- Home

- »

- Organic Chemicals

- »

-

North America Chlor-alkali Market Size 2018-2024, Industry ReportGVR Report cover

![North America Chlor-alkali Market Report]()

North America Chlor-alkali Market Analysis By Product (Caustic Soda, Chlorine, Soda Ash), Trends & Dynamics, Competitive Landscape, Value Chain Analysis, Price Trend Analysis, And Forecasts, 2018 - 2024

- Report ID: GVR-1-68038-421-5

- Number of Report Pages: 97

- Format: PDF, Horizon Databook

- Historical Range: 2014 - 2016

- Forecast Period: 2017 - 2024

- Industry: Bulk Chemicals

Industry Insights

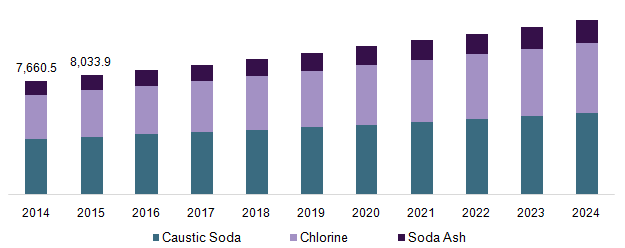

The North America chlor-alkali market size was valued at USD 13.68 billion in 2015 and is expected to grow at an estimated CAGR of 4.1% from 2016 to 2024. Growing production capacities along with rising consumption from various end-use industries for chlor-alkali products is anticipated to fuel market growth. Increased use of chlorine-based products in the detergents, soaps, textiles, glass, etc. is expected to drive demand over the forecast period.

Chlorine and caustic soda being the building blocks for numerous chemicals and other intermediate products have supported the chlor-alkali industry development. A positive outlook for soda ash from the recent drop in consumption is also expected to foster growth over the forecast period. The chlor-alkali production also includes other chlorine derivatives such as hydrogen, hydrochloric acid, and polyvinyl chloride resin among others.

U.S. chlor-alkali market volume by product, 2014 - 2024 (USD Million)

Hydrogen gas is used in the hydrogenation of edible oils and the manufacture of soaps and petroleum products. The growing preference for various chlorine-based products in the U.S. and Canada is anticipated to foster growth over the coming years. However, sluggish industrial growth and a slowing economy are expected to hinder demand in Mexico.

Adverse effects on the environment as a result of a high level of mercury production as a by-product and carbon emission during chlor-alkali production are expected to restrain the growth. Furthermore, the highly energy-intensive manufacturing process results in high production costs, which in turn is anticipated to hinder the market over the forecast period.

Adoption of many R&D activities towards the development of new production processes such as the membrane process instead of the mercury process for caustic soda production are expected to provide new opportunities to the manufacturers.

Product Insights

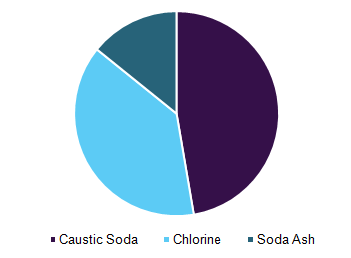

Chlorine segment has experienced a rapid expansion in the last few years due to growing industries such as insecticides, pharmaceuticals, textiles, aromatics, etc. Chlorine is used as a raw material for manufacturing a wide range of chemicals, which is further projected to boost consumption.

Chlorine is an important raw material used in the production of polyvinyl chloride. The rising demand for PVC in the construction industry is anticipated to propel growth. Chlorine is expected to emerge as the fastest-growing as well as the largest product segment.

Chlor-alkali market volume by product, 2015 (USD Million)

Caustic soda is known to be a strong alkali compound and reacts with various substances including zinc, aluminum, etc. This is an important factor likely to boost the demand in upcoming years. Further, the rising consumption of caustic soda in alumina extraction is also anticipated to foster development.

Regional Insights

The U.S. is expected to emerge as the fastest-growing region in North America. Increasing R&D activities towards the development of new products and production processes are expected to provide new opportunities to the companies in this region. Mercury is not generally perceived as a risk in Mexico, and no stringent standards have been implemented to govern these specific products.

In Canada, the growing chemical industry is expected to play a key role in supporting demand. According to the Chemistry Industry Association of Canada, chemical exports in Canada were around USD 19 billion, the U.S. being one of the major importers. Thus, trade relations with the U.S. are expected to play a key role in the future growth of this product.

Competitive Insights

The chlor-alkali industry is anticipated to be a pro-cyclical industry and product consumption is directly influenced by trends in economic activity. The business of end users especially companies manufacturing paper, vinyl, PVC, etc. are cyclical, and have historically experienced periodic downturns.

These economic downturns are likely to be characterized by reduced product demand, excess manufacturing capacity, and low average selling prices. Hence, end-user business activities greatly influence operations as well as the financial condition of raw material suppliers as well as manufacturers.

Capacity expansion and joint ventures, to fulfill growing requirement are expected to create new opportunities for the market players. Pricing policies of key players are likely to be influenced by fluctuations in energy prices, as chlor-alkali production is an energy-intensive process. Companies such as Olin Corporation, Ineos Group Limited, Occidental Petroleum Corporation, etc are some of the key participants.

Report Scope

Attribute

Details

Base year for estimation

2016

Actual estimates/Historical data

2014 - 2016

Forecast period

2017 - 2024

Market representation

Volume in Kilo Tons and revenue in USD Million & CAGR from 2016 to 2024

Regional scope

North America

Country scope

U.S., Canada, Mexico

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

15% free customization scope (equivalent to 5 analyst working days)

If you need specific market information, which is not currently within the scope of the report, we will provide it to you as a part of customization

Segments Covered in the ReportThis report forecasts volume & revenue growth and provides an analysis of the latest trends in each of the sub-segments from 2014 to 2024. For the purpose of this report, Grand View Research has segmented North America chlor-alkali market on the basis of product and region:

-

Product Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2024)

-

Caustic Soda

-

Alumina

-

Inorganic Chemicals

-

Organic Chemicals

-

Food, Paper & Pulp

-

Soaps & Detergents

-

Textiles

-

Water Treatment

-

Steel/Metallurgy-Sintering

-

Others

-

-

Chlorine

-

EDC/PVC

-

Inorganic Chemicals

-

Organic Chemicals

-

Isocyanates

-

Chlorinated Intermediates

-

Propylene Oxide

-

Pulp & Paper

-

C1/C2, Aromatics

-

Water Treatment

-

Others

-

-

Soda Ash

-

Glass

-

Chemicals

-

Soaps & Detergents

-

Metallurgy

-

Water Treatment

-

Pulp & Paper

-

Others

-

-

-

Regional Outlook (Volume, Kilo Tons; Revenue, USD Million, 2014 - 2024)

-

North America

-

The U.S.

-

Canada

-

Mexico

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."