- Home

- »

- Next Generation Technologies

- »

-

North America Commercial Drone Market Size, Report, 2030GVR Report cover

![North America Commercial Drone Market Size, Share & Trends Report]()

North America Commercial Drone Market Size, Share & Trends Analysis Report By Product, By Application, By End-use, By Propulsion Type, By Range, By Operating Mode, By Endurance, By Maximum Takeoff Weight, By Region, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-321-3

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

The North America commercial drone market size was estimated at USD 6.44 billion in 2023 and is projected to grow at a CAGR of 9.5% from 2024 to 2030 due to an increase in the adoption of drones in various industries. For instance, the agriculture industry is benefitting from drones as they aid farmers in pest control and crop management, and based on real-time monitoring, farmers can take active measures to improve the condition of crops in fields.

Artificial Intelligence (AI), machine Learning algorithms, and advanced data analytics integration in drones enable businesses to extract valuable insights from aerial data collected by drones. AI and machine learning are essential in drones as they enable automating complex tasks such as flight control, data analysis, learning from data, identifying patterns, and real-time decision-making with minimal human intervention. In August 2021, Qualcomm launched Flight RB5 5G Platform. This platform offers low-power consumption, advanced AI features, 5G connectivity, and the ability to support multiple cameras. The trend of integrating drones with AI is expected to continue, lead to enhanced drone offerings for end-users, and subsequently drive market growth.

The regulatory environment in North America is relatively favorable towards commercial drone operations. For instance, in September 2023, Zipline, a prominent drone delivery company, was granted Federal Aviation Administration (FAA) approval to fly drones beyond the visual line of sight, allowing Zipline to extend its drone operations over U.S. airspace. Alongside Zipline, other drone operators such as UPS subsidiary Flight Forward, uAvionix, and Phoenix Air Unmanned have recently received similar approvals from the FAA. These approvals pave the way for more streamlined processes for drone flights and open up opportunities for retailers to enhance product delivery using unmanned aircraft. This regulatory support has encouraged businesses to adopt drones for various applications, boosting market demand.

Market Concentration & Characteristics

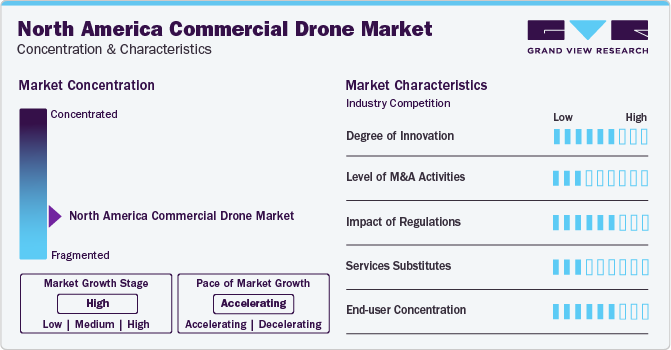

The market growth stage is high, and the pace of growth is accelerating. Rapid technological advancements and increasing applications across various sectors, such as security, delivery, agriculture, energy, media, construction, real estate, and others, drive the growth of this market.

Leading players in the North America commercial drone industry are engaging in merger and acquisition (M&A) to boost their industry positions. Major players seek to enrich their portfolios by integrating complementary technologies, catering to the rising demand across various sectors such as agriculture, defense, and surveillance.

Regulatory challenges and privacy concerns present significant obstacles in the global drone industry, necessitating comprehensive frameworks to ensure safe and responsible drone utilization. Governments worldwide are crafting and enforcing regulations that strike a balance between fostering innovation and safeguarding public safety and privacy rights. Issues such as airspace management, licensing prerequisites, and data security give rise to legal and operational considerations.

Product Insights

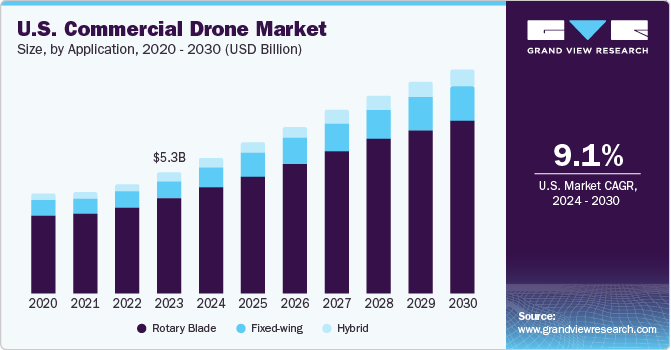

The rotary blade segment accounted for the largest revenue share of 78.3% in 2023. The growth of rotary blade drones can be attributed to the fact that they are highly flexible and agile, allowing them to perform a wide range of tasks effectively. The use of rotary blade drones is increasing in North America due to the growing demand for various applications such as aerial photography, surveillance, delivery of packages, and more. In addition, rotary blade drones are relatively simple to operate, which contributes to their growing popularity across different industries and sectors.

