- Home

- »

- Healthcare IT

- »

-

North America Biotechnology And Pharmaceutical Services Outsourcing Market, Report, 2030GVR Report cover

![North America Biotechnology And Pharmaceutical Services Outsourcing Market Size, Share & Trends Report]()

North America Biotechnology And Pharmaceutical Services Outsourcing Market Size, Share & Trends Analysis Report By Service (Consulting, Regulatory Affairs), By End Use, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-330-1

- Number of Report Pages: 110

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2024 - 2030

- Industry: Healthcare

Market Size & Trends

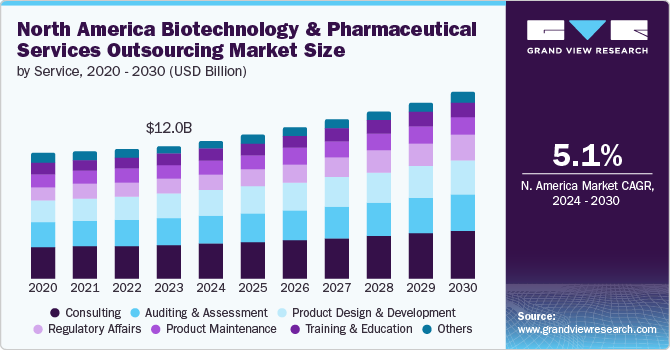

The North America biotechnology and pharmaceutical services outsourcing market size was estimated at USD 12.01 billion in 2023 and is projected to grow at a CAGR of 5.13% from 2024 to 2030. Changes in regulatory landscape, the strong presence of pharmaceutical & biotechnology companies, growing focus on core business activities by biotechnology and pharmaceutical firms and rise in economic & competitive pressures are some of the factors driving market growth. Furthermore, rising demand for skilled regulatory affairs experts and consultants with expertise in data management for pharmaceutical and biotech firms is anticipated to propel overall market growth.

Rising drug development costs, lessening internal R&D development capabilities, increasing regulatory frameworks, and low-cost service deployment to contract research organizations (CROs) and contract manufacturing organizations (CMOs) are some of the major factors driving market growth.

Growing investments in R&D activities in the biopharmaceutical industry are expected to positively impact on the overall outsourcing market. As pharmaceutical firms are proactively involved in the discovery and development of novel drug formulations, there is a growing need for several advanced services to ensure the safety & efficacy of these products. R&D activities drive the development of new pharmaceuticals, biologics, and vaccines, necessitating comprehensive sterility testing methodologies to comply with regulatory requirements. Pharmaceutical and biotechnology companies are now focusing on their core competencies and outsourcing noncore functions to increase their productivity & operational efficiency. These companies frequently outsource R&D activities to CROs to reduce costs & increase focus on core functions. Small and medium-scale companies, which do not have in-house capabilities, have to outsource their regulatory affairs to enter into new markets. Thus, factors above are driving overall market growth in North America.

Biotechnology and pharmaceutical companies have to deal with continuous changes in regulatory requirements. Noncompliance with the changing regulatory requirement can result in penalties and delays, which may lead to loss of revenue. According to a survey sponsored by Genpact, 72.0% of executives from the life sciences industry consider regulatory compliance as one of the top three challenges faced by life sciences companies. Regulatory departments often face the burden of handling multiple tasks simultaneously and have to ensure compliance with stringent regulatory standards at all times. An increase in efforts by companies to expand their geographic reach and gain rapid approvals is expected to further contribute to the adoption of outsourcing models for regulatory services.

High clinical development failure rates further enhanced the need for outsourcing in the biotechnology and pharmaceutical sectors. Approximately 90% of drug candidates fail to progress from clinical trials to market approval, representing a significant risk and financial loss for companies. Outsourcing mitigates this risk by leveraging the expertise and infrastructure of CROs and other service providers. These external partners possess specialized knowledge in clinical trial design, regulatory compliance, and patient recruitment, increasing the likelihood of successful outcomes and reducing the overall risk associated with drug development.

In pharmaceuticals and biopharmaceutical companies, innovations and speed-to-clinic factors are significantly important. In addition, specialty pharmaceuticals and biopharmaceutical players rely on one-stop-shop CDMOs to deliver these requirements in the industry. Many CDMOs promote themselves as one-stop-shop CDMOs. In this service model, a CDMO handles everything from API to dosage form and early development to commercialization. However, to provide these services, a CDMO must have a range of technologies and handling capabilities to address problem statements. There is a wide range of product design capabilities among CDMO players that can be critical in scaling a product concept and bringing it to the market.

