North America Automotive Aftermarket Industry Size, Share & Trend Analysis Report By Replacement Part, By Distribution Channel, By Service Channel, By Certification Type, By Country-Level, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-481-7

- Number of Report Pages: 150

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Technology

Industry Size & Trends

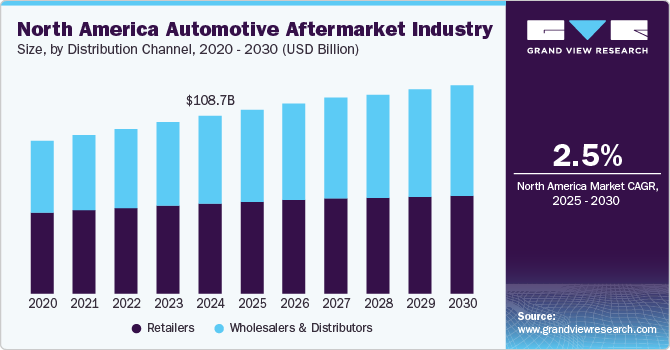

The North America automotive aftermarket industry size was estimated at USD 108.73 billion in 2024 and is projected to grow at a CAGR of 2.5% from 2025 to 2030. The increasing average age of vehicles on the road leads to a higher demand for replacement parts and services, which is responsible for the market growth in North America. Technological advancements in vehicles have also spurred the growth of specialized aftermarket products, catering to the needs of modern, tech-savvy consumers.

The rise of e-commerce has made aftermarket parts more accessible, allowing consumers to purchase products online easily. With an increasing focus on vehicle customization and performance upgrades, the industry continues to expand its offerings. Moreover, partnerships between manufacturers and retailers have streamlined distribution channels, enhancing market efficiency. This combination of factors has contributed to a robust and upward trajectory for the aftermarket sector.

Shifting consumer preferences toward sustainability is also transforming the industry in North America. Many consumers are now opting for eco-friendly parts and services, creating demand for products such as fuel-efficient tires and alternative fuel conversion kits. The push for electric vehicles (EVs) has led to the emergence of new aftermarket segments, including battery replacements and EV-specific parts. Companies in the aftermarket industry are increasingly investing in research and development to stay ahead of these trends, ensuring they can meet evolving consumer needs. Furthermore, government regulations promoting environmental sustainability are encouraging the adoption of green technologies within the industry. With these shifts, businesses are finding opportunities to innovate while aligning with broader environmental goals. The growing consumer awareness of environmental impacts is thus driving both demand and innovation in this space.

As consumer-spending power fluctuates, many drivers are opting to maintain and repair their existing vehicles rather than purchase new ones, boosting aftermarket sales. Moreover, the increasing complexity of automotive technologies has led to a rise in professional service providers, creating opportunities for businesses offering specialized maintenance and repair services. The expansion of the ride-sharing economy has also driven demand for vehicle upkeep, as fleets require regular servicing to remain operational. Furthermore, market consolidation has been a trend, with larger companies acquiring smaller businesses to expand their reach and enhance their capabilities. Global supply chain disruptions, however, pose challenges for the industry, affecting the availability of parts and materials. Despite these challenges, the North American aftermarket industry is expected to maintain steady growth in the coming years.

Replacement Part Insights

Based on replacement part, the tire segment led the market with the largest revenue share of 23.0% in 2024. Tires dominate the market because they are one of the most frequently replaced components due to regular wear and tear. With more vehicles staying on the road for longer periods, the need for tire replacements continues to grow steadily. Moreover, the diversity of driving conditions in North America, from extreme winters to hot summers, increases demand for seasonal tire changes such as winter and all-season tires. The rise in off-road vehicles and customization trends has further driven the demand for specialized performance tires. Technological advancements in tire manufacturing, such as low-rolling-resistance and eco-friendly designs, have also attracted environmentally conscious consumers.

The turbochargers segment is experiencing rapid market growth in North America due to their ability to enhance fuel efficiency and engine performance. As automakers focus on meeting stricter emissions standards and producing smaller, more fuel-efficient engines, turbochargers have become more common in vehicles. This has created a growing market for turbocharger replacements and upgrades, especially as more vehicles with these components age. Car enthusiasts seeking to boost their vehicle’s power and acceleration are increasingly turning to aftermarket turbocharger kits for performance tuning. Furthermore, advancements in turbocharger technology have made them more reliable, efficient, and accessible, contributing to their rising popularity in the aftermarket.

Distribution Channel Insights

Based on the distribution channel, the retailers segment led the market with the largest revenue share of 50.6% in 2024. Retailers dominate the North America market because they provide direct access to consumers, offering a wide range of parts and services. Retailers, both physical stores and online platforms, have capitalized on the growing demand for convenience, allowing customers to purchase automotive products quickly and easily. The rise of e-commerce has further strengthened the position of retailers, enabling them to reach a broader customer base and offer a variety of delivery options. Many retailers also provide added services such as installation, repair, and maintenance, which attract consumers looking for a one-stop solution. Moreover, brand recognition and trust are crucial, as established retailers have built strong customer loyalty.