The hybrid drone segment is expected to witness the fastest growth during the forecast period. Hybrid drones combine fixed-wing and multi-rotor blades, allowing them to hover, take off, and land vertically. This hybrid technology reduces the hard work of a remote controller, keeping the drone stable. These drones enhance their productivity and power by integrating the capacity of batteries and fuel, which allows them to fly for long periods with heavy payloads, even in extreme weather conditions. These benefits associated with hybrid drones are boosting their demand.

Application Insights

The commercial application segment accounted for the largest revenue share in 2023. Drones offer unique capabilities for tasks such as surveillance, monitoring, real-time data collection, and delivery services, making them valuable tools for businesses. As a result, companies from multiple industries are adopting drones to enhance operational efficiency and productivity, which in turn is fostering the segment's growth.

The government and law enforcement segment is expected to witness the fastest growth during the forecast period. Drones offer law enforcement agencies and government bodies advanced capabilities for monitoring, tracking, and responding to various situations effectively. The increasing demand for drones in surveillance, security, and emergency response applications drives this segment's growth.

End-use Insights

The media and entertainment segment accounted for the largest revenue share in 2023. The use of drones is increasing in applications, such as filming and photography, for taking aerial shots in movies. The versatility and mobility of drones enable filmmakers and photographers to explore creative angles and compositions, enhancing the overall quality of their work. Moreover, drones have provided cost-effective solutions for these applications in contrast to renting helicopters.

The delivery and logistics segment is expected to witness the fastest growth during the forecast period. The rise of e-commerce and online shopping has led to a greater need for efficient and timely delivery services, which drones can provide effectively. Drones offer a fast and cost-effective solution for last-mile delivery, enabling companies to reach customers quickly and efficiently. Walmart has collaborated with Wing, a drone delivery service owned by Alphabet, to extend its drone delivery offerings to customers in the Dallas metropolitan region.

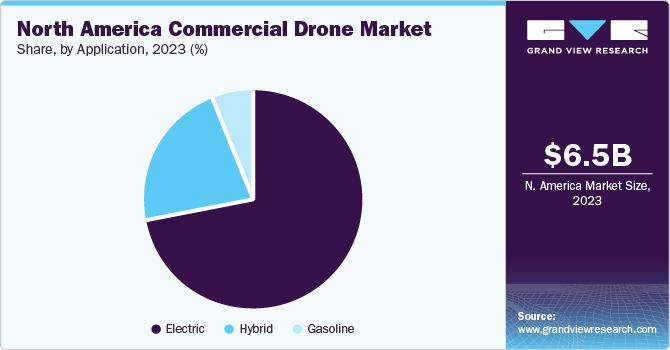

Propulsion Type

The electric propulsion segment accounted for the largest revenue share in 2023. Advancements in electric propulsion technology have increased the capabilities of drones, making them more efficient, quieter, and environmentally friendly for a wide range of applications such as precision agriculture, industrial operations, search and rescue missions, aerial photography, mapping, and infrastructure inspections. The growing emphasis on sustainability and the benefits associated with drones having electric propulsion are driving their demand.

The hybrid propulsion is anticipated to witness the fastest growth during the forecast period. Market demand for longer flight durations and the ability to carry heavier payloads have raised demand for hybrid drones. Hybrid drones offer longer flight times, enabling them to cover larger distances and conduct long missions effectively. Industries such as agriculture, infrastructure inspection, and emergency response benefit from the increased payload capacity of hybrid drones, allowing for the integration of advanced sensors, cameras, and other specialized equipment to enhance operational efficiency and data collection capabilities.

