North America Blister Packaging Market Size, Share & Trends Analysis Report By Material (Plastic Films, Paper & Paperboard), By Technology (Thermoforming, Cold Forming), By Type, By End-use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-269-4

- Number of Report Pages: 180

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

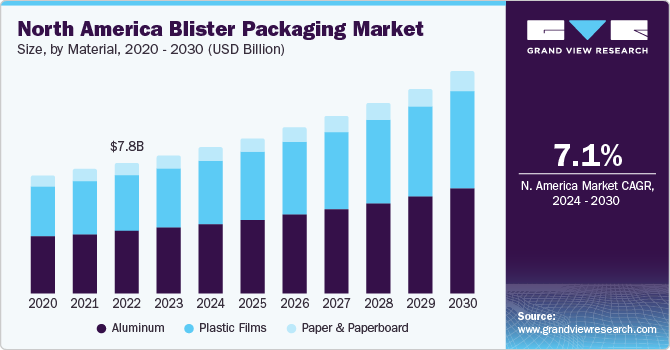

The North America blister packaging market size was valued at USD 8.28 billion in 2023 and is expected to expand at a CAGR of 7.1% from 2024 to 2030. Growing demand for tamper-evident packaging in the healthcare industry and the increasing consumption of oral solid dosages is driving the demand for blister packaging in North America.

A significant increase in the production and sales of pharmaceuticals in North American countries is positively impacting the growth of the market in the region. For instance, according to the European Federation of Pharmaceutical Industries and Associations (EFPIA), North America accounted for a 52.3% share of the global pharmaceutical sales in 2022. Similarly, 64.4% of sales of new medicines launched during 2017 to 2022 were from the U.S. market. Hence, the launch of new medicines in the form of tablets, capsules, and pills creates the need for reliable packaging solutions, which, in turn, is expected to drive the demand for blister packaging in healthcare over the forecast period.

In addition, the presence of major vaccine manufacturers, such as Pfizer, Inc., Merck & Co., Inc., Aldevron, and GBI, in North America is expected to drive the demand for clamshell blister packing to safeguard vials and ampoules filled with vaccines during transportation as well as offer protection from external factors such as temperature and air, which may affect the efficacy of medicines.

According to The World Bank Group, the population in the age group of 65 and above in North America increased from 56.69 million in 2018 to 64.51 million in 2022. The growing population in the region results in significant job opportunities, which influences the changes in the lifestyle as well as eating habits of consumers, contributing to a rise in chronic health issues, such as diabetes, high blood pressure, and other cardiovascular ailments. This is driving the demand for OSD pharmaceuticals, which, in turn, is expected to positively influence the healthcare blister packaging industry, since the majority of OSD medications are packaged in blister packs.

Blister packaging is also used for packaging food products such as cut fish, cut meat, and sliced fruits. Additionally, blister packaging can be used for packaging protein powders, snacks, and other protein-rich products. The growing consumption of these products is expected to create a demand for reliable packaging solutions, which is anticipated to boost the growth of the market in the region. For instance, according to the Food and Agriculture Organization (FAO), the U.S. has the highest per capita meat consumption, with the average person in the country consuming 149 kg (327.8 lb.) of meat per year. Blister packaging safeguards the enclosed product from dust and moisture during transit and sale. Hence, this positive outlook is projected to drive the demand for packaging solutions, such as blister packaging.

Market Concentration & Characteristics

Key companies operating in North America blister packaging market include Amcor plc, Constantia Flexibles, UFlex Limited, CCL Healthcare, Sonoco Products Company, WINPAK LTD., WestRock Company, SteriPackGroup, Honeywell International Inc., Klöckner Pentaplast, Südpack, TekniPlex, Blisterpak, Inc., Nelipak, and ACG.

Companies are increasingly focusing on developing and offering recyclable blister packaging in the market. For instance, in April 2023, MAX Solutions, a specialty packaging company, launched MAX Ecoblister, a novel packaging option designed as an eco-friendly substitute for traditional plastic blister packs. This innovative packaging solution combines the recyclability of a fiber top card with a PaperFoam tray, maintaining the tray's compostable properties. MAX Ecoblister provides brands with effective functionality and an appealing presentation and enhances overall sustainability.

Moreover, major players are collaborating with raw materials providers in order to procure recyclable plastics used in manufacturing sustainable blister packaging solutions. For instance, in November 2023, Amcor plc signed a Memorandum of Understanding (MOU) with NOVA Chemicals Corporate, a leading producer of sustainable polyethylene. The agreement includes the procurement of mechanically recycled polyethylene resin (rPE) from NOVA Chemicals Corporate, which was planned to be utilized in the production of flexible packaging films. This initiative aligns with Amcor's dedication to promoting packaging circularity by increasing the utilization of rPE in flexible packaging applications, which can include forming films for blister packaging.

