North America Athletic Wear Market Size, Share & Trends Analysis Report By Product (Top Wear, Bottom Wear, Underwear/ Base Layers), By Price Range (Mass, Premium), By Distribution Channel, By Country, And Segment Forecasts, 2025 - 2030

- Report ID: GVR-4-68040-492-6

- Number of Report Pages: 80

- Format: PDF

- Historical Range: 2018 - 2024

- Forecast Period: 2025 - 2030

- Industry: Consumer Goods

North America Athletic Wear Market Trends

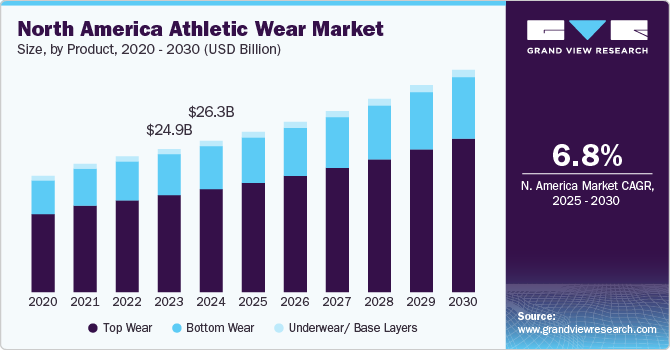

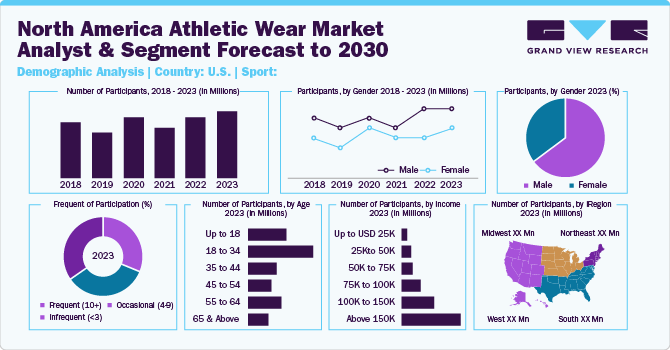

The North America athletic wear market size was valued at USD 26.28 billion in 2024 and is expected to grow at a CAGR of 6.8% from 2025 to 2030. Based on the 2020 National Health Interview Survey in the U.S., 24.2% of adults aged 18 and older adhered to the 2018 Physical Activity Guidelines for Americans, which recommend both aerobic and muscle-strengthening exercises. The industry is driven by a growing health-conscious population and a rising trend of active lifestyles. With increased emphasis on fitness, more people are incorporating exercise into their daily routines, leading to a surge in demand for athletic wear designed for performance and comfort. This trend is particularly pronounced in the U.S., where fitness activities like yoga, running, and gym workouts have become mainstream, spurring the need for functional, durable, and stylish athletic apparel.

Another significant driver is the blurring line between athletic wear and everyday fashion. Consumers are increasingly wearing gym clothes, such as leggings, joggers, and sports bras, outside of workout settings, contributing to the rise of athleisure. This shift has been particularly strong in Canada, where the preference for comfortable yet stylish clothing has fueled the demand for versatile athletic wear that can transition seamlessly from the gym to casual outings.

E-commerce penetration also plays a critical role in driving industry growth. The convenience of online shopping and the availability of a wide range of products from both established and emerging brands have made it easier for consumers across North America to access athletic wear. U.S.-based companies like Nike and Lululemon, as well as e-commerce platforms like Amazon, have capitalized on this trend by expanding their digital presence, offering personalized experiences, and improving logistics to meet rising consumer expectations.

Furthermore, the increasing health consciousness among consumers is one of the primary drivers for the North America athletic wear industry. The growing awareness of the importance of maintaining a healthy lifestyle has led to a surge in participation in various physical activities, including running, yoga, gym workouts, and team sports. According to a report by the World Health Organization, the number of people engaging in regular physical activity has risen significantly over the past decade, contributing to the heightened demand for athletic wear. This shift toward a healthier lifestyle is not just limited to younger demographics but also includes older adults who are adopting fitness regimes to improve their overall well-being.