Range Insights

Visual Line of Sight (VLOS) segment accounted for the largest revenue share in 2023. Visual Line of Sight (VLOS) in drones are operated within the operator’s direct visual line of sight. VLOS enables direct control of the drone, allowing operators to navigate safely and avoid collisions with individuals and obstacles. The rising adoption of these drones for commercial applications such as agriculture, aerial photography, surveillance, and inspection are key drivers fueling the growth of the VLOS Drone market.

Beyond Visual Line of Sight (BVLOS) segment is anticipated to witness the fastest growth during the forecast period. BVLOS drones are equipped with advanced sensors, communication systems, and autonomous capabilities, allowing them to fly at extended distances and heights without direct visual contact from the operator. These technological advancements make BVLOS drones valuable for infrastructure inspections, aerial surveys, and delivery services and are driving segment growth.

Operating Mode Insights

Remotely piloted segment accounted for largest revenue share in 2023. Technological advancements such as improved battery life, better control systems, enhanced safety features, and increased payload capacities have increased the adoption of remotely piloted drones for commercial purposes such as commercial deliveries, infrastructure inspections, surveillance activities, agriculture, and more.

The fully autonomous segment is expected to witness the fastest growth during the forecast period. Fully autonomous drones offer advanced capabilities that enable them to operate without human intervention, relying on onboard sensors, algorithms, and artificial intelligence. This autonomy allows drones to perform complex tasks efficiently and independently, making them ideal for applications that require precision, scalability, and operational flexibility, consequently driving their demand. For instance, Flytrex has partnered with national restaurant chains to introduce fully automated drone delivery services for ultrafast food delivery. This innovative approach leverages drones to provide rapid and efficient delivery of meals from restaurants directly to customers' locations.

Endurance Insights

The less than 5 hours segment accounted for the largest revenue share in 2023. Drones with less than 5 hours of endurance are increasingly being demanded for quick operations that require less flight time, such as monitoring, mapping, inspection missions, and other tasks that can be efficiently completed within a few hours. The primary reason for employing these drones for such tasks is their affordability compared to models with extended flight times, meeting performance requirements without compromising effectiveness.

The 5-10 hours segment is expected to witness the fastest growth during the forecast period. The demand for drones with more than 10 hours of endurance is increasing in industries such as defense, security, agriculture, and infrastructure inspection. These drones with extended flight duration can cover vast areas efficiently and collect detailed data without the need for frequent recharging or battery changes. These factors, coupled together, are boosting the segment's growth.

Maximum Takeoff Weights

The less than 25kg takeoff weight segment accounted for the largest revenue share in 2023. The rise in demand for drones weighing up to 25 kg is due to their flexibility, affordability, and convenience. This weight range allows drones to be used in various applications, such as aerial surveys, monitoring, inspections, and data collection, while meeting strict regulations. Additionally, these drones can navigate well in small spaces and maintain efficient flight performance, contributing to the increasing demand for this segment.

The 25kg - 500kg takeoff weight segment is expected to witness the fastest growth during the forecast period. The increasing demand for these drones is driven by applications requiring higher payload capacities and the capability to transport heavier equipment or sensors. They are commonly employed in surveillance, reconnaissance, border patrol, and other strategic missions that mandate long-endurance flights.

Country Insights

U.S. Commercial Drone Market Trends

The U.S. held the largest market share of 82.4% in the North American commercial drone market in 2023, owing to supportive regulatory frameworks and government initiatives. The Federal Aviation Administration (FAA) in the U.S. has been making moves to support the country's market. FAA has approved the flying of drones beyond Visual Line of Sight (BVLOS) for many companies, such as Wing Aviation and uAvionix. For instance, in February 2024, The US State Department gave the green light for the possible sale of 31 armed drones, missiles, and related equipment to India for almost $4 billion (£3.14 billion).

Canada Commercial Drone Market Trends

Canada is expected to witness the fastest growth during the forecast period due to many Canadian companies such as Drone Delivery Canada, ING Robotic Aviation, and Aerobotika have established a strong presence in the commercial drone market, offering a wide range of products and services that address specific industry requirements. Their expertise, experience, and track record have solidified Canada's position as a dominant player in North America's commercial drone industry.

Key North America Commercial Drone Company Insights

Some of the key companies in North America commercial drone market include Draganfly Innovations Inc., Freefly Systems, Drone Delivery Canada and others.

