- Home

- »

- Pharmaceuticals

- »

-

North America Cannabis Technology Market, Report, 2030GVR Report cover

![North America Cannabis Technology Market Size, Share & Trends Report]()

North America Cannabis Technology Market Size, Share & Trends Analysis Report By Application (Retail & Dispensing, Cultivation & Agriculture, Processing & Manufacturing), By Technology (Software, Hardware), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-302-5

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

North America Cannabis Technology Market Trends

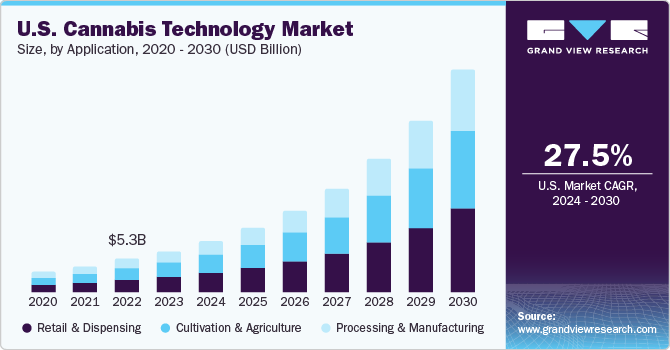

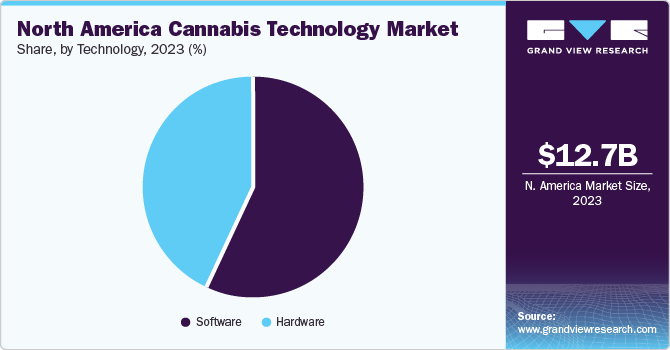

The North America cannabis technology market size was estimated at USD 12.70 billion in 2023 and is expected to grow at a CAGR of 28.3% from 2024 to 2030. The cannabis technology market or cannatech market growth is attributed to various factors, including the legalization of cannabis across many states in the U.S. and Canada, growing demand from consumers for higher quality and a wider variety of cannabis products, the emergence of advanced analytics, and the adoption of AI-driven solutions aimed at enhancing efficiency within the cannabis sector. For instance, a report by the Cannabis Business Times highlighted that over two-thirds (68%) of cannabis growers implement technology to manage temperature controls automatically.

The growing acceptance of both medicinal and recreational marijuana in numerous states in the U.S. and across Canada has significantly increased the market demand for cannabis products, along with the technologies necessary for their effective production, distribution, and retail. This increasing demand is further driven by strict regulatory environments that require thorough adherence to compliance standards. Consequently, advanced technological solutions have become crucial, especially in seed-to-sale tracking systems. These systems are designed to provide transparency and ensure compliance with legal standards across the supply chain.

By closely tracking every step from growth to the final sale, these systems meet regulatory demands while improving operational efficiency and building consumer confidence in the legal marijuana industry. For instance, in February 2024, New York's legal cannabis operators are facing a tight deadline to implement seed-to-sale tracking systems amid regulators' lack of clear guidance. In late 2022, the Office of Cannabis Management chose BioTrack as the state's official seed-to-sale software. Recently, the OCM emailed cultivators, processors, and retailers to notify them to adopt BioTrack's system or an alternative that can integrate with BioTrack within the next two months.

Integrating big data analytics and sophisticated Customer Relationship Management (CRM) systems is transforming the cannabis sector by providing essential optimization and strategic planning tools. By harnessing big data analytics, cannabis firms can gather and scrutinize huge data of information from sales, cultivation, and consumer engagements, aiding in identifying consumer trends, optimizing growing conditions, and tracking market movements. For example, analyzing purchasing trends helps fine-tune inventory and marketing efforts to match consumer demand.

