- Home

- »

- Food Additives & Nutricosmetics

- »

-

North America Collagen Market Size, Industry Report, 2030GVR Report cover

![North America Collagen Market Size, Share & Trends Report]()

North America Collagen Market Size, Share & Trends Analysis Report By Source (Bovine, Porcine), By Product (Gelatin), By Application (Food & Beverages, Healthcare), And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-216-6

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Specialty & Chemicals

North America Collagen Market Trends

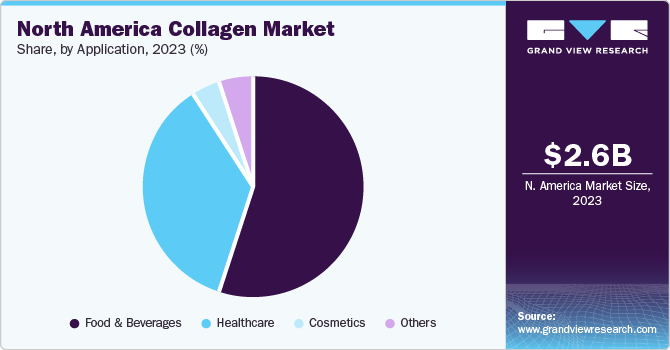

The North America collagen market size was valued at USD 2.60 billion in 2023 and is anticipated to grow at a compound annual growth rate (CAGR) of 11.2% from 2024 to 2030. This growth is fueled by the rising use of products in various industries, including cosmetics, and increasing investments in healthcare and well-being. The expansion of the native collagen market is driven by its increasing use in the food industry, growing interest in protein and nutricosmetics, expanding use of collagen-based biomaterials in healthcare, and rising per capita income.

The gelatin industry is expected to see steady growth in the upcoming forecast period, due in large part to its widespread use in the food and beverage sector. This versatile ingredient is commonly found in confectionery, desserts, and meat products. Additionally, its role in pharmaceuticals an cosmetics fuels its consistent rise.

Hydrolyzed collagen has experienced a steady increase in popularity over the years, thanks to its promotion of skin health, hair growth, and joint support as a beauty supplement. Its inclusion in functional foods and sports nutrition products has also contributed to its growth.

For consumers who prioritize natural and sustainable products, native collagen is the preferred choice. This type is expected to gradually gain in demand, particularly in biomedical applications like wound healing and implants. It is often used as a dietary supplement to support bone and joint health.

The synthetic collagen market has demonstrated a consistent upward trend, thanks to its use in tissue engineering and drug delivery. Its continued market presence is supported by biotechnological advancements and customization options. The other category, which includes specialized variants, continues to grow incrementally due to niche applications and ongoing innovation.

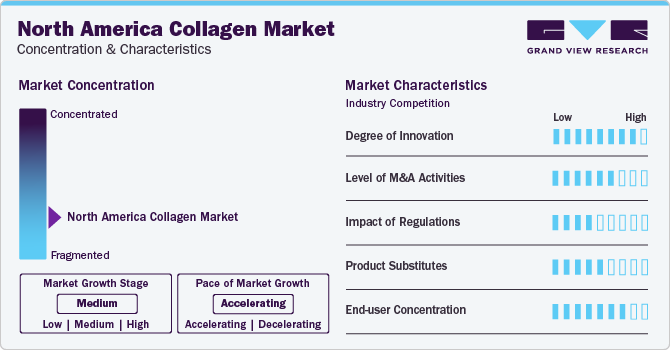

Market Concentration & Characteristics

The collagen market in North America is currently undergoing a significant level of innovation. Many ingredient manufacturers are trying to enter the fragmented market by developing customized collagen-based solutions that cater to individual needs. Many partnerships, mergers, and acquisitions are also taking place in the market. For instance, Geltor has formed a strategic collaboration with Gelita to introduce animal-free collagen.

Despite North America being a promising market for health supplements, the collagen market faces challenges due to the availability of counterfeit products and cheap substitutes. Therefore, more stringent regulations are necessary.

