North America Cannabis Grow Lights Market Size, Share & Trends Analysis Report By Product (Light-Emitting Diode, High-Intensity Discharge Lamps), By Cultivation (Indoor, Greenhouse), By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-313-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

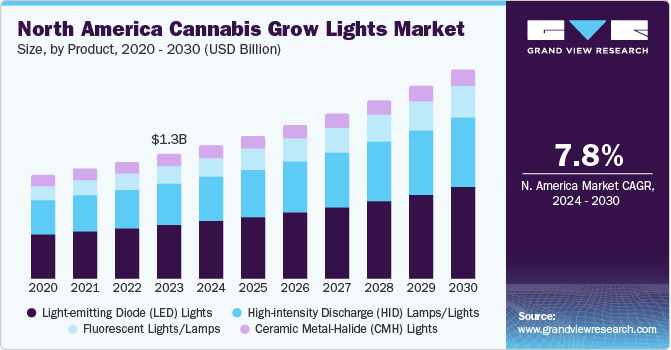

The North America cannabis grow lights market size was estimated at USD 1.30 billion in 2023 and is projected to grow at a CAGR of 7.8% from 2024 to 2030. Cost reductions in grow light fixation, technological advancements, and the growing adoption of high-intensity discharge (HID) lights boost the market growth. Furthermore, the rise in the use of cannabis for medical purposes, increased research activities regarding cannabis, and growing public awareness of the need for alternative cannabis farming, such as indoor and greenhouse cultivation, fuels market growth. According to Health Canada, there were 16.3 million square feet of licensed cultivation areas for cannabis indoor and greenhouse facilities in March 2023.

Rising technological advancements in cannabis grow lights are expected to accelerate the market growth. The adoption of smart agriculture techniques in the cannabis sector is rising by including artificial intelligence (AI) within lighting management systems. AI can process comprehensive datasets on plant growth, environmental conditions, and light spectrum to optimize cultivation settings. AI-controlled lighting systems can adjust the light spectrum to meet the needs of specific plants or entire crops. By using machine learning algorithms, these systems can understand and adapt to the unique requirements of different cannabis strains. This creates a continuous improvement cycle, refining the lighting conditions for maximum efficiency.

Moreover, cannabis legalization, higher return on investment, rising government initiatives, and growing funding for new indoor farms and greenhouses are all propelling the demand for cannabis grow lights in North America. For instance, in June 2023, The Maryland Department of Commerce opened applications for the initial round of funding through the Cannabis Business Assistance Fund. This fund provides grants and loans designed to enhance the ability of small businesses and entrepreneurs to engage in Maryland's adult-use cannabis industry. Thus, a rise in the cannabis business leads to an increase in cannabis cultivation, which boosts the demand for cannabis grow lights.

Furthermore, growing mergers and acquisitions in the cannabis industry are expected to boost market growth over the forecast period. For instance, the overall value of mergers and acquisitions in 2022 was USD 3.17 billion in the U.S. The top 10 states by mergers and acquisitions deals are as follows:

-

New York

-

Nevada

-

Arizona

-

Texas

-

Colorado

-

California

-

Pennsylvania

-

Massachusetts

-

Florida

-

Michigan

Moreover, according to the research conducted by Cannabis Business Times and Fluence, 15% of research participants reported using “light-emitting diodes” (LEDs) for vegetation, and 31% reported using LEDs for flowering in 2023 for cannabis cultivation. The adoption of various lights for the flowering stage in cannabis cultivation in 2023 is as follows,

|

Type of lights |

Adoption rate in 2023 |

|

LEDs |

73% |

|

Fluorescent lights (Compact, T5, Others) |

6% |

|

High Pressure Sodium (HPS) Lights |

31% |

|

Metal Halide (MH)Lights |

2% |

|

Others |

1% |

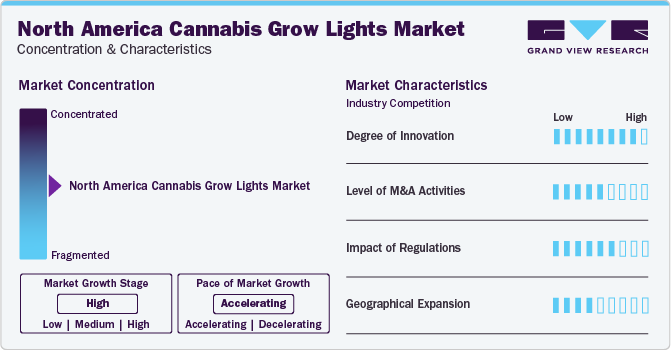

Market Concentration & Characteristics

The cannabis grow lights industry has witnessed high degree of innovation, driven by technological advancements in lighting & its fixation and cannabis cultivation. For example, Philips developed a GreenPower LED grid lighting portfolio for indoor cannabis cultivation with two new cannabis-specific spectra. The Efficient White spectrum is designed to enhance plant growth during vegetative phases. In contrast, the Efficient Broad White spectrum offers the most effective performance for the flowering stages, with an efficiency of approximately 3.0 μmol/J. Moreover, the upgraded grid lighting 1.1 version has expanded its voltage compatibility, ranging from 120 to 480V, which broadens its applicability across different cultivation practices and settings.