Moreover, advanced CRM systems offer deep insights into customer behaviors and preferences, allowing for the segmentation of customers, personalization of marketing efforts, and enhancement of customer service. This tailored approach boosts customer satisfaction & loyalty and streamlines sales processes & lead management, improving sales outcomes. These technologies enable cannabis companies to make informed decisions, optimize their operations from cultivation to sale, and develop targeted marketing strategies that drive engagement and growth. This integrated approach enhances efficiency and positions businesses better to meet the evolving needs of the cannabis market.

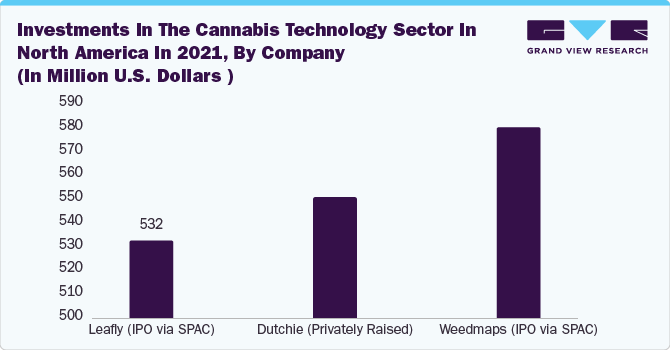

Substantial investments from venture capitalists and private equity firms significantly drive the rapid growth of cannabis technology (CannaTech) companies. These investors channel large amounts of capital into the industry, which is crucial for funding research and the development of cutting-edge technologies. This influx of funds supports the creation of advanced cultivation systems, innovative extraction methods, and sophisticated compliance and tracking software. Moreover, these investments enable cannabis tech companies to expand their operations, scale their businesses, and enter new markets, increasing their market presence and competitiveness.

Furthermore, the trend of cannabis companies going public opens new avenues for financial growth. Initial Public Offerings (IPOs) and other public market activities attract institutional investors, who bring substantial financial resources and credibility to the industry. This increased interest from institutional investors is not only providing the necessary capital for ongoing technological advancements but also fostering a more stable and mature market environment. These public investments help cannabis tech companies to invest in long-term projects, enhance their R&D capabilities, and adopt advanced technologies that drive efficiency and innovation.

Market Concentration & Characteristics

The CannaTech market exhibits a high degree of innovation, driven by rapid advancements in technology and a growing demand for efficiency and compliance. Innovations include precision agriculture techniques such as automated lighting and irrigation systems, advanced extraction methods that enhance product quality, and comprehensive seed-to-sale tracking systems ensuring regulatory compliance. For instance, in July 2021, Agrify Corporation launched Agrify University, a modern 3,500-square-foot indoor vertical farming facility showcasing their latest technology and advanced cultivation techniques. This aims to equip Agrify customers and future growers with the expertise needed to efficiently cultivate cannabis on a large scale using Agrify's vertical farming units (VFUs) and Agrify Insights software.

A diverse range of growth strategies are adopted by companies to strengthen their market positions and revenues, further facilitating market growth. For instance, in January 2023, Akerna announced the sale of its subsidiary, 365 Cannabis, to 365 Holdco LLC. The transaction was completed as per a stock purchase agreement (SPA) dated January 11, 2023. Akerna received USD 500,000 in cash and agreed to cancel an earn-out payment valued at USD 2,283,806 owed to 365 Holdco's principals.

Regulations play an important role in the cannabis technology market. For instance, in regions where cannabis legalization is stringent, technology companies must navigate complex legal frameworks, including strict compliance requirements for tracking, tracing, and labeling cannabis products. These regulations stimulate the development of specialized software solutions, such as seed-to-sale tracking systems, to ensure compliance with legal obligations.

U.S. cannabis regulations vary widely among states, with laws governing cultivation, distribution, sale, and consumption, reflecting a complex interplay of federal and state-level policies.

Canada's cannabis regulations, governed by the Cannabis Act, oversee the cultivation, distribution, sale, and consumption of cannabis products nationwide, with provincial and territorial variations in implementation.