The athleisure trend, where athletic apparel is worn in non-athletic settings, has significantly boosted the sportswear industry. Athleisure blurs the lines between gym wear and casual wear, making it acceptable to wear athletic clothing in everyday activities. This trend is particularly popular among millennials and Gen Z, who prioritize comfort and style. Brands like Nike, Adidas, and Lululemon have capitalized on this trend by launching stylish and versatile athletic wear collections that can be worn both in and out of the gym.

Consumer Insights

Consumer trends and preferences in the North American athletic wear industry are evolving rapidly, driven by a combination of lifestyle changes, technological advancements, and a growing emphasis on health and wellness. One significant trend is the increasing demand for versatile athletic apparel that seamlessly transitions from workout to everyday wear. Consumers are looking for clothing that is not only functional for sports and fitness activities but also stylish enough for casual outings, leading to the rise of athleisure as a dominant category. This shift reflects a broader cultural movement toward active living, where exercise and wellness are integrated into daily routines.

Product Insights

Athletic top wear accounted for a revenue share of 68.01% in 2024. As people increasingly prioritize health and wellness, the demand for athletic apparel, particularly top wear such as t-shirts, tops, hoodies, sweatshirts, and jackets, has risen. This trend is fueled by the growing popularity of athleisure, a fashion movement that blends athletic and casual wear, making sportswear versatile for both workouts and everyday activities.

Innovations such as moisture-wicking, anti-odor, and quick-drying materials have enhanced the appeal of athletic top wear, offering improved comfort and performance. In addition, sustainability concerns have led to increased demand for eco-friendly materials, prompting manufacturers to adopt practices like using recycled fibers and reducing carbon footprints, which further support industry growth.

Athletic bottom wear is expected to grow at a CAGR of 6.2% from 2025 to 2030 in the region. The segment is experiencing significant growth, driven by the increasing adoption of fitness-oriented lifestyles and the popularity of athleisure fashion. Consumers seek comfortable and versatile bottom wear, such as leggings, joggers, shorts, and tights, which can seamlessly transition from workouts to casual wear. The rising trend of hybrid clothing, combining performance features with stylish designs, has fueled the demand for athletic bottom wear in both fitness and everyday activities.

Price Range Insights

The mass-priced athletic wear segment accounted for a revenue share of over 74.47% in 2024. Many consumers prioritize affordability when purchasing athletic wear. Mass-priced athletic wear appeals to a broader segment of the market, including budget-conscious individuals and families. Furthermore, mass-priced athletic wear is often more prominently available in mainstream retail channels in the U.S., such as big-box stores, department stores, and online marketplaces. These channels attract a broader audience of consumers, leading to higher sales volume for mass-priced athletic wear. These factors are expected to contribute to the dominance of mass-priced athletic wear in the region during the forecast period.

The premium-priced athletic wear segment is expected to grow with a CAGR of 7.8% from 2025 to 2030. In the region, there is an increasing trend among consumers prioritizing quality and durability over price, preferring premium-priced athletic wear that offers superior performance and longevity. Premium athletic wear often incorporates advanced materials for enthusiasts who value these factors. Furthermore, a strong brand preference among consumers is seen in the region. Premium athletic wear is often associated with reputable brands known for their quality, innovation, and heritage in the outdoor industry. Consumers in the region are willing to pay a premium for products from these brands due to their perceived value, reputation for excellence, and status symbol within the outdoor community, thereby augmenting the growth of the premium-priced segment during the forecast period.

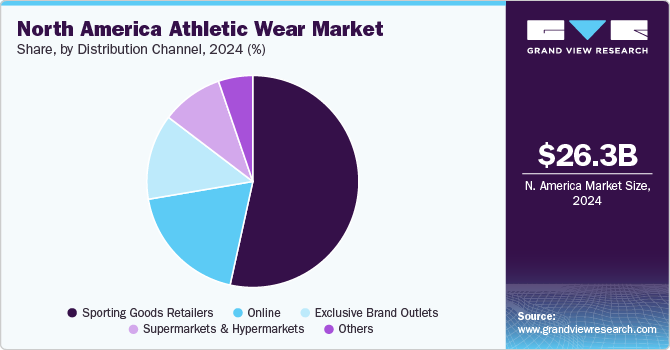

Distribution Channel Insights

The sales of athletic wear through sporting goods retailers accounted for a revenue share of over 53.45% in 2024. These retailers offer a wide range of athletic wear, including specialized apparel for skiing activities. The wide selection caters to the diverse needs and preferences of ski enthusiasts, driving sales through this channel. Furthermore, these stores offer specialized retail experiences tailored to outdoor enthusiasts, with knowledgeable staff who can provide expert advice and guidance on apparel selection. Moreover, many outdoor brands choose to partner with sporting/outdoor retail stores to make their products available and accessible to consumers, resulting in the availability of products from multiple prominent and emerging brands for consumers to choose from, further driving athletic wear sales through this channel in the region during the forecast period.

