- Home

- »

- Automotive & Transportation

- »

-

North America Automotive Collision Repair Market, Industry Report, 2030GVR Report cover

![North America Automotive Collision Repair Market Size, Share & Trends Report]()

North America Automotive Collision Repair Market Size, Share & Trends Analysis Report By Vehicle (Light-duty Vehicle, Heavy-duty Vehicle), By Product (Consumables, Spare Parts), By Service Channels, By Country, And Segment Forecasts, 2024 - 2030

- Report ID: GVR-4-68040-284-5

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2022

- Forecast Period: 2024 - 2030

- Industry: Technology

Market Size & Trends

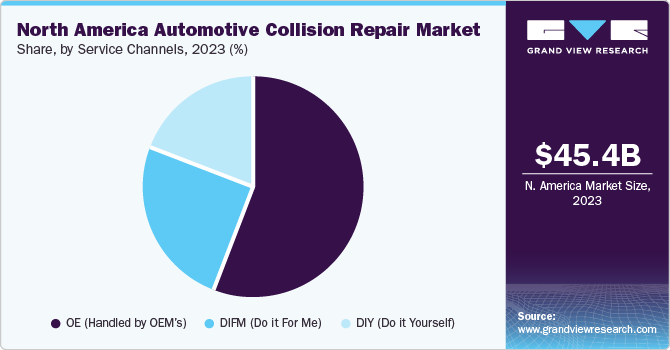

The North America automotive collision repair market size was estimated at USD 45.4 billion in 2023 and is projected to grow at a CAGR of 1.1% from 2024 to 2030. Stringent government regulations and safety standards are driving market growth. Regulatory bodies such as the National Highway Traffic Safety Administration (NHTSA) and the Insurance Institute for Highway Safety (IIHS) update safety standards for vehicles. These regulations contribute to the increased adoption of safety technologies in vehicles and influence repair procedures and standards.

Modern vehicles are equipped with advanced safety features and complex onboard systems, including sensors, cameras, and advanced driver-assistance systems (ADAS). These technologies enhance vehicle safety and reduce accidents.

Compliance with the regulations mentioned above often requires specialized training, equipment, and materials, driving innovation and investment within the collision repair sector. For instance, The National Emission Standards for Hazardous Air Pollutants (NESHAP) rule, specifically targeting paint stripping and surface coating operations at area sources, has significant implications for the automotive collision repair sector. This regulation aims to address air emissions originating from activities such as paint removal and application, which are common practices in collision repair shops.

These technologies enable collision repair technicians to diagnose issues more effectively, assess damage with precision, and execute repairs with greater speed and accuracy. Moreover, as vehicles become increasingly connected and digitized, the integration of IoT (Internet of Things) devices in collision repair can provide real-time data on vehicle status, further enhancing the repair process and customer experience.

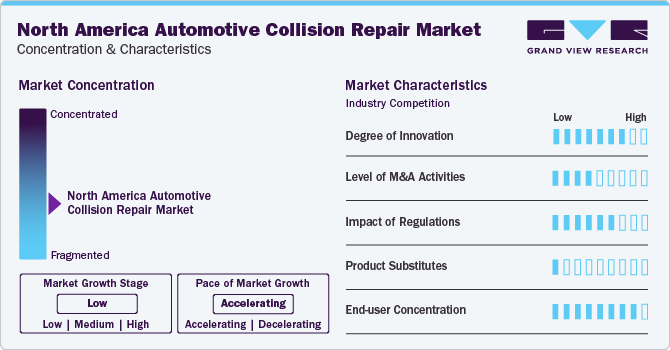

Market Concentration & Characteristics

The market is fragmented and features a high degree of innovation, with companies launching new products with enhanced capabilities to acquire or maintain a robust position in the industry. In July 2023, Palladium Equity Partners launched Collision Auto Parts LLC by acquiring and integrating automotive aftermarket collision repair part companies, namely NAP San Diego LLC, National Auto Parts-Oakland LLC, and National Auto Parts, USA Inc. The objective of Collision Auto Parts is to foster the growth of these three entities and gradually broaden its reach through acquisitions and the establishment of new locations. With this acquisition, Collision Auto Parts emerged as a prominent distributor of automotive aftermarket collision repair equipment, catering to Western U.S. markets with six distribution facilities.

Government regulations have a considerable impact on the market. They can factor into aspects such as parts selection and repair procedures, which are guided mainly by the framework of consumer protection and sustainability. At the federal level, auto parts are regulated by the U.S. Environmental Protection Agency (EPA) and the National Highway Traffic Safety Administration (NHTSA). The rising emphasis on sustainability in the region, particularly in the U.S. and Canada, is influencing the market through emission standards for aftermarket parts.

