- Home

- »

- Advanced Interior Materials

- »

-

North America Ceramic Tiles Market, Industry Report, 2033GVR Report cover

![North America Ceramic Tiles Market Size, Share & Trends Report]()

North America Ceramic Tiles Market (2025 - 2033) Size, Share & Trends Analysis Report By Product (Glazed Ceramic Tiles, Porcelain Tiles, Scratch-free Ceramic Tiles), By Application (Wall Tiles, Floor Tiles), By End Use, By Country, And Segment Forecasts

- Report ID: GVR-4-68039-497-3

- Number of Report Pages: 101

- Format: PDF

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2033

- Industry: Advanced Materials

- Report Summary

- Table of Contents

- Segmentation

- Methodology

- Download FREE Sample

-

Download Sample Report

North America Ceramic Tiles Market Summary

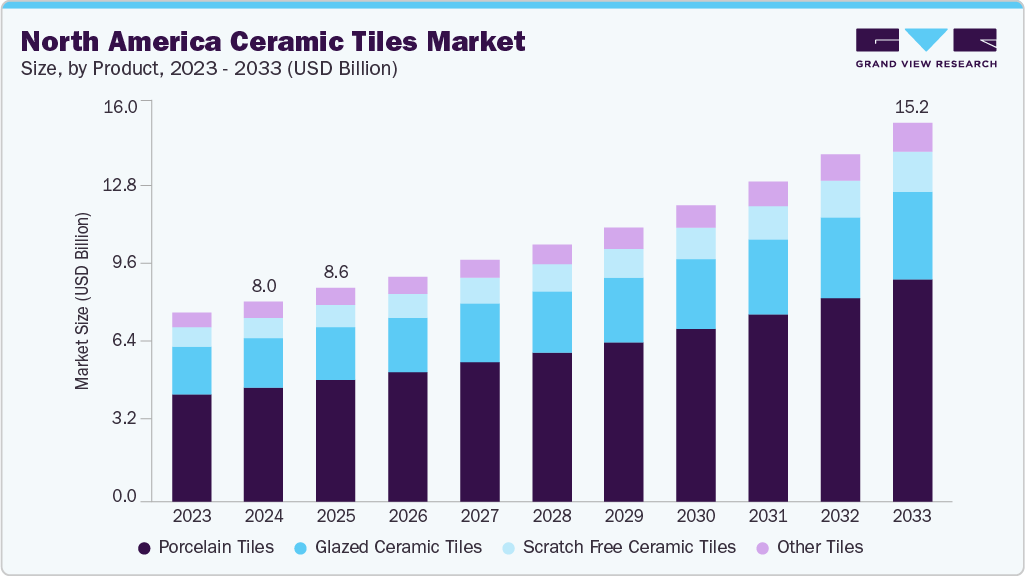

The North America ceramic tiles market size was estimated at USD 8.01 billion in 2024 and is projected to reach USD 15.18 billion by 2033, growing at a CAGR of 7.4% from 2025 to 2033. Increasing residential construction activities in the region are augmenting the demand for construction materials, including ceramic tiles, in North America.

Key Market Trends & Insights

- The U.S. dominated the North America ceramic tiles market with the largest revenue share of 48.4% in 2024.

- By product, the porcelain tiles segment is expected to grow at fastest CAGR of 7.8% over the forecast period.

- By application, the wall tiles segment is expected to grow significantly at CAGR of 7.7% over the forecast period.

- By end use, the residential segment is expected to grow at fastest CAGR of 8.3% over the forecast period.

Market Size & Forecast

- 2024 Market Size: USD 8.01 Billion

- 2033 Projected Market Size: USD 15.18 Billion

- CAGR (2025-2033): 7.4%

- Europe: Largest market in 2024

- U.S.: Largest market in 2024

The demand for ceramic tiles is further projected to grow in the region in the coming years owing to their durability, rigidity, and easy maintenance. Ceramic tiles are increasingly being used in the construction industry and are a very common choice for kitchen and bathroom flooring and wall applications. The growing demand for ceramic tiles in this industry rises from the need to address current construction problems as well as future innovative structural designs. Presently, construction problems include widespread infrastructural decay, which is attributed to the exhaustion of material life for many concrete structures.