The market is characterized by a medium level of merger and acquisition (M&A) activities by leading players. These mergers and acquisitions facilitate access to complementary technologies, expertise, and distribution channels, enabling companies to accelerate product development, improve operational efficiency, and capture a larger share of the market. For instance, in November 2023, ACUITY BRANDS, INC., an industrial lighting technology company, acquired the Arize family of horticulture lighting products from Current Lighting Solutions, LLC. This acquisition is anticipated to enhance the growth of the company’s horticulture lighting business.

Regulations play an important role in shaping the cannabis grow lights market, ensuring the safety and quality of the light products. In Canada, the government continually tries to enhance the certification processes related to LED lighting and environmental protection. The aim is to maintain product integrity and ensure the public's safety through established regulatory standards.

Several market players are expanding their business by launching new products to expand their portfolio. Furthermore, rising product launches create more opportunities for market players. For instance, in March 2021, Thrive Agritech, Inc., an LED horticulture lighting company, introduced the Pinnacle LED grow light. This technology allows the 600W Pinnacle light to replace the best 1,000W effectively double-ended high-pressure sodium lights commonly found in greenhouses and high-intensity indoor cannabis operations.

Product Insights

The light-emitting diode (LED) segment dominated the market with the largest revenue share of around 43.0% in 2023. The demand for efficient and effective LED grow lights has increased with the rapid growth of the cannabis industry. This is due to the rising legalization of cannabis in North America, allowing more growers to legally cultivate cannabis for medical and recreational purposes.

Another factor driving the demand for these lights is the availability and enhanced performance of LED technology. In the past, these LED grow lights didn't produce enough light for plant growth. However, advancements in LED technology have culminated in the development of more luminous and efficient lighting solutions, successfully addressing this issue. Currently, LED grow lights offer plants full-spectrum light for growth and photosynthesis, which leads to healthier and higher-quality plants.

The high-intensity discharge (HID) lamps/lights segment is anticipated to grow at a CAGR of over 8.0% during the forecast period. HID lights are further segmented into high-pressure sodium bulbs and metal-halide (MH) lights. HPS lights are used for growing cannabis from seed to harvest. However, many cultivators prefer starting with an MH bulb to keep the plants shorter before switching to HPS for the flowering stage. HPS lights produce very high yields, making the buds grow big and fat. Such factors boost the segment growth over the forecast period.

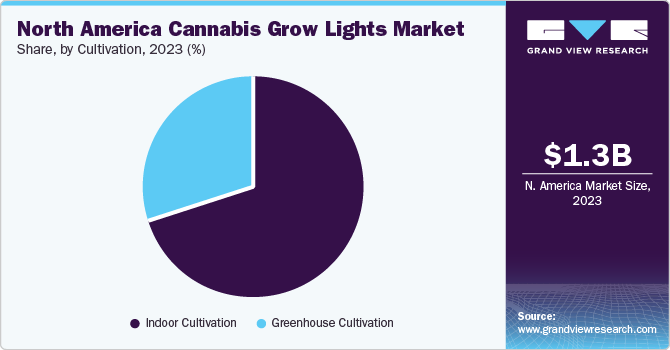

Cultivation Insights

The indoor cultivation segment dominated the market with the largest revenue share in 2023 and is expected to grow at the fastest CAGR over the forecast period. The growing legalization of cannabis for indoor cultivation and demand for cannabis-derived products are propelling market growth in North America. Moreover, according to the State of the Cannabis Lighting Market, a research conducted by Cannabis Business Times and Fluence, 88% of participants grew cannabis indoors under artificial lighting in 2022 in the U.S.

The greenhouse cultivation segment is also expected to grow lucratively over the forecast period. In response to climatic changes, there is an increasing trend toward greenhouse cultivation. Furthermore, according to the State of the Cannabis Lighting Market, a research conducted by Cannabis Business Times and Fluence, 28% of participants grew cannabis in greenhouses under supplemental and natural lighting in 2022 in the U.S.