The wholesalers and distributors segment is growing in the North American industry due to their critical role in the supply chain. As the demand for automotive parts increases, wholesalers and distributors facilitate the efficient distribution of products from manufacturers to retailers and service providers. Their ability to manage large inventories and supply parts in bulk makes them essential for ensuring product availability across different regions. Moreover, as smaller businesses and independent repair shops rely on wholesalers for sourcing parts, the expansion of these businesses drives growth in the wholesale segment. The rise in e-commerce has also boosted the need for distributors, as they fulfill online orders and ensure timely delivery.

Service Channel Insights

Based on service channel, the OE (Delegating to OEMs) segment led the market with the largest revenue share of 60.1% in 2024. It is growing in the North American industry because consumers and businesses increasingly prefer high-quality, reliable parts. OE parts ensure compatibility and performance, as they are specifically designed for vehicles, providing peace of mind for both repair shops and vehicle owners. The growing complexity of modern vehicles, with advanced electronics and specialized components, makes OE parts more attractive, as they are engineered to meet the exact specifications of the vehicle. Moreover, automakers are expanding their reach in the aftermarket sector, offering OE parts directly through authorized dealers, which helps maintain control over quality and brand loyalty. This shift has strengthened the position of OE suppliers in the market as consumers prioritize long-term reliability and vehicle safety.

The DIY (Do It Yourself) segment is predicted to foresee at a significant CAGR during the forecast period. The DIY (Do It Yourself) segment is growing as more consumers seek to save money on repairs and maintenance. The availability of online resources, tutorials, and videos has made it easier for vehicle owners to learn how to perform basic maintenance and part replacements on their own. E-commerce platforms have also made it more convenient for DIYers to purchase aftermarket parts directly, often at lower prices than traditional retail stores. Moreover, as vehicles age, owners of older cars are more likely to handle repairs themselves rather than take them to a mechanic. This growing interest in self-repair, coupled with accessible tools and parts, has led to increased participation in the DIY segment of the aftermarket industry.

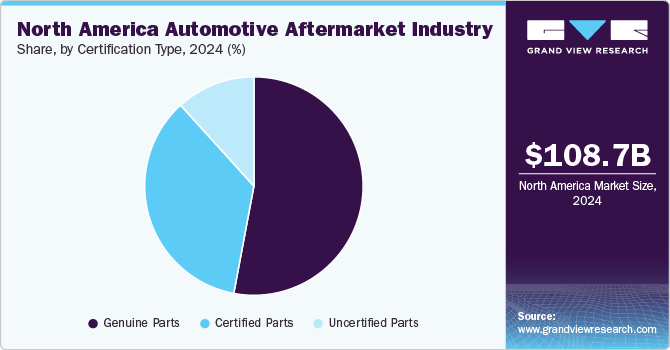

Certification Type Insights

Based on certification type, the genuine parts segment led the market with the largest revenue share of 52.9% in 2024. Genuine parts dominate the industry because they are manufactured by the original equipment manufacturer (OEM), ensuring the highest compatibility and quality for specific vehicle models. Consumers and businesses trust genuine parts for their reliability, performance, and ability to meet factory specifications, reducing the risk of malfunction or compatibility issues. Moreover, genuine parts often come with warranties that provide extra assurance for consumers, making them the preferred choice for major repairs. Automakers promote genuine parts through authorized dealerships, maintaining control over quality and fostering brand loyalty. In a market where vehicle longevity and safety are paramount, genuine parts continue to be the top choice for ensuring optimal performance and durability.

The certified parts segment is predicted to foresee at a significant CAGR during the forecast period. Certified parts are growing in the North American industry because they offer a more affordable alternative to genuine parts while still meeting industry standards. These parts are typically tested and certified by third-party organizations or manufacturers, ensuring quality and performance close to genuine parts without the higher price tag. Certified parts are especially popular among cost-conscious consumers and independent repair shops seeking reliable but less expensive options. As vehicle owners look to save on repairs without compromising safety or functionality, the demand for certified parts has risen. Moreover, increased awareness of certified parts' quality, combined with broader availability through e-commerce and local distributors, has contributed to their growing market presence.

Country Insights

The U.S. automotive aftermarket industry dominated with the largest revenue share of 76% in 2024.The rise of electric vehicles (EVs) is transforming the U.S. by creating a growing demand for EV-specific components such as batteries, powertrains, and charging systems. As the number of EVs on U.S. roads increases, suppliers and repair shops are adapting to accommodate these vehicles, offering specialized parts and services. This shift opens new opportunities for aftermarket providers, particularly in areas like battery replacement, charging infrastructure, and software updates.

The automotive aftermarket industry in Canada is also witnessing an increase in e-commerce, allowing consumers to easily access a wide variety of aftermarket products online, which enhances convenience and affordability. Furthermore, seasonal weather conditions in Canada contribute to the demand for specific products, such as winter tires and all-weather accessories, further driving growth in the aftermarket sector. Overall, these factors are contributing to a dynamic and evolving automotive aftermarket in Canada.