The establishment of a distribution channel to cater to the consumers is posing a challenge for the industry players. The distributors of ceramic tiles are appointed on the basis of their regional presence, warehousing capabilities, capital investment capacity, and logistics. Moreover, material handling is another concern for the safe delivery of ceramic tiles to end users.

Key players compete on the basis of product quality, pattern, texture, and delivery time to target their customers. They primarily focus on offering high-quality products to customers as per their budgets to gain customer satisfaction. Sourcing strategies include strategic relationships with raw material suppliers to ensure uninterrupted production. They tend to collaborate with multiple suppliers to avoid disruptions in the raw material supply. This prevents raw material shortage, which could lead to disruption in product supply.

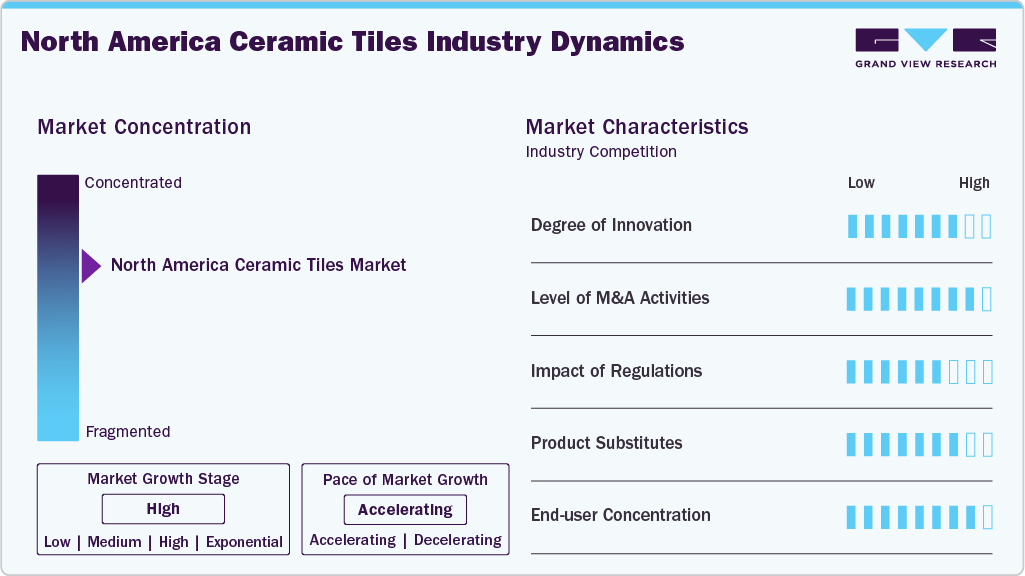

Market Concentration & Characteristics

Market growth stage is high, and pace of growth is accelerating. The industry is fragmented and characterized by the presence of medium-to large-scale players. Companies are focused on offering vast product portfolios to customers in terms of sizes, materials, designs, and colors. They offer customizations in terms of designs and provide consultation services to homeowners, builders, and architects regarding room sizes, colors, and designs. They also launch product lines leveraging innovative technologies, thus widening their product portfolio.

Advancements in inkjet technology have enabled manufacturers to replicate the intricate veining patterns and color depth of natural stones such as marble, travertine, slate, and limestone. Marble-styled tiles are witnessing a growing adoption rate due to their minimalist looks and elegance. These tiles are primarily preferred for bathrooms and corridors in commercial buildings such as shopping malls, hotels, restaurants, and religious buildings.

The ceramic tiles market is governed by several regulations and standards in terms of its use and production. Several agencies, such as the American Society for Testing and Materials (ASTM), the American National Standards Institute (ANSI), and the International Organization for Standardization (ISO), have imposed regulations on the production and installation of ceramic tiles.

Product Insights

Porcelain tiles dominated the market with a revenue share of 57.0% in 2024 and is further expected to grow at the fastest rate over the forecast period. Porcelain tiles are made from fine, dense clay, which is fired at extreme temperatures to make them highly durable. The features of porcelain tiles, including resistance to bacteria and mold, lead to their long-term value in floor covering. In addition, they are not easily faded and have limited maintenance requirements. Porcelain tiles are chemical and stain resistant and, therefore, highly suitable for use in commercial spaces such as hotels, shopping malls, and institutional buildings.