Material Insights

On the basis of material, the market is segmented into plastic films, paper & paperboard, and aluminum. Aluminum is anticipated to dominate the overall market with a market share of 48.7% in 2023. This dominance can be attributed to the extensive usage of aluminum foils in crafting blister pack covers for pharmaceutical products due to their recyclability, high UV resistance, and effective barrier against oxygen and moisture.

Furthermore, plastic films segment is expected to grow at the fastest CAGR of 7.5% during the forecast period. Plastic films, especially those made from materials such as polyvinyl chloride (PVC), polypropylene (PP), and polyethylene terephthalate (PET), are relatively inexpensive compared to other packaging materials such as aluminum or paper-based materials. This makes them a suitable option for blister packaging manufacturers seeking cost-efficient packaging solutions.

Technology Insights

Based on product, the market is bifurcated into thermoforming & cold forming. Thermoforming segment dominated the market and accounted for largest revenue share of 83.9% in 2023 and is expected to grow at a fastest rate during the forecast period. Thermoforming-based blister packaging is a cost-effective packaging solution. It improves the production speed and lowers manufacturing costs compared to other technologies, including cold forming, making it an attractive option for blister packaging manufacturers.

On the other hand, the cold formed blister packaging technique is commonly used in the pharmaceutical packaging industry, particularly for packaging pharmaceuticals and medical devices. One of the main advantages of cold forming is that the aluminum film provides excellent barrier properties, preventing moisture from entering the packaging. Different types of cold form foils, including peelable, push-through, tear-open, child-resistant, and peel-push, are produced based on the specific requirements of pharmaceutical end users worldwide.

Type Insights

Based on type, the market is bifurcated into carded and clamshell. Carded segment dominated the market and accounted for the largest revenue share of 56.9% in 2023 and is expected to grow at a fastest rate during the forecast period. Carded blister packs allow for clear visibility of the packaged product, which is a crucial factor in attracting consumer attention and facilitating impulse purchases, especially in retail environments. The ability to display the product effectively on cards or hanging blisters enhances merchandising opportunities.

On the other hand, clamshell blister packs provide enhanced product protection compared to carded blisters, as the product is enclosed between two rigid plastic shells. This makes them suitable for packaging fragile or high-value products that require extra protection during shipping and handling.

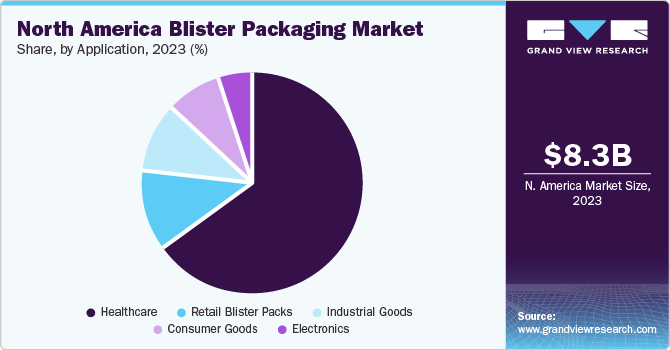

Application Insights

Based on application, the market is segmented into retail blister packs, healthcare, consumer goods, industrial goods, and electronics. Healthcare application segment dominated market and accounted for largest revenue share of over 64.0% in 2023 and is expected to grow at a fastest rate during the forecast period. The healthcare sector's stringent quality and safety requirements, along with the need for dosage control, tamper-evidence, and regulatory compliance, have made blister packaging the most suitable packaging option in the market.

Retail blister packs, particularly carded or clamshell types, allow for clear product visibility on store shelves and displays. This visibility is crucial for attracting consumer attention and driving impulse purchases, especially for products such as toys, consumer electronics, hardware, and personal care items.

Country Insights

U.S. Blister Packaging Market Trends

U.S. dominated the market and accounted for the largest revenue share of over 77.0% in 2023. The U.S. has the largest consumer market in North America, with a high demand for various products across industries, including healthcare, consumer goods, and electronics. This high consumer demand translates into a significant need for packaging solutions, including blister packaging.

According to the National Health Expenditure Account (NHEA), healthcare spending in the U.S. grew by 2.7% in 2021, reaching USD 4.3 trillion or USD 12,914 per person. In terms of Gross Domestic Product (GDP), healthcare spending represented 18.3% of the total. This increasing healthcare expenditure is projected to positively influence the production of pharmaceuticals and medical devices, presenting growth potential for healthcare blister packaging in the country.