Vehicle Insights

The light-duty vehicle segment dominated the market in 2023 with a revenue share of 56.8%, and it is expected to witness the fastest CAGR during the forecast period. The proliferation of electric and hybrid vehicles is driving segment growth. The growing popularity of EVs presents opportunities for collision repair shops to expand their service offerings to cater to the specific needs of electric and hybrid vehicle owners, such as battery diagnostics and repair. According to the U.S. Energy Information Administration, the collective sales of hybrid vehicles, plug-in hybrid electric vehicles, and battery electric vehicles (BEVs) in the U.S. surged to 16.3% of total new light-duty vehicle (LDV) sales in 2023, indicating an increase from the 12.9% share they held in 2022.

The heavy-duty vehicle segment is anticipated to register a considerable CAGR over the forecast period. Technological innovations in heavy-duty vehicle design and manufacturing are driving changes in collision repair methodologies and requirements. With advancements such as telematics systems, vehicle-to-vehicle communication, and autonomous driving features becoming more prevalent in commercial trucks and buses, collision repair shops must adapt to repairing these sophisticated systems. This includes investing in specialized diagnostic tools, training technicians in new repair techniques, and establishing partnerships with manufacturers to access repair information and OEM parts.

Service Channel Insights

The OE (handled by OEMs) segment held the dominant market share in 2023. The increasing complexity of modern vehicles includes advanced technology and materials that require specialized knowledge and equipment for repairs. As a result, repair shops often rely on OE parts to ensure the integrity and safety of the vehicle after repairs. In addition, the growing number of vehicles on the road contributes to the demand for collision repair services, further bolstering the importance of the OE segment in providing high-quality replacement parts.

The DIFM (Do it For Me) is expected to grow at the fastest CAGR over the forecast period. The rising sophistication of automotive paint systems contributes to the demand for professional collision repair services. Modern paint formulations often require precise application techniques and equipment to achieve seamless color matching and finish quality. Professional collision repair shops are equipped with state-of-the-art paint booths and skilled technicians capable of delivering superior paintwork results.

Product Insights

The spare parts segment dominated the market share in 2023. Vehicle complexity and platform consolidation impact the spare parts segment, particularly concerning parts standardization and compatibility. Standardizing parts and components reduces manufacturing costs and simplifies inventory management and repair processes for collision repair shops. In addition, advancements in modular design and component sharing enable spare parts suppliers to offer cost-effective solutions that meet the repair needs of diverse vehicle models and brands, enhancing efficiency and profitability in the collision repair market.

The paints & coatings segment is expected to witness the fastest CAGR over the forecast period. Innovations in automotive paints and coatings, such as the inclusion of nanoparticles in formulations of paint, are boosting the segment’s growth as they significantly enhance aesthetic appeal and performance.

Country Insights

U.S. Automotive Collision Repair Market Trends

The automotive collision repair market in the U.S. held the dominant share in the North America region in 2023, and it is projected to grow at a considerable CAGR over the forecast period. Advancements in materials science are driving market growth. Vehicle manufacturers are increasingly utilizing advanced materials such as high-strength steel, aluminum, and composites to improve fuel efficiency, safety, and performance. While these materials offer benefits in terms of weight reduction and structural integrity, they also present challenges for repair technicians. Specialized equipment, training, and techniques are often required to work with these materials, contributing to the complexity and cost of collision repairs.

Canada Automotive Collision Repair Market Trends

Canada automotive collision repair market is expected to witness the fastest CAGR over the forecast period. Various regions experience diverse weather patterns, including harsh winters with snow and ice, which can lead to an increased frequency of accidents and collisions on the roads. As a result, there is a higher demand for collision repair services, particularly during the winter months. This seasonal variation in demand impacts the operational planning and resource allocation of collision repair shops.

Key North America Automotive Collision Repair Company Insights

Some of the key players operating in the market include Tenneco, Inc., Magna International, and Martinrea International Inc., among others. Key players in the industry are developing new products to capture a larger market share. They are acquiring distributors or players in the larger parent market (automotive market) to expand their portfolios and ultimately secure a better position in the market.

-

Tenneco, Inc. is a designer and manufacturer of automotive parts for after-market and original equipment customers. The company has over 196 manufacturing sites and 29 aftermarket distribution centers worldwide. It owns four business groups operating in the auto parts and components industry: Performance Solutions, DriV Incorporated, Powertrain, and Clean Air.