The scratch-free ceramic tiles segment is expected to grow significantly at a CAGR of 7.3% over the forecast period. These are mainly used in special and heavy-duty applications as they can withstand highly stressed usage conditions of landscapes, pathways, parking, and shop floors. In addition, these tiles are used as staircase solutions, high-traffic tiles, external wall cladding, and swimming pool tiles. Manufacturers are developing new scratch-free ceramic tiles with high durability and functionality for use in spaces exposed to high wear and tear such as restaurants and passages.

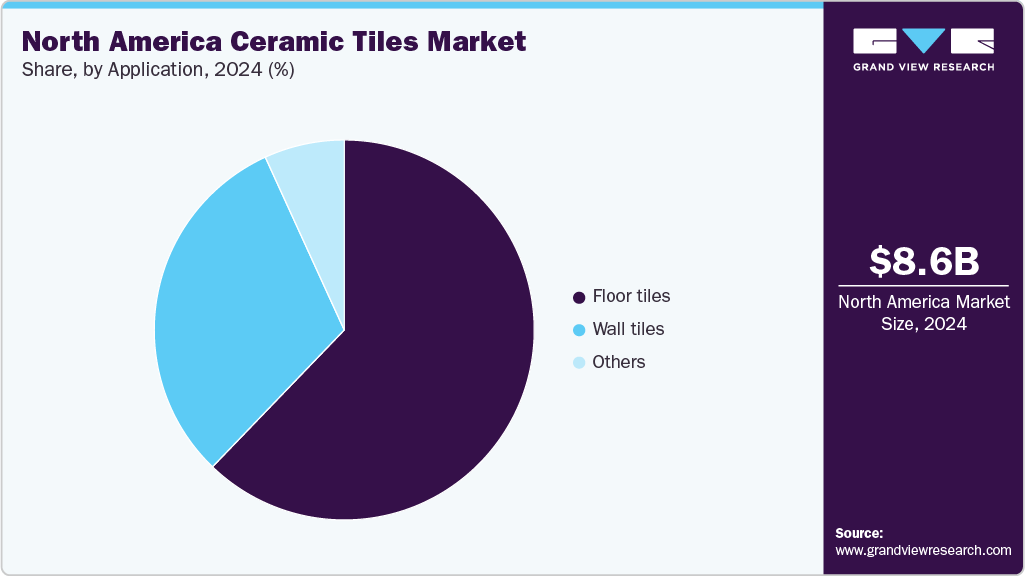

Application Insights

The floor tiles application segment accounted for the largest revenue share of 62.2% in 2024. The preference of consumers is changing towards low-cost and maintenance-free ceramic tiles from traditional marble and stone. Ceramic tiles are stain-resistant and maintain their appearance for a longer period. The demand for ceramic tiles is emerging rapidly on account of their exceptional durability and longevity, making them an ideal choice for flooring applications in high-traffic areas, such as entrances, hallways, kitchens, and living rooms.

The wall tiles segment is expected to grow notably at a CAGR of 7.7% over the forecast period and are increasingly being adopted in newer residential settings, such as in halls, lobbies, and bedrooms. Moreover, these tiles are emerging as a cost-effective alternative to conventional stone materials that are used in commercial settings, such as corporate offices, hotel lobbies, and museums. These trends are, therefore, projected to drive the overall demand for ceramic wall tiles in North America over the forecast period.

Ceramic tiles are known for their durability and longevity, making them suitable for high-traffic areas and environments prone to moisture, such as bathrooms, kitchens, and entryways. The robustness of ceramic tiles ensures that wall surfaces remain intact and attractive over time, reducing the need for frequent maintenance or replacement.

End Use Insights

The residential end use segment accounted for the largest revenue share of 56.8% in 2024 and is further expected to grow at a fastest CAGR over the forecast period. This end use is inclusive of residential buildings, apartments, complexes, and small houses. Ceramic tiles are majorly used in residential applications owing to their low costs, high durability, and excellent shock, stain, and dirt resistance. These tiles are used for flooring and are available in various patterns and shades, thereby making them a perfect choice to create patterns resembling natural stone and wood.

