- Home

- »

- Plastics, Polymers & Resins

- »

-

North America Beverage Cups And Lids Market, Report 2030GVR Report cover

![North America Beverage Cups And Lids Market Size, Share & Trends Report]()

North America Beverage Cups And Lids Market Size, Share & Trends Analysis Report By Material (Paper, Plastics, Foam), By Product (Cups, Lids), By Distribution Channel, By Application, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-304-7

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

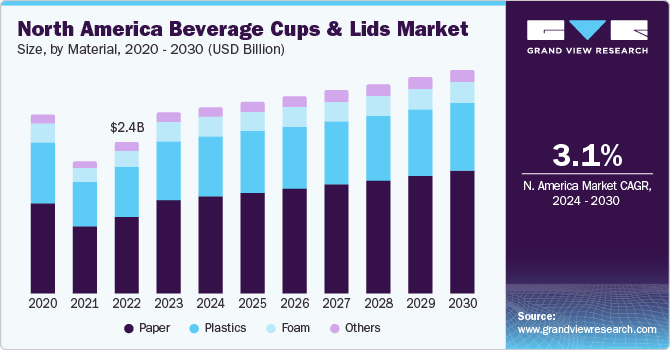

The North America beverage cups and lids market size was estimated at USD 2.82 billion in 2023 and is expected to expand at a CAGR of 3.1% from 2024 to 2030. Growing coffee consumption and flourishing food service industry across the North America is triggering the demand for beverage cups & lids in the North America.

The food service industry in North America encompasses a wide range of establishments that provide food to customers outside their homes. This includes hotels, canteens, university canteens, catering service companies, food bars, and restaurants. The significant factors contributing to the growth of the food service industry in the region include rising demand for personalized services, as well as the easy accessibility of customers to a multitude of food products.

In addition, the rise in the popularity of new restaurant formats, such as virtual kitchens, cloud kitchens, and ghost kitchens, is also contributing to the growth of the food service industry in North America. Therefore, the flourishing food service industry is expected to benefit food service-related companies offering ready-to-eat (RTE) food, beverages, food & beverage packaging, cutlery, etc. This, in turn, is anticipated to increase the demand for beverage cups & lids across the food service industry in the region during the forecast period.

North America has the presence of major food service companies such as KFC Corporation, Domino's, Starbucks Corporation, Pizza Hut, McDonald's, Dunkin' Donuts, Tim Hortons, The Coca-Cola Company, Taco Bell IP Holder, LLC, Wendy's, Burger King Company LLC, Subway, Chick-fil-A, and Arby's IP Holder, LLC. These companies operate a vast number of restaurants and outlets for serving a wide range of beverages to their customers. Therefore, cups & lids are used by them for offering various beverages, including coffee, soft drinks, juices, and others. Hence, the presence of major food service companies in the region is expected to drive the demand for beverage cups & lids in North America over the forecast period.

Furthermore, according to the National Coffee Data Trends (NCDT) report of 2023, approximately 81% of American coffee drinkers consume coffee with breakfast. It is followed by 38% in the morning, 15% with lunch, 19% in the afternoon, 7% with dinner, and 10% in the evening. This demographic landscape highlights the prevalence of coffee consumption throughout the day by Americans which is anticipated to fuel the demand for coffee cups and lids in the region in the coming years. Hence, this outlook is ultimately expected to benefit the overall growth of the beverage cups & lids market in North America during the forecast period.

Moreover, companies operating in the North America beverage cups & lids market are striving to develop plastic-free and biodegradable cups & lids to reduce plastic waste and offer sustainable products in the market. For instance, in November 2023, SOFi Products introduced a 100% plastic-free, biodegradable cup for hot beverages that feature three flaps, which can be folded together to form a spill-proof lid. This eliminates the requirement of a separate lid to seal the cups, which would help counter the packaging waste problem.

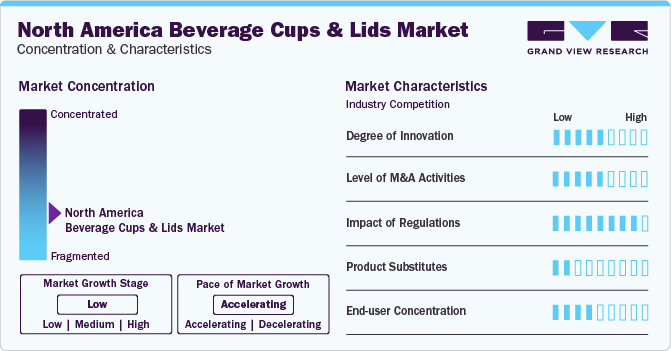

Market Concentration & Characteristics

Prominent companies operating in the North America market for beverage cups & lids include Georgia-Pacific; Amhil; Huhtamaki Oyj; Printpack; Dart Container Corporation; WinCup; Graphic Packaging International, LLC; Mondi; Airlite Plastics; Reynolds Consumer Products; Material Motion, Inc.; CMG Plastics; Berry Global Inc.; Evanesce Inc.; and Karat by Lollicup.

