- Home

- »

- Communications Infrastructure

- »

-

North America Coaxial Cable Market Size, Report, 2030GVR Report cover

![North America Coaxial Cable Market Size, Share & Trends Report]()

North America Coaxial Cable Market Size, Share & Trends Analysis Report By Type, By Application, By End-use (Residential, Commercial, Industrial, Military and Aerospace), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: 978-1-68038-178-8

- Number of Report Pages: 100

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

North America Coaxial Cable Market Trends

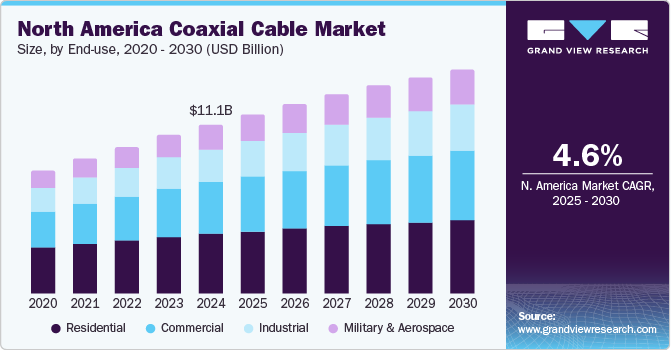

The North America coaxial cable market size was valued at USD 11.14 billion in 2024 and is projected to grow at a CAGR of 4.6% from 2025 to 2030. Growing demand for broadband networks, rising internet use, increasing dependability of businesses, institutes, and professionals on the internet, growing networks by telecommunication companies, and a competitive market scenario are expected to generate rapid growth for this industry during the forecast period.

The market is driven by the significant growth of the telecommunications sector and increasing demand for high-speed internet services. Coaxial cables are essential for broadband internet connections, providing an affordable and dependable way to transmit information quickly. The rising number of data-intensive applications such as online gaming and streaming services underlines the need for robust communication infrastructure, driving high-quality coaxial cables. According to the International Telecommunication Union (ITU), in 2023, more than 67% of the population was exploring the internet, which is approximately 5.4 billion internet users. Moreover, continuous technological advancements are the driving force behind the evolution of the coaxial cable ecosystem, with a focus on advanced cable performance.

Furthermore, the rising demand for implementing 5G networks extensively influences the market for the product. Coaxial cables are essential for distributing networks as they connect base stations and cell towers to the core network. Therefore, their ability to handle high-frequency signals matches the requirements of 5G communication. Apart from telecommunications, the industrial sector also drives the need for coaxial cables, especially in signal transmission situations. Industries such as manufacturing, transportation, and energy depend on coaxial cables for communications, control, and monitoring due to their shielding and toughness abilities in challenging industrial settings.

Type Insights

The RG-6 cable segment dominated the market and accounted for a revenue share of 25.4% in 2024. The growth is attributed to its ability to shield and insulate high-bandwidth and high-frequency applications such as cable, satellite, and internet signals. The growing demand for enhanced video and audio quality and appliances such as TVs, internet connections, and telecommunications systems is driving growth for this segment. Factors such as lack of interference and low-cost installation contribute to the rising demand for RG-6 coaxial cables.

The twin-axial cable segment is expected to experience the fastest CAGR during the forecast period. The growing demand for high-speed internet and other equipment drives the demand for twin-axial high-speed cable solutions. Manufacturers related to this segment are focusing on innovations to fulfill the customers' evolving requirements. Twin axial cables offer a budget-friendly and efficient option for high-speed variance signaling tasks, reducing cable losses and protecting against capacitive fields.

End Use Insights

The residential segment accounted for the largest market revenue share in 2024. The market is driven by innovations such as Fiber-to-the-Home (FTTH) and solutions such as Multimedia over Coax Alliance Access (MOCA Access) by key companies. Moreover, the rising acceptance of work-from-home culture is driving the demand for high-speed internet at homes; as a result, a high percentage of FTTH are installed in residential areas. These coaxial cables offer benefits such as enhanced safety, fire resistance, heat retardant, and so on, making them preferred over other cables.

The military and aerospace segment is anticipated to experience the fastest CAGR over the forecast period. Military specification coaxial cables are essential for securely transmitting high-frequency signals in defense applications such as radar systems, communications, and electronic warfare. Military-grade coaxial cables are manufactured and designed according to specifications set by defense and aerospace organizations to guarantee optimal performance in challenging environmental situations. Various types of coaxial and tri-axial wires are used in military and aerospace due to high flexibility, lightweight, low energy loss, and resistance to high-temperature cables, attributable to the rising demand during the forecast period.