Application Insights

The food and beverages segment dominated the market with a revenue share of 52.48% in the year 2023. The growth of this segment is primarily attributed to the surging demand for dietary supplements and functional food and beverages. The industry relies significantly on the use of food additives to enhance the stability, consistency, and elasticity of food products. Collagen is also widely infused in drinks such as cappuccino, coco, juices, and energy drinks, among others, to enhance their nutritional value and provide additional health benefits.

The utilization of collagen is gaining momentum in healthcare, particularly in the production of wound covers, drug delivery mechanisms, and surgical procedures. The premium-quality products intended for these applications are expected to drive the growth of this industry over the forecast period. Collagen wound covers are commonly used to treat wounds, burns, and non-healing wounds as they can promote skin tissue regeneration and wound healing.

Collagen-based supplements are gaining popularity in the cosmetics industry due to their reported benefits of improving skin texture, elasticity, and hydration, while also reducing the appearance of wrinkles. It is expected that this trend will continue to drive the demand for collagen-based products in the market.

Product Insights

Gelatin dominated the market with a revenue share of 68% in 2023, primarily due to its high demand from the food and beverage industry. Gelatin is an essential protein that offers various nutritional and health benefits, making it a popular ingredient in bakery products, dietary supplements, sports nutrition, and other food products. With consumers' growing concerns about health and fitness, the demand for gelatin is expected to increase even further.

Peptides are expected to witness growth in demand due to their consumption of health and beauty supplements. Peptides are known for improving hair, nails, and skin quality, as well as strengthening bone and joint health. They also help increase protein content, making them a valuable ingredient in sports nutrition and functional food and beverage products.

Native collagen is a protein found in animals' connective tissues, including cartilage, bone, and skin. It is used in skincare products to delay wrinkle formation and reduce marks caused by skin burns and minor wounds. Additionally, it is used to treat joint pain, muscle pain, and osteoarthritis.

Synthetic collagen is broken down by the same enzyme as natural collagen in the human body, making it useful in various biomedical applications. Unlike natural product derived from animal sources, synthetic ones can help avoid immune-related issues. Due to this advantage, there is a growing demand for synthetic-sourced products, which is expected to further boost the market growth.

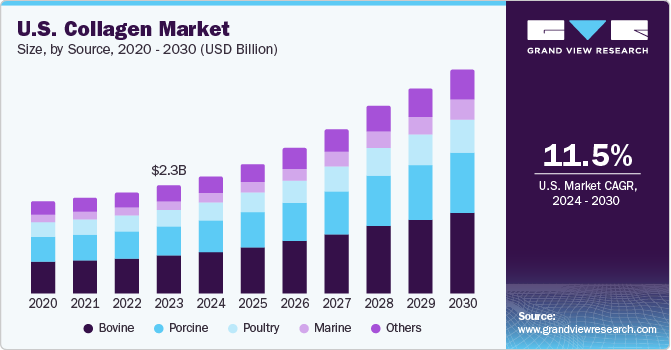

Source Insights

In 2023, the market was dominated by bovine sources, which accounted for more than one-third of the revenue share. This is due to the high availability of cattle and their lower price, which gives them a larger share of the market compared to other sources. Bovine-based products are increasingly in demand for biomedical applications, as they can help cure various medical conditions, such as arthritis, and osteoporosis, and improve skin health. This growing demand is expected to drive market growth over the forecast period. Moreover, the reasonable prices of bovine-based products in the market as compared to other sources, particularly marine sources, are anticipated to further drive the demand for bovine-based products in the near future.

Porcine-based products are widely used in the medical industry due to their similarity to human collagen, which reduces the risk of allergic reactions. These products hold the second-largest market share in the medical industry. When combined with Bovine products, they account for 61% of the market share. The porcine-based products are commonly used in skin tissue engineering, periorbital reconstruction, and chronic musculoskeletal pain treatment. In addition, porcine-based products are also used in cosmetic products such as creams, face gels, and facemasks, where they aid in reducing wrinkles and improving skin elasticity.