The one-stop-shop service model is not completely influenced by sponsors; it is a response by CMOs seeking M&A at lower costs within the fragmented contract pharma manufacturing space. CRO and CMO companies provide one-stop services, which is their primary avenue for growth. The outsourcing industry has benefitted significantly from sponsor consolidation, primarily from acquiring facilities & personnel and M&As to expand their service portfolios & geographic presence by acquiring niche providers. For instance, in March 2024, Pace Life Sciences, LLC acquired New Jersey Laboratory from Curia to support its drug development partners with commercialization activities.

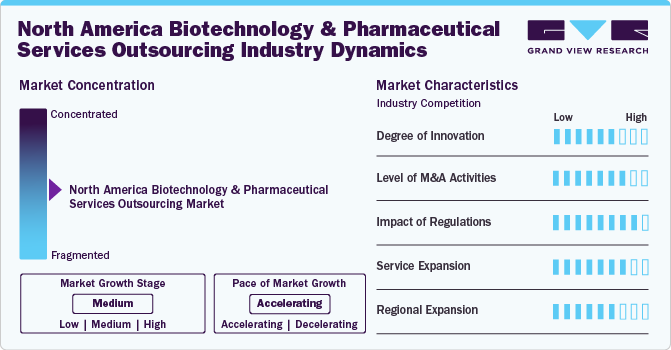

Market Concentration & Characteristics

The market growth stage is medium, at an accelerating pace. The market is characterized by a degree of innovation.

The North America market is characterized by a high degree of innovation. The adoption of several advanced technologies, such as artificial intelligence, machine learning, big data analytics, and blockchain, among others, by CROs and CDMOs is expected to accelerate drug discovery, development, and clinical trials, thereby enhancing market growth potential. Furthermore, innovations in genomics and personalized medicine are driving the need for specialized CRO services to support advanced therapeutic approaches.

The North America market is also characterized by a high level of merger and acquisition (M&A) activity by leading players to expand their capabilities, service offerings, and client base. The market is witnessing significant consolidation as larger CROs and CDMOs acquire smaller firms to enhance their capabilities and expand their service offerings. For instance, in March 2024, LabCorp announced the acquisition of BioReference Health's testing businesses, which focus on reproductive & women's health and clinical diagnostics across the U.S. outside of New Jersey and New York. The acquisition is expected to enhance physicians' and customers' access to the company’s testing capabilities, scientific expertise, and high-quality laboratory services.

The North America market is characterized by a high impact of regulations. The U.S. FDA implemented stringent regulatory requirements to enhance the safety and efficacy of the products, thereby influencing the demand for high-quality CRO services. Furthermore, several companies are focusing on compliance with regulatory standards, which drives the demand for specialized CROs to navigate complex regulatory landscapes.

North America biotechnology and pharmaceutical services outsourcing market is characterized by a high impact on service expansion. The growing trend towards offering comprehensive, end-to-end solutions covering the entire drug development lifecycle, from preclinical research to post-marketing surveillance, will provide a competitive edge to outsourcing service providers. Moreover, expansion of niche services such as biostatistics, data management, pharmacovigilance, and regulatory consulting will offer numerous growth opportunities in the market.

The North America market is characterized by a moderate impact of regional expansion. Companies in the biotechnology and pharmaceutical sectors are expanding their presence within North America to tap into numerous regional markets, leveraging local expertise and patient populations. Moreover, North American CROs and pharmaceutical companies are increasingly establishing a global footprint to conduct multinational clinical trials and access diverse patient populations. For instance, in April 2024, LabCorp announced the expansion of its precision oncology portfolio to advance cancer research & patient care and support biopharma, pharmaceutical, & clinical research partners to develop groundbreaking therapies.

Service Insights

The consulting services segment held the largest revenue share, over 25.69% of the overall revenue size, in 2023 and is predicted to maintain its position over the analysis timeframe. The high segment growth is primarily attributed to increased demand for CRO consultants in the industry. Furthermore, the increasing focus on personalized medicine and the incorporation of digital health solutions is leading to a growing demand for consulting expertise. The sector is also undergoing consolidation, with larger consulting firms acquiring niche players to expand their service range and gain a competitive edge.

The regulatory affairs segment is expected to be the fastest-growing segment over the forecast period due to stringent regulatory requirements in developed countries such as the U.S. and changing regulatory reforms in emerging countries such as Mexico and Puerto Rico. In addition, technological advancements in drug manufacturing and the growth of the biotechnology and pharmaceutical sectors across the region are key factors propelling segment growth. Moreover, an increasing prevalence of chronic diseases, such as cardiovascular diseases and cancer, is anticipated to boost market growth over the forecast period.