-

Magna International is involved in the manufacture of body exteriors and structures, seating systems, control modules, mechatronics, powertrain modules and components, and other products within the same industry. The company owns seven business groups operating within the same industry. The company’s global network includes 342 manufacturing operations and 104 engineering, sales, and product development centers across 28 countries.

-

Martinrea International Inc. is a publicly traded company involved in the development and production of propulsion systems products (engine blocks, transmission housing, and others) and lightweight structure products (subframes, steel hitches, exterior trim, and others). The company’s engineering forte lies in graphene technology, lightweight, and multi-material and joining.

Key North America Automotive Collision Repair Companies:

- Tenneco Inc.

- Magna International

- Martinrea International Inc.

- Dorman Products.

- Meritor Inc. (Cummins Inc.,)

- BorgWarner Inc.

- THE TIMKEN COMPANY

- Arnott Inc.

- AP Emissions Technologies.

- LODI Group

- 3M

Recent Developments

-

In March 2024, Crash Champions acquired Performance Collision Centers and its nine locations in Virginia, South Carolina, and Georgia. This acquisition propels Crash Champions' national network to over 625 locations across 37 states in the U.S. In addition, it brings onboard nine reputable repair centers renowned for consistently earning certifications from leading automotive manufacturers.

-

In February 2024, AirPro Diagnostics partnered with BMW North America. AirPro Diagnostics will be an authorized partner of its BMW Integrated Services Technical Application (ISTA) software for the collision repair network. This collaboration represents a significant advancement in AirPro Diagnostics' dedication to offering state-of-the-art diagnostic technology and solutions to the automotive collision repair sector. Through the integration of ISTA software, collision repair facilities achieve more efficient diagnostic processes, elevate repair precision, and ultimately enhance customer contentment.

-

In January 2024, CollisionRight, a company specializing in consolidating automotive collision repair shops in the U.S., announced a majority investment from Summit Partners, a firm specializing in growth equity investments. This infusion of capital will bolster CollisionRight's expansion strategy, which centers around acquiring and managing top-tier collision repair shops known for their customer-centric approach, particularly in the Central U.S. and Mid-Atlantic regions.

North America Automotive Collision Repair Market Report Scope

Report Attribute

Details

Revenue forecast in 2030

USD 49.04 billion

Growth rate

CAGR of 1.1% from 2024 to 2030

Base year for estimation

2023

Historical data

2018 - 2022

Forecast period

2024 - 2030

Quantitative units

Revenue in USD million/billion and CAGR from 2024 to 2030

Report coverage

Revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Vehicle, product, service channels, country

Regional scope

North America

Country scope

U.S.; Canada; Mexico

Key companies profiled

Tenneco Inc.; Magna International; Martinrea International Inc.; Dorman Products.; Meritor Inc. (Cummins Inc.,); BorgWarner Inc.; THE TIMKEN COMPANY; Arnott Inc.; AP Emissions Technologies.; LODI Group; and 3M

Customization scope

Free report customization (equivalent up to 8 analyst’s working days) with purchase. Addition or alteration to country, regional, and segment scope

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America Automotive Collision Repair Market Report Segmentation

This report forecasts revenue growth at regional and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this report, Grand View Research has segmented the North America automotive collision repair market report based on the vehicle, product, service channels, and country:

-

Vehicle Outlook (Revenue, USD Billion, 2018 - 2030)

-

Light-duty vehicle

-

Heavy-duty vehicle

-

-

Product Outlook (Revenue, USD Billion, 2018 - 2030)

-

Paints & Coatings

-

Consumables

-

Spare Parts

-

-

Service Channels Outlook (Revenue, USD Billion, 2018 - 2030)

-

DIY (Do it Yourself)

-

DIFM (Do it For Me)

-

OE (handled by OEM’s)

-

-

Country Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Mexico

-

Frequently Asked Questions About This Report

b. North America automotive collision repair market size was estimated at USD 45.4 billion in 2023 and is expected to reach USD 46.14 billion in 2024

b. North America automotive collision repair market is expected to grow at a compound annual growth rate of 1.1% from 2024 to 2030 to reach USD 49.04 billion by 2030

b. The U.S. dominated the North America automotive collision repair market with a share of 80.7% in 2023. Advancements in materials science is driving the U.S. automotive collision repair market

b. Some key players operating in the North America automotive collision repair market include Tenneco Inc., Magna International, Martinrea International Inc., Dorman Products., Meritor Inc. (Cummins Inc.,), BorgWarner Inc., THE TIMKEN COMPANY, Arnott Inc., AP Emissions Technologies., LODI Group, and 3M

b. Factors such as stringent government regulations and safety standards and the growing number of vehicles on the road

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."