- Home

- »

- Advanced Interior Materials

- »

-

North America And Australia Silica Market Size, Report, 2030GVR Report cover

![North America And Australia Silica Market Size, Share & Trends Report]()

North America And Australia Silica Market Size, Share & Trends Analysis Report By Application (Oil & Gas, Glass, Food Industry, Foundry Sand, Rubber, Oral Care, Agrochemicals), By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68039-911-8

- Number of Report Pages: 90

- Format: PDF, Horizon Databook

- Historical Range: 2018 - 2023

- Forecast Period: 2025 - 2030

- Industry: Advanced Materials

Market Size & Trends

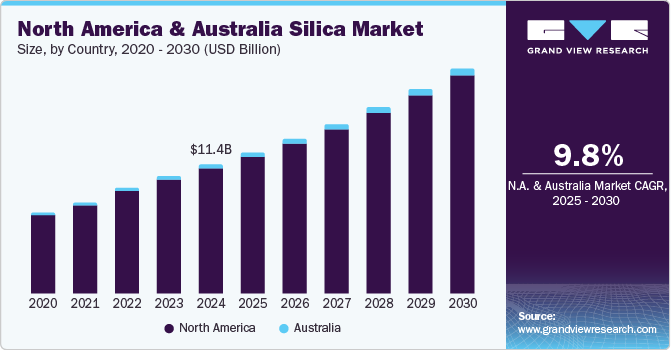

The North America and Australia silica market size was estimated at USD 11.43 billion in 2024 and is projected to expand at a CAGR of 9.8% from 2025 to 2030. This growth is driven by the rising demand for silica in the oil and gas industry due to hydraulic fracturing activities is a major growth driver. Silica's unique properties, such as its hardness and resistance to high temperatures, make it essential for this application. Additionally, the growing construction activities in the region are boosting the demand for silica in glass production and foundry sand. The advancements in research and development and technological innovations are also contributing to the market growth by improving the efficiency and applications of silica.

The technological advancements and a surge in research and development activities are significantly enhancing the applicability of silica across diverse industries, including rubber and glass manufacturing. Innovations in silica-based materials are enabling new applications in sectors such as electronics, renewable energy, and healthcare. For instance, silica is being used in advanced technologies like semiconductors, lithium-ion batteries, and pharmaceuticals, which are expected to propel the market further. Additionally, the launch of innovative applications, such as Bridgestone's new tire technology platform that integrates silica, exemplifies this trend.

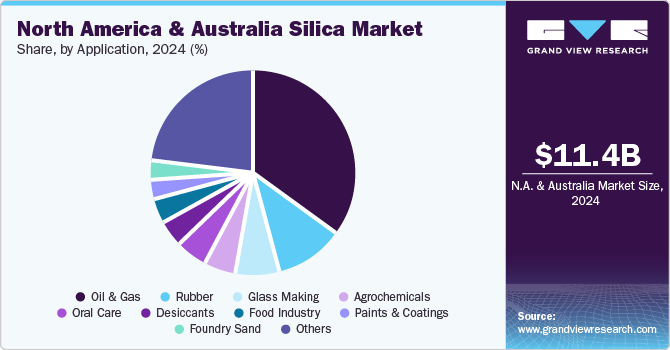

Application Insights

The oil & gas segment accounted for 35.1% of the North America and Australia silica market due to the extensive use of silica in hydraulic fracturing (fracking) processes, where it is used as a proppant to keep fractures open and allow for the extraction of oil and natural gas. The high demand for energy resources in the region, coupled with advancements in drilling technologies, has driven the consumption of silica in this sector. Additionally, major oil and gas companies in North America and Australia have further bolstered the market's growth.

The paints & coatings segment is projected to grow at a CAGR of 10.5% from 2025 to 2030, driven by the increasing demand for high-quality and durable coatings in various industries including construction, automotive, and marine. Silica is used in paints and coatings to enhance properties such as abrasion resistance, durability, and finish quality. The rising construction activities and the growing automotive industry in North America and Australia are expected to drive the demand for silica-based paints and coatings. Furthermore, the development of eco-friendly and sustainable coatings that incorporate silica is contributing to the segment's growth.

