North America Automotive Thermoformed Plastics Parts Packaging Market Size, Share & Trends Analysis Report By Material (PE, PP), By Product (Bulk Containers & Cases, Bags & Pouches), By Accessories Type, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-267-3

- Number of Report Pages: 120

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Bulk Chemicals

Market Size & Trends

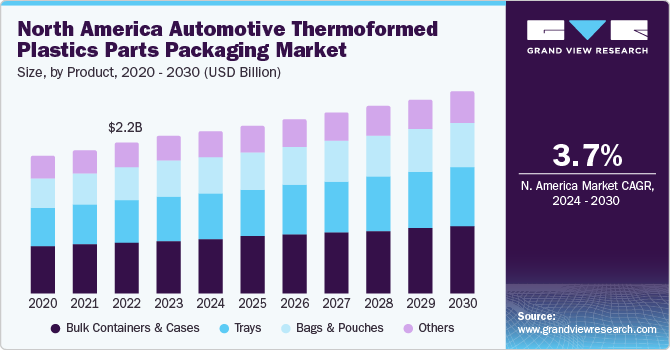

The North America automotive thermoformed plastic parts packaging market size was estimated at USD 2.27 billion in 2023 and is expected to expand at a CAGR of 3.7% from 2024 to 2030. The growing requirement from automotive aftermarket sector in North America for lightweight, cost efficient, and durable packaging material is driving this market.

The U.S. is a key contributor to North American automotive market. According to the Organisation Internationale des Constructeurs d'Automobiles (OICA), the U.S. held a share of 67.98% of the overall vehicle production in North America. Hence, the growth of automotive industry in the country significantly influences the overall automotive aftermarket industry in North America, thereby driving the consumption of packaging associated with it.

The U.S. Government is planning to phase out fossil fuel powered vehicles and is encouraging existing gas-powered vehicle manufacturing plants to shift to hybrid and electric vehicle production. In August 2023, the U.S. Department of Energy announced a USD 12 billion fund allocation in the form of grants and loans for automotive companies that are ready to convert their existing manufacturing facilities to manufacture electric or hybrid vehicles. This transition is expected to boost the number of electric and hybrid vehicles running on roads, thus fueling demand for related automotive spares and positively influencing the market.

The U.S.-Mexico-Canada (USMCA) Trade agreement which came into force in 2020, has significantly contributed to U.S. trade with its neighboring trade partners. According to the United States Trade Representative (USTR), USMCA includes a number of provisions aimed at increasing investments in the automotive sector and promoting local production of automotive parts in the country which is attracting foreign automotive parts manufacturers to set up facilities in the U.S. For instance, in September 2023, a Taiwan-based gears and shafts manufacturer, Hota Industrial Mfg. Co. announced a USD 99.0 million investment in a production facility in New Mexico, U.S. This production facility is expected to become operational by 2025.

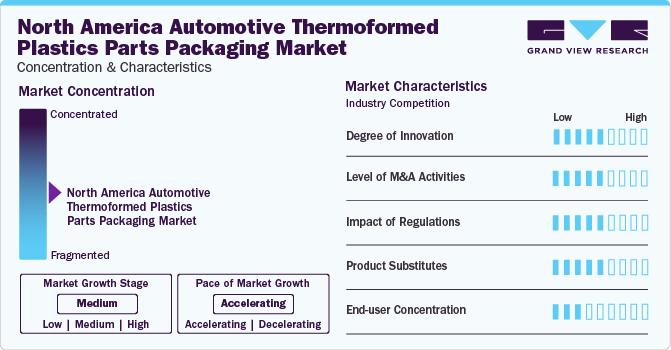

Market Concentration & Characteristics

Prominent players operating in the North America automotive thermoformed plastics parts packaging market include Sealed Air, Kiva Container, Engineered Packaging Solutions Inc, NEFAB GROUP, Schoeller Allibert, TriEnda Holdings, LLC, Knauf Industries, Deufol SE, and Smurfit Kappa among others.

The market is fragmented, comprising both large and small-medium sized players. The market offers intense competition in terms of material, quality of product, price, and innovation. Mergers and acquisition strategic initiatives are undertaken by major automotive thermoformed plastics parts packaging manufacturers in North America to strengthen their market presence. For instance, in November 2023, Specialized Packaging Group acquired U.S.-based Complete Packaging, which specializes in providing customized packaging solutions for use in the automotive, energy, aerospace, and defense industries. These solutions are also used in heavy trucks and equipment, and general industrial applications. This acquisition is a part of the ongoing expansion strategy of Specialized Packaging Group to enhance its production capabilities and increase its geographic reach.