The sales of athletic wear through online channels is expected to grow with a CAGR of 8.0% from 2025 to 2030 in North America. Online channels offer convenience, allowing customers to browse, compare, and purchase athletic wear from the comfort of their homes. Furthermore, online platforms facilitate transparent pricing and easy comparison shopping, enabling consumers to quickly compare prices, features, and customer reviews across different brands and retailers.

Moreover, changing consumer preferences, particularly among younger demographics in the region, favor online shopping due to its convenience, flexibility, and seamless user experience. As digital natives become a larger share of the consumer market in the region, the preference for online channels is expected to drive high sales growth through this channel in the North America athletic wear market during the forecast period.

Country Insights

U.S. Athletic Wear Market Trends

The U.S. athletic wear market accounted for a revenue share of 90.14% in 2024. There has been a notable rise in health consciousness and fitness activities among U.S. consumers, driven by a growing awareness of the benefits of an active lifestyle. This trend is fueling demand for athletic wear that supports various activities, from gym workouts to outdoor running. The emphasis on fitness and well-being is encouraging consumers to invest in high-quality apparel. Americans are increasingly prioritizing physical wellness, which fuels the demand for high-performance apparel designed for a variety of sports and workouts.

This growing interest in fitness is supported by the proliferation of boutique gyms, fitness classes, and wellness apps, creating a strong consumer base for athletic wear. The rise of the wellness movement has also led to a broader acceptance of athleisure, with athletic wear becoming a staple in everyday wardrobes, not just for exercise but also for casual and semi-formal settings.

Canada Athletic Wear Market Trends

The athletic wear market in Canada is expected to grow at a CAGR of 7.8% from 2025 to 2030. Canadians are known for their love of outdoor activities such as cycling, which fuels the demand for high-performance athletic wear that can withstand diverse weather conditions. This focus on outdoor sports and fitness is deeply embedded in the Canadian culture, leading to increased consumer spending on durable, functional athletic apparel.

Sustainability is a growing concern among Canadian consumers, driving demand for eco-friendly and ethically produced athletic wear. As environmental awareness increases, Canadians are seeking brands that prioritize sustainable materials, such as recycled fabrics, and adopt responsible manufacturing practices. The desire to minimize environmental impact aligns with the values of many Canadian consumers, influencing their purchasing decisions in the athletic wear market.

Key North America Athletic Wear Company Insights

The industry is characterized by the presence of numerous well-established players and is fragmented owing to the presence of a large number of athletic wear manufacturers with strong customer networks. Manufacturers are integrating advanced technology into their products. Many brands are investing in research and development to create high-performance fabrics that offer features like moisture-wicking, breathability, temperature regulation, and odor resistance. These innovations enhance comfort and functionality, appealing to consumers who prioritize performance in their athletic gear.

Furthermore, manufacturers are leveraging digital platforms and e-commerce to reach consumers more effectively. With the rise of online shopping, brands are enhancing their online presence, optimizing their websites for user experience, and utilizing social media marketing to connect with their audiences. By adopting these strategies, manufacturers are positioning themselves to thrive in the market.

Key North America Athletic Wear Companies:

- NIKE, Inc.

- Under Armour, Inc.

- Lululemon Athletica Inc.

- adidas Group

- Patagonia, Inc.

- The North Face, Inc.

- Alo, LLC

- PUMA SE

- Columbia Sportswear Company

- New Balance Athletics, Inc.

- Reigning Champ

- Roots Corporation

- Sugoi Performance Apparel

Recent Developments

-

In July 2024, Lululemon Athletica Inc. introduced its new Breezethrough leggings, designed for yoga. With Lululemon's silkiest, fastest-drying fabric, these cool-to-the-touch leggings strike a balance between the brand's Wunder Train and Align designs. The leggings, which come in lengths of 25 and 28 inches as well as 6-inch shorts, are made without a front seam to prevent bunching and sweat stains. These also have a hidden rear waistband pocket.

