory requirements. This includes conducting quality inspections, verifying certifications, and addressing any non-compliance issues with suppliers.

In April 2023, MCS360 opened a service center in Ohio, U.S. This center is equipped withhas a team comprising the operations director, project managers, inspectors, and expert service technicians. This center is designed to address the field property service requirements across MCS360's Single-Family Rental, Commercial, and Mortgage Services businesses.

Key North America Commercial Facility Maintenance Companies:

- MCS360

- Lessen

- Divisions Maintenance Group

- Ferrandino & Son, Inc.

- Powerhouse

- Eleven Western Builders, Inc.

- Facility Maintenance USA

- EMCOR Group Inc.

- ABM INDUSTRIES INCORPORATED

- CLS Facility Services

- Trillium Facility Solutions

- Grounds Control USA

- Retail Contracting Service.

- Facility Maintenance USA

- CBM Commercial Maintenance Company

- Kleenway Building Maintenance Inc.

- All American Facility Maintenance

- Neighborly Company

- BrightView Holdings, Inc.

Recent Developments

-

In December 2023, ABM INDUSTRIES INCORPORATED introduced an Energy Performance Contracting initiative for Orange County Public Schools in central Virginia. This program signifies ABM's third energy savings project for OCPS. Alongside thisIn addition, OCPS underwent a comprehensive enhancement of a crucial HVAC mechanical system and received LED lighting upgrades, enriching the learning environments across all its schools. Beyond the benefits of energy savings & operational cost reductions resulting from improved lighting, water conservation HVAC upgradesand operational cost reductions resulting from improved lighting and water conservation HVAC upgrades, the contract encompasses maintenance services.

-

In February 2023, MCS360 acquired Chain Store Maintenance, a prominent commercial facilities services firm. As part of this acquisition, the former’s interior commercial facility services platform operates under the brand name Chain Store Maintenance. Meanwhile, exterior facility services will remain under the MCS brand. This strategic move broadens the former’s commercial service portfolio as well asand strengthens its capacity to cater to residential clients in the mortgage servicing and single-family rental sectors. The acquisition bolsters MCS360’s network of service providers and self-performing service centers, thereby enhancing its ability to meet the diverse needs of its clientele.

-

In January 2023, Lessen acquired SMS Assist, a facilities maintenance technology company. This strategic merger combines the complementary strengths of both entities, enabling the former to address key pain points within the real estate industry. By leveraging their combined expertise, Lessen aims to deliver a tech-enabled, scalable enterprise solution for commercial and residential services to its customers. The two companies together Together, the two companies cater to a national footprint of approximately 250,000 residential and commercial properties and facilitate around 2.5 million repair and maintenance orders annually. AdditionallyIn addition, the merger enhanced their ability to offer a broader range of property services to their clients.

North America Commercial Facility Maintenance Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 159.07 billion

Revenue forecast in 2030

USD 202.41 billion

Growth Rate

CAGR of 4.1% from 2024 to 2030

Historical Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service type, application, execution, and country

Country scope

U.S.;, Canada

Key companies profiled

MCS360;, Lessen;, Divisions Maintenance Group;, Ferrandino & Son, Inc.;, Powerhouse;, Eleven Western Builders, Inc.;, Facility Maintenance USA;, EMCOR Group Inc.;, ABM INDUSTRIES INCORPORATED;, CLS Facility Services;, Trillium Facility Solutions;, Grounds Control USA;, Retail Contracting Service;, Facility Maintenance USA;, CBM Commercial Maintenance Company;, Kleenway Building Maintenance Inc.;, All American Facility Maintenance;, Neighborly Company;, BrightView Holdings, Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Commercial Facility Maintenance Market Report Segmentation

This report forecasts revenue growth at country level and provides an analysis on the industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America commercial facility maintenance market on the basis ofbased on service type, application, execution, and country:

-

Service Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Exterior Facility Maintenance Services

-

Commercial Landscaping

-

Snow & Ice Management

-

Parking Lot Maintenance

-

-

Interior Facility Maintenance Services

-

Electrical

-

Plumbing

-

Pest Control

-

Commercial Handyman

-

Locksmith

-

Others

-

-

-

Application Outlook (Revenue, USD Billion; 2018 - 2030)

-

Supermarkets & Hypermarkets

-

Retail Stores

-

Restaurants

-

Hospitals

-

Public Buildings

-

Workspaces/Office Buildings

-

Hospitality

-

Banks

-

Convenience Stores

-

Shopping Centers

-

Malls

-

Power Centers

-

Strip Centers

-

-

Other Commercial Applications

-

-

Execution Outlook (Revenue, USD Billion; 2018 - 2030)

-

Self-perform

-

Outsourced

-

-

Country Outlook (Revenue, USD Billion; 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America commercial facility maintenance market size was estimated at USD 153.60 billion in 2023 and is expected to reach USD 159.07 billion in 2024.

b. The North America commercial facility maintenance market, in terms of revenue, is expected to grow at a compound annual growth rate of 4.1% from 2024 to 2030 to reach USD 202.41 billion by 2030.

b. The exterior commercial facility maintenance services service type segment led the market and accounted for 60.9% of the North America commercial facility maintenance market in 2023. The exterior of the facility is constantly exposed to various weather elements, such as wind, rain, snow, and sun. These elements are expected to cause damage to the roof, walls, and other exterior components of the facility over time, thereby driving the market expansion.

b. Some of the key players operating in the North America commercial facility maintenance market include MCS360, Lessen, Divisions Maintenance Group, Ferrandino & Son, Inc., Powerhouse, Eleven Western Builders, Inc., Facility Maintenance USA, EMCOR Group Inc., ABM INDUSTRIES INCORPORATED, CLS Facility Services, Trillium Facility Solutions, Grounds Control USA, Retail Contracting Service, Facility Maintenance USA, CBM Commercial Maintenance Company, Kleenway Building Maintenance Inc., All American Facility Maintenance, Neighborly Company, BrightView Holdings, Inc.

b. Commercial facility maintenance encompasses various types of maintenance activities to preserve the functionality, safety, and appearance of commercial buildings and facilities. These include routine, preventive, emergency, landscaping & ground, electrical system, and security maintenance activities. As a large number of commercial properties are being developed in North America, there is a corresponding increase in the demand for maintenance services to ensure their smooth and efficient operations.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."