Companies are increasingly focusing on the launching of beverage cups & lids in the North America beverage cups & lids market. For instance, in November 2023, CMG Plastics launched a set of new round lids made from linear low-density polyethylene (LLDPE). These lids include the 307CE composite can lid, 401CE composite can lid, and the 307SS paperboard container lid. These round lids are specifically designed to complement composite and paperboard containers, and are ideal for packaging breadcrumbs, drink mixes, and snacks.

In November 2023, Eco Products Inc. introduced two new sets of lids for paper hot cups and molded fiber bowls. The new lids are made from renewable molded fiber that is certified as compostable by the Biodegradable Products Institute (BPI), which would help the company position its products as a sustainable option to plastic lids.

Material Insights

The paper segment is anticipated to dominate the overall market with a share of over 51.0% in 2023. This is attributed to the growing trend toward the usage of recyclable products, which has propelled the demand for paper-based beverage cups & lids across North America.

The plastic segment is expected to grow at a moderate CAGR over the forecast period as the countries across North America are implementing new regulations for reducing plastic waste. For instance, in June 2022, the U.S. Department of the Interior announced a ban on single-use plastic products in national parks and other public lands by 2032. The department issued an order to decrease the procurement and distribution of plastic packaging. Moreover, this initiative is expected to help reduce over 14 million tons of plastic that end up in the ocean every year.

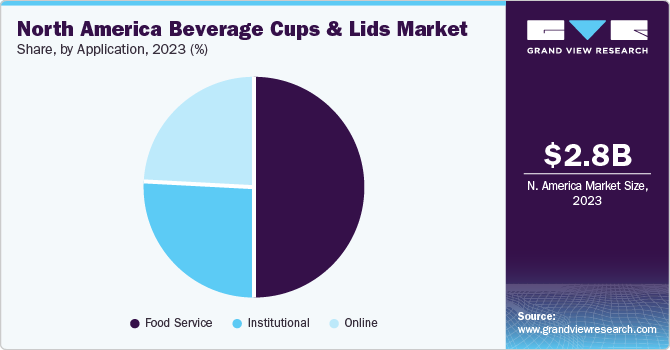

Application Insights

Based on the application, the North America beverage cups & lids market is segmented into food service, online, and institutional. Food service application segment dominated market and accounted for largest revenue share of over 49.0% in 2023. This positive outlook is attributed to rising number of fast-food outlets and increasing adoption of various expansion initiatives by fast-food companies across the North America.

The online application segment is projected to progress at the fastest CAGR of 4.6% over the forecast period. This positive outlook is attributed to the rapid expansion of online food delivery companies and cloud-based quick service restaurants. For instance, in January 2024, DoorDash announced its expansion plans of its restaurant business in the U.S. Furthermore, DoorDash achieved USD 6.3 billion in sales in the first nine months of 2023, up by 33% from the same period in 2022.

Product Insights

The cups segment dominated the market and accounted for largest revenue share of over 67.0% in 2023. The cafe culture and the well-established fast-food industry in the U.S., Canada, and Mexico have positively contributed to the growth of cups segment of the market in the region. The high disposable income and the fast-paced lifestyle of the masses in the U.S. are contributing to the growth of coffee market in the country. This, in turn, leads to the increased demand for cups & lids in the U.S.

On the other hand, lids play a crucial role in the functionality and convenience of beverage cups. The primary purpose of a lid is to prevent the contents of the cup from spilling out during transportation or consumption. Besides, lids are designed with an insulating layer or air pocket to help maintain the temperature of the beverage, keeping hot drinks hot and cold drinks cold for a longer period. Moreover, many lids are designed with a pre-cut or fold-back section to accommodate a straw, making it easier to consume thicker beverages such as milkshakes or smoothies.

Distribution Channel Insights

The direct distributors segment dominated the distribution channel segment and accounted for largest revenue share of over 45.0% in 2023. Direct distributors better manage their inventory levels and respond quickly to fluctuations in demand from end-users, such as restaurants, cafeterias, and other foodservice establishments. This ensures a consistent supply of beverage cups and lids.

The group purchasing organizations (GPOs) distribution channel segment is anticipated to witness the fastest CAGR of 4.3% from 2024 to 2030. GPOs offer discounted bulk purchases and enhanced negotiating power as well as support services, such as advice, spend analysis, and advocacy. The penetration of beverage cups & lids through GPOs is increasing, due to the above-mentioned advantage, and is expected to witness significant growth over the forecast period in North America.

Country Insights

U.S. Beverage Cups And Lids Market Trends

The U.S. dominated the market and accounted for the largest revenue share of over 65.0% in 2023. This can be attributed to the surge in ready-to-drink beverages, particularly coffee and other beverages. Furthermore, the increasing demand for environmentally friendly packaging solutions and the flourishing food & beverage industry in the country is expected to propel the demand for beverage cups & lids in the near future.