-

In May 2024, The North Face launched the LIGHTRANGE collection, a line of lightweight techwear designed for outdoor activities, offering UV protection with a UPF rating of 40+ and above. The collection, which includes short-sleeve tops, thin hoodies, and hats, utilized micro-grid weave technology for breathability and comfort. Available in a variety of colors and sizes for all genders, the collection was released with prices ranging from USD 45 to USD 80.

-

In April 2024, Nike, Inc. launched a new product line, signaling a multi-year cycle of advancements. Powered by digital and cutting-edge technology, the company introduced everyday running apparel and footwear inspired by athletes. Utilizing advanced technology and digital capabilities, the company also introduced a range of products powered by an air cushioning system tailored for various outdoor sports.

North America Athletic Wear Market Report Scope

|

Report Attribute |

Details |

|

Market size value in 2025 |

USD 27.85 billion |

|

Revenue forecast in 2030 |

USD 38.61 billion |

|

Growth Rate (Revenue) |

CAGR of 6.8% from 2025 to 2030 |

|

Actuals |

2018 - 2024 |

|

Forecast period |

2025 - 2030 |

|

Quantitative units |

Revenue in USD million/billion, and CAGR from 2025 to 2030 |

|

Report coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

|

Segments covered |

Product, price range, distribution channel, country |

|

Country scope |

U.S, Canada |

|

Key companies profiled |

NIKE, Inc.; Under Armour, Inc.; Lululemon Athletica Inc.; adidas Group; Patagonia, Inc.; The North Face, Inc.; Alo, LLC; PUMA SE; Columbia Sportswear Company; New Balance Athletics, Inc.; Reigning Champ; Roots Corporation; and Sugoi Performance Apparel |

|

Customization scope |

Free report customization (equivalent up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

|

Pricing and purchase options |

Avail customized purchase options to meet your exact research needs. Explore purchase options |

North America Athletic Wear Market Report Segmentation

This report forecasts revenue growth at the regional and country levels and provides an analysis of the latest industry trends and opportunities in each of the sub-segments from 2018 to 2030. For this study, Grand View Research has segmented the North America athletic wear market report on the basis of product, price range, distribution channel, and country.

-

Product Outlook (Revenue, USD Million, 2018 - 2030)

-

Top Wear

-

T-shirts & Tops

-

Hoodies & Sweatshirts

-

Jackets

-

Others

-

-

Bottom Wear

-

Pants & Leggings

-

Shorts & Skorts

-

-

Underwear/ Base Layers

-

-

Price Range Outlook (Revenue, USD Million, 2018 - 2030)

-

Mass

-

Premium

-

-

Distribution Channel Outlook (Revenue, USD Million, 2018 - 2030)

-

Online

-

Sporting Goods Retailers

-

Supermarkets & Hypermarkets

-

Exclusive Brand Outlets

-

Others

-

-

Country Outlook (Revenue, USD Million, 2018 - 2030)

-

U.S.

-

Canada

-

Frequently Asked Questions About This Report

b. The North America athletic wear market size was estimated at USD 26.28 billion in 2024 and is expected to reach USD 27.85 billion in 2025.

b. The North America athletic wear market is expected to grow at a compounded growth rate of 6.8% from 2025 to 2030 to reach USD 38.61 billion by 2030.

b. Top wear dominated the North America athletic wear market with a share of 68.01% in 2024. Products like compression shirts, tank tops, and sweat-resistant fabrics are gaining traction among fitness enthusiasts and athletes. The popularity of athleisure has expanded the use of top-wear beyond workouts, creating demand for versatile designs suitable for casual settings, driving its demand in the region.

b. Some key players operating in the North America athletic wear market include NIKE, Inc.; Under Armour, Inc.; Lululemon Athletica Inc.; adidas Group; Patagonia, Inc.; The North Face, Inc.; Alo, LLC; PUMA SE; Columbia Sportswear Company; New Balance Athletics, Inc.; Reigning Champ; Roots Corporation; and Sugoi Performance Apparel.

b. The North America athletic wear market is driven by a combination of factors, including shifting consumer lifestyles, the rising focus on health and fitness, advancements in fabric technology, and the growing popularity of athleisure wear.

We are committed towards customer satisfaction, and quality service.

"The quality of research they have done for us has been excellent."