Mexico's cannabis regulation, following the legalization bill passed by the Senate in 2021, oversees the cultivation, distribution, sale, and consumption of cannabis for recreational and medicinal purposes, subject to licensing and regulatory frameworks.

Several market players are expanding their business into new regional countries to strengthen their market position and product portfolio. For instance, in October 2022, TILT Holdings Inc., a global supplier of cannabis industry services encompassing inhalation technologies, cultivation, manufacturing, processing, brand development, and retail, has unveiled the introduction of “H” by Ricky Williams former National Football League (NFL) player, in Pennsylvania.

Application Insights

The retail and dispensing segment dominated the market and held largest revenue share of 37.9% in 2023, due to its direct interaction with consumers and its role in the cannabis supply chain. Retail outlets and dispensaries serve as the primary point of sale for cannabis products, providing customers access to a wide range of offerings while offering education and guidance on product selection and usage. The retail and dispensing sector frequently leads by introducing innovations such as point-of-sale systems, customer relationship management tools, and online ordering platforms. For instance, in April 2024, Clearleaf Inc., introduced SampleDirect, a platform that streamlines product and trade marketing opportunities for cannabis sales brokers and brands, while also enhancing product selection and knowledge for retailers. It allows brands to accurately measure the return on investment of their sampling initiatives. The platform integrates with existing POS systems including Greenline, TechPOS, and Cova, ensuring seamless operation and data synchronization.

The cultivation and agriculture segment is expected to witness fastest growth over the forecast period from 2024 to 2030. The expansion of the cannabis sector is primarily fueled by its growing legalization and its use in treating chronic conditions. The easing of cannabis cultivation laws, particularly for hemp due to its minimal THC content, is also boosting its acceptance in the region. Moreover, the decriminalization of marijuana across various regions and its rising use in healthcare are significant contributors to the surge in cannabis cultivation.

Technological advancements in cultivation methods, including advanced lighting systems, automated irrigation, and precision monitoring tools, enable cultivators to optimize growing conditions, increase yields, and reduce operational costs. For instance, In September 2022, Andrew Wilson, the Founder and CEO of GrowerIQ, highlights the comprehensive compliance obligations associated with lawful cannabis cultivation, which frequently pose significant challenges for growers in maintaining adherence to regulations. GrowerIQ aims to provide operational support for cannabis producers globally, facilitating their effective operation management and ensuring compliance with the stringent regulatory demands they face. GrowerIQ has secured USD 2.19 million in seed financing to widen the distribution of its ERP software tailored for the cannabis sector.

Technology Insights

The software segment dominated the North America cannabis technology market in terms of revenue in 2023 and is also expected to witness fastest growth over the forecast period with a CAGR of 29.0% from 2024 to 2030. Cannabis software streamlines operations for businesses in the cannabis industry by reducing complex, multi-step processes to just a few clicks. It offers multiple features that help track the manufacturing process, collect & analyze data, and facilitate communication across various departments, thereby enhancing efficiency & productivity. Specialized software solutions are essential for ensuring adherence to the regulations, managing inventory, and maintaining detailed records, making them indispensable for businesses operating in the cannabis space. Software solutions also play a crucial role in enhancing customer experience through online ordering platforms, loyalty programs, and integrated point-of-sale systems, thereby driving revenue growth for dispensaries and retailers.

The cannabis software solutions range from dispensary software facilitating deliveries and social networking to payment systems that facilitate the use of digital currencies, along with analytical tools that monitor real-time sales and stock levels. Customer Relationship Management (CRM) and inventory software also streamline operations, while Enterprise Resource Planning (ERP) systems offer comprehensive management of nearly all business aspects, including compliance reporting. For cultivators, specific software aids in product testing, intellectual property rights protection through DNA mapping, and manufacturing processes for cannabis products.

Moreover, the industry benefits from advanced advertising technologies that cater to an expanding market. This comprehensive suite of software solutions is critical for companies within the rapidly changing cannabis industry, fostering operational efficiency, regulatory compliance, and business expansion. For instance, in April 2024, Flowhub, the dispensary growth platform serving cannabis retailers revealed its integration with BioTrack, the official government traceability system employed in 11 legal cannabis markets across the U.S. This integration widens Flowhub's national presence to 36 states, streamlining dispensary operations through a centralized platform tailored to address the evolving requirements of cannabis retailers.