Country Insights

North American Silica Market Trends

The North American silica market is expected to grow at a CAGR of 9.8% from 2025 to 2030, driven by the high demand for silica in the oil and gas industry, particularly for hydraulic fracturing. The region's strong construction activities also play a significant role, with silica being a key component in glass production and foundry sand. Additionally, technological advancements and a surge in R&D activities are expanding the use of silica across various industries, including rubber and glass manufacturing.

Australia Silica Market Trends

The silica market in Australia is projected to be the fastest-growing in the region over the forecast period. Australia is home to abundant silica sand deposits, particularly in Queensland, where the total resources are estimated to exceed two billion tonnes, which is equivalent to more than 600 years of current production in the state. The high quality of these resources, recognized as among the best in the world, further underscores Australia's strategic advantage in the silica market. This robust supply, coupled with increasing demand from various industries, positions Australia as a key player in the global silica market, driving significant growth and investment in the sector.

Key North America And Australia Silica Company Insights

Some of the key players operating in the market include Elkem ASA, Evonik Industries AG, Nouryon, PPG Industries, Inc., PQ Corporation, Saint-Gobain, and others:

-

Elkem ASA is a leading provider of silicones and silicon solutions, with a strong presence in North America and Australia. The company is known for its full ownership of the value chain from quartz to specialty silicones, which positions it uniquely in the market. Elkem's products are widely used in various industries, including rubber, foundry, glass, and oil & gas, where silica is a critical component.

-

Evonik Industries AG is a global leader in specialty chemicals, including silica production. In North America, Evonik has invested significantly in expanding its silica production capabilities, particularly for the semiconductor and tire industries. The company's new ultra-high purity colloidal silica plant in Michigan and the expansion of its Charleston site in South Carolina are strategic moves to meet the rising demand for silica in green tires and semiconductor manufacturing.

Key North America And Australia Silica Companies:

- Elkem ASA

- Evonik Industries AG

- Nouryon

- PPG Industries, Inc.

- PQ Corporation

- Saint-Gobain

- Solvay

- U.S. Silica

- W. R. Grace & Co.-Conn.

- Wacker Chemie AG

Recent Developments

-

In October 2024, Evonik announced the groundbreaking of a substantial expansion at its Charleston, South Carolina, site. This strategic move will augment precipitated silica production capacity by 50%, directly addressing the escalating demand within the U.S. tire industry, with a particular focus on green tire technologies.

-

In September 2024, Canadian Premium Sand Inc. (CPS) is set to establish an integrated patterned solar glass manufacturing facility in Manitoba, with support from the Province of Manitoba and the Government of Canada. This facility will leverage CPS's silica sand to produce ultra-high-clarity patterned solar glass.

North America And Australia Silica Market Report Scope

Report Attribute

Details

Market size value in 2025

USD 12.50 billion

Revenue forecast in 2030

USD 19.93 billion

Growth rate

CAGR of 9.8% from 2024 to 2030

Base year for estimation

2024

Historical data

2018 - 2023

Forecast period

2025 - 2030

Quantitative units

Volume in kilotons, revenue in USD million, and CAGR from 2025 to 2030

Report coverage

Volume and revenue forecast, company ranking, competitive landscape, growth factors, and trends

Segments covered

Application, region

Country scope

U.S.; Canada; Australia

Key companies profiled

Elkem ASA, Evonik Industries AG, Nouryon, PPG Industries, Inc., PQ Corporation, Saint-Gobain, Solvay, U.S. Silica, W. R. Grace & Co.-Conn., Wacker Chemie AG

Customization scope

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope.

Pricing and purchase options

Avail customized purchase options to meet your exact research needs. Explore purchase options

North America And Australia Silica Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the global North America and Australia silica market report based on application, and region.

-

Application Outlook (Revenue, USD Billion, 2018 - 2030)

-

Oil & gas

-

Glass Making

-

Foundry Sand

-

Rubber

-

Agrochemicals

-

Oral care

-

Food Industry

-

Desiccants

-

Paints & Coatings

-

Others

-

-

Regional Outlook (Revenue, USD Billion, 2018 - 2030)

-

U.S.

-

Canada

-

Australia

-

Share this report with your colleague or friend.

![gvr icn]()

NEED A CUSTOM REPORT?

We can customize every report - free of charge - including purchasing stand-alone sections or country-level reports, as well as offer affordable discounts for start-ups & universities. Contact us now

![Certified Icon]()

We are GDPR and CCPA compliant! Your transaction & personal information is safe and secure. For more details, please read our privacy policy.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."