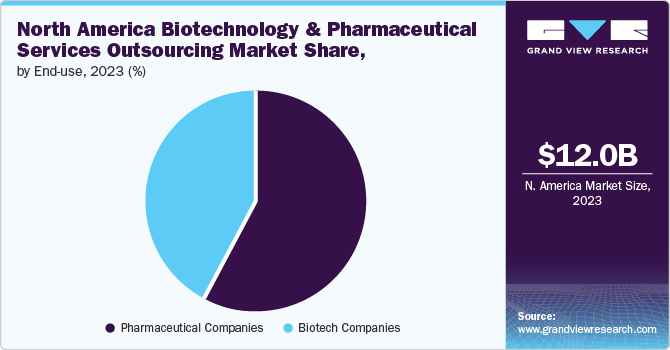

End Use Insights

The pharmaceutical companies segment dominated the market in 2023 and is anticipated to witness a CAGR of 4.86 % over the forecast period. Growing R&D spending by pharmaceutical companies for development of potential novel products and a rise in investments by CROs for development of core capabilities are major factors driving market demand in the upcoming years. Furthermore, an increasing number of small- & medium-sized companies are outsourcing their production work to CDMOs and CMOs. Small- and medium-sized pharmaceutical companies have limited resources & capabilities in formulation development, product design & development, and regulatory services, thereby boosting the pharmaceutical and biotechnology services outsourcing market. Cost pressures and the need for operational efficiency are leading pharmaceutical companies to increasingly outsource R&D, clinical trials, and manufacturing processes to specialized service providers.

On the other hand, the biotechnology companies segment is expected to witness the fastest revenue growth over the forecast period. This growth can be attributed to a lack of capacity & capability to perform regulatory affairs functions and the presence of stringent regulatory requirements in developed countries. Furthermore, lowering profit margins, coupled with rising competition in the market, are contributing to market growth. In addition, easy access to industry experts is another factor accelerating the demand for outsourcing services.

Country Insights

U.S. Biotechnology And Pharmaceutical Services Outsourcing Market Trends

The biotechnology and pharmaceutical services outsourcing market in the U.S. dominated the regional market and accounted for the largest revenue share of over 87.37% in 2023. Several pharmaceutical & biotechnology companies are increasingly outsourcing their development & manufacturing activities to CROs, CMOs, & CDMOs to minimize product lifecycle costs, accelerate time-to-market, and access specialized expertise. In addition, several pharmaceutical & biotechnology companies outsource part of their regulatory functions to meet the evolving regulation requirements, risk mitigations, and quality assurance, contributing to market growth. High R&D spending on clinical trials is another major factor expected to fuel market growth. For instance, in October 2021, the U.S. FDA approved 11 new clinical trial research, resulting in over USD 25 million in funding over the next four years. These grants aim to support the development of new medical products specifically for treating rare diseases.

The biotechnology and pharmaceutical services outsourcing market in Canada held a considerable market share in 2023. This growth is attributed to the rising technological innovations, growing demand for personalized medicine, and increasing number of clinical trials in Canada, which are some of the major factors expected to improve the demand for biotechnology & pharmaceutical services outsourcing. For instance, in February 2023, Roche announced the extended collaboration with Janssen Biotech Inc. to create companion diagnostics for targeted therapies, strengthening the company’s research & innovation activities. The agreement would provide opportunities for both companies to collaborate in precision medicine with multiple companion diagnostics technologies, such as digital pathology, Immunohistochemistry (IHC), Next-Generation Sequencing (NGS), PCR, and immunoassays.

Moreover, according to the Government of Canada, Canada has one of the highest numbers of biotechnology companies worldwide focused on human health, giving the country a strong record of achievement in biopharmaceuticals. In addition, the notable trend toward outsourcing drug development and production to CROs, CMOs, and CDMOs and leveraging their expertise and specialized services is fueling market growth in Canada.

Key North America Biotechnology And Pharmaceutical Services Outsourcing Company Insights

The key market players operating across the market are implementing several strategic initiatives, such as service launches, mergers, acquisitions, partnerships and agreements, collaborations, expansion, etc., to increase market presence and gain a competitive edge in driving market growth. For instance, in January 2024, Labcorp partnered with Hawthorne to accelerate enrolment and study timelines as well as to create a service offering that supports decentralized clinical trials. This partnership broadened the company’s offerings in the market.

Key North America Biotechnology And Pharmaceutical Services Outsourcing Companies:

- Parexel International Corporation

- The Quantic Group

- IQVIA

- Lachman Consultant Services, Inc.