Country Insights

U.S. Cannabis Technology Market Trends

The U.S. CannaTech market dominated the North American region in revenue share of over 50% in 2023. In the U.S., cannabis technology is experiencing significant growth, driven by increasing legalization and acceptance of cannabis for medical purposes. Additionally, the 2020 House of Representatives' move to de-schedule cannabis from the Controlled Substances Act is expected to create substantial market opportunities, further driving the demand for advanced cannabis technologies. As more states move towards cannabis legalization, various industry stakeholders such as investors, manufacturers, and researchers are capitalizing on the opportunity, driving the adoption of cannabis technologies to enhance production and distribution.

Businesses increasingly leverage data & technology to gather & implement actionable insights, allowing them to optimize operations, develop strategies, plan effectively, report accurately, and identify & address business-related issues. In 2023, artificial intelligence (AI) surged in areas such as cultivation automation, dispensary sales, customer service chatbots, and mobile apps. AI and machine learning are enhancing efficiency by identifying stable genetics, increasing crop yields, and reducing labor costs across the supply chain. These advancements help eliminate redundancies and boost profitability. This trend is expected to continue in 2024 as the digital landscape evolves, making operations faster and smarter.

Canada Cannabis Technology Market Trends

The Canada cannabis technology (CannaTech) market is expected to witness significant growth. The cannabis technology market in Canada is a rapidly growing industry, reflecting the broader global trend towards the legalization and acceptance of cannabis for both medical and recreational use. Since the legalization of cannabis in Canada in October 2018, there has been a significant surge in innovation and investment in technology that supports the cannabis industry. This includes advancements in cultivation technologies, product tracking, consumer sales platforms, and compliance software. Furthermore, various companies in the country are launching advanced cannabis software to maintain a competitive edge. For instance, In April 2024, Clearleaf Inc. launched SampleDirect, a platform that transforms the landscape of product and trade marketing for cannabis brands and sales brokers.

Similarly, in September 2023, Square partnered with Jane Technologies to penetrate the Canadian cannabis market through an online ordering service tailored for cannabis dispensaries. This partnership aims to meet the demands of cannabis retailers in Canada by offering a seamless and effective commerce solution. In June 2023, Cova Software, a cannabis retail software company, launched Cova Pay in Canada. This innovative payment processing solution is designed for cannabis shops and integrates with the Cova Point of Sale (POS) system.

Mexico Cannabis Technology Market Trends

The Cannabis Technology market in Mexico is expected to witness fastest growth over the forecast period following the country's recent legislative advancements towards legalizing cannabis for recreational and medicinal use. This emerging market is driven by the need for strong regulatory compliance solutions as Mexico establishes its legal framework, creating demand for advanced seed-to-sale tracking software and inventory management systems to ensure adherence to new laws. Additionally, there is a strong focus on cultivation technology, with advanced solutions for indoor and outdoor growing environments aimed at optimizing yield, quality, and cost-efficiency. For instance, in March 2024, internationally acclaimed wrestler Ric Flair and boxer Mike Tyson announced an exclusive partnership with Elevated Labs in New Mexico. This partnership aims to provide consumers with premium cannabis products.

Key North America Cannabis Technology Company Insights

Key companies in the market are adopting various strategies, including mergers & acquisition, partnerships & collaborations, and new product launches, to increase their market share and strengthen their position in the market. For instance, In July 2023, Barbados' cannabis authority launched a new collaboration with cannabis technology company GrowerIQ to oversee the tracking and reporting of all cannabis production activities. This partnership aims to establish cutting-edge standards for growing medical cannabis sector. Some of the key players operating in the market include 365 Cannabis, dutchie, Akerna Agrify, Nugistics, Ample Organics, Simplifya, GrowerIQ, Distru Greenline, and BioTrackTHC.