The poultry products segment is exhibiting rapid growth, although its growth rate is not significantly higher than other segments. The primary source of poultry based product, which is derived from the cartilage, bones, and tissues of the bird. It is widely used to treat joint and arthritic conditions, which also boosts immunity in general. Consequently, the poultry source segment is projected to expand rapidly, primarily due to the growing use of chicken collagen in treating joint problems.

Key North America Collagen Company Insights

The collagen market in North America is quite fragmented and has several major players, including Nitta Gelatin, NA Inc., Weishardt, Tessenderlo Group, Gelita AG, and Rousselot. These companies play a vital role in the industry, contributing to various applications such as dietary supplements, meat processing, food, cosmetics, and personal care. Their expertise and product offerings drive advancements in health and wellness, supporting bone health, joint function, and overall well-being.

Weishardt has become the first fish collagen producer to obtain the Friend of the Sea Sustainability Certification. This certification is a significant achievement as it recognizes the company’s commitment to sustainable practices.

Gelita AG established a biotechnology center recently, the Biotech Hub in Frankfurt am Main, where biotechnologists and biologists will focus on the development of proteins from biotechnological processes. They also highlighted their recent Bioactive Collagen Peptides solutions for women’s health and personalized delivery methods using certain gelatins.

Key North America Collagen Companies:

- Nitta Gelatin, NA Inc.

- Weishardt

- Tessenderlo Group

- Gelita AG

- Rousselot

- PB Gelatins

- Collagen Solutions

- Gelnex

- Advanced BioMatrix

Recent Developments

-

In January 2024, Darling Ingredients Inc. (Rousselot) completed the acquisition of the Polish rendering company Miropasz Group. They were also named to Newsweek’s America’s Most Responsible Companies List

-

In October 2023, Tessenderlo Group announced several senior leadership changes following the successful merger of Tessenderlo Group and Picanol Group. They also plan to construct a new plant in Defiance, Ohio, US, serving the Eastern Great Lakes region

North America Collagen Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.83 billion

Revenue forecast in 2030

USD 5.36 billion

Growth rate

CAGR of 11.2% from 2024 to 2030

Historical data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Volume in kilotons, revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Volume & revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, source, application

Key companies profiled

Nitta Gelatin, NA Inc., Weishardt, Tessenderlo Group, Gelita AG, Rousselot, PB Gelatins, Collagen Solutions, Gelnex, Advanced BioMatrix.

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Collagen Market Report Segmentation

This report forecasts revenue & volume growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America collagen market report based on product, source, and application:

-

Product Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Gelatin

-

Hydrolysed Collagen

-

Native Collagen

-

Synthetic Collagen

-

Others

-

-

Source Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Bovine

-

Porcine

-

Poultry

-

Marine

-

Others

-

-

Application Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

Food & Beverages

-

Functional Food

-

Functional Beverages

-

Dietary Supplements

-

Confectionary

-

Desserts

-

Meat Processing

-

-

Healthcare

-

Bone & Joint Health Supplements

-

Wound Dressing

-

Tissue Regeneration

-

Medical Implants

-

Cardiology

-

Drug Delivery

-

-

Cosmetics

-

Beauty Supplements (Nutricosmetics)

-

Topical Cosmetic Products

-

-

Others

-

-

Regional Outlook (Volume, Kilotons; Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. Key factors that are driving the market growth include rising use of products in various industries, including cosmetics, and increasing investments in healthcare and well-being.

b. The North America collagen market size was estimated at USD 2.60 billion in 2023 and is expected to reach USD 2.83 billion in 2024.

b. The North America collagen market is expected to grow at a compound annual growth rate of 11.2% from 2024 to 2030 to reach USD 5.36 billion by 2030.

b. U.S. dominated the North America collagen market with a share of 87.2% in 2023. This is attributable to expansion of the native collagen demand, increasing use in the food industry, growing interest in protein and nutricosmetics, expanding use of collagen-based biomaterials in healthcare, in the country.

b. Some key players operating in the North America collagen market include Nitta Gelatin, NA Inc., Weishardt, Tessenderlo Group, Gelita AG, Rousselot, PB Gelatins, Collagen Solutions, Gelnex, Advanced BioMatrix.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."