- GMP Pharmaceuticals Pty Ltd.

- Concept Heidelberg GmbH

- LabCorp

- Charles River Laboratories

- ICON plc.

- Syneos Health

- Lonza

- Catalent Inc.

- Samsung Biologics

Recent Developments

-

In March 2024, Lonza acquired Genentech's large-scale biologics manufacturing site in California, U.S., from Roche to address the growing demand for commercial mammalian contract manufacturing from clients.

-

Parexel and Palantir announced a multiyear strategic collaboration to leverage AI to help its biopharmaceutical customers enhance and accelerate the delivery of clinical trials.

-

In February 2024, Novo Holdings announced the acquisition of Catalent, Inc. This acquisition fits with Novo Holdings' investing strategy in strong, long-term potential established life science companies.

-

In September 2023, ICON plc announced partnership with U.S. Biomedical Advanced Research and Development Authority (BARDA) for initiation of a clinical trial designed for evaluation of effectiveness of next-gen COVID-19 vaccine candidates.

-

In May 2023, LabCorp declared its commitment to enhancing the enduring strategic collaboration with Providence through a newly established agreement. As part of this arrangement, LabCorp will acquire the outreach laboratory business of Providence, Oregon, and specific assets situated in Oregon.

- In March 2023, Charles River launched Apollo, a cloud-based platform that assists drug developers in accessing study data, study milestones, documents, cost estimates, and program planning tools.

North America Biotechnology And Pharmaceutical Services Outsourcing Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 12.45 billion

Revenue forecast in 2030

USD 16.81 billion

Growth rate

CAGR of 5.13% from 2024 to 2030

Actual data

2018 - 2023

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Service, end use, country

Country scope

U.S.; Canada; Mexico; Puerto Rico

Key companies profiled

The Quantic Group; IQVIA; Parexel International Corporation; Lachman Consultant Services, Inc.; GMP Pharmaceuticals Pty Ltd.; LabCorp; Charles River Laboratories; ICON plc; Syneos Health; Lonza; Catalent Inc.; Samsung Biologics

Customization scope

Free report customization (equivalent up to 8 analyst working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Biotechnology And Pharmaceutical Services Outsourcing Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America biotechnology and pharmaceutical services outsourcing market report based on service, end use, and region:

-

Service Outlook (Revenue, USD Million, 2018 - 2030)

-

Consulting

-

Regulatory Consulting

-

Clinical Development Consulting

-

Strategic Planning & Business Development Consulting

-

Quality Management Systems consulting

-

Others

-

-

Regulatory Affairs

-

Legal Representation

-

Regulatory Writing & Publishing

-

Product Registration & Clinical Trial Applications

-

Regulatory Submissions

-

Regulatory Operations

-

Others

-

-

Product Design & Development

-

Research, Strategy, & Concept Generation

-

Concept & Requirements Development

-

Detailed Design & Process Development

-

Design Verification & Validation

-

Process Validation & Manufacturing Transfer

-

Production & Commercial Support

-

-

Auditing and Assessment

-

General Auditing

-

Gap Assessments

-

Due Diligence Assessments

-

Mock Audits/Inspections

-

Inspection/Audit Management and Support

-

Others

-

-

Product Maintenance

-

Training & Education

-

Others

-

-

End Use Outlook (Revenue, USD Million, 2018 - 2030)

-

Pharmaceutical Companies

-

Biotech Companies

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Puerto Rico

-

Frequently Asked Questions About This Report

b. The North America biotechnology and pharmaceutical services outsourcing market size was estimated at USD 12.01 billion in 2023 and is expected to reach USD 12.45 billion in 2024.

b. The North America biotechnology and pharmaceutical services outsourcing market is expected to grow at a compound annual growth rate of 5.13% from 2024 to 2030 to reach USD 16.81 billion by 2030.

b. The U.S. dominated the North America biotechnology and pharmaceutical services outsourcing market with a share of 87.17% in 2023. This is attributable to growing number of clinical trials, advanced healthcare infrastructure, high R&D investment, reduced service cost, and availability of skilled professionals among others.

b. Some key players operating in the North America biotechnology and pharmaceutical services outsourcing market include The Quantic Group; IQVIA; Parexel International Corporation; Lachman Consultant Services, Inc.; GMP Pharmaceuticals Pty Ltd.; LabCorp; Charles River Laboratories; ICON plc; Syneos Health; Lonza; Catalent Inc.; Samsung Biologics.

b. Key factors that are driving the market growth include growing focus on clinical trials, growing adoption of one-stop-shop CROs and CDMOs, increasing outsourcing trends, and growing R&D spending among others.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."