-

Draganfly Innovations Inc. is a Canadian company specializing in manufacturing and developing drones. It offers a wide range of drones depending on needs and preferences. Its products include entry-level drones, such as Commander 3 XL, and advanced professional drones, such as Commander 3 XL Hybrid, designed for surveillance, industrial inspection, and delivery.

-

Freefly Systems is an American company that manufactures, designs, and markets remote-controlled vehicles, gimbals, camera movement systems, and stabilizers, including drones for aerial cinematography and medical supply delivery.

Key North America Commercial Drone Companies:

- Alpha Drones USA

- Draganfly Innovations Inc.

- Drone Delivery Canada

- Freefly Systems

- Intel Corporation

- Parrot Drone SAS.

- Skydio, Inc.

- Skyfront

- UVify Inc.

Recent Developments

-

In January 2024, Walmart announced the largest drone delivery expansion, which includes stores across the Dallas-Fort Worth area. This expansion aims to offer drone delivery to up to 75% of the Dallas-Fort Worth population, covering more than 30 towns and municipalities without the help of dedicated observers who can see the drone at all times, called the Beyond Visual Line of Sight (BVLOS).

-

In October 2023, Amazon Pharmacy recently announced drone delivery for medications. This service is initially being launched in College Station, Texas, allowing customers to receive their prescription medications delivered right outside their door within 60 minutes or less. By introducing drone delivery for medications, Amazon aims to enhance convenience and access to appropriate patient care, bridging the gap between diagnosis and treatment within a critical timeframe.

North America Commercial Drone Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 7.26 billion

Revenue forecast in 2030

USD 12.51 billion

Growth rate

CAGR of 9.9% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end-use, propulsion type, range, operating mode, endurance, maximum takeoff weight

Country scope

U.S., Canada

Key companies profiled

Alpha Drones USA; Draganfly Innovations Inc.; Drone Delivery Canada; Freefly Systems; Intel Corporation; Parrot Drone SAS.; Skydio, Inc.; Skyfront; UVify Inc.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Commercial Drone Market Report Segmentation

This report forecasts revenue growth at regional and country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America commercial drone market report based on product, application, end-use, propulsion type, range, operating mode, endurance, maximum takeoff weight, and country.

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Fixed-wing

-

Rotary Blade

-

Hybrid

-

Commercial

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Commercial

-

Filming & Photography

-

Inspection & Maintenance

-

Mapping & Surveying

-

Precision Agriculture

-

Surveillance & Monitoring

-

Others

-

-

Government & Law Enforcement

-

Firefighting & Disaster Management

-

Search & Rescue

-

Maritime Security

-

Border Patrol

-

Police Operation

-

Traffic Monitoring

-

Other

-

-

-

End-Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Agriculture

-

Delivery & Logistics

-

Energy

-

Media & Entertainment

-

Real Estate & Construction

-

Security & Law Enforcement

-

Others

-

-

Propulsion Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Gasoline

-

Electric

-

Hybrid

-

-

Range Outlook (Revenue, USD Billion, 2018 - 2030)

-

Visual Lane of Sight (VLOS)

-

Extended Visual Line of Sight (EVLOS)

-

Beyond Visual Line of Sight (BVLOS)

-

-

Operating Mode Outlook (Revenue, USD Billion, 2018 - 2030)

-

Remotely Piloted

-

Partially Piloted

-

Fully Autonomous

-

-

Endurance Outlook (Revenue, USD Billion, 2018 - 2030)

-

<5 Hours

-

5-10 Hours

-

>10 Hours

-

-

Maximum Takeoff Weight Outlook (Revenue, USD Billion, 2018 - 2030)

-

<25kg

-

25kg - 500kg

-

>500kg

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The North America commercial drone market size was estimated at USD 6.44 billion in 2023 and is expected to reach USD 7.26 billion in 2024

b. The North America commercial drone market is expected to grow at a compound annual growth rate of 9.9% from 2024 to 2030 to reach USD 12.51 billion by 2030

b. The U.S. held the largest market share of 82.4% in the North American commercial drone market in 2023, owing to supportive regulatory frameworks and government initiatives

b. Some key players operating in the North America commercial drone market include Alpha Drones USA, Draganfly Innovations Inc., Drone Delivery Canada, Freefly Systems, Intel Corporation, Parrot Drone SAS., Skydio, Inc., Skyfront, UVify Inc.

b. The increase in the adoption of drones in various industries and favorable regulatory environment towards commercial drone operations are the key factors driving the regional market growth

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."