Commercial segment is expected to grow significantly at CAGR of 6.1% over the forecast period. Ceramic tiles are also used in various commercial applications such as offices, malls, lobbies, institutions, and hospitals. The rise in the number of commercial establishments in North America that are undergoing renovations, along with ongoing industrialization, is expected to fuel the growth of commercial segment of the market in the coming years.

Country Insights

The North America ceramic tiles industry is expected to witness significant growth over the coming years on account of the increasing construction of commercial and residential commercial buildings in the region. The market is witnessing a rapid shift toward the domestic production of ceramic tiles, which is backed by the growing demand from flooring and walling applications.

U.S. Ceramic Tiles Market Trends

The U.S. ceramic tiles industry is primarily driven by strong growth in residential and commercial construction activities, supported by rising renovation and remodeling projects across the country. Increasing consumer preference for durable, easy-to-maintain, and aesthetically appealing flooring solutions is enhancing the demand for ceramic tiles in both new and existing homes. Besides, the integration of advanced digital printing and 3D manufacturing technologies has enabled manufacturers to offer a wider range of design options that mimic natural materials like stone and wood. The trend toward sustainable building materials is also encouraging the use of eco-friendly ceramic tiles. Furthermore, the expansion of the real estate sector and infrastructure investments by the government continue to bolster market growth in the United States.

Canada Ceramic Tiles Market Trends

The ceramic tiles industry in Canada is fueled by growing residential construction and renovation projects, particularly in urban areas such as Toronto, Vancouver, and Montreal. The increasing adoption of energy-efficient and sustainable building materials is leading consumers and builders to prefer ceramic tiles due to their durability and low environmental impact. Rising disposable incomes and a growing interest in interior aesthetics are further accelerating demand for premium and customized tile designs. Additionally, favorable government incentives promoting green buildings and energy conservation are positively impacting the use of ceramic tiles in flooring and wall applications. The influence of international design trends and the availability of imported products are also expanding the market’s design variety and competitiveness in Canada.

Mexico Ceramic Tiles Market Trends

The Mexico ceramic tiles industry is strengthened by rapid urbanization and the robust expansion of residential and commercial infrastructure projects across major cities. Affordable housing programs initiated by the government, along with increasing foreign investments in construction and real estate, are stimulating market demand. The availability of locally sourced raw materials such as clay and silica supports cost-effective production, enhancing the competitiveness of domestic manufacturers. Furthermore, Mexico’s rising middle-class population is increasingly inclined toward modern interior décor, boosting demand for decorative and high-quality ceramic tiles. The growth of export activities to North and Central American countries, supported by trade agreements such as the USMCA, further contributes to the positive outlook of Mexico’s ceramic tile industry.

Key North America Ceramic Tiles Company Insights

Some of the key players operating in the market include MOHAWK INDUSTRIES, INC., Shaw Industries Group, and Interceramic.

-

MOHAWK INDUSTRIES, INC. is primarily engaged in the production of flooring components. It designs, sources materials, manufactures, and distributes different types of flooring materials to markets including residential new construction, residential replacement, and commercial constructions. The company operates its business through segments: Global Ceramics, Flooring North America, and Flooring Rest of the World. This company majorly operates in the U.S., Europe, Russia, Australia, and New Zealand and has sales operations catering to over 170 countries.

-

Shaw Industries Group operates as a subsidiary of Berkshire Hathaway, Inc., which is engaged in freight rail transport, insurance, and utility businesses across the globe. Shaw Industries Group, Inc. is engaged in designing, manufacturing, and supplying of flooring materials to residential and commercial flooring applications. The geographies served by the company include major states in the U.S., Australia, Canada, China, India, Singapore, the UK, Brazil, Chile, France, Mexico, and the UAE.

Roca Tiles USA and ANN Sacks Tile & Stone are some of the emerging market participants in market.