Key North America Cannabis Technology Companies:

- 365 Cannabis

- dutchie

- Akerna Agrify

- Nugistics

- Ample Organics

- Simplifya

- GrowerIQ

- Distru

- Greenline

- BioTrackTHC

Recent Developments

-

In April 2024, Agrify Corp., a company specializing in cannabis production technology, announced that it will be acquired by Nature’s Miracle Holding, a controlled environment agriculture technology firm. The equity of Agrify in this deal is valued at approximately USD 6.3 million. The overall value of the transaction has not been disclosed.

-

In January 2024, the cannabis technology company GrowerIQ has finalized its acquisition of Ample Organics, a Canadian tech platform business, in a deal that signifies a significant expansion of its presence in both the Canadian and international markets. GrowerIQ acquired Ample from U.S.-based Akerna Corp.

-

In November 2023, TILT Holdings Inc., a global provider of comprehensive cannabis business solutions, announced a partnership to distribute Flower by Edie Parker in Pennsylvania via its subsidiary, Standard Farms, LLC.

-

In October 2023, Alpine IQ, a leader in data-driven marketing, analytics, and loyalty solutions announced its enhanced integration with 365 Cannabis, a comprehensive ERP software solution. This upgraded integration streamlines interactions between customers and retailers, providing retailers with tools to boost customer loyalty and increase sales.

-

In April 2023, Akerna Corp. announced that it will sell its cannabis software division, encompassing MJ Platform and Leaf Data Systems, to MJ Freeway Acquisition Co for USD 5 million in cash. Alleaves is joining in the funding for this acquisition. The deal's closure is scheduled to align with the previously disclosed Gryphon Digital Mining merger.

-

In October 2022, Cannabis technology platform Dutchie announced that it will start offering a comprehensive insurance program specifically designed for businesses in the legal marijuana industry. This new insurance program aims to address the unique risks and challenges faced by cannabis businesses, providing coverage options that are often difficult to secure through traditional insurance providers.

- In May 2022, California-based cannabis technology company Blaze Solutions has acquired Canada-based dispensary point-of-sale software company Greenline. The financial terms of the deal have not been disclosed.

North America Cannabis Technology Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 15.91 billion

Revenue forecast in 2030

USD 71.07 billion

Growth rate

CAGR of 28.3% from 2024 to 2030

Actual data

2018 - 2023

Forecast data

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Technology, application, and country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

365 Cannabis; dutchie; Akerna Agrify; Nugistics; Ample Organics; Simplifya; GrowerIQ; Distru Greenline; BioTrackTHC

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Cannabis Technology Market Report Segmentation

This report forecasts revenue growth and provides at regional and country levels an analysis of the latest trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America cannabis technology market report based on application, technology, and country:

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Retail & Dispensing

-

Cultivation & Agriculture

-

Indoor Cultivation

-

Greenhouse Cultivation

-

Outdoor Cultivation

-

-

Processing & Manufacturing

-

-

Technology Outlook (Revenue, USD Million, 2018 - 2030)

-

Software

-

ERP (Enterprise Resource Planning) Solutions

-

Point-of-Sale (POS) Software

-

Patient/Customer Management Software

-

Others

-

-

Hardware

-

Grow Lights

-

Point-of-Sale (POS) Systems

-

Greenhouse Equipment

-

Trimming Machines

-

Packaging and Labeling Machinery

-

Hydroponic Systems

-

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America cannabis technology market size was estimated at USD 12.7 billion in 2023 and is expected to reach USD 15.91 billion in 2024.

b. The North America cannabis technology market is expected to grow at a compound annual growth rate of 28.3% from 2024 to 2030 to reach USD 71.07 billion by 2030.

b. The U.S. cannabis technology market dominated the North American region in revenue share of over 50% in 2023. In the U.S., cannabis technology is experiencing significant growth, driven by increasing legalization and acceptance of cannabis for medical purposes.

b. Some key players operating in the market include 365 Cannabis, dutchie, Akerna Agrify, Nugistics, Ample Organics, Simplifya, GrowerIQ, Distru Greenline, and BioTrackTHC

b. The cannabis technology market or cannatech market growth is attributed to various factors, including the legalization of cannabis across many states in the U.S. and Canada, growing demand from consumers for higher quality and a wider variety of cannabis products

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."