Country Insights

U.S. Cannabis Grow Lights Market Trends

The U.S. dominated the cannabis grow lights market with the highest revenue share in 2023. In the U.S., cannabis is used in the pharmaceutical, cosmetic, and food & beverage industries. The growing legalization of cannabis and increasing acceptance of its use for medical purposes are the key factors driving the growth of the market. The rising research on the use of cannabis and its medicinal properties has led to an increase in demand for cannabis, which further boosts the market growth. Furthermore, the rise in the launch of technologically advanced products fuels market growth. For instance, in October 2023, Mammoth Lighting, an LED grow lights manufacturer, introduced its latest LED grow light, combining the Samsung EVO chip with a new green photon boost. The trials of this product showed enhancement in yields and plant quality.

Key North America Cannabis Grow Lights Company Insights

Key participants in the cannabis grow lights market are focusing on devising innovative business growth strategies in the form of product portfolio expansions, partnerships & collaborations, mergers & acquisitions, and business footprint expansions.

Key North America cannabis grow lights Companies:

- Koninklijke Philips N.V.

- Valoya

- Heliospectra

- Kind LED Grow Lights

- VIVOSUN

- California LightWorks

- Biological Innovation and Optimization Systems, LLC

- ViparSpectra

- Mars Hydro

- Hydrobuilder.com

- Hydrofarm

- Active Grow

- Thrive Agritech

Recent Developments

-

In April 2023, FOHSE, a manufacturer of LED grow lights, introduced the Pisces, a high-performance LED grow light for home growers. It is used to grow a wide variety of plants, including cannabis. This series is available in 900W and 700W options, offering potential photosynthetic photon flux (PPF) values of 2494 umol

-

In February 2023, California Lightworks, a manufacturer of high-performance LED grow lights, introduced its new SpectraMax Vertical 1000 for maximum yields and quality results

North America Cannabis Grow Lights Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 1.39 billion |

|

Revenue forecast in 2030 |

USD 2.17 billion |

|

Growth rate |

CAGR of 7.8% from 2024 to 2030 |

|

Actual data |

2018 - 2023 |

|

Forecast data |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, cultivation, country |

|

Regional scope |

North America |

|

Country scope |

U.S., Canada, Mexico |

|

Key companies profiled |

Koninklijke Philips N.V.; Valoya ; Heliospectra ; Kind LED Grow Lights; VIVOSUN; California LightWorks; Biological Innovation and Optimization Systems, LLC; ViparSpectra; Mars Hydro; Hydrobuilder.com; Hydrofarm |

|

Customization scope |

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Cannabis Grow Lights Market Report Segmentation

This report forecasts revenue growth at regional, and country level and provides an analysis of the latest industry trends in each of the sub segments from 2018 to 2030. For this study, Grand View Research, Inc. has segmented the North America cannabis grow lights market report based product, cultivation, and country:

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Light-emitting diode (LED) Lights

-

High-intensity discharge (HID) Lamps/Lights

-

High Pressure Sodium Bulbs

-

Metal-halide (MH) Lights

-

-

Fluorescent Lights/Lamps

-

T5 Fluorescent Grow Lights/Lamps

-

Compact Fluorescent Light/ Lamp (CFL)

-

-

Ceramic metal-halide (CMH) Lights

-

-

Cultivation Outlook (Revenue, USD Million, 2018 - 2030)

-

Indoor Cultivation

-

Greenhouse Cultivation

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The global North America cannabis grow lights market size was estimated at USD 1.30 billion in 2023 and is expected to reach USD 1.39 billion in 2024.

b. The global North America cannabis grow lights market is expected to grow at a compound annual growth rate of 7.8% from 2024 to 2030 to reach USD 2.17 billion by 2030.

b. By product, the light-emitting diode (LED) lights segment dominated the cannabis grow lights market in 2023 and accounted for the largest revenue share of 43.1%. The demand for efficient and effective LED grow lights has increased with the rapid growth of the cannabis industry.

b. Some key players operating in the market include Koninklijke Philips N.V., Valoya , Heliospectra , Kind LED Grow Lights, VIVOSUN, California LightWorks, Biological Innovation and Optimization Systems, LLC, ViparSpectra, Mars Hydro, Hydrobuilder.com, Hydrofarm

b. Cost reductions in grow light fixation, technological advancements, and the growing adoption of High-intensity discharge (HID) lights boost the market growth. Furthermore, the rise in the use of cannabis for medical purposes, increased research activities regarding cannabis, and growing public awareness of the need for alternative cannabis farming, such as indoor and greenhouse cultivation, fuels market growth.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."