Canada Blister Packaging Market Trends

The Canada blister packaging marketis projected to grow at a lucrative CAGR during the forecast period. Blister packaging, particularly the carded type, is commonly used for packaging food products, and its tamper-evident design & product protection properties make it suitable for packaging fruits and vegetables. According to Statistics Canada, fruit and vegetable farm-gate sales rose by 13.1% in 2022 to USD 3.0 billion compared to 2021. The sales for both fruit and vegetables increased by 15.3% and 11.2% respectively compared to 2021. At the national level, total fruit and vegetable production rose by 6.1% to 3.5 billion kilograms in 2022. This landscape is expected to create the need for efficient and protective packaging solutions to ensure the freshness and quality of these products.

Mexico Blister Packaging Market Trends

The blister packaging market in Mexico is expected to witness growth, owing to the growing demand for reliable packaging solutions required for the medical devices and pharmaceuticals produced in the country. Furthermore, the National Institute of Public Health in Mexico reported that the prevalence of diabetes among the total population was 16.8% in 2018 and 15.7% in 2020. This outlook increased the demand for injectable medications, such as insulin for diabetes management, which, in turn, drives the demand for syringes across the country. Medical devices such as syringes require reliable packaging to prevent damage and deterioration of the product, which is expected to boost the demand for healthcare blister packaging in the country.

Key North America Blister Packaging Company Insights

The market is fragmented with the presence of a significant number of companies. North America blister packaging industry has been witnessing a significant number of new product launches, merger & acquisitions, and expansions over the past few years.

-

In September 2023, Acino International AG acquired M8 Pharmaceuticals, a rapidly expanding specialty biopharmaceutical company headquartered in Mexico City. M8 is primarily engaged in the licensing, marketing, and distribution of both innovative and established medicines in Mexico and Brazil. This strategic acquisition is expected to enable the company to enter the two largest pharmaceutical markets in Latin America, thereby expanding its geographical reach and solidifying its presence in the region.

-

In July 2023, Constantia Flexibles introduced a new pharmaceutical packaging solution called REGULA CIRC, which uses coldform foil. The packaging replaces conventional PVC with a PE sealing layer, resulting in a reduction in plastic content while increasing the proportion of aluminum. This optimization enhances the sustainability of the packaging and improves material recovery during recycling processes.

Key North America Blister Packaging Companies:

- Amcor plc

- Constantia Flexibles

- UFlex Limited

- CCL Healthcare

- Sonoco Products Company

- WINPAK LTD.

- WestRock Company

- SteriPackGroup

- Honeywell International Inc.

- Klöckner Pentaplast

- Südpack

- TekniPlex

- Blisterpak, Inc.

- Nelipak

- ACG

North America Blister Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 8.8 billion |

|

Revenue forecast in 2030 |

USD 13.26 billion |

|

Growth rate |

CAGR of 7.1% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, Volume in Kilotons, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue forecast, Volume Forecast, competitive landscape, growth factors and trends |

|

Segments covered |

Material, technology, type, end-use, country |

|

Regional scope |

North America |

|

Country Scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

Amcor plc; Constantia Flexibles; UFlex Limited; CCL Healthcare; Sonoco Products Company; WINPAK LTD.; WestRock Company; SteriPackGroup; Honeywell International Inc.; Klöckner Pentaplast; Südpack; TekniPlex; Blisterpak, Inc.; Nelipak; ACG |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Blister Packaging Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America blister packaging market report based on material, technology, type, end-use, and country:

-

Material Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Plastic Films

-

Polyvinyl Chloride (PVC)

-

Polyethylene (PE)

-

Polyethylene Terephthalate (PET)

-

Others

-

-

Paper & Paperboard

-

Solid Bleached Sulfate (SBS)

-

White-lined chipboard

-

Others

-

-

Aluminum

-

-

Technology Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Thermoforming

-

Cold Forming

-

-

Type Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Carded

-

Clamshell

-

-

End-use Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

Retail Blister Packs

-

Healthcare

-

Consumer Goods

-

Industrial Goods

-

Electronics

-

-

Country Outlook (Revenue, USD Million; Volume, Kilotons, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America blister packaging market was estimated at around USD 8.28 billion in the year 2023 and is expected to reach around USD 8.8 billion in 2024.

b. The North America blister packaging market is expected to grow at a compound annual growth rate of 7.1% from 2024 to 2030 to reach around USD 13.26 billion by 2030.

b. Healthcare emerged as a dominating application with a value share of around 64.0% in the year 2023 owing to the healthcare sector's stringent quality, regulatory compliance, safety requirements, along with the need for dosage control, tamper-evident packaging.

b. The key player in the North America blister packaging market includes Amcor plc, Constantia Flexibles, UFlex Limited, CCL Healthcare, Sonoco Products Company, WINPAK LTD., WestRock Company, SteriPackGroup, Honeywell International Inc., Klöckner Pentaplast, Südpack, TekniPlex, Blisterpak, Inc., Nelipak, and ACG.

b. Growing demand for tamper-evident packaging in the North America healthcare industry and increasing consumption of oral solid dosages is driving the demand for blister packaging in North America.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."