-

Roca Tiles USA is engaged in the manufacturing, distributing, and marketing of ceramic and porcelain tile under the brand of ‘Roca’ and ‘United States Ceramic Tile’. The company’s product portfolio includes wall tile and high-resistant outdoor and indoor floor tiles. It includes a wide array of complementary tile pieces in different colours, marble, concrete, wood, fabric, and decorative tiles.

-

ANN Sacks Tile & Stone is a subsidiary of Kohler Co. that is engaged in the manufacturing and distribution of tile, stone, and plumbing products. The products offered by the company find application in residential spaces including room, bathroom, kitchen, and living spaces. The company serves various consumers, architects, designers, and trade professionals with designed tile & stone, plumbing fittings & fixtures, along with lighting, cabinetry, and accessories for home, bath and kitchen spaces.

Key North America Ceramic Tiles Companies:

- MOHAWK INDUSTRIES, INC.

- Crossville, Inc.

- Florida Tile, Inc.

- Roca Tiles USA

- Daltile

- Shaw Industries Group

- Interceramic

- Vitromex USA, Inc.

- Emser Tile

- ANN Sacks Tile & Stone

Recent Developments

- In June 2023, Crossville, Inc. announced the introduction of a new line of porcelain tile panels called ‘Sahara Noir’. The line is made in Italy by Laminam and stocked in the U.S. Sahara Noir porcelain tile panels are available in 1200 mm x 3000 mm size format, which is wider than traditional porcelain panels, and are available in 5.6 mm thickness, ideal for counters, interior and exterior walls, flooring in dry interior spaces, and furniture.

North America Ceramic Tiles Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 8.56 billion

Revenue forecast in 2033

USD 15.18 billion

Growth rate

CAGR of 7.4% from 2025 to 2033

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2033

Quantitative units

Volume in million square meters and revenue in USD Million/billion and CAGR from 2025 to 2033

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Product, application, end use, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

MOHAWK INDUSTRIES, INC.; Crossville, Inc.; Florida Tile, Inc.; Roca Tiles USA; Daltile; Shaw Industries Group; Interceramic; Vitromex USA, Inc.; Emser Tile; ANN Sacks Tile & Stone

Customization scope

Free report customization (equivalent up to 8 analysts’ working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Ceramic Tiles Market Report Segmentation

This report forecasts revenue growth at regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Grand View Research has segmented the North America ceramic tiles market report based on product, application, end use, and country.

-

Product Outlook (Volume, Million Square Feet; Revenue, USD Million, 2021 - 2033)

-

Glazed Ceramic Tiles

-

Porcelain Tiles

-

Scratch-free Ceramic Tiles

-

Other Products

-

-

Application Outlook (Volume, Million Square Feet; Revenue, USD Million, 2021 - 2033)

-

Wall Tiles

-

Floor Tiles

-

Other Applications

-

-

End Use Outlook (Volume, Million Square Feet; Revenue, USD Million, 2021 - 2033)

-

Residential

-

Commercial

-

-

Country Outlook (Volume, Million Square Feet; Revenue, USD Million, 2021 - 2033)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America ceramic tiles market size was estimated at USD 8.01 billion in 2024 and is expected to reach USD 8.56 billion in 2025.

b. The North America ceramic tiles market is expected to grow at a compound annual growth rate of 7.4% from 2025 to 2033 to reach USD 15.18 billion by 2033.

b. Porcelain tiles dominated the market with a revenue share of 57.0% in 2024 and is further expected to grow at fastest rate over the forecast period. Porcelain tiles are made from fine, dense clay, which is fired at extreme temperatures to make them highly durable.

b. Key players operating in the market are MOHAWK INDUSTRIES, INC., Crossville, Inc., Florida Tile, Inc., Roca Tiles USA, Daltile, Shaw Industries Group, Interceramic, Vitromex USA, Inc., Emser Tile, ANN Sacks Tile & Stone

b. The key factors that are driving the North America ceramic tiles include increasing residential construction activities in the region.

Share this report with your colleague or friend.

Need a Tailored Report?

Customize this report to your needs — add regions, segments, or data points, with 20% free customization.

ISO 9001:2015 & 27001:2022 Certified

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

Trusted market insights - try a free sample

See how our reports are structured and why industry leaders rely on Grand View Research. Get a free sample or ask us to tailor this report to your needs.