Regulations surrounding plastic use and environmental concerns significantly impact the market. Regulations such as California's ban on single-use plastic bags & pouches and several states considering similar measures, create a demand shift towards alternative packaging materials. This potentially impacts the share of plastics in automotive thermoformed plastics parts packaging.

Material Insights

Based on material, polyethylene (PE) dominated the market, accounting for the largest revenue share of 32.9% in 2023. The lightweight and cost-effectiveness of polyethylene along with its ability to physically transform into foam, flexible films, pouches & bags, and rigid containers contribute to its market dominance.

Polypropylene (PP) is expected to progress at a significant CAGR over the forecast period. Its cost efficiency coupled with its properties such as exceptional chemical resistance and stiffness are driving its growth.

Product Insights

Based on product, the market is segmented into bulk containers & cases, trays, bags & pouches, and others. Bulk containers & cases segment dominated the market, accounting for a revenue share of 33.9% in 2023. They are significantly used in primary, secondary, and tertiary packaging of almost every small, medium, and large-sized automotive part, thus contributing to their high market share.

The trays segment is expected to exhibit a significant CAGR from 2024 to 2030. The high growth rate is attributed to its increasing demand in packaging of fragile automotive aftermarket products.

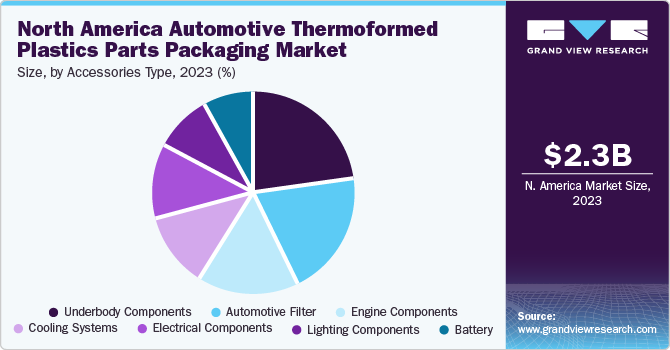

Accessories Type Insights

Based on accessories type, the market is segmented into underbody components, automotive filter, engine components, cooling systems, electrical components, lighting components, and battery. The underbody component segment dominated the market and accounted for the largest revenue share of 23.1% in 2023. The significant market share can be attributed to the high replacement rate of underbody components, such as tires, brake pads, suspension, brake liners, bumpers, and exhaust which are often subjected to wear, abrasions, impacts, and vibrations.

The electrical components segment is expected to progress at a significant CAGR from 2024 to 2030. The high growth rate can be attributed to the growing shift to electric vehicles and increasing popularity of self-driving cars which can increase the aftermarket demand for electrical components.

Country Insights

U.S. Automotive Thermoformed Plastics Parts Packaging Market Trends

U.S. held the largest revenue share of 84.3% in 2023. Significant presence of automotive aftermarket parts suppliers such as Robert Bosch, Denso, Magna International, Continental Automotive, and ZF Friedrichshafen, among others and rapid growth of e-commerce platforms for selling aftermarket parts are expected to drive the market demand.

Canada Automotive Thermoformed Plastics Parts Packaging Market Trends

The Canada automotive thermoformed plastics parts packaging market is expected to progress with a significant CAGR over the forecast period. Outlook for Canadian automotive aftermarket is promising, with key growth opportunities in emerging trends like electric vehicles, telematics, and advanced driver-assistance systems (ADAS). All these factors are expected to drive automotive aftermarket parts demand, which, in turn, is expected to drive the market growth.

Mexico Automotive Thermoformed Plastics Parts Packaging Market Trends

The automotive thermoformed plastics parts packaging market in Mexico is expected to progress with a CAGR of 3.9% over the forecast period. Mexico is a major country in the global automotive market, ranking as the seventh-largest passenger vehicle manufacturer across the globe. Automotive aftermarket in Mexico is witnessing rapid growth, fueled by robust demand, increasing customer focus on safety and comfort, advancements in distribution channels, and rapid economic development. The industry is supported by significant sales of vehicles and a growing number of assembly plants established by major car manufacturers including Ford Motor Company, General Motors, FCA US LLC., NISSAN USA, Volkswagen of America, Inc., Toyota Motor Sales, U.S.A., Inc, and Honda - Todos los derechos reservados among others, which influence the demand for automotive parts, thereby boosting the market growth.