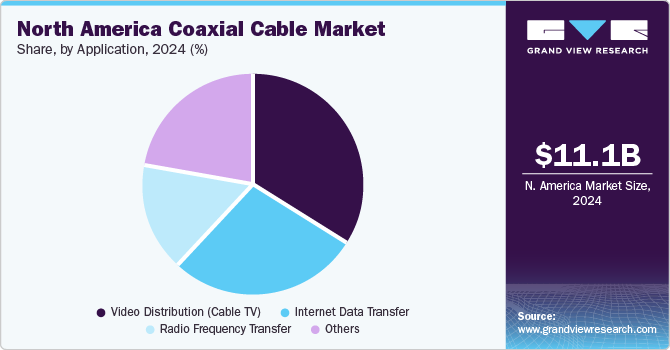

Application Insights

The video distribution (cable TV) segment accounted for the largest revenue share in 2024. Rising demand for RG-6 cables used for televisions, internet connections, CCTV, and high-quality video streaming has fueled growth for this segment. High bandwidth capacity, simple installation process, high durability, and reliability coaxial cables are preferred over other sorts. Some cables are ideal for cable TV connections due to the additional insulating layers that provide protection. The emergence of OTT, on-demand video platforms, and concepts such as fire sticks and smart TVs equipped with subscriptions to multiple platforms is expected to generate greater demand for this segment in the approaching years.

The internet data transfer segment is projected to experience the fastest CAGR over the forecast period. Internet data transmission through a coaxial cable is a prevalent technique employed in numerous cable TV and Internet setups. Some internet transmission methods over coaxial cables are modulation, cable modem, DOCSIS (DATA Over Cable Service Interface Specification), router, etc. The availability of various coaxial cables serves a wide range of customer bases and motivates manufacturers to improve these products to enhance the consumer experience. Growing demand for broadband connection, dependence on smartphone technology, and rising number of intent users in the region are contributing to the growth of this segment.

Country Insights

U.S. Coaxial Cable Market Trends

The U.S. coaxial cable market accounted for the largest revenue share of regional industry and accounted for 50.0% in 2024. This market is primarily driven by the country's growing number of internet users, unceasing dependence of businesses and individuals on the internet, increasing demand for broadband connections, and network expansion initiatives embraced by prominent organizations in the telecommunication industry. According to the Pew Research Center, 95 % of U.S. adults use Internet services. In addition, 15% of U.S. adults use the internet only through smartphones and do not have home broadband connections.

Canada Coaxial Cable Market Trends

Canada coaxial cable market is expected to grow at the fastest CAGR during forecast period. This is attributed to rising demand from the telecommunication sector, growing use of connected devices technology, and increasing investments by the service provider in infrastructure development and enhancements. For instance, in May 2024, TELUS announced an investment of nearly USD 16 billion in the Canadian province of Alberta, aimed at the expansion and improvement of its network infrastructure.

Key North America Coaxial Cable Company Insights

Some of the key companies in the North America coaxial cable market are Belden Inc., Comcast, General Cable Corporation (prysmian), LS Cable & System, and others. Key companies are adopting innovative strategies, cost-effective repair offerings, new product launches, and collaborations with other organizations to address the growing competition and increasing demand due to network expansion.

-

Belden Inc. designs and manufactures insulated wire, cable, and related products. The company has evolved from a cable manufacturer to a signal transmission solutions provider with a comprehensive product portfolio that includes connectivity, cable, and networking solutions. It serves numerous markets, including smart buildings, industrial automation solutions, and broadband & 5G.

-

General Cable Corporation produces electrical cables and optical fibers for the energy and telecommunication industry. Prysmian provides CATV/antenna cables that transmit high-quality data to TVs and new multimedia applications. Its coaxial cable solutions cover various network layers, including attenuation and screening classes.

Key North America Coaxial Cable Companies:

- Belden Inc.

- Comcast

- General Cable Corporation (prysmian)

- LS Cable & System

- NEXANS

- Southwire Company, LLC.

- Sumitomo Electric Industries, Ltd.

- TE Connectivity

- Zhuhai Hansen Technology Co., Ltd.

- Amphenol Corporation

Recent Developments

-

In July 2024, Belden Inc. announced that it had concluded the acquisition process of Precision Optical Technologies, Inc. Precision's strong positioning in the optical transceiver market is expected to provide additional benefits to Beldon's plan to enhance its enterprise solutions offerings and broadband-related markets.

North America Coaxial Cable Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 14.76 billion

Growth rate

CAGR of 4.6% from 2025 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Revenue in USD billion and CAGR from 2025 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Type, application, end use, country

Country scope

U.S., Canada, Mexico

Key companies profiled

Belden Inc.; Comcast; General Cable Corporation; LS Cable & System.; NEXANS; Southwire Company, LLC.; Sumitomo Electric Industries, Ltd.; TE Connectivity.; Zhuhai Hansen Technology Co., Ltd., Amphenol Corporation

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Coaxial Cable Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America coaxial cable market report based on type, application, end use, and country:

-

Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Hardline Coaxial Cable

-

Tri-axial Cable

-

Twin-axial Cable

-

RG-6 Cable

-

RG-11 Cable

-

Others

-

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Video Distribution (Cable TV)

-

Internet Data Transfer

-

Radio Frequency Transfer

-

Others

-

-

End Use Outlook (Revenue, USD Billion, 2018 - 2030)

-

Residential

-

Commercial

-

Industrial

-

Military & Aerospace

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."