The rapid growth of e-commerce food delivery platforms, such as Uber Eats, Grubhub, and others, due to high consumer spending and changing eating habits, is expected to support the growth of the beverage cups & lids market in the country. For instance, in October 2023, Dominos announced its plans to expand the Uber Eats partnership from Las Vegas to corporate and franchised stores in Miami, Houston, and Seattle.

Canada Beverage Cups And Lids Market Trends

The Canada beverage cups & lids market is expected to grow during the forecast period. In July 2023, Coca-Cola announced its plans to launch 100% recycled plastic bottles and refillable cups for fountain dispensers in Canada. All new reusable beverage utensils are expected to be manufactured by Coke Canada facilities located in Ontario, Brampton, Alberta, Quebec, British Columbia, and Calgary. Market players are focused on adopting various strategies to replace single-use plastic beverage utensils with paper-based beverage cups & lids, which is expected to propel the market growth in the country over the forecast period.

Mexico Beverage Cups And Lids Market Trends

The beverage cups & lids market is expected to witness significant growth, owing to the growth of the restaurant industry in the country, which is dominated by micro and small food service businesses. In addition, the share of international, as well as domestic food chains, is increasing, owing to the presence of favorable government regulations in the country. Online food delivery is an emerging trend in the country while the trend of take-out/home delivery is becoming more popular in Mexico. This is expected to drive the growth of the beverage cups & lids market in the country over the forecast period.

Key North America Beverage Cups And Lids Company Insights

The market is fragmented with the presence of a significant number of companies. North America beverage cups & lids industry has been witnessing a significant number of new product launches and expansions over the past few years. This can be attributed to the rising demand for on-the-go beverages across the North America.

-

In July 2023, Huhtamaki Oyj, a prominent global provider of sustainable packaging solutions, made a substantial investment in its facility located in Paris, Texas, U.S. This investment involves expanding the manufacturing capacity and consolidating an external warehouse. The company planned to invest approximately USD 30 million in production assets while leasing the warehouse and manufacturing facility. This strategic move aims to significantly enhance the capacity of its food service business in North America.

-

In March 2023, WinCup launched the first-ever paper cups for hot beverages lined with polyhydroxyalkanoate (PHA). This innovative biopolymer is derived from the fermentation of canola oil, making it suitable for home and industrial composting. Moreover, it is marine biodegradable.

Key North America Beverage Cups And Lids Companies:

- Georgia-Pacific

- Amhil

- Huhtamaki Oyj

- Printpack

- Dart Container Corporation

- WinCup

- Graphic Packaging International, LLC

- Mondi

- Airlite Plastics

- Reynolds Consumer Products

- Material Motion, Inc.

- CMG Plastics

- Berry Global Inc.

- Evanesce Inc.

- Karat by Lollicup

North America Beverage Cups And Lids Market Report Scope

Report Attribute

Details

Market size value in 2024

USD 2.89 billion

Revenue forecast in 2030

USD 3.48 billion

Growth rate

CAGR of 3.1% from 2024 to 2030

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion, and CAGR from 2024 to 2030

Report coverage

Revenue forecast, competitive landscape, growth factors and trends

Segments covered

Material, product, application, distribution channel, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Georgia-Pacific; Amhil; Huhtamaki Oyj; Printpack; Dart Container Corporation; WinCup; Graphic Packaging International, LLC; Mondi; Airlite Plastics; Reynolds Consumer Products; Material Motion, Inc.; CMG Plastics; Berry Global Inc.; Evanesce Inc.; Karat by Lollicup

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Beverage Cups And Lids Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For the purpose of this study, Grand View Research has segmented the North America beverage cups and lids market report on the basis of material, product, distribution channel, application, and country:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Paper

-

Plastics

-

Foam

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Cups

-

Lids

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Corporate Distributors

-

Individual Distributors

-

Group Purchasing Organizations (GPOs)

-

Direct Distributors

-

Others

-

-

Application Outlook (Revenue, USD Million, 2018 - 2030)

-

Food Service

-

Online

-

Institutional

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. The North America beverage cups and lids market was estimated at around USD 2.82 billion in the year 2023 and is expected to reach around USD 2.89 billion in 2024.

b. The North America beverage cups and lids market is expected to grow at a compound annual growth rate of 3.1% from 2024 to 2030 to reach around USD 3.48 billion by 2030.

b. Food service emerged as a dominating application with a value share of around 49.0% in the year 2023 owing to a rising number of fast-food outlets and increasing adoption of various expansion initiatives by fast-food companies across the North America.

b. The key player in the North America beverage cups & lids market includes Georgia-Pacific, Amhil, Huhtamaki Oyj, Printpack, Dart Container Corporation, WinCup, Graphic Packaging International, LLC, Mondi, Airlite Plastics, Reynolds Consumer Products, Material Motion, Inc., CMG Plastics, Berry Global Inc., Evanesce Inc., and Karat by Lollicup.

b. Growing coffee consumption and flourishing food service industry across North America is expected to drive the demand for the beverage cups & lids.

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."