Key North America Automotive Thermoformed Plastics Parts Packaging Company Insights

The market is highly fragmented with a significant presence of global as well as local companies offering various types of automotive aftermarket parts packaging products. Major players operating in the market undertake various strategies such as mergers & acquisitions, joint ventures, new product launches, and geographical expansion to strengthen their market presence.

-

In June 2023, NEFAB GROUP acquired PolyFlex Pro, a major American industry player with expertise in eco-friendly returnable solutions. This strategic move is aimed at reinforcing NEFAB GROUP’s global market positioning and its dedication to conserving resources within supply chains.

-

In July 2023, NEFAB GROUP, opened a new manufacturing facility in Chihuahua, Mexico. This establishment aimed to effectively meet the increasing demand for wood and plywood crating, thermoformed, and corrugated packaging solutions in the country.

Key North America Automotive Thermoformed Plastics Parts Packaging Companies:

- Sealed Air

- Kiva Container

- Engineered Packaging Solutions Inc.

- Sonoco Products Company

- Smurfit Kappa

- Deufol SE

- NEFAB GROUP

- Primex Plastics Corporation

- Schoeller Allibert

- Knauf Industries

- JAMESTOWN PLASTICS

- TriEnda Holdings, LLC

North America Automotive Thermoformed Plastics Parts Packaging Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2024 |

USD 2.34 billion |

|

Revenue forecast in 2030 |

USD 2.92 billion |

|

Growth rate |

CAGR of 3.7% from 2024 to 2030 |

|

Historical data |

2018 - 2022 |

|

Forecast period |

2024 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2024 to 2030 |

|

Report coverage |

Revenue Forecast, Competitive Landscape, Growth Factors and Trends |

|

Segments covered |

Material, product, accessories type, country |

|

Regional scope |

North America |

|

Country Scope |

U.S.; Canada; Mexico |

|

Key companies profiled |

Sealed Air; Kiva Container; Engineered Packaging Solutions Inc.; Sonoco Products Company; Smurfit Kappa; Deufol SE; NEFAB GROUP; Primex Plastics Corporation; Schoeller Allibert; Knauf Industries; JAMESTOWN PLASTICS; TriEnda Holdings, LLC |

|

Customization scope |

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional & segment scope |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Automotive Thermoformed Plastics Parts Packaging Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of latest industry trends in each sub-segment from 2018 to 2030. For this study, Grand View Research has segmented the North America automotive thermoformed plastics parts packaging market report based on material, product, accessories type, and country:

-

Material Outlook (Revenue, USD Million, 2018 - 2030)

-

Polyethylene (PE)

-

Polypropylene (PP)

-

Polyvinyl Chloride (PVC)

-

Polycarbonate (PC)

-

Others

-

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Bulk Containers & Cases

-

Bags & Pouches

-

Trays

-

Others

-

-

Accessories Type Outlook (Revenue, USD Million, 2018 - 2030)

-

Battery

-

Cooling Systems

-

Underbody Components

-

Automotive Filter

-

Engine Components

-

Lighting Components

-

Electrical Components

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

Mexico

-

-

Frequently Asked Questions About This Report

b. The North America automotive thermoformed plastics parts packaging market was estimated at USD 2.27 billion in the year 2023 and is expected to reach USD 2.34 billion in 2024.

b. The North Ameria automotive thermoformed plastics parts packaging market is expected to grow at a compound annual growth rate of 3.7% from 2024 to 2030 to reach USD 2.92 billion by 2030.

b. U.S. dominated North America automotive plastics parts packaging market, accounting for largest revenue share of over 84.3% in 2023. . Significant presence of automotive aftermarket parts suppliers such as Robert Bosch, Denso, Magna International, Continental Automotive, and ZF Friedrichshafen, among others and rise of e-commerce platforms for selling aftermarket parts are expected to contribute to demand for packaging for these parts.

b. Key players in North America automotive thermoformed plastics parts packaging market include Sealed Air, Kiva Container, Engineered Packaging Solutions Inc, NEFAB GROUP, Schoeller Allibert, TriEnda Holdings, LLC, Knauf Industries, Deufol SE, and Smurfit Kappa among others.

b. Growing automotive aftermarket sector in North America and growing investment in establishing automotive parts production facilities in North America.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."