Key North America Automotive Aftermarket Company Insights

Prominent firms have used product launches and developments, followed by expansions, mergers and acquisitions, contracts, agreements, partnerships, and collaborations as their primary business strategy to increase their market share. The companies have used various techniques to enhance market penetration and boost their position in the competitive industry. For instance, 3M launched the 3M Clean Sanding System, a complete dust extraction solution designed for body shops in Canada and around the globe. This system includes pneumatic and electric random orbital sanders, dust extractors, and various abrasives designed to improve workspace cleanliness and efficiency.

Key North America Automotive Aftermarket Companies:

- 3M

- Advance Auto Parts

- AutoZone, Inc.

- Cooper Tire & Rubber Company

- Dorman Products, Inc.

- LKQ Corporation

- O’Reilly Auto Parts

- Pep Boys

- RockAuto, LLC

- Tire Rack

View a comprehensive list of companies in the North America Automotive Aftermarket Industry

Recent Developments

-

In December 2023, AutoZone has expanded its partnership with Relex Solutions to optimize supply chain operations in Brazil, improving demand forecasting and stock availability in the automotive aftermarket. Relex’s technology aims to help AutoZone simplify operations, reduce costs, and integrate its systems across the U.S., Mexico, and Brazil, enhancing scalability and efficiency in the automotive aftermarket sector

-

In October 2023, 3M launched the 3M Skills Development Center in St. Paul, Minnesota, a 15,000-square-foot facility to train and upskill automotive technicians through hands-on education in collision repair and refinishing. With over 100 training sessions planned annually, the center addresses the industry's urgent need for skilled technicians amidst evolving vehicle technologies

-

In March 2022, Advance Auto Parts collaborated with Tekmetric, a U.S. software company, to provide a cloud-based shop management system for its Professional customers, Worldpac customers, and TechNet-affiliated repair shops. This partnership integrates AdvancePro's parts catalog into Tekmetric's platform, offering seamless parts ordering, repair workflows, and real-time business analytics to improve shop efficiency and customer service

North America Automotive Aftermarket Industry Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 112.52 billion |

|

Revenue forecast in 2030 |

USD 127.51 billion |

|

Growth rate |

CAGR of 2.5% from 2025 to 2030 |

|

Base year for estimation |

2024 |

|

Historical data |

2018 - 2023 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Replacement part, distribution channel, service channel, certification type, country level |

|

Regional scope |

North America |

|

Country scope |

U.S.; Canada |

|

Key companies profiled |

3M; Advance Auto Parts; AutoZone, Inc.; Cooper Tire & Rubber Company; Dorman Products, Inc.; LKQ Corporation; O'Reilly Auto Parts; Pep Boys; RockAuto, LLC; Tire Rack |

|

Customization scope |

Free report customization (equivalent up to 8 analysts' working days) with purchase. Addition or alteration to country & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Automotive Aftermarket Industry Report Segmentation

This report forecasts revenue growth at country level and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America automotive aftermarket industry report based on replacement part, distribution channel, service channel, certification type, and country-level.

-

Replacement Part Outlook (Revenue, USD Billion, 2018 - 2030)

-

Tire

-

Battery

-

Brake Parts

-

Filters

-

Body parts

-

Lighting & Electronic components

-

Wheels

-

Exhaust components

-

Turbochargers

-

Others

-

-

Distribution Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

Retailers

-

Wholesalers & Distributors

-

-

Service Channel Outlook (Revenue, USD Billion, 2018 - 2030)

-

DIY (Do It Yourself)

-

DIFM (Do It For Me)

-

OE (Delegating To OEM’s)

-

-

Certification Type Outlook (Revenue, USD Billion, 2018 - 2030)

-

Genuine Parts

-

Certified Parts

-

Uncertified Parts

-

-

Country Level Outlook (Revenue, USD Billion, 2018 - 2030)

-

North America

-

U.S.

-

Canada

-

-

Frequently Asked Questions About This Report

b. The global North America automotive aftermarket industry size was estimated at USD 108.73 billion in 2024 and is expected to reach USD 112.52 billion in 2025.

b. The global North America automotive aftermarket industry is expected to grow at a compound annual growth rate of 2.5% from 2025 to 2030 to reach USD 127.51 billion by 2030.

b. Retailers segment dominated the North America automotive aftermarket industry with a share of 76% in 2024. Retailers, both physical stores and online platforms, have capitalized on the growing demand for convenience, allowing customers to purchase automotive products quickly and easily.

b. Some key players operating in the North America automotive aftermarket industry include 3M, Advance Auto Parts, AutoZone, Inc., Cooper Tire & Rubber Company, Dorman Products, Inc., LKQ Corporation, O'Reilly Auto Parts, Pep Boys, RockAuto, LLC, Tire Rack

b. Key factors that are driving the market growth include increasing average age of vehicles on the road, technological advancements in vehicles, and increasing focus on vehicle customization and performance upgrades

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."